Unsure if you should rent or buy a home? The decision is the biggest purchase in most people's lives & the financial decision has many components to it.

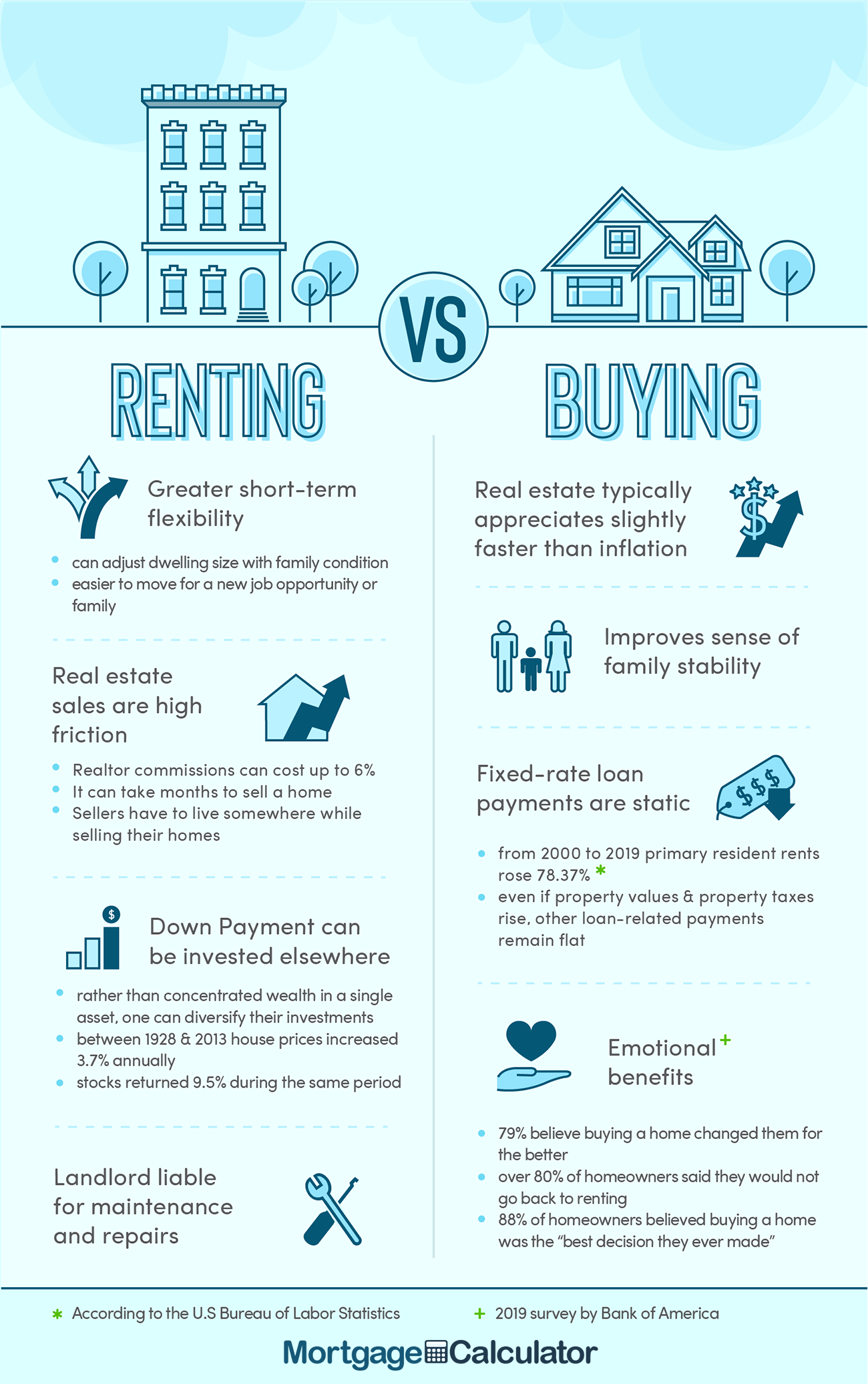

Comparing rent vs buying is more complicated than looking at payment priceas alone because you have to consider the opportunity cost of the investment, your job stability, if flexibility to move is important, along with many factors not reflect in the monthly mortgage payment price: closing cost, property taxes, potential returns on other investments, real estate appreciation, selling costs, etc.

The following table shows current El Monte 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down.

Purchasing a home is often the single biggest financial commitment of most people's lives.

Such purchases are often financed over a 30-year term, which impacts many other aspects of life.

