Home purchases are wrought with myriad concerns, from financing matters to moving logistics. Each aspect of the process is important, enabling well-prepared buyers to quickly close deals on desirable properties. Some requirements are unavoidable, attached to every completed deal. Appraisals and credit checks, for example, cannot be circumvented to expedite the process. Other conditions are unique and don't apply to every transaction.

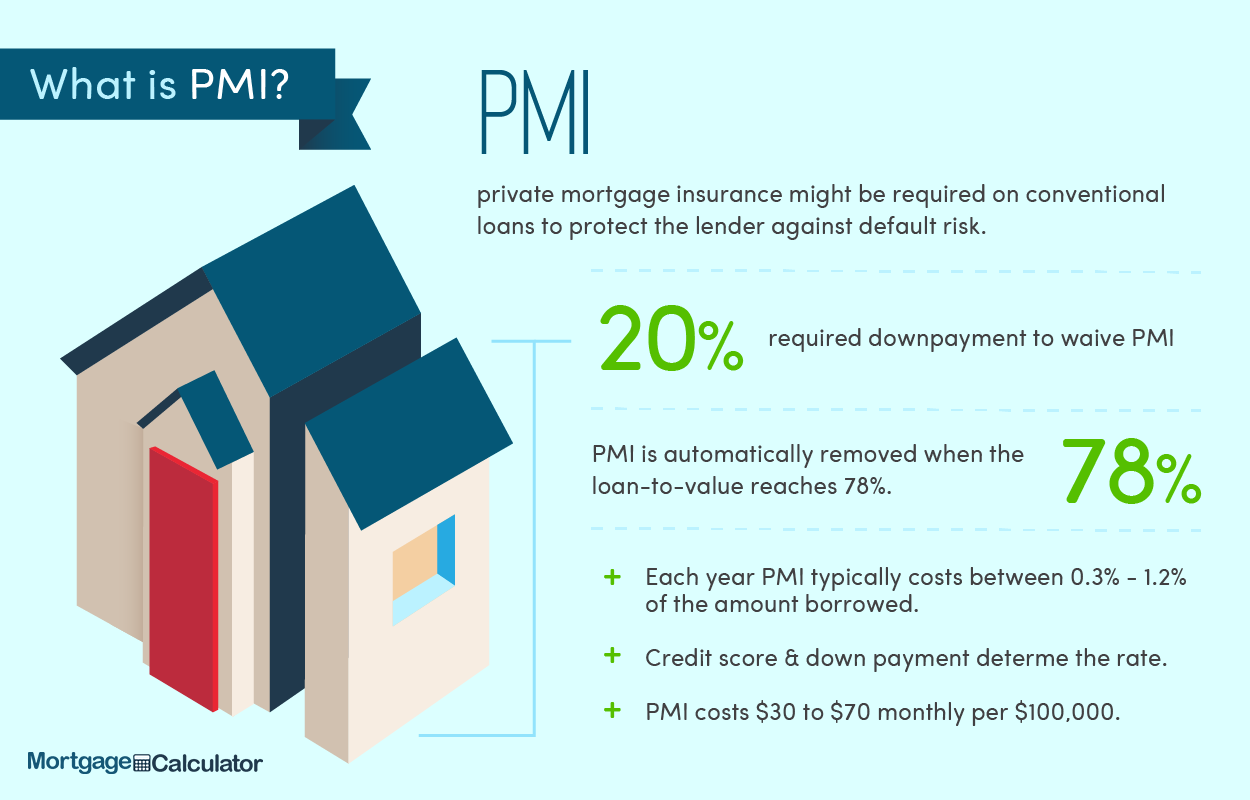

Private Mortgage Insurance (PMI) is a necessary add-on faced by some buyers required to carry the added protection in order to obtain financing. Well-qualified applicants with substantial down payments are typically exempt from the requirement, which ultimately protects lenders from default. Those presenting greater risk, however, may be subject to PMI mandates.

The mortgage lending industry sustains itself by adequately balancing risk and protecting itself from default. The recent housing market meltdown led to unprecedented numbers of foreclosures, which ultimately undermined the global financial system. Though the industry's collapse was only one piece of the perfect storm of financial duress, subsequent conditions highlighted questionable lending practices and caused regulators and financial institutions to reevaluate policies and procedures. While it is not a new concept, Private Mortgage Insurance is one of many safeguards receiving renewed attention following the downturn.

