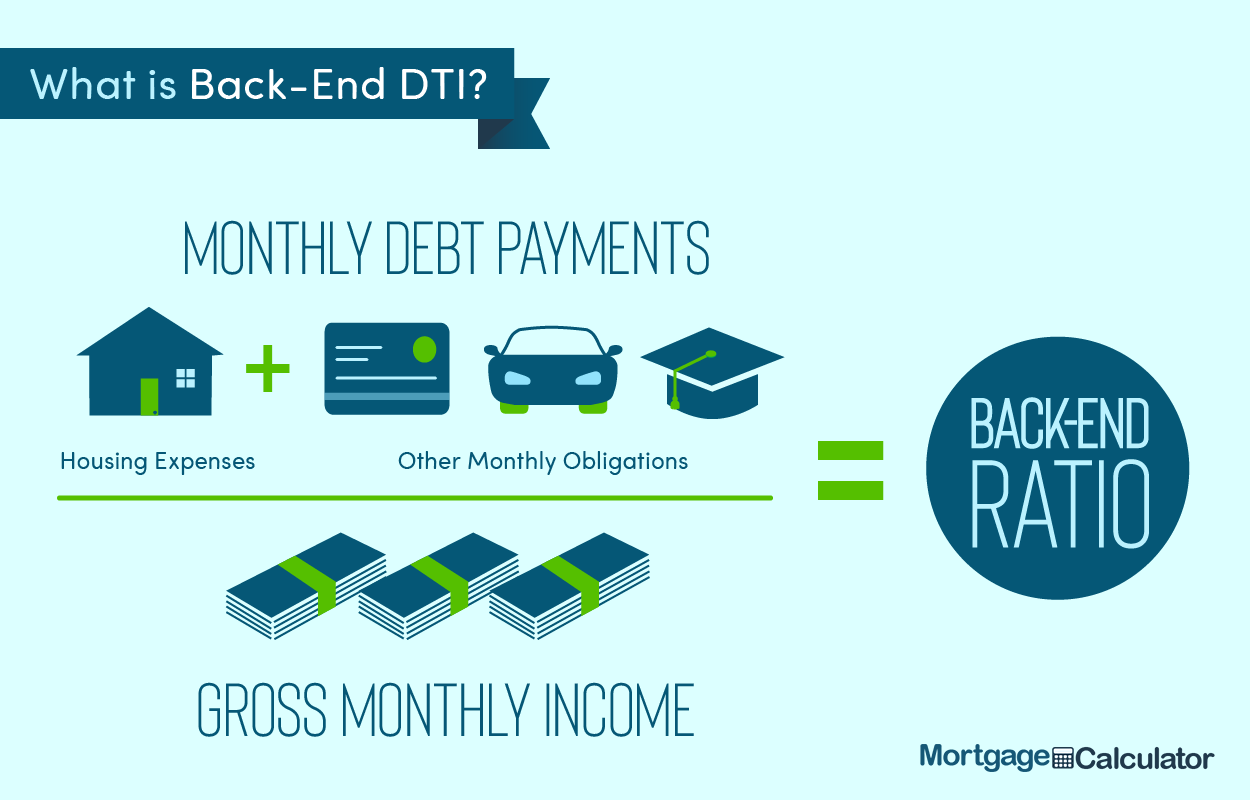

Use this to figure your debt to income ratio. A back end debt to income ratio greater than or equal to 40% is generally viewed as an indicator you are a high risk borrower.

For your convenience we list current El Monte mortgage rates to help homebuyers estimate their monthly payments & find local lenders.

The following table shows current El Monte 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down.

The number one rule of personal finance is to earn more money than you spend.

How Lenders View Risk

When you apply for a major loan, the lender won't see how often you stay late at the office to help out the boss, what a great asset you are to your company, or how skilled you are in your chosen field.

What your lender will see when he looks at you is a financial risk and a potential liability to his business. He sees how much you earn and how much you owe, and he will boil it down to a number called your debt-to-income ratio.

If you know your debt-to-income ratio before you apply for a car loan or mortgage, you're already ahead of the game. Knowing where you stand financially and how you're viewed by bankers and other lenders lets you prepare yourself for the negotiations to come.

