The following table shows current 30-year El Monte mortgage rates. You can use the menus to select other loan durations, alter the loan amount. or change your location.

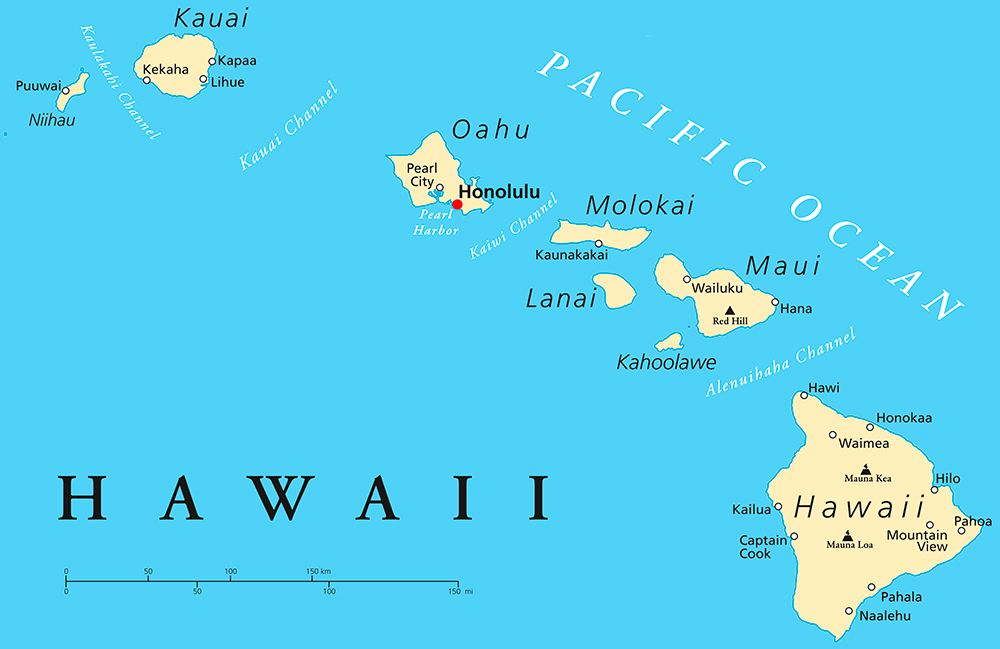

Gorgeous white sand beaches, crystal blue water, and warm, sunny weather, it's easy to see why Hawaii is a premier destination for tourists, biologists, industry professionals and people who love water recreational sports like surfing. The state of Hawaii is made up of over 1,500 miles of islands, and it is in the state in the United States to be made entirely of islands.

Hawaii is the eighth-smallest state in the United States and the eleventh least-populated. However, it is also the thirteenth most densely populated state in the nation. The local way of living in Hawaii is more laid-back, but the cost of living is one of the highest found in the United States.

People move to this state for the picturesque scenery, gorgeous weather, and the diverse culture. The job market is competitive, and you normally won't be guaranteed a higher-paying job until you're actually in Hawaii. Housing can also be expensive, and the median rent is $1,438, with the poverty rate around 9.3% as of 2016. However, there is a good amount of real estate to choose from on many of the islands.

When people move out of this state, one of the primary reasons for doing so is the low wages simply can't compete with the higher costs of living. Even though Hawaii's minimum wage is $9.25 an hour, the median price for purchasing a home is $515,000. This makes it very hard to have money left over after you pay all of your monthly expenses.

Currently, the Hawaii real estate market is competitive, and it has been steadily rising since 2012 when the prices hit their all-time low because of the housing market crash. The first quarter of 2016 saw a slight spike in home prices around Hawaii as a whole, and this continued into the first quarter of 2017 when the housing markets experienced a slight fall in sales. It recovered, and it has continued its steady climb ever since.

In comparison, Honolulu's housing market hit their lowest prices in 2011, and they stayed in this low plateau area until the first quarter of 2012. Since the second quarter of 2012, the housing prices in Honolulu have been on a steady increasing track, with 2014 and 2016 seeing slight spikes in the median housing prices. As of 2017, Honolulu and Hawaii both have higher housing prices and sale activity than they did before the housing bubble burst and their prices fell.

Hawaii's historic housing market has experienced many peaks and lows since 1990. From the time frame of 1990 to early 1994, housing prices were at a plateau and didn't rise or fall drastically either way. There was a slight drop in housing prices in 1995, but they recovered quickly by the end of that same year. Once 1995 came and went, the real estate market fell until late 1997 when they hit a plateau and fell to all-time lows in 1990. The market began to recover, and they started on a steep increase, hitting their highest peak in 2007. Once the housing bubble burst, Hawaii's real estate market began a rocky descent until they bottomed out in 2012.

Honolulu started the 1990s with slightly higher prices that plateaued until 1994 when they saw a slight rise in prices. These prices dropped slightly in early 1995, and they continued this downward slide until 1999 when the markets hit lows that hadn't been since the early 1990s. In 2000, Honolulu real estate prices saw a quick but steady increase in prices until 2006 with the prices peaked sharply and dropped off. They peaked at their highest rate in 2007 and started a gradual decrease until 2011.

When you compare both of these trends to the national average, they have large areas of differences. The limited supply of land on the island has coupled with strong foreign demand to give the islands a different demand profile. While the national housing market had a steady incline from the 1990s, the Hawaii housing market had several lows. The Hawaii housing market also didn't rise or fall as far as the national average during the housing crisis. This is presumably in part due to the geographic isolation.

During the time of the recession, just like any other industry, the real estate also suffered a major set back. But towards the latter half of 2009, things began to creep back to normalcy. Home buyers who had been dithering till then began to look for homes at low mortgage rates and slowly the sales began to pick up. The Oahu market is more stable than all of the other cities in Hawaii and most of the rest of America. The real estate prices are also really high because of the area’s desirability as a resort, unique history and land size. In certain places in Hawaii the land development is reasonably poor when compared to demand.

The rate of homeownership on the islands is low relative to other states. In 1997 only 50.2% of residents owned their home. This number jumped to a peak of 60.6% in 2004, but has fallen back to 57.7% in 2016.

