Want to see how fast you will pay off your home loan? Use this free calculator to figure out what your remaining principal balance & home equity will be after paying on your loan for a specific number of months or years. If you want to add extra payments to your loan to pay it off quicker, please use this calculator to see how quickly you will pay off your loan by making additional payments.

Want to Build Equity Faster?

Current El Monte mortgage rates are displayed below. Given the current low-rate environment, you may be able to save thousands by refinancing at today's rates.

How much money could you save? Lock in low rates on your El Monte home today & save on interest expenses for years to come!

By default $400,000 15-yr fixed-rate refinance loans are displayed in the table below. Filters enable you to change the loan amount, duration, or loan type.

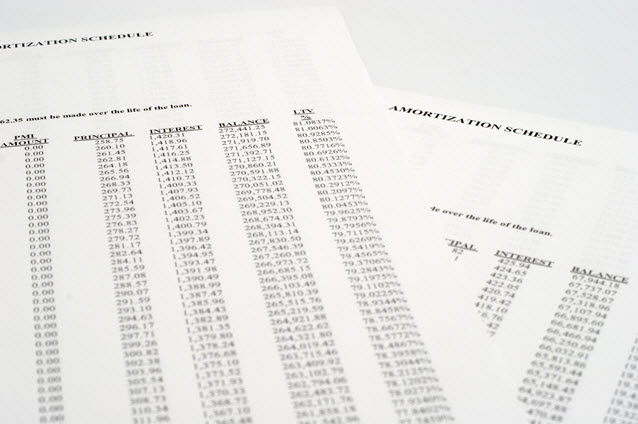

When you buy your first home, you may get a shock when you take a look at your first mortgage statement: You'll hardly make a dent in your principle as the majority of your payment will apply toward interest. Even though you may be paying over $1,000 a month toward your mortgage, only $100-$200 may be going toward paying down your principal balance.

The amount that you pay in principle each month depends on a number of variables, including:

The reason that the majority of your early payments consist of interest is that for each payment, you are paying out interest on the principle balance that you still owe. Therefore, at the beginning of your loan, you may owe a couple hundred thousand dollars and will still have a hefty interest charge. With each payment, you will reduce the principle balance and, therefore, the amount of interest you have to pay. However, since your loan is structured for equal payments, that means that you're just shifting the ratio, not actually paying less each month. With each successive payment, you are putting in a little more toward principle and a little less toward interest. By the end of your loan term, the majority of each payment will be going toward principle.

Making Extra Payments Early

If you pay extra on your loan early into the term it means the associated debt is extinguished forever, which means a greater share of your future payments will apply toward principal. We offer the web's most advanced extra mortgage payment calculator if you would like to track how one-off or recurring extra payments will impact your loan.

The precise formula for determining the payment for your monthly mortgage payments is:

P=L[c(1+c)^n]/[(1+c)^n-1]

You can use this formula to determine your payment at any time. Then subtract it from your actual mortgage payment to determine the principle that you are paying each month.

Of course, this formula is quite complicated, and it isn't necessary to use it at all. There are two other ways to understand your principle payment each month.

The first is to look at your bill. If you are receiving a monthly statement for your mortgage, it should include a breakdown of your payment, including how much goes to principle, how much goes to interest and how much goes to variables such as property taxes, private mortgage insurance and homeowner's insurance.

The second is to use a calculator like the one offered here. It allows you to enter the amount of the loan, the current interest rate, the length of the loan and the number of months you have already paid in the loan. It will then provide you quick and accurate results so you can get a clear picture of your principle payments each month. The results are e-mailed directly to you within moments, and you don't have to enter any personal information to get your results. Use it regularly to find out exactly where you stand with your mortgage.

Take Your Calculations With You

The above calculator on this page allows you to create a printable PDF which you can email to yourself. You can also enter a future payment date to see where your loan will be at the end of next year. If you make irregular or extra payments you may want to use either our extra mortgage payment calculator or download our Excel mortgage calculator.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!