Use our convenient calculator to figure your ratio. This information can help you decide how much money you can afford to borrow for a house or a new car, and it will assist you with figuring out a suitable cash amount for your down payment.

| Loan Type | Front End Limit | Back End Limit |

|---|---|---|

| Conventional | N/A | 50% |

| FHA | many lenders require 31% or below; can't get approved via Automated Underwriting System if above 46.9% | 43% with FICO below 620; borrowers with FICO above 620 can exceed 50% up to 56.9% with compensating factors; many lenders may have tighter standards |

| VA | N/A | lender benchmark of 41%; varries by lender |

| USDA | 29% to 32%, higher with compensating factors | 41%, or 44% with a PITI below 32% |

On June 22, 2020 the CFPB announced they were taking steps to address GSE patches which could see the DTI ratio removed as a requirement for qualifying mortgages. They would instead rely on loan pricing information as the basis for qualification.

“The Bureau proposes to amend the General QM definition in Regulation Z to replace the DTI limit with a price-based approach. The Bureau is proposing a price-based approach because it preliminarily concludes that a loan’s price, as measured by comparing a loan’s annual percentage rate to the average prime offer rate for a comparable transaction, is a strong indicator and more holistic and flexible measure of a consumer’s ability to repay than DTI alone.

For eligibility for QM status under the General QM definition, the Bureau is proposing a price threshold for most loans as well as higher price thresholds for smaller loans, which is particularly important for manufactured housing and for minority consumers. The NPRM also proposes that lenders take into account a consumer’s income, debt, and DTI ratio or residual income and verify the consumer’s income and debts.”

Calculate your monthly income by adding up income from all sources. Start with your base salary and add any additional returns you receive from investments or a side business, for example. If you receive a year-end bonus or quarterly commissions at work, be sure to add them up and divide by 12 before adding those amounts to your tally.

Don't Forget Your Spouse!

Your spouse's income is also included in your income calculation provided you are applying for the loan together.

What if Your Spouse Has Poor Credit?

If one spouse has poor credit and the other buyer would still qualify without including their spouse on the loan, then it can make sense to have the spouse with better credit apply for the mortgage individually. If the spouse with poor credit is included on a joint application the perceived credit risk will likely be higher. Bad credit mortgages charge higher interest rates.

Now that you have your average monthly income you can use that to figure out your DTIs.

| Front End Ratio Example | Amount |

|---|---|

| Monthly Income | $6,000 |

| Mortgage Payment | $1,100 |

| Home Insurance | $100 |

| HOA Fees | $100 |

| Property Taxes | $200 |

| Total Monthly Housing Expenses | $1,500 |

| $1,500 / $6,000 = | 25% |

| Front End Ratio | 25% |

It's as simple as taking the total sum of all your monthly debt payments and dividing that figure by your total monthly income. Firstly, though, you must make sure to include all of your obligations:

And remember to include taxes, insurance, and private mortgage insurance in this figure. Also, use the minimum payment when calculating credit cards.

The sum of the above is your monthly obligation. This number will be compared against your income to calculate your back end ratio.

| Back End Ratio Example | Amount |

|---|---|

| Monthly Income | $6,000 |

| Mortgage Payment | $1,100 |

| Home Insurance | $100 |

| HOA Fees | $100 |

| Property Taxes | $200 |

| Front End Subtotal | $1,500 |

| Car Payment | $300 |

| Credit Card Payment | $50 |

| Student Loans | $150 |

| Other Monthly Debt Payments | $500 |

| Total Monthly Home & Debt Payments | $2,000 |

| $2,000 / $6,000 | 33% |

| Back End Ratio | 33% |

To determine your DTI ratio, simply take your total debt figure and divide it by your income. For instance, if your debt costs $2,000 per month and your monthly income equals $6,000, your DTI is $2,000 ÷ $6,000, or 33 percent.

This number doesn't necessarily portray a detailed picture of your financial strengths and weaknesses, but it does give lenders the thumbnail sketch of your finances they need to make a decision.

First of all, it's desirable to have as low a DTI figure as possible. After all, the less you owe relative to your income, the more money you have to apply toward other endeavors (or emergencies). It also means that you have some breathing room, and lenders hate to service consumers who are living on a tight budget and struggling to stay afloat.

But your DTI is also a crucial factor in figuring out how much house you can truly afford. When lenders evaluate your situation, they look at both the front ratio and the back ratio.

No. Instead of worrying about your debt-to-income ratio, you should work towards lowering the number to a more favorable percentage. The DTI is an important tool for lending institutions, but it is only one of the many barometers they use to gauge how safe it would be to lend you money.

However, when it comes to buying a home, your DTI sits front and center on the negotiation table. You will certainly incur higher interest rates with a high (anything more than 40 percent) DTI, and you may be required to slap down a heftier down payment.

