Going through bankruptcy and foreclosure makes it difficult to apply for future loans. But if you had to file for bankruptcy or other similar records in the past, you can still recover. While it’s certainly challenging, it’s definitely possible to improve your credit score, save up, and qualify for a home loan once more.

Our guide will discuss how you can bounce back and secure a mortgage even with a foreclosure or bankruptcy record. We’ll discuss the general waiting period for bankruptcies, foreclosures, and short sales before borrowers can apply for a home loan. Then, we’ll provide tips on how to rebuild your credit score to regain creditworthiness. Finally, we’ll include pointers on how to create a savings and debt repayment plan.

To secure any loan, lenders evaluate your creditworthiness or ability to repay a loan. And when you apply for a mortgage, your lender evaluates your credit score and financial history, income, and even the extent of your debts. Out of these factors, having unsatisfactory credit score hinders mortgage approval. Bankruptcy, foreclosure, and other similar records can damage your credit score by more than a hundred points.

The following sections will rundown what happens under bankruptcy, foreclosure, and short sales. These will also indicate how long they reflect on your credit history.

When you file for bankruptcy, you declare that you are unable to pay most of your debt obligations. This includes a wide array of debts such as your mortgage, car loan, credit card debts, and personal loans. While you can keep your home during bankruptcy by reaffirming your mortgage and making continuous payments, other people are unable to do so. In the U.S., there are two types of bankruptcies: Chapter 7 bankruptcy and a chapter 13 bankruptcy filing. During bankruptcy, your credit remains frozen which keeps you from applying for new credit while your case is pending.

Bankruptcies are generally more damaging to credit scores compared to foreclosures or short sales. This is because they impact multiple accounts. Defaulting on several loans takes longer to repair a borrower’s credit history, which makes it harder to improve your credit score. It also requires a longer waiting period before you can apply again for credit.

Only consider bankruptcy as a last resort. Filing for bankruptcy incurs great damage on your credit history. Furthermore, bankruptcy does not discharge debts such as taxes, student loans, as well as child support and alimony. It also does not cover credit card purchases for luxury products and services.

Foreclosure occurs when you are unable to make payments and eventually default on your loan. This violates your mortgage agreement which prompts your lender to take action. Before foreclosure, homeowners usually receive warnings in the form of a letter, email, or phone call to remind them of missed payments. After 120 days of nonpayment, lenders usually initiate foreclosure measures. In certain states, this entails a court proceeding which may take a year or so before approval. However, in other jurisdictions, court proceedings may only take a couple of weeks.

Under foreclosure, your mortgage lender will repossess your property and obtain ownership of your home. This process allows the lender to recoup the borrowed amount by selling the house in the market. Foreclosures typically stay on your credit report for as long as 7 years.

A short sale or pre-foreclosure sale is when you sell your property for less than the remaining balance on your mortgage. If your lender agrees to a short sale, you can sell your house and use the proceeds to pay off a portion of your mortgage balance. Depending on your circumstance, you might be obligated to make contributions toward the remaining balance. However, after a short sale is finalized, borrowers are usually relieved of the burden to repay the remaining balance. This is referred to as a ‘deficiency waiver.’ A short sale can remain in your credit record for 7 years from the original date of delinquency. It also reflects for 7 years from the date it was paid even if your payments were never late.

When you have a deed in lieu of a foreclosure, you are transferring the title of your property to your lender to be released of your loan obligation and to avoid foreclosure. This is the trade-off borrowers make to be relieved of their mortgage debt. A deed in lieu of foreclosure typically reflects on your credit record for 4 years.

Depending on the type of mortgage, having foreclosure or bankruptcy history requires waiting periods before you can qualify for a loan. Taking a conventional loan, for instance, usually requires a longer time compared to a loan backed by the Federal Housing Administration (FHA). In other cases, loans backed by the U.S. Department of Agriculture (USDA) does not allow borrowers to apply again if their old USDA loan was foreclosed. Meanwhile, those with loans sponsored by the U.S. Veterans Affairs (VA) can secure a mortgage after 2 years of being discharged from foreclosure.

