When the homeowner approaches the lender and they begin the process of filling out the mortgage loan application, it is a very good idea to know what types of mortgages are available and the advantages and disadvantages for each of them. This article takes a look at one year adjustable rate mortgages, fixed rate mortgages, 2-step mortgages, 10/1 adjustable rate mortgages, 5/5 and 5/1 adjustable rate mortgages 3/3 and 3/1 adjustable rate mortgages, 5/25 mortgages, and balloon mortgages. Government backed programs including FHA, VA & USDA loans are briefly discussed.

A mortgage in which the interest rate remains the same throughout the entire life of the loan is a conventional fixed rate mortgage. These loans are the most popular ones, representing over 75% of all home loans. They usually come in terms of 30, 15, or 10 years, with the 30-year option being the most popular. While the 30-year option is the most popular, a 15-year builds equity much faster.

The biggest advantage of having a fixed rate is that the homeowner knows exactly when the interest and principal payments will be for the length of the loan. This allows the homeowner to budget easier because they know that the interest rate will never change for the duration of the loan.

Not only are fixed rate mortgages the most popular of home loans, but they are also the most predictable. The rate that is agreed upon in the beginning is the rate that will be charged for the entire life of the note. The homeowner can budget because the monthly payments remain the same throughout the entire length of the loan. When rates are high and the homeowner acquires a fixed rate mortgage, the homeowner is later able to refinance when the rates go down. If the interest rates go down and the homeowner wants to refinance, the closing costs must be paid in order to do so. Some banks wishing to keep a good customer account may wave closing costs. If a buyer buys when rates are low they keep that rate locked in even if the broader interest rate environment rises. However, home buyers pay a premium for locking in certainty, as the interest rates of fixed rate loans are usually higher than on adjustable rate home loans.

The following table allows you to compare current rates and monthly payments for various common home loan types.