Through the first 3 quarters of 2020 real estate held up far better than it did during the 2008 housing recession. Central banks and politicians reacted faster and much more aggressively to the COVID-19 crisis than they did to the 2008 recession. Many novel and unconventional policies which began in response to the prior recession were used much more aggressively in this recession. For instance, here are some of the policies which were enacted:

On November 24, 2020 the Federal Housing Finance Agency (FHFA) raised conforming loan limits by 7.42%, reflecting strong annual growth in the nationwide FHFA House Price Index (HPI). 2022 and 2023 saw limit increases of 18.05% and 12.21%, the fastest 2-year growth rates since 1986 & 1987, and inline with the 15.95% growth in 2006. In 2024 and 2025 the limits were increased at more historically normal levels of 5.56% and 5.21%.

| Year | Oahu Median Price | National Average Home Price |

|---|---|---|

| 2006 | $630,000 | $244,900 |

| 2007 | $643,500 | $254,400 |

| 2008 | $624,000 | $232,400 |

| 2009 | $575,000 | $208,600 |

| 2010 | $592,750 | $218,200 |

| 2011 | $575,000 | $240,100 |

| 2012 | $620,000 | $221,700 |

| 2013 | $650,000 | $251,500 |

| 2014 | $675,000 | $269,800 |

| 2015 | $700,000 | $292,000 |

| 2016 | $735,000 | $288,400 |

| HI Rank | US Rank | Geography | 2016 Pop | 2010 Pop | Change | % △ |

|---|---|---|---|---|---|---|

| 1 | 54 | Urban Honolulu, HI | 992,605 | 953,207 | 39,398 | 4.13% |

| 2 | 222 | Hilo, HI | 198,449 | 185,079 | 13,370 | 7.22% |

| 3 | 256 | Kahului-Wailuku-Lahaina, HI | 165,474 | 154,924 | 10,550 | 6.81% |

| 4 | 473 | Kapaa, HI | 72,029 | 67,091 | 4,938 | 7.36% |

The state of Hawaii is composed primarily of seven islands of which Oahu is the most populated. Oahu is the third-largest island in the state of Hawaii, and it is home to 992,605 residents as of July 2016. This population represents two-thirds of Hawaii's total population, and it is one of the most popular islands to live and work on. The state of Hawaii's capital, Honolulu is located here, and it is Hawaii's largest city. Additionally, Oahu is home to Pearl Harbor, and this lagoon is where a large portion of the United State's Navy base. The attack on Pearl Harbor in 1941 led to the United States joining World War II.

There are several prominent beaches located on this island including one of Hawaii's most popular and famous beaches, Lanikai Beach. Additionally, Kailua Beach Park is cited as one of the best beaches in Hawaii to visit. Tourists like to visit the USS Arizona Memorial, which is a tribute to the Pearl Harbor bombing and the victims. If you like hiking and natural attractions, the Diamond Head State Monument allows visitors to visit a 300,000-year-old crater and take in the breathtaking views.

This island is very healthcare oriented, and the largest employer is the Kahuku Medical Center with over 1,200 employees. This hospital is also the oldest medical facility in Oahu. Also, tourism plays a large roll in supporting the local economy, with thousands of people coming to this island each year.

The median home price for the island of Oahu is $730,000 for a single family home. This price has increased 9.5% over the past year, and prices are projected to rise by an additional 3.1%. The price per square foot is right around $580.

Hawaii is also known as the Big Island, as it is the largest island in the Hawaiian Island chain, and it has a population of 198,449 people. The island does not have cities, it is divided up into nine different districts, and they all fall under Hawaii County. Historically, the sugarcane industry made up the backbone of the island's economy, until the last plant closed in 1996. Today, the economy relies on a healthy year-round tourism industry.

The Parker Ranch is one of the largest cattle ranches in the United States with 175,000 acres, and it is a large export business. Also, the State of Hawaii is the largest employer with 8,115 employees, and the Natural Energy Laboratory of Hawaii Authority is located here. This is a green economic development technology and ocean science park.

One of the most popular tourist destinations is Akaka Falls, and this is the tallest waterfalls on the island. The East Hawaii Cultural Center is another large tourist draw that holds workshops, exhibits, and several classes. Finally, the Hawaii Volcanos National Park is located in the city of Hilo, and this is an extremely busy tourist attraction.

The median home prices on the island of Hawaii are $515,300, and the price per square foot is $493. These prices have increased 5.5% in the past year, and they're projected to continue to rise another 2.2% in the coming year.

The second-largest island in the Hawaiian Islands is Maui with 165,386 year-round residents. This island has a rich history, and it was a central point in World War II's Pacific Theater. It acted as a staging center, rest and relaxation spot, and a training base for more than 100,000 soldiers. There was rapid population growth in 2007 with the city of Kīhei attracting retirees and tourists by the hundreds.

Maui has a two-season year, and the temperatures stay around the same temperatures year-round in the mid-80s. There are several microclimates on this island because of the differences in elevations, and they are divided into four sectors. Depending on which sector you're in, the average temperatures can fluctuate by fifteen to twenty degrees.

The economy relies heavily on tourism and agriculture with papaya, coffee, pineapple juice, and fresh flowers being major exports. There are over 30 snorkeling beaches around Maui, and this is a huge draw for tourists. Makena State Park is home to some of the most popular beaches on Maui, with Makena Beach being the most photographed beach in the Hawaiian Islands. The Hāna Highway is another popular tourist destination, and it is a highway that winds by black sand beaches and waterfalls.

The median home prices in Maui is $509,700, and this price has increased by 4.7% in the past year. The price per square foot is $599, and this matches the Maui Metro. However, the Maui Metro has a higher median home price at $679,450.

The island of Kauai is the oldest one in the Hawaiian Islands and the twenty-first largest with a population of 72,091 people. Tourism is the largest economic support, with over one million people visiting this island each year. It is also the home of the United States Navy's Barking Sands, and this is a Pacific Missle Range Facility. The city of Lihue is an important tourist destination with several parks, tours, and waterfalls. The island of Kauai is affectionately called the Garden Island for its abundance of tropical flowers and native plants.

Tourists come to this island for the gorgeous scenery, state parks, beaches, and hiking trails. The Haena State Park has several beaches, 4,000-year-old caves, and large coral reefs that draw dozens of people for surfing and snorkeling. The Kauai Heritage Center of Hawaiian Culture and the Arts offers classes in hula and lei making, as well as the Hawaiian language.

The median home price in Kauai is $480,600, and this price has increased over the previous year by 6.7%. The price per square foot is around $509, and this is higher than the Kappa Metro of $502, as well as the median home price of $460,000.

Honolulu is the largest city in Hawaii, and there are 351,792 people that call this city home. It is part of the Honolulu Metro, and the Metro area has a combined population of 992,605 people. Honolulu is also the capital of Hawaii, and it is the main gateway between the rest of the islands any tourists the come to the islands. You'll also find a large military presence, international business, and a wide variety of cultures. It is a major financial center for all of the Hawaiian islands, and it is the most remote city of its size in the world.

The economy is Honolulu is supported by business and tourism, as thousands of tourists pass through this city on their way to other islands. Each year, the tourism industry gives an influx of almost ten billion dollars to the local economy, and this helps to draw hundreds of people each year who are looking for an idyllic place to live and a steady job market.

