The following calculator makes it easy to quickly estimate the closing costs associated with selling a home & the associated net proceeds. Simply enter your sales price, mortgage information & closing date and we'll estimate your totals. The actual fees, expenses & outstanding loan balance will depend on the actual closing date & other related factors. You can expand each section in the calculator below to enter your details. When you are done you can use the button in the upper right corner of the calculator to save the results and email yourself a link to the calculated result.

The following table shows current El Monte 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down.

One factor this calculator does not take into account is capital gains. According to IRS topic 701, homowners selling their primary residence can often exclude up to $250,000 in capital gains on the sale, or $500,000 if they file jointly with their spouse. To qualify you must have owned the home for at least 2 of the last 5 years leading up to the date of sale & used it for your primary residence. The exclusion can only be used once in a two-year period & does not apply to properties obtained through a 1031 exchange. IRS Publication 523 has more eligibility information.

Here are the capital gain rates for 2025 based on income level & filing status.

| Tax Rate | Married Filing Jointly or Qualified Widow(er) | Single | Head of Household | Married Filing Separately |

|---|---|---|---|---|

| 0% | $0 - $96,700 | $0 - $48,350 | $0 - $64,750 | $0 - $48,350 |

| 15% | $96,701 - $600,050 | $48,351 - $533,400 | $64,751 - $566,700 | $48,351 - $300,000 |

| 20% | Over $600,050 | Over $533,400 | Over $566,700 | Over $300,000 |

The cost basis of the home is typically the price the home was purchased for, however major home additions can increase the cost basis of the house. For example, a $280,000 home with a $60,000 addition might have the cost basis considered at $340,000, which would allow an individual to sell it tax free for up to $590,000, while a married couple could sell it for as much as $840,000 without incurring any taxes.

If an individual filing single sold the above home for $620,000 then if they qualified for the deduction only $30,000 of the gains would be taxed at a rate based on where their income fell on the above table. So if they made $400,000 in taxable income they would pay 15% of $30,000, or $4,500 in longterm capital gains on the home sale.

Sellers who are in a rush to sell & are frustrated with being unable to sell their home may want to engage a Realtor to help them sell their home or look into iBuyers to see if the haircut they'll take selling their house at a discount is worth more than the stress and uncertainty tied to making multiple loan payments or being unable to move when they would like to.

When it comes to home-selling, not everyone stages their property. Some people put their house on sale without highlighting its best features.

Truth is, selling a house is one of the most significant financial transactions people make in a lifetime. To ensure a successful sale, your property must be well-prepared. Expect potential buyers to scrutinize every corner of your home when they come for viewing.

That said, it pays to make home improvements to impress buyers. There are many ways to prepare and redecorate a home to make it look like new. Doing so helps sell the house sooner at a more favorable price.

In this feature, we’ll talk about the benefits of home staging. We’ll discuss essential home improvements before selling a house. On top of this, we’ll mention some home staging tips you should beware of. We’ll also talk about the best time to sell residential property.

Before anything else, let’s talk about the best time to sell a home.

When you think about seasons, it’s good to sell a house around the springtime when it’s warmer. People prefer this period because it’s easier to move with fair weather. Children are also out of school during these months. However, don’t just think about seasonal selling.

The best time to sell your house is when you have enough equity in your home. Home equity is the portion of loan that you’ve paid off. This is a must to cover the costs of selling and moving to another home. If you don’t have enough home equity, you’ll have to pay these added expenses from your own savings.

How Much is Enough Home Equity to Sell a Home?

You’ll need at least 10 percent home equity if you need to relocate. This is according to veteran real-estate agent Danny Freeman from Memphis Tennessee. If you’re planning to move to a larger home, you’ll need a minimum of 15 percent equity versus the payoff to sell the house. Use your equity to cover the downpayment or a portion of it when you move to a bigger home.

The longer you’ve lived in a house, the more equity you gain. Majority of homeowners build enough equity after they’ve paid their mortgage for 5 years. This is usually enough to offset the cost of buying, closing, and moving into a new home. It maximizes your earnings from the home’s sale.

Now let’s move on to the importance of home staging before listing.

How Effective is Home Staging in Selling Property?

Around 83 percent of buyers’ agents state that home staging made it easier for a buyer to visualize property as a future home. This is according to a 2019 profile by the National Association of REALTORS® (NAR) Research Group. For every $100 spent on staging a house, a seller can potentially recoup around $400.

For homebuyers, the most important rooms to stage are the living room (47%), followed by the master bedroom (42%), and the kitchen (35%). About 28 percent of sellers’ agents said they staged a house before listing them for sale. On the other hand, 13 percent of sellers’ agents said they only staged homes that were hard to sell.