Seasoned lenders know that a ratio above 40 percent means you're treading on the slippery slope to fiscal collapse. It says you're making ends meet, but just barely. Lenders will assume that any additional loan you take on might be the last straw.

Can you lower your DTI? Of course! Lowering your ratio is almost as easy as calculating it. Then again, it will take you a lot longer. Fortunately, it's easier and quicker than improving your credit score, but it does require a major shift in your way of thinking.

Can you reduce your DTI to zero? Maybe or maybe not, but that's still a goal worth setting. Use the following tips to put your best foot forward for lenders.

We'd like to tell you to just spend less and save more, but you've probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly (or quarterly), you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

We'd like to tell you to just spend less and save more, but you've probably heard that before. It might be different, though, if you could see your progress in tangible terms, and your DTI can do just that. If you calculate the ratio yearly (or quarterly), you will hopefully see the percentage drop steadily. If you conscientiously work your total debt downward, your DTI ratio will reflect that, both to you and to potential lenders.

The first part of your plan of action is to increase your income. For starters, you could ask for a raise in salary or you could work more overtime. Racking up overtime hours is an excellent way to lower your DTI because it provides an instant boost to your income.

Taking a part-time job to supplement your normal salary is an even better way to increase your income, and the prospect of finding a part-time position in your field is excellent. Many people find that turning a hobby into a part-time job is like hardly working at all.

There are countless opportunities to be found online. For example, there are tutoring jobs in every subject and legitimate, work-from-home writing jobs. You can easily find a second job with flexible hours. Become a dog walker, consultant, or whatever else you would enjoy doing to supplement your ordinary wages.

Work tirelessly at paying down your bills, loans, and other obligations.

Reducing your debt quickly is an act of attrition. Don't pretend you "need" something that you merely "want." Spending less now in order to enjoy riper fruits later on is a brave decision, and seeing the fruits of your labor grow by regularly monitoring your debt-to-income ratio is a terrific incentive. As your debts are repaid your credit will improve.

There are numerous websites devoted to getting you out of debt, and you should visit them frequently. Explore consolidation as a way to simplify and reduce your payments.

How Much Could You Save By Consolidationg Your Debts?

We offer a free & easy-to-use debt consolidation calculator.

If you have high interest debts those should be paid off first because those savings are untaxed. If your debts are subsidized and charge low rates of interest like student loans then it might make sense to compound your savings while slowly paying down your debts.

You need the rate of return from your investments to dramatically outperform the interest rate you pay on loans to justify investing aggressively while carrying debts though, as any returns in the stock market or via other investments are subject to both significant volatility and income taxes.

Your Best Investment? Usually Yourself!

To achieve above-market returns on a consistent basis you must know something the market does not know which is also actually true. This is most likely to be the case only in fields where you have deep expertise and experience.

The best investments with the highest potential returns usually come from one of the following:

If you have low interest student loans which will take many years to extinguish it may make sense to start your housing journey with a cheaper home that is a bit smaller or a bit further from work in order to get started on the housing ladder.

Some people view renting as throwing money away, but even if you put 20% down on a home you are 5X leveraged into a single illiquid investment. Getting laid off during a recession can lead to forclosure.

Over the long run other financial assets typically dramatically outperform real estate. Buying a home for most people is more about investing in emotional stability instead of seeking financial returns.

Real Estate Price Appreciation

Real estate can see sharp moves in short periods of time, though generally tends to keep up with broader rates of inflation across the economy over long periods of time.

In 2006 near the peak of the American housing bubble the New York Times published an article titled This Very, Very Old House about a house on the outskirts of Amsterdam which was built in 1625. They traced changes in property values in the subsequent nearly 400 years to determine it roughly tracked inflation.

Longterm Stock Market Returns

The S&P 500 has returned around 8% annually from 1957 to 2018. The original composit index began in 1926 with 90 stocks. Including the early years of the stock market boosted the average annual return to around 10.5%, though most years see significant volatility which requires one to be in the market over the longterm to compensate for the risk of bad timing.

Congratulations, you've taken the first step to financial freedom by using this calculator, but don't forget to check back periodically to run the numbers again. Here's a word of caution, though: while you're whittling away at your debt, your DTI ratio will skyrocket like a roman candle. This is because you're devoting a larger percentage of your total income to your obligations - and that’s a good thing.

But once they are paid off, your ratio will plummet to zero. This means that you won’t have to spend a single penny on debt or interest – and, oh, what a glorious feeling that will be!

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!