Honolulu has a semi-hot tropical climate with temperatures that fluctuate very little year round. The summer seasons is very dry, with the fall and winter seasons bringing rain, sometimes in abundance. The daily temperatures sit between 80 and 90 degrees, with the lows being between 65 and 75 degrees all year round. Additionally, the average sea temperature ranges from 75.5 degrees in March to 80 degrees in September. The city is also very humid, with the humidity levels staying around 60% to 70% all year.

As this city is a huge tourist city, there are dozens of museums, performance arts, visual arts, parks, beaches, and waterfalls to keep the visitors entertained. One of the most popular attractions is the Ala Moana Center, and this is the largest open-air shopping center in the world. The Aloha Tower is an important Hawaiian landmark, and this lighthouse has been standing since 1926. Finally, the Honolulu Museum of Art celebrates Honolulu's history and the Hawaiian culture with several exhibits, tours, and dance performances.

There are several private and public schools located in this city, and they serve over 31,000 students throughout the city. For secondary education, the Hawaii Pacific University has over 4,900 students enrolled in a variety of degrees. You can also attend the Honolulu Community College for degrees in automotive and airplane maintenance, as well as marine biology.

Along with the tourism industry, the healthcare industry also plays a vital role in Honolulu's economy. The biggest employer in Honolulu is the Kapiolani Medical Center for Women and Children, and it employs 1,500 employees and 630 physicians. The second-largest employer is also a healthcare system, and Queen's Medical Center employs over 1,350 people. The Hawaii State Police Department is the third-largest employer with over 800 employees.

The median house price in Honolulu is $712,000, and this is a price increase of 4.2% over the past year. The average price per square foot is $679, and these prices are predicted to rise 1.7% over the next year. These prices are higher than the Honolulu Metro's median house prices of $680,000, and the Metro's price per square foot of $533.

The district of Hilo is the largest settlement located in Hawaii County, and it has a population of 45,380 people as of 2016. Additionally, Hilo is part of the Hilo Metro, and as of 2016, there were 196,428 people living in the Metro area. You'll find Hilo Bay here, and the city sits at the base of two volcanoes. It is here that you'll also find some of the most important astronomy observatories in the world like the Imiloa Astronomy Center. There are also several companies based here, and Hilo is a rapidly growing city with several tourist destinations.

As Hilo is the oldest city in Hawaii, it is a big tourist destination that has several shopping centers, parks, museums, and interactive exhibits. Additionally, agriculture plays a large role in supporting the economy, with several exports coming out of this city each year.

This city has a tropical rainforest climate with a large amount of rainfall each year. Hilo is the fourth-wettest city in the United States, and the humidity levels stay around the high 70s and low 80s. The average temperature doesn't have large fluctuations, and it stays around 80 degrees year round. January and February are the coolest months in Hilo, and the temperature stays around 69 degrees.

This old city is a mixing pot of several cultures, and it has many events, museums, and festivals that go on year round. The East Hawaiian Cultural Center offers tours of regular exhibits, as well as hands-on workshops and demonstrations. The Pacific Tsunami Museum and the Merrie Monarch Festival draw thousands of tourists each year. This festival takes place a week after Easter, and it is a week-long cultural event that celebrates the history of the Hawaiian people.

Hilo is home to several primary schools, and it also has several exclusive charter institutions throughout the city. If you want post-secondary education, Hilo has two educational institutions to choose from. The University of Hawaii at Hilo has over 3,900 students enrolled, and over 1,500 staff members. The Hawaii Community College is also located here, and it serves over 2,000 students.

There are several smaller employers in Hilo that cater to the tourism industry, but the largest employers are educational based. The University of Hawaii at Hilo is the largest employer in the city, and it employs over 1,500 residents. The second-largest employer is the Hilo Medical Center, and it has over 1,250 staff members currently employed.

The median local home price in Hilo is $297,400, and the price per square foot is $238. These prices have seen a 5.7% increase in the past year, with a projected increase of 2.4% in the coming year. These prices are still lower than the Hilo Metro area where the median home price is $339,500, and it has a $316 price per square foot.

The city of Kapaa is a smaller unincorporated place with just 10,794 people. This small town is located on the north of Wailua on the east side. The main economic support of Kapaa is its large year-round tourism income. There are dozens of small shops, boutiques, and cafes dotted along the town. There is also a large water activity shop where you can purchase wetsuits and gear, or rent recreational vehicles. The Wailua Shopping Plaza and the Coconut Marketplace are large shopping centers where tourists can find restaurants, Hawaiian momentos, shirts, artwork, jewelry, and restaurants.

The first Saturday of the month features the Art Walk where local artists showcase their wares. You can enjoy free food, shows, and live music. There are also several booths with local arts and crafts as well as hands-on demonstrations. The median housing price for Kapaa is $466,200, and the price per square foot is $493. The Kapaa Metro area has a median housing price of $615,000, and the price per square foot here is $502.

The city of Kahului is located on the island of Maui, and it has a population of 28,476 people as of 2016. This city serves as a retail center for the larger city of Maui, and it is home to several large malls and shopping centers. This city isn't traditionally considered to be a tourist destination, but it does have several museums, large companies, and a strong economy.

The local economy revolves around the retail and travel sector. The large shopping malls feature a variety of smaller shops and larger stores, as well as specialty and vintage stores. There are also several companies based in this city, and they provide a lot of the area's residents with employment opportunities as well as opportunities for career advancement.

Kahului has a hot semi-arid climate that is characterized by its dry, humid summers that are tempered by the strong trade winds. The average temperature stays in the mid-80s year round, with it falling into the mid-60s during the evening hours. This city also experiences average rainfall totals, and it is considered to be one of the windiest cities in the United States.

There are several parks, beaches, gardens, and museums for tourist and locals to see. The Maui Nui Botanical Gardens is dedicated to protecting the rich plant life that can be found in Maui and around the city of Kahului. Additionally, the Kanaha Pond State Wildlife Sanctuary has over 142 acres of wetland, and it is a famous Hawaiian waterfowl sanctuary with three of Hawaii's endangered species of ducks housed here.

Several large companies help to support the economy, and they are some of the largest employers in the city. The Maui Electric Company has over 2,600 employees and the Hale Makua Health Services has almost 500 people currently employed. Finally, the Aloha Air Cargo company also plays a large part in the economy, and it currently has over 400 employees.

The median home prices in Kahului are $480,000 with a price per square foot of $376. Over the past year, these prices have increased 8.6%, but they're still lower than the larger Maui Metro. Currently, the Maui Metro area has a median home price of $674,950, and their price per square foot is right around $599.

Other Cities to Consider

In addition to the above, some other popular cities in Hawaii are Kapolei, Kailua, Lihue, Kailua-Kona, and Lanai City. These places are famous for their beaches, bays, basins, craters, cliffs, arches, forests, lakes, islands, streams, ridges, slopes, summits, valleys and swamps. Since tourism reigns supreme in Hawaiian cities it is important to build good hotels, ATMs, banks, etc. for tourist convenience. Tourists can indulge in sports as well as sight seeing and sun bathing at the stunning beaches in Hawaii. Hawaii is a lovely place to retire to and mortgage will be affordable for many retirees.