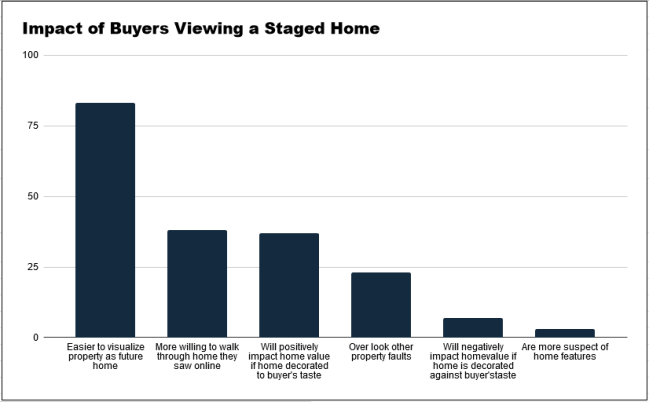

The graph below shows how home staging impacts buyers who view houses for sale.

Apart from helping people visualize a new home, 38 percent of buyers are more willing to check a staged house they saw online. Meanwhile, 37 percent find staged homes more appealing when it’s decorated to their taste.

Around 23 percent of buyers also don’t mind overlooking property issues. Moreover, around 10 percent of buyers thought of anything negative about a staged home. This is comprised of 7 percent who visited homes that were decorated against their taste, and 3 percent of buyers who had doubts about the home’s features.

Higher Offers on Staged Homes

According to NAR, for staged homes, 22% of sellers’ agents note that buyers offered a 1 to 5 percent dollar value increase compared to similar homes. Around 17 percent of agents reported that home staging increased the dollar value of a house between 6 to 10 percent.

Real-estate agents often help sellers stage their house before listing a house. Based on NAR’s survey, agents commonly recommend the following home improvement tips for a successful sale:

Most sellers can benefit from removing excess clutter and full general cleaning. Decluttering highlights how much space your home has. It helps potential buyers imagine what they can do with with your home once they move in. Having a lot of clutter distracts buyers from seeing potential in your home. It also makes it look like it has less storage space.

Home Staging Don’ts: You might think hiding all the clutter in the closet will work. Unfortunately, this often backfires. Buyers might think you don’t have enough closet space. It’s best to get rid of all the unnecessary items before you entertain buyer visits.

Another important tip you should never skip is cleaning. Even without redecorating or remodeling, homes look a lot better just by cleaning and making rooms look spotless. Cleaning gets rid of unpleasant odors and makes surfaces look pristine. It’s also one of the most cost-effective ways to stage your home without spending a lot. Good cleaning helps make homes look like new.

Home Staging Don’ts: Sometimes harsh cleaning products may leave your bathroom (or any area in your home) with unpleasant smells. Try to avoid these products. If you really need to use them, make sure to get a deodorizer. Air out your home before scheduling viewings. The last thing you want is to turn off buyers.

Buyers Avoid Extra Cleaning

Anticipate buyers who are sensitive to dirt and smells. People don’t want to put on extra work to clean a house. And when it comes to home viewing, it helps to have spotless carpets and tidy furniture. Get mild and air freshener too. This improves the overall impression of your home.

Potential buyers have reservations with pets in the house. This makes homes with pets harder to sell. Animals usually mean there’s extra cleaning to be done. You have to vacuum your floors and carpets more often. You also need to deal with pet odors, which can be neutralized by washing stained areas and using air fresheners. Just make sure your deodorizers are not harmful to pets. Cats and dogs may also scratch furniture and walls. Be sure to inspect your home for any damage. If you find them, which is likely, have those areas repaired before selling your house.

Home Staging Don’ts: Leaving traces of your pet in the house might make or break the deal. Be sure to clear out pet bowls. Clean traces of pet fur on the furniture. Make time to do some cleaning before a buyer comes for viewing.

Keep Pets Out During Viewing

Once a buyer checks your home, get your furry friends out for a while. Create a game plan for showings. Ask a neighbor to look after your pet. Have your partner take your dogs out for a walk. If you can hire a pet-sitter, then it’s worth the extra bucks. The smoother the viewing goes, the higher chances you’ll get on a good offer.

Buyers need to see themselves living in your house. You can help them by removing picture frames, large toys, or any furniture with a highly personal touch. These objects show your own taste and preferences. That said, it’s better to create a neutral setting (but not a drab, empty space) where buyers can see potential in the rooms.

Sellers usually have mixed feelings about staging their home. Of course, you want to secure the best price from buyers. At the same time, you think your home is beautiful and can sell “as is.” But more often, people don’t share your taste when it comes to selecting interiors.

In a Washington Post feature, this is exactly what Marina and Daniel Ein dealt with. The Ein’s home was decorated with antiques, art, and an exquisite collection of Oriental rugs. It seemed elegant. But when they had to sell it, it was listed for over a year with no offers. The Eins only staged their home after much needed advice from a real-estate agent.