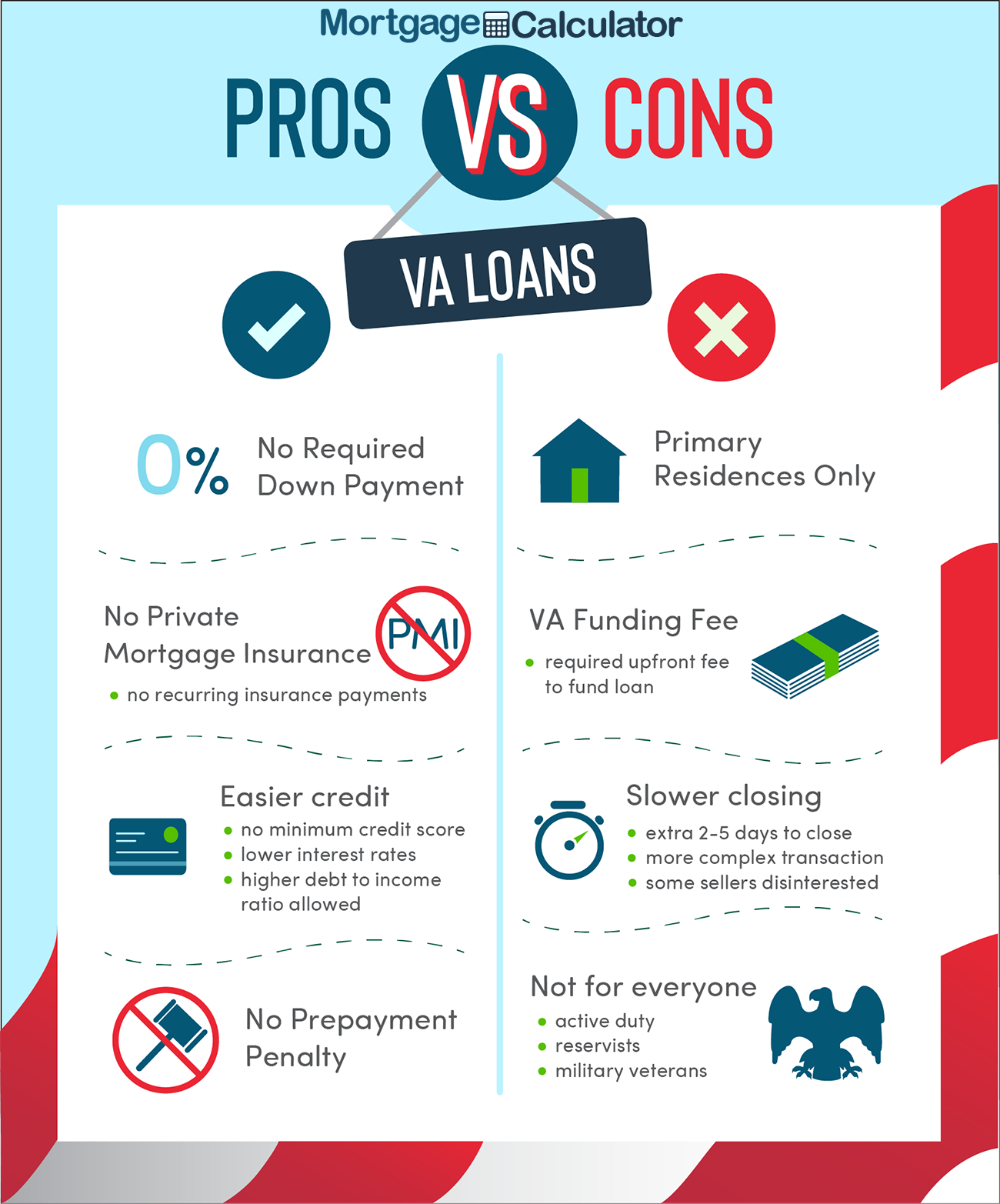

VA loans are guaranteed by the US Department of Veteran Affairs. They help veterans & active duty military members afford purchasing a home without requiring a down-payment by guaranteeing 20% of the loan's value up to the conforming loan limit.