With a bankruptcy or foreclosure record, you can’t expect to be eligible in a couple of months. The waiting period is based on how long it takes to rebuild your credit score. Those with significantly low credit scores can take more years to recover. Lenders also consider your individual situation when evaluating the reasons behind defaulting on your mortgage. Certain extenuating circumstances, such as an accident resulting in expensive medical bills, are regarded differently from exorbitant credit card purchases.

Extenuating Circumstances

Extenuating circumstances are non-recurring events that render your conduct less serious. These have a significant impact on your ability to attend or fulfill legal requirements, which can reduce your waiting period for a mortgage. It considers events beyond the borrower’s control, such as an accident, job loss, sudden medical emergency, divorce decree, or the death of a breadwinner spouse.

If you’re claiming extenuating circumstances, you must submit a formal letter to your loan servicer. It should explain why you had no other recourse than to default on your payments. It must also come with supporting files that verify your claim, such as healthcare bills, a lay-off notice, or divorce records.

The following sections highlight waiting intervals for different types of home loans, including extenuating circumstances before you can apply again for a mortgage.

Most homebuyers in the U.S. typically secure conventional mortgages. These loans do not receive direct funding from the government and are usually bundled into mortgage-backed securities guaranteed by Fannie Mae and Freddie Mac. Without direct government sponsorship, these lenders take on more credit risk from borrowers. Thus, conventional loans generally have stricter credit qualification requirements than government-backed mortgages. They usually approve a credit score of 680, but higher scores of 700 and above usually receive more favorable rates.

If you have a bankruptcy or foreclosure history, expect to wait quite a while before you can obtain a mortgage again. But if you can prove extenuating circumstances, it’s possible to secure a loan a lot sooner.

Use our conventional loan calculator to estimate your monthly payments. You can use the following mortgage rate table to see what rates are available in your area, though you might be charged slightly higher rates if you have credit issues and/or a limited down payment.

Before agreeing to a particular loan, ensure you shop around to find the best rate, as small differences in interest rates can lead to thousands of dollars of savings over the life of a loan. The following interactive table highlights current El Monte mortgage rates.

The FHA loan is a popular choice for homebuyers who have credit problems or a limited down payment. Mortgages backed by the Federal Housing Authority (FHA) are geared towards low to moderate income borrowers. FHA loans come with low down payment options, affordable rates, and lenient credit requirements. Borrowers can qualify for an FHA loan with a credit score of 500, provided they make a 10% down payment on the home’s purchase price. Borrowers with a credit score of 580 are allowed to make a down payment as low as 3.5%.

FHA loans are a viable option if you have difficulty qualifying for a traditional conventional mortgage. If you have a foreclosure, bankruptcy, or short sale record, consider taking an FHA loan when you buy a home. This option generally has a shorter waiting period compared to conventional mortgages and other government-backed loans.

Use our FHA loan calculator to estimate your monthly payments.

The U.S. Veterans Affairs backs VA loans exclusively provided for active military, veterans, and qualifying military spouses. Because it’s federally backed by the government, VA loans come with a zero down payment option (100% financing), affordable rates, and flexible credit requirements. These are privileges given to veterans and military to help them obtain homes. While VA-sponsored lenders have relaxed credit standards, they usually prefer borrowers with a credit score of at least 620.

Unlike conventional mortgages, VA loans come with a shorter waiting period for application for those who experienced bankruptcy or foreclosure. If you’re a veteran or active military member, consider taking advantage of this incentive.

Use our VA loan calculator to estimate your monthly mortgage payments.

USDA loans are mortgages sponsored by the U.S. Department of Agriculture. This type of financing is geared towards low to moderate income borrowers looking to purchase homes in USDA-approved rural areas. Apart from the location requirement, a borrower’s income should not exceed 115% of the median household income in their area.

