Debt Investment Offers Tax-Free & Risk-Free Returns

Before you invest in stocks or bonds offered by investment brokers on Wall Street, be sure to check you can't earn a higher rate of return by investing in paying off your own debt faster! For example, if you have a credit card costing you 19% per year, and you increase your payment, you will get a guaranteed 19% return by paying that off quicker. What's more, your earnings will be tax-free, which would mean you would need a far higher taxable investment return to reach that same effective return.

Use this calculator to see how much you can earn by increasing your debt payments and paying off your debts faster.

For your convenience we list current personal loan rates, HELOC & home equity loan rates & El Monte mortgage refinance rates to help people borrowers local lenders & consolidate their debts at lower-interest rates.

The following table shows current El Monte 30-year mortgage rates. You can use the menus to select other loan durations, alter the loan amount, change your down payment, or change your location. More features are available in the advanced drop down.

Our rate table lists current home equity offers in your area, which you can use to find a local lender or compare against other loan options. From the [loan type] select box you can choose between HELOCs and home equity loans of a 5, 10, 15, 20 or 30 year duration.

When you have financial obligations and you receive some extra money, one question will occupy your mind: should I use the money to pay off my obligations or should I bankroll the newfound cash?

We know the answer, but it's not what you think. And it’s definitely not what you've heard through the grapevine.

Conventional wisdom says that when you have to decide between investing and paying off debt, just calculate your (ROI). But we will soon see that financial ROI should not be your main consideration.

First of all, a basic glossary of relevant terms is in order. Know the lingo before you sit down with lenders or investment brokers.

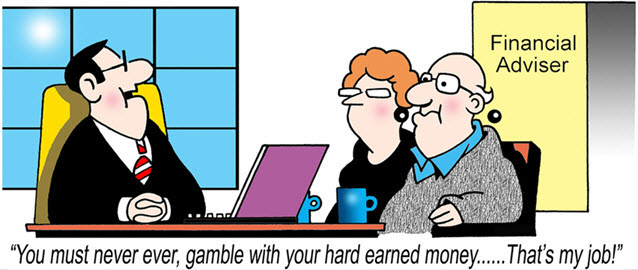

You must bear in mind that any financial expert in his or her right mind would advise you to fund any opportunity with a great ROI, but there are ulterior motives at work.

First of all, when you invest your money, someone gets a commission and someone else gets recurring management fees. When you instead use that money to reduce your debt, you don't need the services of any salesmen, brokers, or financial advisors. Now you may understand why so much is made of investing a windfall rather than using it to pay off your financial obligations.

All those commissions and fees you pay when you invest your money are non-refundable and must be paid, even if you lose money in the endeavor. When you pay down your bills, on the other hand, you don't have to pay anything else to anyone - and you are guaranteed to get a decent return on your investment.

Use our handy calculator to figure out where your money will serve you best. For a typical example, let's say your highest interest debt is a credit card with an 18% interest rate. You originally planned to use that card only for emergencies, but now it's eating you alive.

The balance owed on that pesky card is still $6,500, even though you've been making the $225 minimum monthly payments on time. Enter that information into the calculator.

Now consider your investment opportunity. Let's suppose you have $2,500 that an old business associate finally paid you back after more than decade. Since you had long since written off the loss and this seems like "found" money, the temptation is to be cavalier and invest this little windfall. Fair enough.

Next, enter your tax bracket (15%) and the amount you have to invest ($2,500). The typical investment rate of return for the investment you're anxious to dabble in is 4% annually, but you have to factor in the commission charged by the brokerage firm ($175) and their yearly fees ($60). Enter all that data into the calculator and press "CALCULATE." Surprise! It's not even close.

The lightning-fast calculation shows that by investing that $2,500 in paying down the money you owe, you will save $1,396 in interest charges. And you’ll be able to pay off your obligation in 21 months instead of 39 months. That's impressive, and so is the fact that investing in paying off the money you owe earns you a guaranteed 18% on the money you use for that purpose.

But if you put that $2,500 in a traditional investment, which pays 4% annually, you will earn just $153 in interest (after taxes). Once you subtract the commission and fees you have to pay the brokerage, you're left with a return on your investment of -$127. That’s negative $127!

Of course, every debt is different and most of the variables you enter into the Repayment vs. Investment Calculator will differ from our example. But since it's so much fun to tinker with this calculator, we should try another very different example.

This time, we'll examine the decision facing someone with a different set of choices. The question is: should you worry about a small balance on a minor credit card, or should you invest in a once-in-a-lifetime investment that your cousin Murray can't stop talking about?

So we'll compare the merits of paying down a $1500 balance on a 15% interest credit card, which we’ll say is your highest interest financial liability. Paying down a debt is always prioritized by starting with the highest interest obligation.

This 15% card has a balance owed of about $1500, so the monthly minimum payment is just $94.

Murray’s get-rich-scheme is, of course, a sure-fire, can't miss deal that is guaranteed to give you an annual return of at least 18%. It has something to do with investing in Bitcoin ATM machines, the fastest-growing sector of the international currency exchange. At least, that’s what your cousin tells you.

But at 18% a year ROI, and a chance to become a Bitcoin billionaire, you're in! You commit your $2,500 to the venture and start dreaming about yachts and stretch limos.

Then Murray tells you about the upfront costs. You have to contribute $350 toward the cost of the ATM machine and $120 a year to maintain a Bitcoin Wallet to store your profits. Now let's see what the calculator comes up with.

Did you think the Bitcoin empire was a better choice this time? Nope. The calculator never lies, and it shows that the $2,500 applied to the current amount you owe would not only bring that balance down to zero (and leave some folding money in your wallet, too) but it would save you $183 in interest charges.

With the Bitcoin option, even if everything went smoothly and you reaped an enviable 18% annual yield, you would still LOSE money on the deal (-$135). That's not accounting for the spreads trading in and out of Bitcoin nor even allowing the possibility that the value of Bitcoins might plummet, making your ATM machine obsolete.

You should run the numbers for yourself, but it's pretty obvious that investing your money in paying down your current obligations is wiser than hanging onto to your high-interest debts while you gamble money elsewhere.

As we have seen, paying down your bills gives you a guaranteed rate of return, and it's a smart, tax-free way to increase your disposable income down the road. After all, most other investments are taxable.

If you believe in yourself and in your future, then invest in it by reducing your debts.

Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you save today!