How Do Biweekly Mortgage Payments Work?

In the early years of a longterm loan, most of the payment is applied toward interest. Home buyers can shave years off their loan by paying bi-weekly & making extra payments. Bi-weekly payments help you pay off principal in an accelerated fashion — before interest has a chance to compound on it.

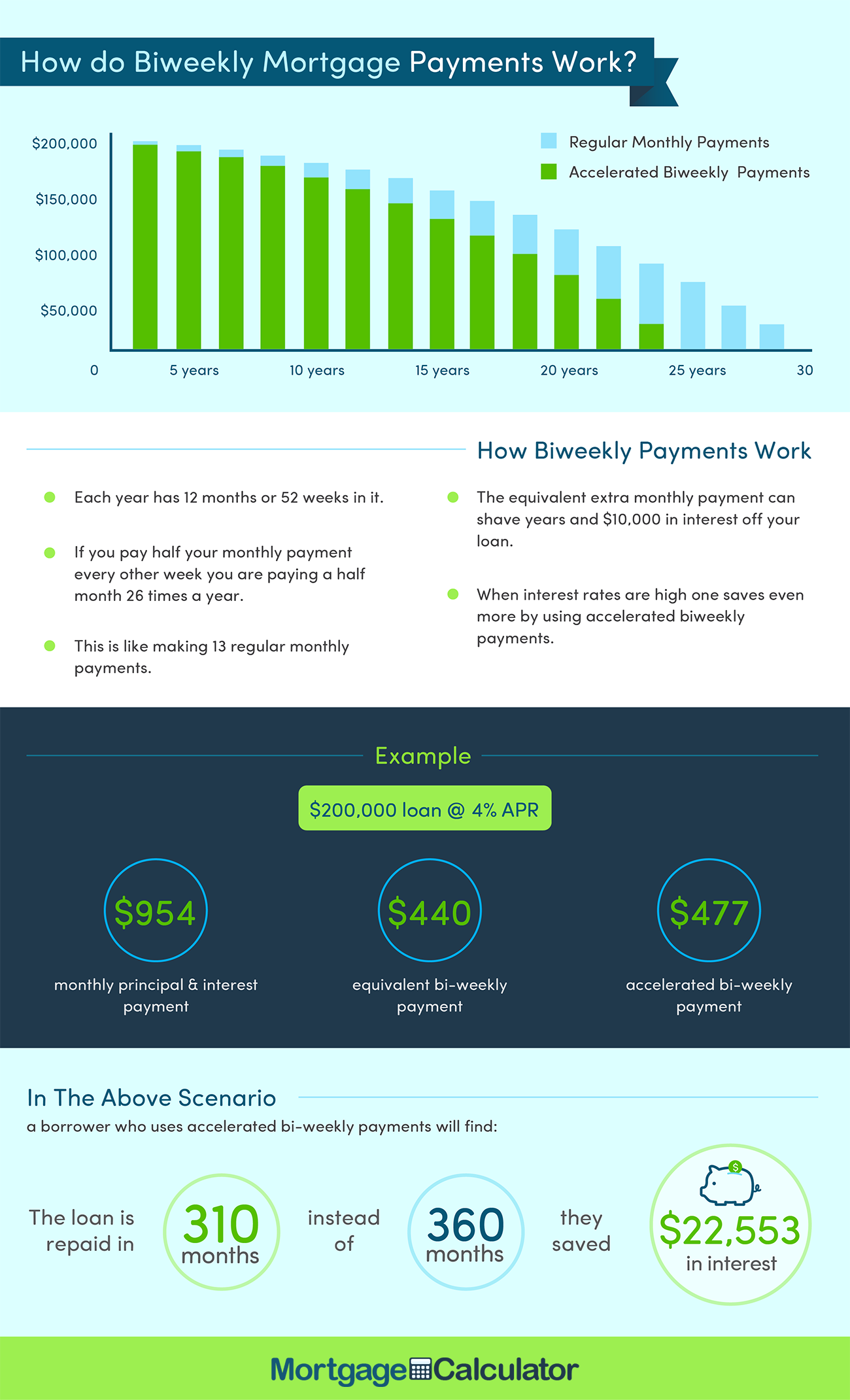

In making biweekly payments, those 26 annual payments effectively create an additional (13th) month of regular payments in each calendar year.