As of July 1, 2016 the state of Georgia has an estimated population of 1,428,557 across 6,422.63 mi² yielding a population density of 222.43 people per mi² across the state.

The following table highlights the July 1, 2016 populations for each county based on United States Census Bureau estimates.

| County | Islands | 2016 Pop | 2010 Pop | Change | % △ |

|---|---|---|---|---|---|

| Honolulu | O'ahu & Northwestern Hawaiian Islands (except Midway Atoll) | 992,605 | 953,207 | 39,398 | 4.13% |

| Hawaii | Hawai'i | 198,449 | 185,079 | 13,370 | 7.22% |

| Maui | Maui, Kaho'olawe, Lānaʻi, Molokai (except Kalaupapa Peninsula) & Molokini | 165,386 | 154,834 | 10,552 | 6.82% |

| Kauai | Kaua'i, Ni'ihau, Lehua & Ka'ula | 72,029 | 67,091 | 4,938 | 7.36% |

| Kalawao | Kalaupapa Peninsula & Moloka'i | 88 | 90 | -2 | -2.22% |

The following table highlights the July 1, 2016 populations of the urban Honolulu and populations across the state based on United States Census Bureau estimates. For Census Designated Places (CDP) where there was no population estimate available for 2016 the 2011-2015 American Community Survey 5-Year Estimates data was used.

All table columns are sortable. Click on the column headers to sort by that column. Click again to sort low to high. Cities with higher levels of population growth typically see the increased demand drive faster real estate price appreciation.

| Rank | Geography | County | 2016 Pop | 2010 Pop | Change | % △ | Land mi² | Pop Den mi² |

|---|---|---|---|---|---|---|---|---|

| 1 | Urban Honolulu CDP | Honolulu | 351,792 | 337,256 | 14,536 | 4.31% | 60.52 | 5,572.64 |

| 2 | East Honolulu CDP | Honolulu | 48,092 | 49,914 | -1,822 | -3.65% | 23.01 | 2,169.23 |

| 3 | Pearl City CDP | Honolulu | 47,021 | 47,698 | -677 | -1.42% | 9.11 | 5,235.78 |

| 4 | Hilo CDP | Hawaii | 45,380 | 43,263 | 2,117 | 4.89% | 53.39 | 810.32 |

| 5 | Waipahu CDP | Honolulu | 41,165 | 38,216 | 2,949 | 7.72% | 2.8 | 13,648.57 |

| 6 | Kailua CDP | Honolulu | 38,722 | 38,635 | 87 | 0.23% | 7.76 | 4,978.74 |

| 7 | Kaneohe CDP | Honolulu | 33,654 | 34,597 | -943 | -2.73% | 6.53 | 5,298.16 |

| 8 | Kahului CDP | Maui | 28,476 | 26,337 | 2,139 | 8.12% | 14.45 | 1,822.63 |

| 9 | Mililani Town CDP | Honolulu | 28,021 | 27,629 | 392 | 1.42% | 4.01 | 6,890.02 |

| 10 | Ewa Gentry CDP | Honolulu | 22,676 | 22,690 | -14 | -0.06% | 2.18 | 10,408.26 |

| 11 | Kihei CDP | Maui | 22,401 | 20,881 | 1,520 | 7.28% | 9.28 | 2,250.11 |

| 12 | Mililani Mauka CDP | Honolulu | 21,055 | 21,039 | 16 | 0.08% | 3.98 | 5,286.18 |

| 13 | Schofield Barracks CDP | Honolulu | 20,858 | 16,370 | 4,488 | 27.42% | 2.77 | 5,909.75 |

| 14 | Makakilo CDP | Honolulu | 20,631 | 18,248 | 2,383 | 13.06% | 3.82 | 4,776.96 |

| 15 | Kapolei CDP | Honolulu | 18,737 | 15,186 | 3,551 | 23.38% | 4.14 | 3,668.12 |

| 16 | Wahiawa CDP | Honolulu | 17,484 | 17,821 | -337 | -1.89% | 2.07 | 8,609.18 |

| 17 | Wailuku CDP | Maui | 16,064 | 15,313 | 751 | 4.90% | 5.32 | 2,878.38 |

| 18 | Halawa CDP | Honolulu | 14,812 | 14,014 | 798 | 5.69% | 2.37 | 5,913.08 |

| 19 | Ewa Beach CDP | Honolulu | 14,287 | 14,955 | -668 | -4.47% | 1.21 | 12,359.50 |

| 20 | Royal Kunia CDP | Honolulu | 14,198 | 14,525 | -327 | -2.25% | 3.02 | 4,809.60 |

| 21 | Waianae CDP | Honolulu | 13,632 | 13,177 | 455 | 3.45% | 5.36 | 2,458.40 |

| 22 | Waimalu CDP | Honolulu | 13,333 | 13,730 | -397 | -2.89% | 1.83 | 7,502.73 |

| 23 | Kailua CDP | Hawaii | 12,652 | 11,975 | 677 | 5.65% | 35.63 | 336.09 |

| 24 | Nanakuli CDP | Honolulu | 12,405 | 12,666 | -261 | -2.06% | 2.99 | 4,236.12 |

| 25 | Kalaoa CDP | Hawaii | 12,214 | 9,644 | 2,570 | 26.65% | 39.17 | 246.21 |

| 26 | Lahaina CDP | Maui | 12,118 | 11,704 | 414 | 3.54% | 7.78 | 1,504.37 |

| 27 | Hawaiian Paradise Park CDP | Hawaii | 11,684 | 11,404 | 280 | 2.46% | 15.21 | 749.77 |

| 28 | Ocean Pointe CDP | Honolulu | 11,336 | 8,361 | 2,975 | 35.58% | 2.03 | 4,118.72 |

| 29 | Kaneohe Station CDP | Honolulu | 11,285 | 9,517 | 1,768 | 18.58% | 4.38 | 2,172.83 |

| 30 | Waipio CDP | Honolulu | 11,261 | 11,674 | -413 | -3.54% | 1.25 | 9,339.20 |

| 31 | Waimea CDP | Hawaii | 10,817 | 9,212 | 1,605 | 17.42% | 39.29 | 234.46 |

| 32 | Kapaa CDP | Kauai | 10,794 | 10,699 | 95 | 0.89% | 10.01 | 1,068.83 |

| 33 | Aiea CDP | Honolulu | 9,262 | 9,338 | -76 | -0.81% | 1.66 | 5,625.30 |

| 34 | Hickam Housing CDP | Honolulu | 9,243 | 6,920 | 2,323 | 33.57% | 4.59 | 1,507.63 |

