This calculator figures monthly home payments for 15-year loan terms. To help you see current market conditions and find a local lender current El Monte 15-year and current El Monte 30-year mortgage rates are published below the calculator.

The following table shows current El Monte 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down.

Here is a table listing current El Monte 15-year fixed rates.

Across the United States 88% of home buyers finance their purchases with a mortgage. Of those people who finance a purchase, nearly 90% of them opt for a 30-year fixed rate loan. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans, with 6% of borrowers choosing a 15-year loan term.

| Loan Type | Percent of Borrowers Buying a Home | Percent of All Home Buyers |

|---|---|---|

| 30-year Fixed | 90% | 79.2% |

| 15-year Fixed | 6% | 5.28% |

| Adjustable-rate | 2% | 1.76% |

| Other Fixed-Rate Loan Terms | 2% | 1.76% |

| Use Any Type of Financing | 100% | 88% |

| Paid Cash in Full | N/A | 12% |

Source: Freddie Mac's 2016 home buyer statistics, published on April 17, 2017.

When interest rates are low (as they were after the global recession was followed by many rounds of quantitative easing) home buyers have a strong preference for fixed-rate mortgages. When interest rates rise consumers tend to shift more toward using adjustable-rate mortgages to purchase homes.

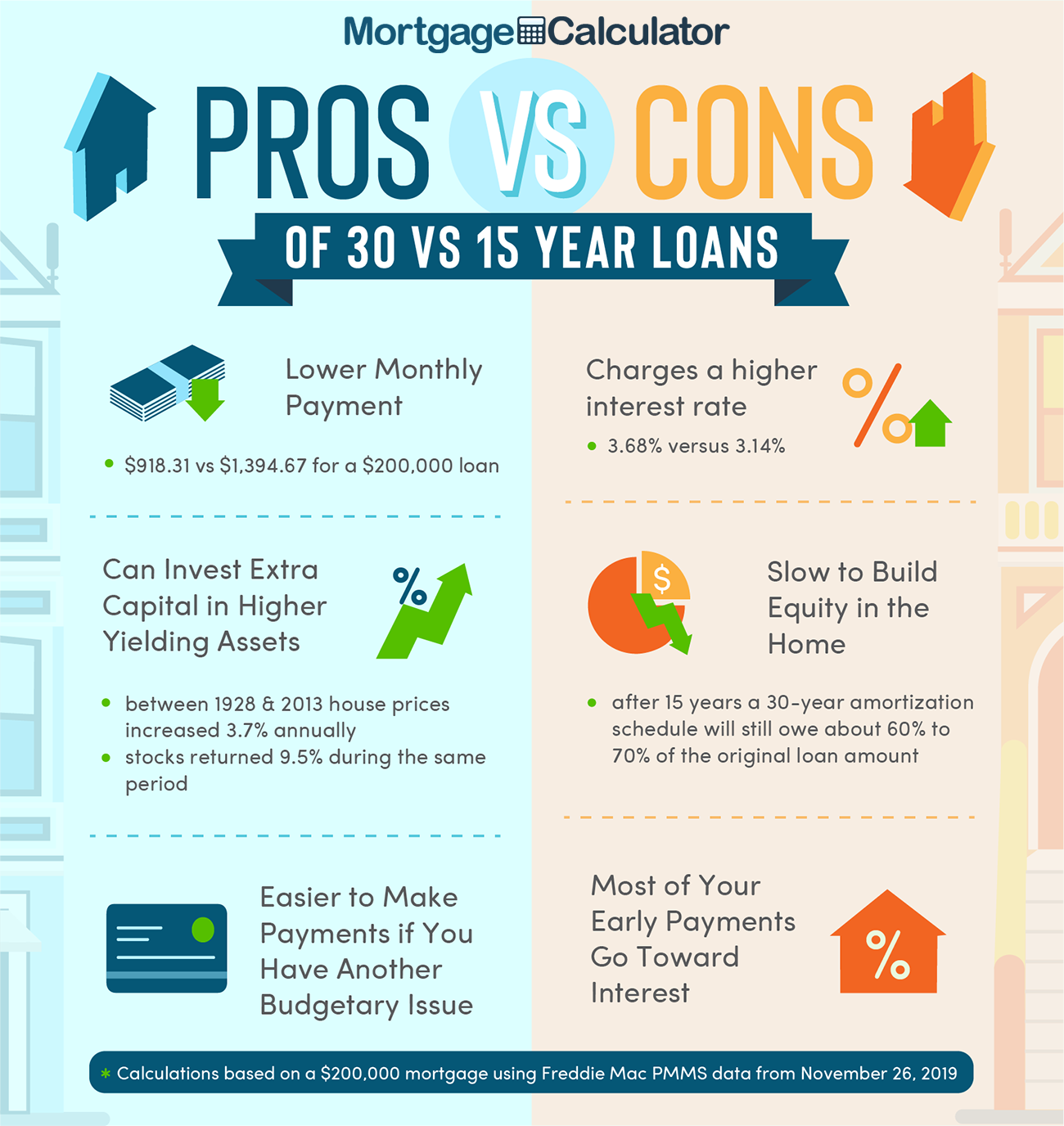

The big advantage of a 30-year home loan over a 15-year loan is a lower monthly payment.