For your convenience current El Monte mortgage rates are published underneath the calculator to help you make accurate calculations reflecting current market conditions.

How much money could you save? Compare lenders serving El Monte to find the best loan to fit your needs & lock in low rates today!

By default 30-yr fixed-rate loans are displayed in the table below, using a 20% down payment. Filters enable you to change the loan amount, down payment, loan duration, or type of loan.

Most mortgages require the home buyer purchase private mortgage insurance (PMI) to protect the lender from the risk of default. If the borrower do not put a 20% down payment on the house and obtain a conventional loan you must pay for this insurance premium which could be anywhere from 0.5% to 1% of the entire loan. That means that on a $200,000 loan, you could be paying up to $2,000 a year for mortgage insurance. That averages out to $166 a month ($2000/12). This premium is usually rolled into your monthly payment and protects the lender in case you default. It does nothing for you except put a hole in your pocket. Once the equity reaches 20% of the loan, the lender does not require PMI. So if at all possible, save up your 20% down payment to eliminate this drain on your finances.

Another way to save money on your mortgage in addition to adding extra to your normal monthly payments is the bi-weekly payment option. You pay half of a mortgage payment every two weeks instead of the usual once monthly payment. This essentially produces one extra payment a year since there are 26 two- week periods. At the end of the year you will have made 13 instead of 12 monthly payments. So on the 30 year $200,000 loan at 5% example we have been using, the interest was $186,511.57 using monthly payments. If using bi-weekly payments, the interest is only $150,977.71 saving you $35,533.86 over the life of the loan.

If your lender does not offer a bi-weekly option or charges for the service, you can do the same thing yourself for free. Simply add an extra 1/12 of a mortgage payment to your regular payment and apply it to principal. Our example has a monthly payment of $1,073.64, so adding an extra $89.47 ($1,073.64/12) to principal each month will produce the same result.

Unfortunately, switching may not be as simple as writing a check every two weeks. If you are already on an automatic payment plan, you will need to find out from your lender if you can cancel or change it. You will then need to find out if your lender will accept biweekly payments, or if there is a penalty for paying off your mortgage early.

Some services offer to set up bi-weekly payments for you. However, these companies may charge you a fee for the service (as much as several hundred Dollars), and they may only make the payment on your behalf once a month (negating much of the savings).

Instead, you should make the payment directly to the lender yourself, and you must be sure that it will be applied right away and that the extra will be applied toward your principle.

As long as you have strong will, it's better to make the payments directly instead of signing up for an automatic payment plan since it will give you more flexibility in case of lean times.

Buying a home is one of the most expensive long term purchases you will make in your lifetime. So it's most important to know your options and choose the loan that best fits your situation.

While there are many places to get your loan, there are basically two main types of loans to consider: Fixed Rate and Adjustable Rate Mortgages (ARM). Fixed rate mortgages are loans where the interest rate remains the same throughout the life of the loan. Your principal and interest payments are the same each month so you know what to expect. You will not have to worry about the market and fluctuations in interest rates. Your rate would be fixed. This is a good option especially if you intend to remain in your house more than just a few years.

Fixed rate mortgages are usually offered for a term of 30 years, 20 years, or 15 years. Most buyers choose a 30 year mortgage because the monthly payment is more comfortable. But it would be a mistake not to consider a 15 year fixed mortgage. Yes, the monthly payments are higher but the savings over the life of the loan are significant. If you took out a $200,000 mortgage at 5% for 30 years, your monthly principal and interest payment would be $1,073.64 and you will have paid $186,511.57 in interest. BUT, if you took out a 15 year loan for the same amount and interest rate, your monthly principal and interest payment would be $1,581.59 and you will have paid $84,685.71 in interest - a savings of over $100,000! In all practicality a loan for a shorter duration has less duration risk tied to it, so you would get a lower interest rate on the shorter loan, which would further increase those savings. Again, yes, the monthly payment is higher but with a little sacrifice, think of what you could do with an extra $100,000 of your own hard earned money? Why should you give it to the bank?