| 35 | Waihee-Waiehu CDP | Maui | 9,159 | 8,841 | 318 | 3.60% | 4.11 | 2,151.09 |

| 36 | Maili CDP | Honolulu | 8,910 | 9,488 | -578 | -6.09% | 1.72 | 5,516.28 |

| 37 | Makaha CDP | Honolulu | 8,813 | 8,278 | 535 | 6.46% | 2.43 | 3,406.58 |

| 38 | Holualoa CDP | Hawaii | 8,390 | 8,538 | -148 | -1.73% | 13.2 | 646.82 |

| 39 | Ahuimanu CDP | Honolulu | 8,354 | 8,810 | -456 | -5.18% | 2.69 | 3,275.09 |

| 40 | Pukalani CDP | Maui | 8,072 | 7,574 | 498 | 6.58% | 4.28 | 1,769.63 |

| 41 | Haiku-Pauwela CDP | Maui | 7,846 | 8,118 | -272 | -3.35% | 15.78 | 514.45 |

| 42 | Waikele CDP | Honolulu | 7,786 | 7,479 | 307 | 4.10% | 1.1 | 6,799.09 |

| 43 | Kula CDP | Maui | 7,478 | 6,452 | 1,026 | 15.90% | 34.61 | 186.42 |

| 44 | Lihue CDP | Kauai | 7,360 | 6,455 | 905 | 14.02% | 6.67 | 967.77 |

| 45 | Ewa Villages CDP | Honolulu | 7,356 | 6,108 | 1,248 | 20.43% | 1.13 | 5,405.31 |

| 46 | Napili-Honokowai CDP | Maui | 6,723 | 7,261 | -538 | -7.41% | 2.64 | 2,750.38 |

| 47 | Makawao CDP | Maui | 6,523 | 7,184 | -661 | -9.20% | 3.47 | 2,070.32 |

| 48 | Waikoloa Village CDP | Hawaii | 6,350 | 6,362 | -12 | -0.19% | 17.83 | 356.81 |

| 49 | Waimanalo CDP | Honolulu | 6,164 | 5,451 | 713 | 13.08% | 4.35 | 1,253.10 |

| 50 | Pupukea CDP | Honolulu | 5,705 | 4,551 | 1,154 | 25.36% | 3.44 | 1,322.97 |

| 51 | Wailea CDP | Maui | 5,656 | 5,938 | -282 | -4.75% | 7.44 | 798.12 |

| 52 | Wailua Homesteads CDP | Kauai | 5,645 | 5,188 | 457 | 8.81% | 7.3 | 710.68 |

| 53 | Laie CDP | Honolulu | 5,644 | 6,138 | -494 | -8.05% | 1.34 | 4,580.60 |

| 54 | West Loch Estate CDP | Honolulu | 5,364 | 5,485 | -121 | -2.21% | 0.62 | 8,846.77 |

| 55 | Waipio Acres CDP | Honolulu | 4,961 | 5,236 | -275 | -5.25% | 1 | 5,236.00 |

| 56 | Hanamaulu CDP | Kauai | 4,946 | 3,835 | 1,111 | 28.97% | 1.27 | 3,019.69 |

| 57 | Whitmore Village CDP | Honolulu | 4,919 | 4,499 | 420 | 9.34% | 0.91 | 4,943.96 |

| 58 | Captain Cook CDP | Hawaii | 4,594 | 3,429 | 1,165 | 33.97% | 12.86 | 266.64 |

| 59 | Kahaluu CDP | Honolulu | 4,565 | 4,738 | -173 | -3.65% | 3.48 | 1,361.49 |

| 60 | Heeia CDP | Honolulu | 4,481 | 4,963 | -482 | -9.71% | 3.09 | 1,606.15 |

| 61 | Hawaiian Beaches CDP | Hawaii | 4,453 | 4,280 | 173 | 4.04% | 24.54 | 174.41 |

| 62 | Kalaheo CDP | Kauai | 4,358 | 4,595 | -237 | -5.16% | 3.5 | 1,312.86 |

| 63 | Hawaiian Ocean View CDP | Hawaii | 4,276 | 4,437 | -161 | -3.63% | 36.79 | 120.6 |

| 64 | Waimanalo Beach CDP | Honolulu | 4,255 | 4,481 | -226 | -5.04% | 1.97 | 2,274.62 |

| 65 | Iroquois Point CDP | Honolulu | 3,935 | 3,374 | 561 | 16.63% | 0.56 | 6,025.00 |

| 66 | Kahaluu-Keauhou CDP | Hawaii | 3,783 | 3,549 | 234 | 6.59% | 5.6 | 633.75 |

| 67 | Hauula CDP | Honolulu | 3,755 | 4,148 | -393 | -9.47% | 1.15 | 3,606.96 |

| 68 | Waialua CDP | Honolulu | 3,690 | 3,860 | -170 | -4.40% | 2.19 | 1,762.56 |

| 69 | Ainaloa CDP | Hawaii | 3,596 | 2,965 | 631 | 21.28% | 1.97 | 1,505.08 |

| 70 | Haleiwa CDP | Honolulu | 3,576 | 3,970 | -394 | -9.92% | 2.28 | 1,741.23 |

| 71 | Waikapu CDP | Maui | 3,561 | 2,965 | 596 | 20.10% | 11.04 | 268.57 |

| 72 | Kaunakakai CDP | Maui | 3,544 | 3,425 | 119 | 3.47% | 12.83 | 266.95 |

| 73 | Lanai City CDP | Maui | 3,519 | 3,102 | 417 | 13.44% | 6.92 | 448.27 |

| 74 | Puhi CDP | Kauai | 3,435 | 2,906 | 529 | 18.20% | 0.89 | 3,265.17 |

| 75 | Orchidlands Estates CDP | Hawaii | 3,305 | 2,815 | 490 | 17.41% | 9.7 | 290.21 |

| 76 | Kilauea CDP | Kauai | 3,208 | 2,803 | 405 | 14.45% | 4.95 | 566.26 |

| 77 | Mountain View CDP | Hawaii | 3,088 | 3,924 | -836 | -21.30% | 55.76 | 70.37 |

| 78 | Kekaha CDP | Kauai | 2,915 | 3,537 | -622 | -17.59% | 1 | 3,537.00 |

| 79 | Honaunau-Napoopoo CDP | Hawaii | 2,813 | 2,567 | 246 | 9.58% | 37.99 | 67.57 |

| 80 | Wheeler AFB CDP | Honolulu | 2,712 | 1,634 | 1,078 | 65.97% | 2.31 | 707.36 |