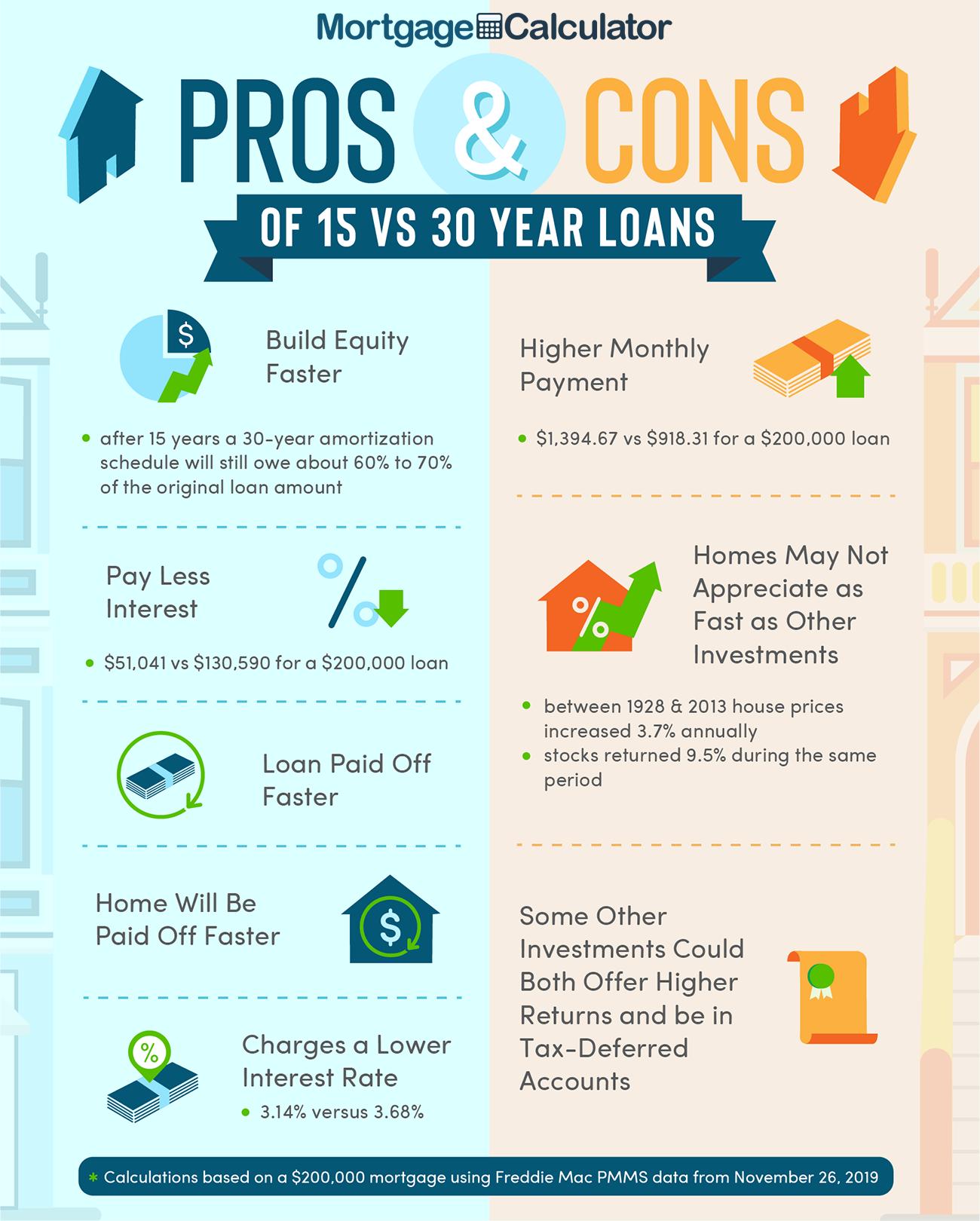

However, for those who can afford the slightly higher payment associated with a 15-year mortgage are getting a better deal in almost every possible way. Here are some of the advantages of a 15-year mortgage over a 30-year mortgage:

The following table shows loan balances on a $200,000 home loan after 5, 10 & 15 years for loans on the same home.

| Mortgage Type | 15-YR FRM | 30-YR FRM |

|---|---|---|

| Interest Rate (APR) | 3.1% | 3.7% |

| Monthly Principal & Interest | $1,416.53 | $937.60 |

| Total Monthly Payment | $2,004.02 | $1,525.09 |

| Loan Balance 5 Years | $145,999.80 | $183,333.98 |

| Loan Balance 10 Years | $78,639.08 | $158,836.20 |

| Loan Balance 15 Years | $0.00 | $129,368.36 |

| Equity Built, 15 Years | $200,000 + Appreciation | $70,631.64 + Appreciation |

| Interest Paid, 15 Years | $51,275.94 | $94,436.36 |

| Total of 180 Payments | $360,723.60 | $274,516.20 |

| Remaining P & I payments | 0 | 180 |

| Remaining Interest Expense | $0 | $39,397.24 |

| Total Interest Expense | $51,275.94 | $133,833.60 |

Please note the above used interest rates were relevant on the day of publication, but interest rates change daily & depend both on the individual borrower as well as broader market conditions.

The above calculations presume a 20% down payment on a $250,000 home & a closing cost of $3,700 which is rolled into the loan.

You can use the following calculators to compare 15 year mortgages side-by-side against 10-year, 20-year and 30-year options.

The following table lists historical average annual mortgage rates for 15-year & 30-year mortgages.

| Year | 30-YR FRM Rate | 30-YR Points | 15-YR FRM Rate | 15-YR Points | 15 vs 30 Rate Diff |