If you are fairly certain in the stability of your career and your family wants to settle down then buying a home can make a lot of sense.

Home buyers who used fixed-rate mortgages can lock in low interest rates for decades to come. If rates rise their interest rates stay the same along with their monthly mortgage payments. If rates fall then the homeowner can refinance to lock in the lower rate.

Do you want to knock down a wall? Would you like to add on an extension? Are there other home renovations you would like to do which a landlord won't allow?

When you own a home you have more flexibility with making changes to the property. And if you make renovations which increase the value of the property then you will not only benefit from those changes while you live in the property you will also increase the value of the home & what you get paid when you go to sell the home.

While most advice about homeownership is tied strictly to finances, people who own their homes tend to have a great emotional benefit from homeownership. Concentrix Analytics conducted an online survey of 1,919 adults on behalf of Bank of America between January 30 and February 21, 2019.

| Question | Yes | No |

|---|---|---|

| Does owning a home make you happier than renting did? | 93% | 7% |

| Could you go back to renting after owning? | 17% | 83% |

| Has being a homeowner made you a better person? | 79% | 21% |

New homeowners can deduct the annual interest paid on up to $750,000 of home mortgage debt from their income when they file their state and federal income taxes.

The standard federal income tax deduction for 2025 is $15,750 for individuals or married people filing individually, $23,625 for head of household & $31,500 for married couples.

This would mean that at a 7% rate of interest on a 30-year home loan individuals who borrow $250,000 or more would save money by itemizing their deductions, just based on their mortgage interest, with any other state or local taxes increasing the value of itemizing. Married couples filing jointly would save by itemizing the mortgage interest on $452,000 or more (with any SALT providing additional savings). If interest rates rise then tax savings over the standard deduction would kick in at even lower borrowing amounts. State and local taxes (SALT) are also deductible, up to a combined limit of $40,000 per year.

Homes purchased with a mortgage and down payment of 20% gives the homebuyer 5 to 1 leverage on the purchase. So long as the home appreciates faster than the cost of the interest they are charged there is a good chance the homeowner will make money when compared against renting, particularly if they intend to live in the home for at least 5 to 7 years.

Longterm capital gains are typically taxed at a significantly lower rate than ordinary income. In some cases homeowners can generate up to $250,000 on the sales of their primary residence without incurring any taxes on the transaction.

Is your job in an industry which is in flux? Or might your employer require you to move if you get a promotion? If so, then homeownership can be a risky proposition. If you pay on a 30-year loan for 15 years and suddenly get sick or lose your job you could have the home foreclosed on & lose all of your investment.

Similar sad events can happen with marriages. Around half of all marriages end in divorce. Divorce is expensive & stressful. The added cost of going through a divorce could make the family budget fall apart. And if things go south while the economy is also in a slump then you are likely to either sell at a loss or gain much less than you would have if you could have sold the home in a hot market.

All families should try to have at least 6 to 12 months budget saved for any emergency which make come up, yet very few families do.

When calculating the cost of homeownership many people include PITI - principal, interest, property taxes, and homeowner's insurance. Owning a home also has other significant costs including property maintenance and in some cases association dues.

Investors who purchase a low-cost Vanguard index fund or a stable stock with high liquidity can quickly liquidate the position in a matter of seconds at a cost below $10. Investors who have a temporary cash shortage may also be able to borrow agaisnt some investment accounts & quickly repay it, or they could choose to sell only a small portion of their overall holdings to cover the funding needs, obligating themselves to only pay capital gains taxes on the portion of the position which was liquidated.

Homeowners who have most their wealth tied up in a house will have a much harder time leveraging their liquidity in crunch time, as home equity loan approval can take weeks. Those who decide to sell their house outright still have to figure out where to live while the house is being sold. If the market is down when they need money there is not an easy way to liquidate a portion of the position. Shifting from a renter to a landlord is a lot of hard work.

In down markets transactions are slow as credit standards tighten when demand cools and prices are falling. Transactions are also expensive as Realtors typically charge a 6% sales commission in addition to all the other costs associated with transfering ownership.

In some markets renting is a far better deal than buying, while in other markets buying is a far better deal than renting.

All real estate markets are local. A big employer coming to town can drive up prices. A big employer leaving town can drive down demand and prices.

In hot real estate markets home prices often appreciate faster than the associated rental prices change as people buy in the hope of capturing future appreciation.

The future is unknowable & past performance does not guarantee foward performance. A few ratios you can look at to see how your local market compares to other markets are:

As this article discussed, you not only need to account for the market conditions, but you also have to consider your family plans, financial position, career options & life goals.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!