| 81 | Hanapepe CDP | Kauai | 2,630 | 2,638 | -8 | -0.30% | 0.92 | 2,867.39 |

| 82 | Koloa CDP | Kauai | 2,623 | 2,144 | 479 | 22.34% | 1.25 | 1,715.20 |

| 83 | Eleele CDP | Kauai | 2,604 | 2,390 | 214 | 8.95% | 0.78 | 3,064.10 |

| 84 | Wailua CDP | Kauai | 2,584 | 2,254 | 330 | 14.64% | 1.47 | 1,533.33 |

| 85 | Honalo CDP | Hawaii | 2,571 | 2,423 | 148 | 6.11% | 29.58 | 81.91 |

| 86 | Paia CDP | Maui | 2,561 | 2,668 | -107 | -4.01% | 6.13 | 435.24 |

| 87 | Hawaiian Acres CDP | Hawaii | 2,516 | 2,700 | -184 | -6.81% | 19.43 | 138.96 |

| 88 | Kahuku CDP | Honolulu | 2,513 | 2,614 | -101 | -3.86% | 0.96 | 2,722.92 |

| 89 | Volcano CDP | Hawaii | 2,430 | 2,575 | -145 | -5.63% | 58.56 | 43.97 |

| 90 | Keaau CDP | Hawaii | 2,415 | 2,253 | 162 | 7.19% | 2.57 | 876.65 |

| 91 | Princeville CDP | Kauai | 2,400 | 2,158 | 242 | 11.21% | 2.39 | 902.93 |

| 92 | Honokaa CDP | Hawaii | 2,359 | 2,258 | 101 | 4.47% | 1.27 | 1,777.95 |

| 93 | Lawai CDP | Kauai | 2,253 | 2,363 | -110 | -4.66% | 4.06 | 582.02 |

| 94 | Maunawili CDP | Honolulu | 2,149 | 2,040 | 109 | 5.34% | 1.84 | 1,108.70 |

| 95 | Kualapuu CDP | Maui | 1,998 | 2,027 | -29 | -1.43% | 29.35 | 69.06 |

| 96 | Anahola CDP | Kauai | 1,951 | 2,223 | -272 | -12.24% | 3.63 | 612.4 |

| 97 | Keokea CDP | Maui | 1,951 | 1,612 | 339 | 21.03% | 18.35 | 87.85 |

| 98 | Kealakekua CDP | Hawaii | 1,894 | 2,019 | -125 | -6.19% | 7.23 | 279.25 |

| 99 | Ko Olina CDP | Honolulu | 1,872 | 1,799 | 73 | 4.06% | 1.08 | 1,665.74 |

| 100 | Kapaau CDP | Hawaii | 1,851 | 1,734 | 117 | 6.75% | 2.87 | 604.18 |

| 101 | Nanawale Estates CDP | Hawaii | 1,714 | 1,426 | 288 | 20.20% | 2.19 | 651.14 |

| 102 | Waimea CDP | Kauai | 1,690 | 1,855 | -165 | -8.89% | 1.84 | 1,008.15 |

| 103 | Pepeekeo CDP | Hawaii | 1,681 | 1,789 | -108 | -6.04% | 1.19 | 1,503.36 |

| 104 | Mokuleia CDP | Honolulu | 1,653 | 1,811 | -158 | -8.72% | 1.46 | 1,240.41 |

| 105 | Leilani Estates CDP | Hawaii | 1,557 | 1,560 | -3 | -0.19% | 4.03 | 387.1 |

| 106 | Fern Acres CDP | Hawaii | 1,426 | 1,504 | -78 | -5.19% | 6.81 | 220.85 |

| 107 | Pahala CDP | Hawaii | 1,405 | 1,356 | 49 | 3.61% | 0.84 | 1,614.29 |

| 108 | Wainaku CDP | Hawaii | 1,388 | 1,224 | 164 | 13.40% | 1.32 | 927.27 |

| 109 | Hawi CDP | Hawaii | 1,345 | 1,081 | 264 | 24.42% | 1.18 | 916.1 |

| 110 | Makaha Valley CDP | Honolulu | 1,284 | 1,341 | -57 | -4.25% | 4.13 | 324.7 |

| 111 | Omao CDP | Kauai | 1,270 | 1,301 | -31 | -2.38% | 1.27 | 1,024.41 |

| 112 | Hana CDP | Maui | 1,258 | 1,235 | 23 | 1.86% | 10.56 | 116.95 |

| 113 | Papaikou CDP | Hawaii | 1,234 | 1,314 | -80 | -6.09% | 1.44 | 912.5 |

| 114 | Kaanapali CDP | Maui | 1,202 | 1,045 | 157 | 15.02% | 4.95 | 211.11 |

| 115 | Haliimaile CDP | Maui | 1,190 | 964 | 226 | 23.44% | 3.46 | 278.61 |

| 116 | Olinda CDP | Maui | 1,161 | 1,084 | 77 | 7.10% | 7.49 | 144.73 |

| 117 | Kaaawa CDP | Honolulu | 1,139 | 1,379 | -240 | -17.40% | 0.8 | 1,723.75 |

| 118 | Discovery Harbour CDP | Hawaii | 1,107 | 949 | 158 | 16.65% | 3.56 | 266.57 |

| 119 | Kurtistown CDP | Hawaii | 1,070 | 1,298 | -228 | -17.57% | 5.95 | 218.15 |