|---|---|---|---|---|---|

| 2025 | 6.60 | 5.78 | -0.82 | ||

| 2024 | 6.72 | 5.96 | -0.76 | ||

| 2023 | 6.81 | 6.11 | -0.70 | ||

| 2022 | 5.34 | 0.81 | 4.58 | 0.85 | -0.76 |

| 2021 | 2.96 | 0.68 | 2.27 | 0.64 | -0.69 |

| 2020 | 3.11 | 0.73 | 2.60 | 0.69 | -0.51 |

| 2019 | 3.94 | 0.5 | 3.39 | 0.5 | -0.55 |

| 2018 | 4.54 | 0.5 | 4.00 | 0.5 | -0.54 |

| 2017 | 3.99 | 0.5 | 3.27 | 0.5 | -0.72 |

| 2016 | 3.65 | 0.5 | 2.93 | 0.5 | -0.72 |

| 2015 | 3.85 | 0.6 | 3.09 | 0.6 | -0.76 |

| 2014 | 4.17 | 0.6 | 3.29 | 0.6 | -0.88 |

| 2013 | 3.98 | 0.7 | 3.11 | 0.7 | -0.87 |

| 2012 | 3.66 | 0.7 | 2.93 | 0.7 | -0.73 |

| 2011 | 4.45 | 0.7 | 3.68 | 0.7 | -0.77 |

| 2010 | 4.69 | 0.7 | 4.1 | 0.7 | -0.59 |

| 2009 | 5.04 | 0.7 | 4.57 | 0.7 | -0.47 |

| 2008 | 6.03 | 0.6 | 5.62 | 0.6 | -0.41 |

| 2007 | 6.34 | 0.4 | 6.03 | 0.4 | -0.31 |

| 2006 | 6.41 | 0.5 | 6.07 | 0.5 | -0.34 |

| 2005 | 5.87 | 0.6 | 5.42 | 0.6 | -0.45 |

| 2004 | 5.84 | 0.7 | 5.21 | 0.6 | -0.63 |

| 2003 | 5.83 | 0.6 | 5.17 | 0.6 | -0.66 |

| 2002 | 6.54 | 0.6 | 5.98 | 0.6 | -0.56 |

| 2001 | 6.97 | 0.9 | 6.5 | 0.9 | -0.47 |

| 2000 | 8.05 | 1 | 7.72 | 1 | -0.33 |

| 1999 | 7.44 | 1 | 7.06 | 1 | -0.38 |

| 1998 | 6.94 | 1.1 | 6.59 | 1.1 | -0.35 |

| 1997 | 7.6 | 1.7 | 7.13 | 1.7 | -0.47 |

| 1996 | 7.81 | 1.7 | 7.32 | 1.7 | -0.49 |

| 1995 | 7.93 | 1.8 | 7.48 | 1.8 | -0.45 |

| 1994 | 8.38 | 1.8 | 7.86 | 1.8 | -0.52 |

| 1993 | 7.31 | 1.6 | 6.83 | 1.6 | -0.48 |

| 1992 | 8.39 | 1.7 | 7.96 | 1.7 | -0.43 |

| 1991 | 9.25 | 2 | |||

| 1990 | 10.13 | 2.1 | |||

| 1989 | 10.32 | 2.1 | |||

| 1988 | 10.34 | 2.1 | |||

| 1987 | 10.21 | 2.2 | |||

| 1986 | 10.19 | 2.2 | |||

| 1985 | 12.43 | 2.5 | |||

| 1984 | 13.88 | 2.5 | |||

| 1983 | 13.24 | 2.1 | |||

| 1982 | 16.04 | 2.2 | |||

| 1981 | 16.63 | 2.1 | |||

| 1980 | 13.74 | 1.8 | |||

| 1979 | 11.2 | 1.6 | |||

| 1978 | 9.64 | 1.3 | |||

| 1977 | 8.85 | 1.1 | |||

| 1976 | 8.87 | 1.1 | |||

| 1975 | 9.05 | 1.1 | |||

| 1974 | 9.19 | 1.2 | |||