USDA loans come with affordable rates, a zero down payment option, and lenient credit requirements. USDA-sponsored lenders prefer a credit score of 640, which streamlines your application process. Meanwhile, if your score is below 640, you may still secure a USDA loan, but approval will take much longer. If you have a foreclosure or bankruptcy history, the waiting period for a USDA loan is usually shorter compared to conventional loans.

Use our USDA loan calculator to estimate your monthly mortgage payments.

When You Cannot Qualify for a USDA Loan

If you have a foreclosure or short sale history, USDA-sponsored lenders have specific rules for mortgage application. In particular, if your foreclosed home was backed by a USDA loan, you cannot qualify for a USDA mortgage again. Moreover, you are not eligible for a USDA loan if you took a short sale on your primary residence to buy a better house than your short-sale property.

To qualify for a mortgage again, the most important step is to improve your credit score. The time it takes to repair credit scores varies per individual. While some homeowners may recover in two years with diligent loan payments, others have a harder time juggling several debt obligations. And if you’re not used to budgeting and prioritizing major expenses, you will certainly find debt repayment difficult. Generally, the higher your credit score, the longer it takes to recover if you experienced a great drop on your credit rating.

Besides rent, living expenses, and a car loan, perhaps you have large credit card bills you’re struggling to pay. Paying back large debts, of course, is easier said than done. But as long as you’re making the proper steps to reorganize your finances, your situation should get better. Ultimately, the time it takes will depend on the extent of your debts and how soon you can address them.

In 2011, a FICO study compared different types of credit damaging issues, such as 30 to 90 day late payments, bankruptcies, short sales, and foreclosures. The research sampled borrowers that started with different credit scores: Fair (680), Good (720), and Excellent (780). According to the simulation’s results, the extent of damage due to mortgage problems is highly dependent on a borrower’s initial credit score.

Those with higher initial credit scores tend to have credit ratings that drop lower. They also take a lot longer to recover than those with lower credit scores. Depending on the borrower’s initial score, the recovery could take 9 months (for 30-day late payments) to as long as 10 years (for bankruptcy). Based on FICO’s study, the following tables show how different mortgage problems impact credit scores. The results presume all variables are held constant, without new accounts or delinquencies.

| Credit Issues | w/ Fair FICO Score | w/ Good FICO Score | w/ Excellent FICO Score |

|---|---|---|---|

| Initial FICO score | ~680 | ~720 | ~780 |

| 30 days late mortgage payment | 600 – 620 | 630 – 650 | 670 – 690 |

| 90 days late mortgage payment | 600 – 620 | 610 – 630 | 650 – 670 |

| Short sale or Deed in lieu of foreclosure (no balance deficiency) | 610 – 630 | 605 – 625 | 655 – 675 |

| Short sale (w/ balance deficiency) | 575 – 595 | 570 – 590 | 620 – 640 |

| Foreclosure | 575 – 595 | 570 – 590 | 620 – 640 |

| Bankruptcy | 530 – 550 | 525 – 545 | 540 – 560 |

The next table shows the estimated time it took to recover the original credit scores. Notice how subjects with higher credit scores took longer to repair their original credit rating. For instance, after a bankruptcy, a person with a 680 credit score took 5 years to recover, while a 720 credit score took 7 to 10 years to recover. Meanwhile, a person with a 780 credit score took 7 to 10 years to recover. Review the table below.