| 120 | Punaluu CDP | Honolulu | 1,064 | 1,164 | -100 | -8.59% | 1.6 | 727.5 |

| 121 | Poipu CDP | Kauai | 1,042 | 979 | 63 | 6.44% | 2.57 | 380.93 |

| 122 | Mahinahina CDP | Maui | 1,016 | 880 | 136 | 15.45% | 6.7 | 131.34 |

| 123 | Kaumakani CDP | Kauai | 940 | 749 | 191 | 25.50% | 0.95 | 788.42 |

| 124 | Naalehu CDP | Hawaii | 847 | 866 | -19 | -2.19% | 2.17 | 399.08 |

| 125 | Pahoa CDP | Hawaii | 826 | 945 | -119 | -12.59% | 2.19 | 431.51 |

| 126 | Waikane CDP | Honolulu | 771 | 778 | -7 | -0.90% | 6.8 | 114.41 |

| 127 | Puako CDP | Hawaii | 741 | 772 | -31 | -4.02% | 10.31 | 74.88 |

| 128 | Eden Roc CDP | Hawaii | 687 | 942 | -255 | -27.07% | 6.4 | 147.19 |

| 129 | Fern Forest CDP | Hawaii | 669 | 931 | -262 | -28.14% | 12.47 | 74.66 |

| 130 | Paauilo CDP | Hawaii | 633 | 595 | 38 | 6.39% | 1.04 | 572.12 |

| 131 | Laupahoehoe CDP | Hawaii | 533 | 581 | -48 | -8.26% | 2.12 | 274.06 |

| 132 | Halaula CDP | Hawaii | 530 | 469 | 61 | 13.01% | 2.65 | 176.98 |

| 133 | Paukaa CDP | Hawaii | 520 | 425 | 95 | 22.35% | 0.43 | 988.37 |

| 134 | Launiupoko CDP | Maui | 505 | 588 | -83 | -14.12% | 5.33 | 110.32 |

| 135 | Kukuihaele CDP | Hawaii | 436 | 336 | 100 | 29.76% | 1.71 | 196.49 |

| 136 | Maunaloa CDP | Maui | 431 | 376 | 55 | 14.63% | 0.72 | 522.22 |

| 137 | Ualapu'e CDP | Maui | 372 | 425 | -53 | -12.47% | 3.17 | 134.07 |

| 138 | Honomu CDP | Hawaii | 364 | 509 | -145 | -28.49% | 0.47 | 1,082.98 |

| 139 | Kapalua CDP | Maui | 322 | 353 | -31 | -8.78% | 4.8 | 73.54 |

| 140 | Pakala Village CDP | Kauai | 317 | 294 | 23 | 7.82% | 2.4 | 122.5 |

| 141 | Maalaea CDP | Maui | 298 | 352 | -54 | -15.34% | 5.44 | 64.71 |

| 142 | Haena CDP | Kauai | 280 | 431 | -151 | -35.03% | 1.45 | 297.24 |

| 143 | Kalihiwai CDP | Kauai | 271 | 428 | -157 | -36.68% | 2.65 | 161.51 |

| 144 | Kawela Bay CDP | Honolulu | 248 | 330 | -82 | -24.85% | 0.58 | 568.97 |

| 145 | Hanalei CDP | Kauai | 210 | 450 | -240 | -53.33% | 0.65 | 692.31 |

| 146 | Wainiha CDP | Kauai | 168 | 318 | -150 | -47.17% | 2.4 | 132.5 |

| 147 | Makena CDP | Maui | 132 | 99 | 33 | 33.33% | 9.47 | 10.45 |

| 148 | Waiohinu CDP | Hawaii | 112 | 213 | -101 | -47.42% | 1.37 | 155.47 |

| 149 | Olowalu CDP | Maui | 92 | 80 | 12 | 15.00% | 2.94 | 27.21 |

| 150 | Manele CDP | Maui | 20 | 29 | -9 | -31.03% | 1.23 | 23.58 |

| 151 | Kalaeloa CDP | Honolulu | 9 | 48 | -39 | -81.25% | 0.26 | 184.62 |

Annual Estimates of the Resident Population: April 1, 2010 to July 1, 2016

Source: U.S. Census Bureau, Population Division

Release Date: May 2017.

As of 2026 the conforming loan limit across the United States is set to $832,750, with a ceiling of 150% that amount in HERA high-cost areas where median home values are higher. The state of Hawaii has a conforming loan limit of $1,249,125 for most one-unit properties. Maui and Kalawao counties have a higher loan limit than the rest of the country, with single-unit properties having a $1,299,500 conforming loan limit.

Here are loan limits for metro areas across the state. Loans above these limits are considered jumbo loans. Jumbo loans typically have a slightly higher rate of interest than conforming mortgages, though spreads vary based on credit market conditions.

| County | Metropolitan Designation | 1 Unit Limit | 2 Unit Limit | 3 Unit Limit | 4 Unit Limit |

|---|---|---|---|---|---|

| Hawaii | Hilo, Hi | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| Honolulu | Urban Honolulu, Hi | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| Kalawao | Kahului-Wailuku-Lahaina, Hi | $1,299,500 | $1,663,600 | $2,010,950 | $2,499,100 |

| Kauai | Kapaa, Hi | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| Maui | Kahului-Wailuku-Lahaina, Hi | $1,299,500 | $1,663,600 | $2,010,950 | $2,499,100 |

Several different types of home loans are available in The Aloha State. Fixed-rate loans are very common, and the terms include thirty, twenty, fifteen, and ten years. The longer the life of the mortgage, the lower the monthly payment will be, which is why the 30-year loan is the most popular. The downside of this, however, is that the APR is higher compared to shorter-term loans. The difference can be as large as a full percentage point, which leads to a lot more interest paid over the life of the loan when combined with a longer loan term.

In addition to conventional 30-year and 15-year fixed-rate mortgages, lenders offer a wide variety of adjustable rate mortgages (ARM’s). While these instruments have lost some of their attractiveness during the recession, there are still circumstances where they offer the only way for a borrower to qualify. Properly structured (that is, with strict limits on how much the rate can fluctuate), such loans are still a legitimate way for borrowers to purchase a home and start building equity while establishing their credit so as to qualify for conventional loans upon the ARM’s expiration. These loans provide interest rates that fluctuate, as the name implies. The APR is usually fixed for an initial term, such as three, five, seven or ten years. Then the rate adjusts depending on the performance of a referenced index rate, usually once per year; but it can change more frequently. The loan agreement may state in detail how frequently the APR can change, and it may also include a rate cap to prevent large changes.

Balloon mortgages are another route for aspiring homeowners. Balloon mortgages are when a large portion of the borrowed principle is repaid in a single payment at the end of the loan period. Balloon loans are not common for most residential buyers, but are more common for commercial loans and people with significant financial assets.

A few lenders in the Aloha State offer interest-only loans, but usually only for periods of three years. These are mortgages where payments are applied only to interest for a period of time. The loan's principal isn't paid down, so the monthly payments are very low. The low monthly payments only lasts a few years, however. Typically, it's about three years. After this period, monthly payments spike because the loan's principal hasn't been reduced & the remainder of the loan must be paid off in a compressed period of time. For example, on a 3 year IO 30-year loan, the first 3 years are interest only payments, then the loan principal must be paid in full in the subsequent 27 years.

When qualifying for a loan, a credit score of 720 or better can help secure a favorable loan. Some mortgage lenders in the Honolulu area have approved borrowers with credit scores around 640. The best rates and deals will be obtained with a score above 740. There is a lot of competition among lenders, and this environment can create nice perks for borrowers. For example, some banks will offer special deals on closing costs for borrowers who qualify. The cost might be added to the mortgage or the bank will pay the closing costs but add a few basis points to the APR.

A debt-to-income ratio of 40% and a down payment of 20% are what most banks want to see on a home loan application. They will accept worse numbers, but fees and APR's could go up as a result. Also, a down payment of less than 20% typically results in required mortgage insurance. This down payment requirement does not apply for Federal assistance programs such as FHA, in which applicants can have a lower credit score and income but still receive financing.

The piggyback loan is another type of mortgage which is simply two mortgages in one. The piggyback loan can eliminate the need for private mortgage insurance by covering 80% of the home's value with the first loan, while the second loan helps to pay for part of the down payment.