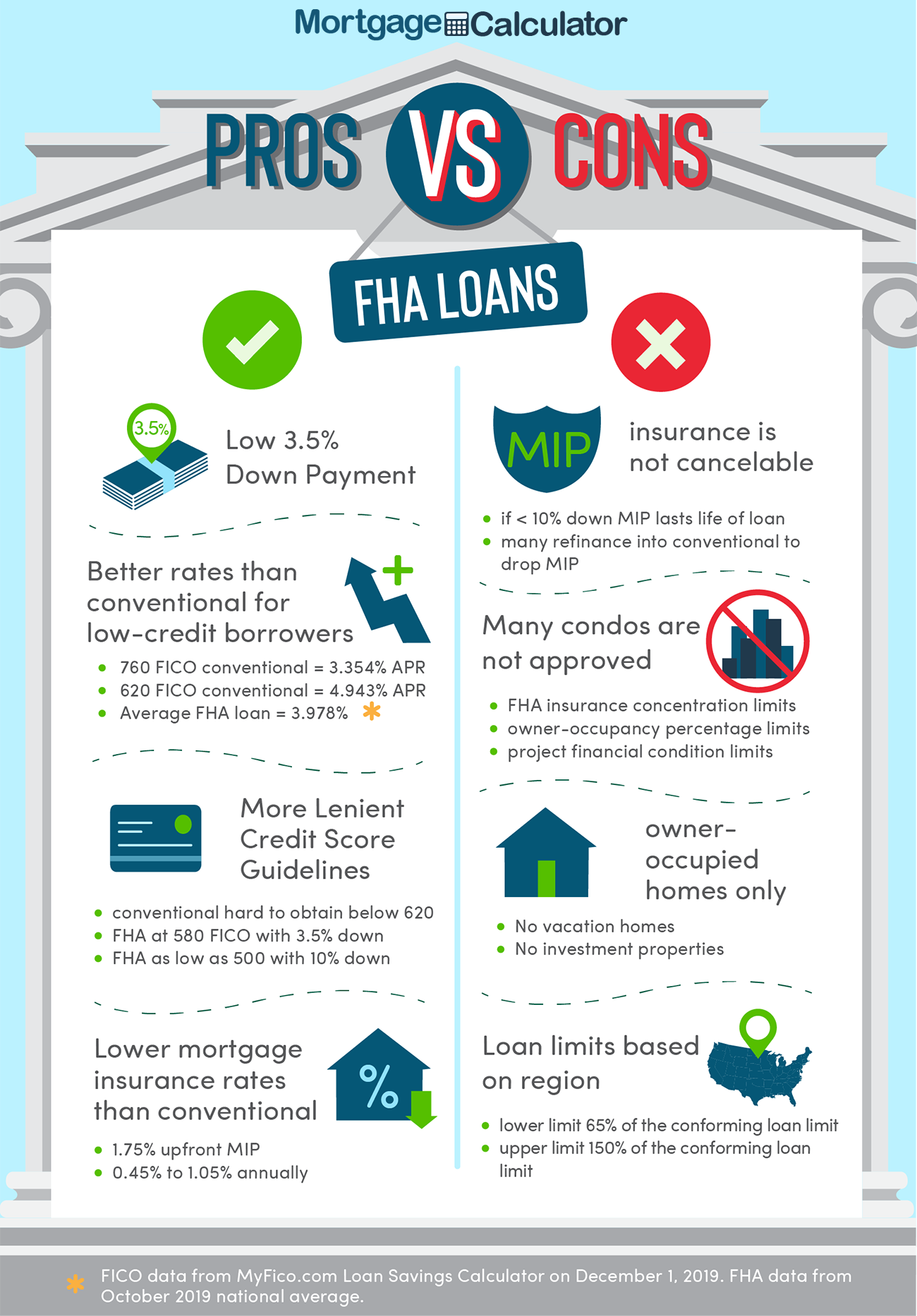

Although it is true that there are several different types of mortgages making a comeback, the FHA home loan remains one of the most popular. The reasoning behind this is the multiple benefits an individual is eligible for once they qualify for this loan.

1

Gift Funds. The FHA is one of the only lenders that are very proactive in protecting their applicants' ability to accept monetary gifts for payments. An applicant can accept up to 100% of the down-payment in the form of a gift from a relative, friend, employer, charitable group, or government homebuyer program. You will have to follow the process to accept the gift though.

2

Low Downpayment. One of the biggest draws to this program is the low down-payment amount. Most down payments are around 10% or higher. However, the FHA program offers down payments for as low as 3.5%. This means buyers don't have to worry about saving as much for their down payments, and they can save their money for repairs of emergency funds.

3

Many Property Types are Eligible. Unlike several mortgage lenders, the FHA is flexible on the property types that are eligible for financing. Borrowers can purchase a home in any neighborhood located in the United States, the District of Columbia, or any territory the United States holds. You can purchase a single family home, two unit homes, three and four unit homes, condominiums, mobile homes, and manufactured homes.

4

No Social Security Number Required. Every home-buyer does not have a social security number. Normally, this would be something that prevented them from purchasing a home. The FHA will allow people without a valid social security number to secure a loan. This is good news for employees of the World Bank, employees of Foreign Embassies, and non-resident aliens.

Rural home buyers with low to moderate incomes may qualify for USDA loans backed by the US Department of Agriculture.

The USDA Rural Housing Program (Section 502) guarantee program was created to help boost rural development by extending credit to people with moderate income.

Moderate income is defined as the greater of 115% of the U.S median family income or 115% of the state-wide and state non-metro median family incomes or 115/80ths of the area low-income limit. These USDA loan limits are based upon both the local market conditions and the family size. The moderate income guarantee loan limit is the same in any given area for households of 1 to 4 people & is set to another level for homes of 5 to 8 people. The following table lists examples of limits from a few select areas of the country.

| Location | 1 to 4 Person Limit | 5 to 8 Person Limit |

|---|---|---|

| Fort Smith, AR-OK MSA | $78,200 | $103,200 |

| Northwest Arctic Borough, AK | $157,850 | $208,350 |

| Oakland-Fremont, CA HUD Metro | $145,700 | $192,300 |

| San Francisco, CA HUD Metro | $202,250 | $266,950 |

The floor values on the above limits are $78,200 and $103,200 respectively. Homes with more than 8 people in them can add 8% for each additional member. You can view income limits in your local area here.

Loans can be used for regular, manufactured or modular homes which are no more than 2,000 square feet in size.

The effective loan limit starts at $125,500 in low-cost areas and goes as high as $508,920 in expensive parts of California.

You can view loan amount limits in your local area here.

Quickly Compare Monthly Mortgage Payments for Various Loan Scenarios

Compare fixed, adjustable & interest-only mortgages side by side.

A mortgage loan in which the interest rate changes based on a specific schedule after a “fixed period” at the beginning of the loan, is called an adjustable rate mortgage or ARM. This type of loan is considered to be riskier because the payment can change significantly. In exchange for the risk associated with an ARM, the homeowner is rewarded with an interest rate lower than that of a 30 year fixed rate. When the homeowner acquires a one year adjustable rate mortgage, what they have is a 30 year loan in which the rates change every year on the anniversary of the loan.