| Credit Issues | w/ Fair FICO Score | w/ Good FICO Score | w/ Excellent FICO Score |

|---|---|---|---|

| Initial FICO score | ~680 | ~720 | ~780 |

| 30 days late mortgage payment | 9 months | 2.5 years | 3 years |

| 90 days late mortgage payment | 9 months | 3 years | 7 years |

| Short sale or Deed in lieu of foreclosure (no balance deficiency) | 3 years | 7 years | 7 years |

| Short sale (w/ balance deficiency) | 3 years | 7 years | 7 years |

| Foreclosure | 3 years | 7 years | 7 years |

| Bankruptcy | 5 years | 7 – 10 years | 7 – 10 years |

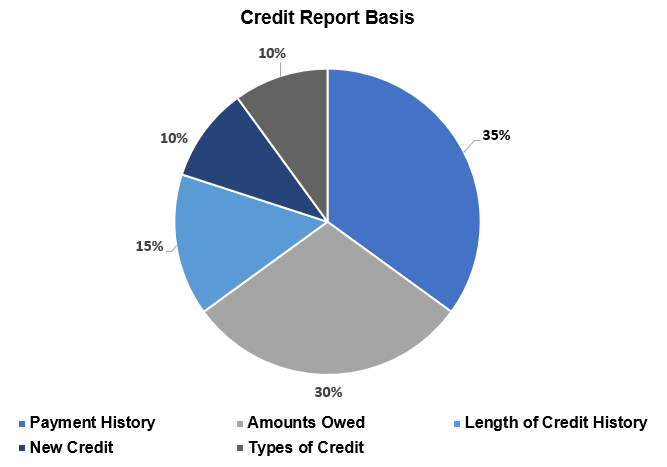

While each person’s financial situation is unique, there are concrete steps you can take to actively improve your credit score. Though you won’t see drastic improvements right away, we assure you that each little initiative you make has a cumulative impact on your credit rating. To understand how your credit score is determined, let’s look at the basis for your credit report. According to the National Credit Union Administration (NCUA), credit ratings are established based on the following factors on your credit report:

The largest and most significant basis for your credit score is your payment history. This accounts for 35% your credit report. It shows whether you have late payments, how long your payments were overdue, and if you’ve defaulted on any loans. Likewise, it reveals if you always pay on time. This is why a negative record on your payment history drives a significant blow on your credit score.

The second largest factor is the amounts you owe, which is 30% of your credit report. This shows just how much you owe your lender, from your mortgage and car loan, all the way to your credit card balances. Having large balances that don’t decrease will likewise impact your credit score negatively.

On the third spot is the length of your credit history, which is 15% of your credit report. This pertains to how long you have maintained your accounts. Keeping old accounts such as a mortgage is a good sign you can keep up with long-term monthly payments. This shows you are a reliable borrower who can commit to agreed loan terms.

To improve your credit score and qualify for a mortgage after bankruptcy or foreclosure, follow these steps:

Credit score recovery depends on your own concerted efforts. It’s crucial to prioritize debt repayment to gain financial footing sooner. You can accelerate debt repayment by making larger payments toward your debts. If you’re struggling with your finances, the most important step you can take is to make consistent and timely payments toward debt obligations. Remember, your payment history is the largest factor for your credit rating. Therefore, consistently paying bills on time will boost your credit score. Don’t underestimate the power of paying bills on time. Even if credit repair takes a while, making sure you don’t miss payments will ensure your credit score does not drop any further.

The second most important step is to reduce your debts. Credit bureaus must see an apparent decrease in the amounts you owe to raise your credit rating. While you can’t undo records in your payment history, you can certainly start reducing the debts you owe. Under bankruptcy of foreclosure, make sure to pay any debt the court requires you to pay.

Furthermore, make the effort to focus on large, high-interest debts such as credit cards. This can be done by allotting extra amounts towards your monthly credit card payments. While paying the minimum keeps you from missing payments, this is not enough. In reality, only making minimum credit card payments will take a ridiculous length of time to remove credit card debt. It also results in costly interest charges, which eat away at your savings.

It’s easy to incur large balances on your credit cards because of compound interest. Compound interest is interest that grows based on the original interest and the amount you owe. This is the reason why it’s much harder to eliminate credit card debts the longer you pay them off. If you have credit card balance from month to month, you should seriously pay it down as soon as you can. Ideally, you should keep your credit card balance low or clear it every month to prevent additional interest charges.