Prospective home buyers who don't find what they're looking for at one of the state's private banks may want to take a look at some of the mortgage options the federal government offers. One of them is the loan program at the Veterans Administration, which provides mortgages with zero down. On top of that great deal, VA loans do not require private mortgage insurance. The agency does, however, charge a funding fee, and this varies from 1.2% to 3.3%. Making a voluntary down payment will reduce this charge. And in case you're wondering, yes you do have to be a qualified veteran to get one of these unbeatable deals.

If you're not a vet, you may want to consider the Federal Housing Administration's home loan services. The FHA offers loans to people who have a credit score of at least 580 and who can put at least 3.5% down. The government agency also offers mortgages for lower credit scores, but it requires more money down with these loans.

USDA loans can help people with low incomes in rural parts of the state qualify for a subsidized low-interest loan. Given the low population density throughout most of the state, most areas qualify.

Hula Mae Program

If you're a first-time homebuyer who's trying to get a 30-year mortgage, you may be eligible to secure lower interest home loans through the Hula Mae program. Additionally, you may be eligible to get down payment assistance for up to 3% of the home's price. You will have to apply for this program with a participating lender, and the lender will orchestrate the closing on your home purchase. The loan must have a closing date of 60 days or less, and there are a few eligibility requirements you have to meet including:

Hawaii Mortgage Credit Assistance

The Hawaii Housing Finance and Development Corporation can issue mortgage certificates to potential homebuyers who need help paying their down payments. The Hawaii Mortgage Credit Assistance program is meant for low and moderately-low income applicants, and it reduces the amount of Federal income tax you'll pay. In turn, this gives you more available income to apply for a mortgage, and 20% of your yearly mortgage interest will be applied as a Federal tax credit. The eligibility requirements are:

Bank of Hawaii – First Time Homebuyer Program

The Bank of Hawaii offers a special first-time homebuyer's program that offers free mortgage counseling, and you can obtain your mortgage at a reduced rate. It also gives the applicants reduced closing costs and reduced down payment requirements. The qualifying guidelines are also more flexible than a traditional mortgage, and the Bank of Hawaii lists all of the eligible properties that applicants can choose from. There are fixed and adjustable interest rates available, and no prepayment penalties. You have to apply for this program through the Bank of Hawaii, either in person or online.

Hawaii does not have an elevated risk of wildfires, hail or tornadoes but it has a number of risks associated with being on a rock formation in the Pacific Ocean, far way from other land. These risks include:

Standard haomeowner's insurance policies typically do not cover damages due to earthquakes or flooding.

Flash floods are not uncommon. In 2008 heavy rains on the Big Island caused flooding which damaged many homes in Waiakea Uke.

When King Tide coincides with high surf many areas which are normally free from flooding can quickly become covered in a foot or more of water.

Home buyers with mortgages in high-risk areas are required to buy flood insurance. Most flood insurance policies are sold by the United States federal government through The National Flood Insurance Program. Under-priced flood insurance in high-risk areas act as a subsidy to wealthy homeowners.

The NFIP does not charge nearly enough to cover the expected costs of its liabilities. The assessments are not sufficient to build any buffer to cover an extraordinary year, such as what occurred with Hurricane Katrina in 2005 or Hurricane Sandy in 2012. Because homeowners don't incur the full cost of building in a flood zone we end up with more houses there than if homeowners incurred the full cost of the flood risk, which exacerbates the government's costs in the next disaster.

Typically, homes built after 2002, when building code regulations tightened, are subject to lower insurance rates than older homes. On the other hand, homes without hurricane straps, with roofs that do not meet current standards for wind, with older plumbing or with outdated electrical systems may be difficult or very expensive to insure.

Homeowners who live in lower risk areas & are not required to purchase flood insurance heavily cross-subsidize homeowners who are in areas where floods are more common.

The state of Hawaii has the lowest property tax rate in the United States at 0.32%. However, since Hawaii's real estate is one of the most expensive in the nation, the lower tax rate doesn't save Hawaiian homeowners a lot of money. For example, if you purchase a home worth $504,500, you'll pay $1,412 in property taxes each year. To put it in perspective, Deleware has a property tax rate of 0.53%, and their median home price is $232,900. This means that you'll pay $1,234 each year on your property in Deleware, even though you're paying almost double the rate on your property taxes.

Homeowner Exemption

Since Hawaiians pay such steep property taxes, there is a homeowner exemption they can claim to reduce their tax burden. You must apply for this exemption, and this is especially important if you've recently purchased a home. The typical exemption amount is $40,000, but it does go up based on several factors. For example, you purchased a home valued at $320,000, but you got a home exemption amount of $45,000. You would be taxed and pay property taxes on $275,000 instead of the full $320,000. You have to own your home and consider it your primary residence to be eligible. Additionally, you have to record your ownership of the property with the Bureau of Conveyances, State Department of Land and Natural Resources, and you have to file a claim before December 31st.

This is a formal document that is made out by both the creditor and the debtor at the time of the real estate transaction. It contains the name of the buyer and the name of the person who sells it and the legal description of the property. This written document should be notarized. There are three types of deeds used in real estate transactions in Hawaii. Those are the Quitclaim Deed, the Grant Deed and the Warranty/Non Warranty Deeds. In the deeds, the terms Grantor and grantee are used to signify the lender and the debtor. Through the quitclaim deed, the transaction is done when the ownership interest and the title are transferred from one person to the other without any limits. There are no warranties or guarantees that the title is free of claims or liens. This is usually done in the case of divorcing couples when one party signs off to the other. In the grant deed, the ownership is transferred, but the title is retained unless specifically mentioned. In the warranty/non warranty Deed there are several other types that claim that the title is good, free of any claims or leins and is the most common form of transfer.

The state of Hawaii is one of twelve non-recourse states. This means that a borrower can default on their mortgage and walk away without fear that the mortgage lender will come after them for any money they owe. Each non-recourse state also has some form of an anti-deficiency statute as well. These anti-deficiency statues prevent the mortgage lender from going after the borrower for any additional money.

For example, if the borrower owed $120,000 on the mortgage and you default, the lender will typically sell the home at a sheriff's sale or an auction. If they sold the home for $80,000, there would be a deficiency of $40,000. The anti-deficiency statute prevents the lender from making the borrower pay the $40,000 the lender lost at the sheriff's sale or auction. The lender simply has to absorb the loss and move on. However, Hawaii's anti-deficiency statute only applies to non-judicial foreclosures.

In Hawaii, lenders can choose to use a judiciary or a non-judiciary process to foreclose on a property, and before 2011 the non-judiciary route was the one most lenders took. However, in 2011, the state of Hawaii introduced the Mortgage Foreclosure Dispute Resolution Program for all non-judiciary foreclosures. This is more commonly known as mortgage mediation, and most lenders want to bypass this mediation process, so they choose the judicial foreclosure process.

Here are resources to learn more about the Hawaii real estate market.

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today's low rates may benefit from recent rate volatility.

Are you paying too much for your mortgage?

Check your refinance options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you refinance and save today!