This calculator that will help you to compare the estimated consequences of keeping your Traditional IRA as is, versus converting your Traditional IRA to a Roth IRA.

Assumptions: This calculator assumes you will keep your Roth IRA for at least 5-years and you won't withdraw any funds until age 59-1/2. The calculator also assumes your return on investment remains constant and that you will remain in the indicated federal tax bracket for each period (conversion may or may not push you into a higher tax bracket for the year of conversion). Finally, the calculator does not account for any state taxes or AMT (Alternative Minimum Tax). All results are hypothetical, so be sure to consult a qualified tax professional before making any decisions regarding your existing IRA.

Our rate table lists current home equity offers in your area, which you can use to find a local lender or compare against other loan options. From the [loan type] select box you can choose between HELOCs and home equity loans of a 5, 10, 15, 20 or 30 year duration.

An IRA is an individual retirement account where you receive a tax break for contributions today but pay taxes on withdrawals in retirement. Contributions are deducted from your income on your tax return. As a reference, in 2014 you could contribute up to $6,500 a year and if you are 50 or older you could add an additional $1,000. There are no income limitations. Growth is tax deferred and minimum required distributions begin at 70 ½ years old. You must wait until age 59 ½ before withdrawals or suffer a 10% penalty.

A Roth IRA is the opposite. You pay taxes now on your contributions, but withdrawals are tax free in retirement. Deposits are not tax deductible on your tax return, but growth is tax free. Income limitations for singles filers is $114,000 and $181,000 for joint filers. Contribution limits are $6,500 a year with a $1,000 catch up for those 50 or older. You must hold the account for at least five years before beginning withdrawals or suffer the 10% penalty. If you expect taxes to rise in the next 20-30 years then the Roth IRA may be an excellent choice.

Up until 2010 only those with adjusted gross incomes of less than $100,000 could convert their IRA to a Roth IRA. Since then the limitation has been lifted and now anyone regardless of income can convert. Several different pretax retirement accounts may be converted to a Roth IRA. They are:

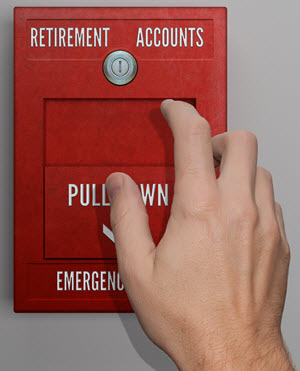

Before you convert any of your pretax accounts to a Roth IRA there are some things to take into consideration. The most important thing to consider is the federal taxes. You must pay taxes at your current rate on all the contributions that are being converted. If you believe your taxes will be higher in retirement than they are today, then a conversion may be the correct step for you.

Before you convert any of your pretax accounts to a Roth IRA there are some things to take into consideration. The most important thing to consider is the federal taxes. You must pay taxes at your current rate on all the contributions that are being converted. If you believe your taxes will be higher in retirement than they are today, then a conversion may be the correct step for you.

But you must also consider how you will pay for those taxes. Do you have savings set aside in a non-retirement account for this purpose? If not, it would be to your disadvantage to use part of your IRA conversion money to cover the taxes. This would reduce the amount going to your Roth IRA account that grows tax free, and if you are younger than 59 ½ you may be subject to the 10% penalty. To reduce the tax hit, you may want to consider breaking the conversion over several years. This may also alleviate the potential of pushing you into a higher tax bracket.

If you are less than five years away from needing your retirement savings then conversion may not be a good option for you. Roth IRA accounts must be established for at least five years before withdrawal or you may pay a 10% penalty. Be sure to consult your financial advisor before making an IRA to Roth Conversion.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!