Some people may close their credit card account in an attempt to boost their credit score. However, this strategy usually fails. Having fewer accounts actually lowers your credit score. The same amount of debt spread between fewer accounts suggests you are using more of your credit line. This is a bad sign for lenders, so don’t be tempted to close your account. Closed accounts also continue to show up on your credit report and credit bureaus typically include them in calculations.

Moreover, opening a new credit card account also does not increase your credit score. In certain cases, it may even lower it. Thus, the best course of action is to pay down your current accounts to reduce your credit utilization ratio.

Credit Card Use & Self-control

To avoid racking up your credit card balance, you must stop swiping it, at least until your finances recover. Some people take great lengths to avoid credit card use by locking them away in safes. Depending on what method works for you, the idea is to stop spending more than you can afford. To rise above your debt problems, you must address the issues that got you there in the first place.

It’s important to cultivate the discipline of living within your means. Plan your expenses and stick to a budget. Use cash or a debit card instead for the meantime. And once your finances recover, only use your credit card for important purchases or emergency expenses. More importantly, make sure to keep your credit card balance low to maintain a good credit score.

Credit agencies assess how long you keep credit accounts active. This is a positive sign that you can manage payments and control the amount of debt in your accounts. While paying off debt is important, building a good credit history is also a vital basis for your creditworthiness. This is how you can use your debts to build a better credit rating along the way.

Keeping accounts open for a long time, indicate you are a responsible and reliable account holder. It shows you can fulfill debt obligations as you agreed with your lender. Building a good payment history on your car loan, mortgage, and your credit card bills will certainly go a long way. If you’ve been using a credit card for many years, keep your account open. The longer your account history, the more favorable it is for your credit score.

You might have heard diversifying your accounts is good for your credit score. While this is true, opening several new accounts within a short period of time actually damages your credit score. This is not recommended especially if you don’t possess a long credit history. Opening new accounts actually shortens the average age of your accounts, which results in a lower credit score. Furthermore, opening a series of new accounts is seen negatively by credit agencies and lenders, which make up 10% of your credit report.

But if you actually need a new credit card or a loan soon, limit your credit inquiries within one month. For instance, consumers have 45 days to do rate comparison shopping for mortgages before it negatively impacts their credit score. FICO recognizes searches for single loans and multiple credit lines by checking the length of time between each inquiry. For mortgages, 45 days will not incur negative points on your credit score, which counts as a single loan. Note that multiple hard inquiries on your credit report will lower your credit score, so avoid this while you can.

Keeping a Diverse Set of Accounts

Diversifying your accounts should occur within a normal pace, which comprises 10% of your credit report. People with diverse accounts are seen a low-risk borrowers compared to others with three credit cards and no car loans or mortgages. If you’ve experienced bankruptcy or foreclosure, and you have three credit cards, it’s a good idea to prioritize paying one of your credit cards (especially the high-interest one) to reduce your debt.

Ideally, consumers should not be applying for large loans within the same period of time. Here’s a good example of a timeline to diversify your accounts. For instance, you got your first car loan 6 years ago. Prior to this, you already had at least two credit cards and you’ve diligently paid your student loans for 10 years. Toward the coming year, you’re ready to apply for a mortgage to purchase your own home. Within this timeframe, you’ve diversified your accounts, as opposed to applying for multiply accounts within the same year.

Besides paying on time and reducing your debts, make sure to check your credit report. The Federal Trade Commission (FTC) notes that around 20% of all credit reports have incorrect information. This can be a wrong address or a recorded payment on the wrong account. It can include sharing data with someone of a similar name, or even an incorrect Social Security number. Depending on the extent of the error, the wrong information can actually reduce your credit score. The FTC states that around 5% of consumers have credit report mistakes that could result in unfavorable loan deals.