However, obtaining a one-year adjustable rate mortgage can allow the customer to qualify for a loan amount that is higher and therefore acquire a more valuable home. Many homeowners with extremely large mortgages can get the one year adjustable rate mortgages and refinance them each year. The low rate lets them buy a more expensive home, and they pay a lower mortgage payment so long as interest rates do not rise.

Can You Handle Interest Rates Moving Higher?

The traditional ARM loan which resets every year is considered to be rather risky because the payment can change from year to year in significant amounts. Unless the buyer plans to quickly flip the property or has plenty of other assets and is using an interest-only loan as a tax write off, almost anyone taking adjustable rates should try to pay extra in order to build up equity in case the market turns south.

The 10/1 ARM has an initial interest rate that is fixed for the first ten years of the loan. After the 10 years is up, the rate then adjusts each year for the remainder of the loan. The loan has a life of 30 years, so the homeowner will experience the initial stability of a 30 year mortgage at a cost that is lower than a fixed rate mortgage of the same term. However, the ARM may not be the best choice for those planning on owning the same home for over 10 years unless they regularly make extra payments & plan on paying off their loan early.

The 7/1 ARM has an initial interest rate that is fixed for the first seven years of the loan. After the 7 years is up, the rate then adjusts each year for the remainder of the loan. The loan has a life of 30 years, so the homeowner will experience the initial stability of a 30 year mortgage at a cost that is lower than a fixed rate mortgage of the same term. However, the ARM may not be the best choice for those planning on owning the same home for over 7 years unless they regularly make extra payments & plan on paying off their loan early.

An adjustable rate mortgage that has the same interest rate for part of the mortgage and a different rate for the rest of the mortgage is called a 2-step mortgage. The interest rate changes or adjusts in accordance to the rates of the current market. The borrower, on the other hand, might have the option of making the choice between a variable interest rate or a fixed interest rate at the adjustment date.

Those borrowers who make the decision to take a two-step mortgage are taking the risk of the interest rate of the mortgage adjusting upward after the expiration of the fixed-interest rate period. Many borrowers who take the two-step mortgage have plans of refinancing or moving out of the home before the period ends.

The 5/5 and the 5/1 adjustable rate mortgages are amongst the other types of ARMs in which the monthly payment and the interest rate does not change for 5 years. The beginning of the 6th year is when every 5 years the interest rate is adjusted. That’s every year for the 5/1 ARM and every 5 years for the 5/5. These particular ARMs are best if the homeowner plans on living in the home for a period greater than 5 years and can accept the changes later on.

The 5/25 mortgage is also called a “30 due in 5” mortgage and is where the monthly payment and interest rate do not change for 5 years. At the beginning of the 6 th year, the interest rate is adjusted in accordance to the current interest rate. This means the payment will not change for the remainder of the loan. This is a good loan if the homeowner can tolerate a single change of payment during the loan period.

Mortgages where the monthly payment and interest rate remains the same for 3 years are called 3/3 and 3/1 ARMs. At the beginning of the 4th year, the interest rate is changed every three years. That is 3 years for the 3/3 ARM and each year for the 3/1 ARM. This is the type of mortgage that is good for those considering an adjustable rate at the three-year mark.

Balloon mortgages last for a much shorter term and work a lot like an fixed-rate mortgage. The monthly payments are lower because of a large balloon payment at the end of the loan. The reason why the payments are lower is because it is primarily interest that is being paid monthly. Balloon mortgages are great for responsible borrowers with the intentions of selling the home before the due date of the balloon payment. However, homeowners can run into big trouble if they cannot afford the balloon payment, especially if they are required to refinance the balloon payment through the lender of the original loan.

Many commercial loans are structured as balloon loans which must be rolled over every 5 or 10 years. Most residential mortgages are not structured as balloon loans.

Balloon loans were common in the United States prior to the great recession, but out of the Great Recession the Federal government made new residential loan regulations along with creating entities like Fannie Mae to add liquidity to the mortgage market.

Rental property loans & loans on vacation homes may require larger down payments and have more stringent qualification requirements than other mortgage types as lenders will view the additional purchases as having a higher level of risk & do not want to loan to borrowers which they feel are over-extended.

The Federal Reserve has hinted they are likely to taper their bond buying program later this year. Lock in today's low rates and save on your loan.

Are you paying too much for your mortgage?

Check your refinance options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you refinance and save today!