Use this calculator to help estimate closing costs on a VA home loan. Enter your closing date, the sale price, your military status & quickly see the estimated closing cost. This is an estimate of how much you will need on the day your home purchase is made. Please remember that this is an estimate, the actual fees and expenses may change depending on a variety of factors including the actual closing date, your military status & if you finance your funding fee.

Take advantage of your military benefits today with a $0-down VA loan from Veterans United. Veterans United is the nation's #1 VA home purchase lender & has originated over $10.2 billion in home loans since 2017.

Veterans & Military: Check Your Eligibility for 0% Down Today!

For your convenience current El Monte VA loan rates are published below. You can use these to estimate your mortgage interest rates and payments.

Below is a summary of the inputs and calculations used to calculate estimated payments and closing costs.

The fifth section of the calculator [Loan costs] contains multiple important variables for veterans. Namely it lists VA status, loan use & if the funding fee is financed in the loan. By default these are set to active duty/retired military, first time use & funding fee financed.

Military Status

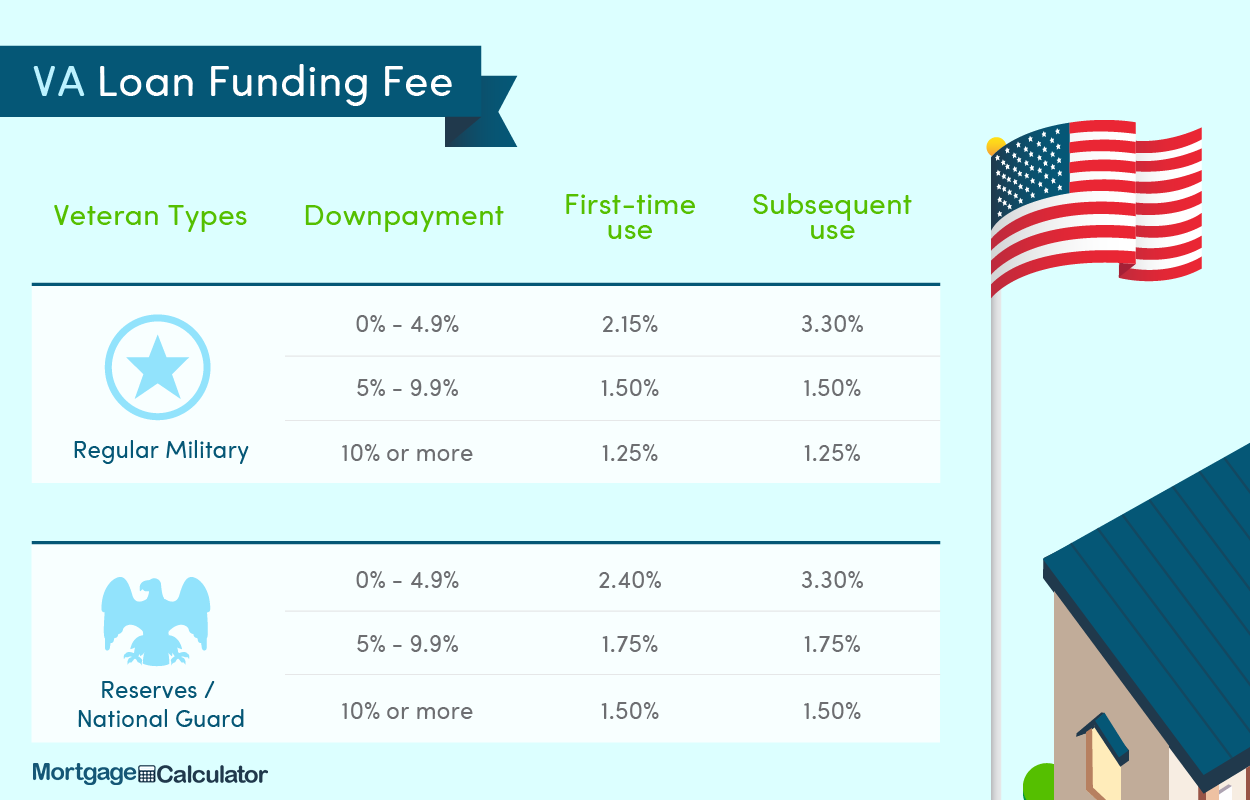

If you are a reservist or a member of the guard, please change this variable to reflect your funding fee.

First or Subsequent Use

If this is an additional use rather than first time use then reset that field to reflect the higher funding fee for subsequent uses.

Roll Funding Fee Into Loan

If you do not want to finance the funding fee, then set the financing option to No.

Injured in Service

If you were 10% or more disabled while in service, your funding fee can be waived. Set "finance the funding fee" to No and deduct that number from your cash due at closing to get your actual closing costs.

You can also edit any of the other variables in the calculator. For sections that are minimized by default, please click on the dropper in the upper right section to expand them. Once you are done with your calculations you can click on the [View Report] button to bring up a detailed report about your loan. Once you are in the active report view you can click the [Print] button to create a printer friendly version of your results.

Here is a mortgage rate table listing current VA loan rates available in the city of El Monte and around the local area.

| Borrower | Down Payment | Funding Fee (1st use) | Subsequent Funding Fee |

|---|---|---|---|

| Disabiled 10%+ in Service | Any | 0% | 0% |

| Regular Military | None | 2.15% | 3.3% * |

| Regular Military | 5 - 10% | 1.5% | 1.5% |

| Regular Military | 10% &Up | 1.25% | 1.25% |

| Regular Military | Cash Out Refi | 2.15% | 3.3% |

| Reservist & National Guard | None | 2.4% | 3.3% * |

| Reservist & National Guard | 5 - 10% | 1.75% | 1.75% |

| Reservist & National Guard | 10% &Up | 1.5% | 1.5% |

| Reservist & National Guard | Cash Out Refi | 2.4% | 3.3% |

| Regular Military, Reservist & National Guard | IRRRLs | 0.5% | 0.5% |

| Regular Military, Reservist & National Guard | Manufactured Homes | 1.0% | 1.0% |

| Regular Military, Reservist & National Guard | Loan Assumptions | 0.5% | 0.5% |

* The higher subsequent use fee does not apply to these types of loans if the Veteran's only prior use of entitlement was for a manufactured home loan.

Source: Funding Fee Table [PDF] on benefits.va.gov, citing Public Law 112-56, signed November 21, 2011

On August 1, 2019 Ginnie Mae announced they were lowering the loan-to-value limit on cash out refinancing loans to 90% LTV. Previously the limit was 100%.