Home Staging Don’ts: Avoid leaving personal items laying around the house. Remove family photos or framed certificates on walls. Remove used towels or clothes in the bathroom and the the masters bedroom. Not seeing your personal items will make buyers more comfortable too.

Keep Decors Simple and Neutral

Sellers who stage their house with a more neutral ambiance helps increase the chances of offers. It helps to know local home trends in the market too. But to be safe, keep your decor simple and neat.

Rooms tend to be versatile when you’re using them. A living room sometimes transforms into an extended sleeping area. A guest room is used as a spare office space. But when you’re staging your home, be sure to define its purpose.

A dining room should look like an inviting place to share meals. The living area should not look like people sleep in it. Again, the idea is to make it presentable for its purpose. Even if your buyer has other plans for the room, what’s important is you gave them a pleasant impression. This helps buyers imagine it as their own.

Be Careful: Depending on your home’s condition, it’s not always advisable to rent furniture. This is especially true if renting will cost you more. So weigh it in. According to Home Guide, renting furniture costs between $300 to $500 per month. That’s including all rooms. Staging furniture rental for a living rooms costs $150 to $350 per month. Remember: Your aim is to make the most positive impact with minimal costs. If you do rent furniture, limit your budget.

Rearrange Your Furniture

Not everyone has extra funds to rent staging furniture. But you can work around this by rearranging your furniture. While you’re at it, try to create as much open space in your room when you move your couch, tables, and other furniture. Finally, if a piece of furniture looks out of place, remove it. Removing mismatched furniture will improve your living space visually.

Seeing cracks on walls and ceilings can point to foundation issues. If your house does have foundation problems, you’ll likely have to get it fixed. If not, you must notify buyers about the issue. This will make it extra challenging to sell the house. That said, it’s worth getting it fixed so you can sell the home at a favorable price. Consider making small renovations that add value at minimal cost.

Sometimes walls have cracks, but are not a cause for alarm. Home inspectors can tell you if a crack indicated serious foundation problems. But more importantly, they can confirm if you shouldn’t worry about it. You can repair harmless cracks so buyers don’t count them as red flags. According to HomeAdvisor, the average home inspection costs around $315 for small homes and condominium units. If you have a larger house, it can cost around $400 or more.

Pre-sale Home Inspections Are Not Required

Traditionally, buyers arrange for home inspections. But in certain cases, like possible foundation issues, you can have it inspected before listing. It may be worth getting a pre-sale home inspection before selling a house. This helps you know the best possible price for your property. But to be clear, this is not mandatory for sellers.

Sometimes, you can’t restore old walls with cleaning. When this happens, it’s a good idea to invest in repainting. Even if you just paint the exterior and the living room, it can make a big difference.

Home Guide states that painters charge between $1 to $3 per square foot to paint a room. The average cost of painting a room ranges from $350 to $850. Want to do it yourself? It’s more affordable at around $100 to $300. If the house is due for a paint job, painting helps sell your home at a way better price.

Be Careful: Repainting a house can get very expensive, so don’t get carried away. Having an entire home interior painted can cost between $1,200 to $3,900. Again, set a budget for your painting project to avoid overspending.

Consider Repainting Custom Colored Walls

Repainting applies to old custom walls. Flashy paint or wallpaper make homes difficult to sell. Here’s a tip: replace old paint jobs with warm, neutral colors. This makes rooms more inviting compared to plain white walls.

Your goal is to stage the home to appeal to the widest number of buyers. When you have a viewing schedule, take time to open the windows to let fresh air in. Maybe throw in accent pillows on your couch for style. Some sellers even put fresh flowers in a vase to make the focal rooms look more appealing.

At the end of the day, you want to make the house look warm and inviting. It should have the most positive impact to your buyer. A great home impression gives you better chances of selling at a higher price.

To maximize your home sale, price your home at the right range. If you think overpricing will get you a good deal, it’s actually counterproductive.

Don’t Overprice the House

Overpricing can take longer to sell a house. A higher price range can also hurt you because potential buyers won’t find your home on the right listing. People looking for homes usually search for the price range. If your home isn’t in the appropriate price range, it makes it hard for buyers to find your property.

Before selling a house, make sure you have enough home equity. It will help offset the cost of buying a new home. And when it comes to pricing your property, make sure to sell at the right price range. Overpricing a home will make it more difficult for buyers to find your listing. At the right price range, you will attract more potential buyers who might offer more favorable deals.

Finally, staging is an important step in attracting people to purchase your home. While it’s necessary, beware of spending too much in the process. Focus on highlighting the best features of your property. Aim to appeal to a wider market. This way, more viewers might consider buying your home.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!