You can request a copy of your credit report at AnnualCreditReport.com. Consumers are entitled to a free credit report every 12 months. If you find any incorrect information on your file, you must dispute the error to your credit reporting agency. Explain the error via formal letter, and attach documents that would support your claim. To know more about how to dispute credit report errors, visit the Consumer Finance Protection Bureau (CFPB) page.

Beware of Credit Repair Scams

During bankruptcy or foreclosure, you might come across “credit repair” schemes that promise to improve your credit score. These shady companies might claim to remove negative records on your credit report right away. They may even offer to raise your credit score by associating your credit report with another consumer that has a good credit score. This practice, called ‘piggybacking,’ is illegal when done without a legitimate relationship with a consumer. It is also considered fraud if you deliberately do it to mislead banks and other lending institutions.

The only way you can improve your credit score is to do the work. Make payments on time and reduce your debts. The reality is there’s no quick way to fix your credit. To avoid further issues, it’s best to stay away from credit repair scams.

At the core of improving your credit score is a good debt repayment strategy. At this point, you should seriously start organizing your finances. This may sound daunting, especially if you’re not used to financial planning or setting budgets. Others are also unmotivated with the prospect of calculations and cutting down expenses. However, here’s a better way to reframe your perspective: Budgeting is living within your means while being able to afford your wants.

Budgeting is a method of reducing your expenses while boosting your income. This starts with making a list of essential day-today expenses, and segregating them from non-essential discretionary costs. As a rule of thumb, you must always prioritizes important purchases over things that are good to have, but not necessary. Essential expenses include things like food, utilities, rent, transportation, and basic costs you need for daily living. Non-essentials cover everything from nice clothes, shoes, dining out, hobbies, trips, etc.

Assess your monthly income. List down how much you spend per month. Then, factor in how much debt you need to pay and include that in your essential expenses. Once you make your list, you’ll have a pretty good idea what products and services you usually spend on, and which expenses you can anticipate. From there, you can adjust your budget to make room for debt payments and savings.

Cut down on unnecessary expenses like dining out, certain hobbies, or buying new clothes. Some people also choose to rent at affordable locations to maximize their savings. If you want to reduce transportation costs, you can also take public transportation if you have an accessible bus or train route in your area. Finally, if you plan to purchase a home in the near future, make sure to budget for savings to gather enough down payment.

Sometimes, it can be hard to distinguish between necessary expenses and wants. This is where the 50/30/20 budget method can keep you in check.

Use the 50/30/20 Budget Plan

The 50/30/20 budget method is a financial strategy that encourages efficient use of your income. This method prescribes 50% of your monthly after-tax income toward essential expenses. 30% should go toward non-essential costs, while 20% must be set strictly for savings. While you can closely follow this rule, the idea is to adjust your budget as needed, particularly when you’re prioritizing debts.

For instance, if you’re going through bankruptcy, you can reduce your non-essential costs down to 10%. This way, you can allocate more money toward paying off credit card debts. The budget plan also emphasizes the importance of setting aside savings for emergency funds. Even while paying debts, you must save a small amount of money for a rainy day. You’ll never know when you might need it for sudden car repairs or medical costs. Financial advisors recommend saving at least 6 months to a years’ worth of emergency funds.

Now that you know how to organize your finances, it’s time to create an effective debt repayment plan. Take note of these strategies to pay off your debts faster.

Decide which debt you need to prioritize first. This can be done in two ways, using the snowball method or the avalanche method. When you use the snowball method, you focus on paying debts with the smallest balance until you reach the largest debts. Meanwhile, with the avalanche method, you prioritize paying down high-interest debts and work your way down. Many people typically like clearing small debts first. This gives them a sense of accomplishment, which further motivates them to reach their payoff goal.

But between the two strategies, the most efficient way to clear debt is the avalanche method. When you clear away high-interest debts, you effectively spend less on total interest costs. However, with a large, high-interest debt, this may take a lot longer. Thus, it’s crucial to keep your patience. Once you’ve paid of your initial focus debt, you must move on to the next debt. This process should continue until you’ve eliminated all your debts.