Adjustable Rate Mortgages (ARMs) are the opposite of fixed rate mortgages. The interest rate adjusts just as the name implies. The rate will change annually according to the market after the initial period. One year ARMs used to be the standard, but the market has now produced ARMs called hybrids which combine a longer fixed period with an adjustable period. The initial period can be three years (3/1), five years (5/1), seven years (7/1) or ten years (10/1). So a 5/1 ARM means that during the initial period of 5 years, the interest rate is fixed and thereafter will adjust once a year.

The one reason to consider the ARM is that the interest rate at the initial period of the loan is usually lower than the interest rate for fixed mortgages. If you know you will be in your house only a few years, or if you think interest rates will decrease, this may be a good option for you. If you plan to stay longer, then make sure you have a way to increase your income to offset the increased mortgage payment.

You are not in the dark about rate increases with an ARM. Each loan has set caps that govern how high or low the interest rate can increase or decrease for the life of the loan. Caps are also in place for each adjustment period after the initial fixed period. These terms will be clearly stated in the loan paperwork. Don't hesitate to ask the lender questions about interest rates, caps, initial period, etc. so you will fully understand what you are undertaking.

The 2017 Tax Cuts and Jobs Act bill increased the standard deduction to $12,000 for individuals and married people filing individually, $18,000 for head of household, and $24,000 for married couples filing jointly. These limits have increased every year since. In 2025 the standard deduction for single filers & married filing separately is $15,000. Head of households can deduct $22,500 whie married joint filers can deduct $30,000.

Before the standard deduction was increased through the passage of the 2017 TCJA 70% of Americans did not itemize their taxes. Many homeowners will not pay enough mortgage interest, property taxes & local income tax to justify itemizing the expenses - so the above interest savings may not lead to income tax savings losses for many Americans. If you do not plan on itemizing your taxes enter zero in your marginal tax rate to remove the impact of mortgage interest deductions from your calculation.

The new tax law also caps the deductiblility of property taxes combined with either state income or sales tax at $10,000. The mortgage interest deductibility limit was also lowered from the interest on $1 million in debt to the interest on $750,000 in debt. Mortgages originated before 2018 will remain grandfathered into the older limit & mortgage refinancing of homes which had the old limit will also retain the old limit on the new refi loan.

After choosing either a fixed rate mortgage or an ARM, you will also need decide which loan product is right for you. Each has different requirements, so click on the links to get full details.

Conventional Fixed-rate & ARM Mortgages

Conventional loans are those that are not backed directly by any government agency (though many of them may ultimately be purchased by government sponsored enterprises Fannie Mae and Freddie Mac). Qualifying typically requires a significant down payments and good credit scores. Rates can be fixed or adjustable. Most homebuyers choose the 30-year fixed loan structure. We offer a calculator which makes it easy to compare fixed vs ARM loans side-by-side. Conforming loans have a price limit set annually with high-cost areas capped at 150% of the base cap. The limit for single family homes in 2026 is $832,750. This limit goes up to $1,249,125 in high cost areas.

Jumbo Mortgages

Jumbo loans are those above the conforming limit and are more difficult to qualify for and usually have higher interest rates. While most conforming loans are structured as 30-year fixed loans, ARMs are quite popular for jumbo loans.

FHA Loans

FHA loans (Federal Housing Administration) are loans insured by the federal government. They require low down payments of 3.5% and low closing costs. Many first-time homebuyers and buyers with poor credit scores choose FHA loans. Learn more at the FHA.

VA Loans

VA Loans are insured by the Deptment of Veterans Affairs and are offered to eligible to retired veterans, active-duty and reservist military personnel and their spouses. They require no down payment and interest rates are competitive and market driven. Ginnie Mae insures payments on residential mortgage-backed securities issued by government agencies.

USDA Loans

USDA loans are backed by the United States Department of Agriculture. These loans are available in rural areas and allow no downpayment.

Balloon Loans

Balloon loans are those that have lower payments initially, but require a large one- time payment at the end of the term usually paying off the balance. The CFPB published an introductory guide to balloon loans. Many commercial mortgages are structured as balloon loans, though few residential mortgages are.

Interest Only Loans

Interest-only loans are usually adjustable rate loans that require only interest payments (no principal) for three to ten years. After that period your payment increases dramatically because you will then pay both interest and principal. If you are unable to pay you will need to refinance. The FDIC published a PDF offering an overview of interest-only options.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!