| 1973 | 8.04 | 1 | |||

| 1972 | 7.38 | 0.9 |

Source: Freddie Mac PMMS.

Home buyers who have a strong down payment are typically offered lower interest rates. Homeowners who put less than 20% down on a conventional loan also have to pay for property mortgage insurance (PMI) until the loan balance falls below 80% of the home's value. This insurance is rolled into the cost of the monthly home loan payments & helps insure the lender will be paid in the event of a borrower default. Typically about 35% of home buyers who use financing put at least 20% down.

As of 2026 the FHFA set the conforming loan limit for single unit homes across the continental United States to $832,750, with a ceiling of 150% that amount in areas where median home values are higher. The limit is as follows for 2, 3, and 4-unit homes $1,066,250, $1,288,800, and $1,601,750. The limits are higher in Alaska, Hawaii, Guam, the U.S. Virgin Islands & other high-cost areas. Loans which exceed these limits are classified as jumbo loans.

The limits in the first row apply to all areas of Alabama, Arizona, Arkansas, Delaware, Georgia, Illinois, Indiana, Iowa, Kansas, Kentucky, Louisiana, Maine, Michigan, Minnesota, Mississippi, Missouri, Montana, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Rhode Island, South Carolina, South Dakota, Texas, Vermont, Wisconsin & most other parts of the continental United States. Some coastal states are homes to metro areas with higher property prices which qualify the county they are in as a HERA designated high-cost areas.

The limits in the third row apply to Alaska, Guam, Virgin Islands, Washington D.C & Hawaii.

| Units | 1 | 2 | 3 | 4 |

|---|---|---|---|---|

| Continental U.S. Baseline | $832,750 | $1,066,250 | $1,288,800 | $1,601,750 |

| Designated High-cost Areas | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |

| Alaska, Hawaii, Guam & U.S. Virgin Islands | $1,249,125 | $1,599,375 | $1,933,200 | $2,402,625 |