Once you’ve evaluated your finances, decide how much you can allot for debt payments. Remove unnecessary costs to maximize your expenses. This should be a reasonable amount that can pay down your debt within three to five years. You can also include additional income from overtime pay, work bonuses, or even your tax refund. Once you’ve established the amount, commit to it. Repayment plans are only successful if you can make consistent timely payments.

Once you’ve decided your payment amount, determine how much time it will take to pay down your debt. For instance, your focus debt is a credit card balance of $15,000 at 16% APR. You can calculate how much time it takes to pay off your balance with a minimum payment of $180 per month. Then, compare how much faster you can pay it down if you pay an additional $300, for monthly credit card payments worth $480. See the results below.

Credit card balance: $15,000

APR: 16%

| Credit Card Details | Minimum Payment | Minimum Payment + $300 |

|---|---|---|

| Monthly payment | $180 | $480 |

| Total interest paid | $29,329.44 | $4,533.62 |

| Number of payments | 592 payments | 41 payments |

| Estimated payoff time | 49 years | 3 years |

Based on the example, if you kept on paying the minimum payment of $180, it would take you 49 years or 592 payments to wipe out your credit card balance. This will generate expensive interest costs worth $29,329.44. On the other hand, if you budget an additional $300 toward your monthly payment, you can clear your credit card balance within 3 years or 41 payments. This generates a total of $4,533.62 in interest costs. Thus, making an extra payment of $300 per month saves you $24,795.82 on interest charges.

Keeping tabs on your payment goals let’s you know how much you still owe. It also helps keep you determined to sustain your payment plan. After several months, knowing you’ve lessened your credit card balance down to 30% sounds is encouraging. If ever you feel like slacking off or not paying on time, just think of all the progress you’ve made. You’ll be reluctant to throw that all away with a missed payment. And when you’re motivated, you’re likely to keep making extra payments to wipe out your debts.

What If I Can’t Make Extra Payments?

There are times when you might not afford additional payments. This can be due to sudden expenses like car repairs, illness, or an accident. In these situations, of course it’s more important to prioritize emergency expenses. But as a rule, make sure to make the minimum payment. Even without the extra amount, a timely payment ensures your credit score won’t go down. Once you’re able to make extra payments again, just resume as usual.

Besides cutting down costs, try to find ways to generate extra money. This will relieve some of the pressure of saving each dollar for debt payments. The most common way to increase earnings is to clock in more overtime work. Depending on your position, scheduling days for extra hours can really boost your monthly take-home pay. In other cases, people opt to do freelance work on the side.

These days, there are plenty of avenues for freelance gigs. Sites like Upwork, Freelancer.com, and Fiverr allow part-time job seekers to find clients that match their services. Depending on your skills, many companies look for online writers, graphic designers, and video transcriptionists. Many clients also look for virtual assistants. With numerous openings, you’re likely to find a freelance position that works for you. At the end of the day, just make sure it does not interfere with your main job. Between a freelance gig, it’s more important to protect your primary source of income.

Obtaining a mortgage after a bankruptcy, foreclosure, or a short sale record is challenging for many consumers. However, it’s definitely possible to obtain mortgage approval if you diligently improve your credit score. This can be done by paying bills on time, maintaining low credit card balances, and paying off high-interest debts. It also helps to dispute credit report errors to increase your credit rating.

Going through bankruptcy or foreclosure is not the end. Though it will be difficult at times, just remember to stay patient. Keep pushing for your payoff goals. Waiting periods are required before taking a mortgage for good reason. With more time, you can repair your credit and finally pay down large debts. This experience should also teach you to budget your expenses responsibly. Take advantage of the waiting time to build your credit and recover your finances. The sooner you reduce your debts, the sooner you can purchase a home again.

The Federal Reserve has hinted they are likely to taper their bond buying program later this year. Lock in today's low rates and save on your loan.

Are you paying too much for your mortgage?

Check your refinance options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you refinance and save today!