Conventional mortgages for primary residences typically require a down payment of at least 20-percent. Under certain circumstances, homes are financed with less money down, but these loans fall outside “standard” parameters, so they are considered riskier propositions. Buyers with solid credit and adequate down payments are eligible for the best available interest rates and are generally not required to jump through additional hoops to qualify for financing. Those with credit irregularities on their record or down payments below acceptable thresholds, on the other hand, may be called-upon to produce added assurance for lenders – including PMI.

The add-on coverage protects lenders from risk of default, reimbursing them in the event a borrower fails to make agreed-upon payments. Premiums are the responsibility of the borrower and generally rolled-in to monthly mortgage payments. A $600 PMI policy premium, for example, might be broken into twelve equal payments, adding $50 to the total monthly remittance.

Private mortgage insurance premiums vary in amount, from a fraction of a percent to as much as 1.5% of the value of the original loan. PMI is paid each year, until it is no longer required by the lender issuing the mortgage.

In 2017 the ability to deduct PMI from income taxes expired.

In the past the cost of PMI could sometimes be claimed as a deduction when filing a tax return. Ultimately, Congress decides how tax reporting is handled, so some years their legislation allows PMI to be deducted, while other years it does not qualify. When PMI was deductible it was based on an income scale with lower income earners being able to deduct the full amount while individuals who earned above $50,000 and couples who earned above $100,000 had 10% of their PMI deducted for each $1,000 they were above those limits.

Here is a chart of estimated monthly PMI costs based on a rate of 0.55%.

| Home Type | March 2017 Price | 3% down | 5% down | 10% down | 15% down | 20% down |

|---|---|---|---|---|---|---|

| Median Existing Home | $236,400 | $105 | $103 | $98 | $92 | $0 |

| Median Existing Single-Family Home | $237,800 | $106 | $104 | $98 | $93 | $0 |

| Median Existing Condos & Co-ops | $224,700 | $100 | $98 | $93 | $88 | $0 |

| Median Existing West Home | $347,500 | $154 | $151 | $143 | $135 | $0 |

| Median Existing Northeast Home | $260,800 | $116 | $114 | $108 | $102 | $0 |

| Median Existing South Home | $210,600 | $94 | $92 | $87 | $82 | $0 |

| Median Existing Midwest Home | $183,000 | $81 | $80 | $75 | $71 | $0 |

| Median New Home * | $315,100 | $140 | $137 | $130 | $123 | $0 |

| Average New Home * | $388,200 | $173 | $169 | $160 | $151 | $0 |

Sources: *Census.gov, all others NAR

The above table used a flat rate of 0.55% for simplicity sake. However, lenders typically charge an adjusting PMI rate based on the size of the downpayment. The following table shows how the PMI rate may changed based on various loan-to-value (LTV) ratios on different loans for a house using the same purchase price. A larger down payment helps homeowers save three different ways: they get charged a lower PMI rate, the PMI rate is only charged against the amount of the loan (rather than the full price or value of the home), and a smaller loan size will have less interest expense.

| Home Price | Down Payment | LTV | Loan Amount | Insurance Rate | Annual Premium | Monthly Premium |

|---|---|---|---|---|---|---|

| $200,000 | $10,000 | 95% | $190,000 | 0.78% | $1,482 | $123.50 |

| $200,000 | $20,000 | 90% | $180,000 | 0.52% | $936 | $78.00 |

| $200,000 | $30,000 | 85% | $170,000 | 0.35% | $595 | $49.58 |

| $200,000 | $40,000 | 80% | $160,000 | not required | $0 | $0 |

PMI is applied to address very specific circumstances; so many buyers are unfamiliar with the concept. It is only those with low down payments who are compelled to add PMI, and even when it is required, there is light at the end of the tunnel for borrowers.

Loan-to-value ratio determines how long a mortgage is subject to PMI requirements. As a result, the original purchase price, down payment amount, appraised value, and other variables influence how PMI is handled. Once a home dips below a designated threshold, the mandate is lifted and PMI payments are discontinued. Borrowers carrying Private Mortgage Insurance are well-served to track payments and remain mindful of outstanding mortgage balances, so they do not leave money on the table covering premiums.

When a home's loan-to-value ratio drops below 80%, home owners can reasonably request concessions from lenders, asking them to discontinue PMI and eliminate the need for the added payments. In fact, The Homeowners Protection Act guards buyers' interests, requiring lenders to issue a PMI disclosure outlining the terms of the coverage mandate. The disclosure identifies the date at which mortgage holders reach their 80% ratio, enabling them to make timely cancellation requests. Of course, if additional principal payments were made during the life of a loan, the original projected date does not apply.

The following stipulations for lifting PMI requirements are in-place among most lenders:

Aside from proactive cancellation requests, lenders are required to automatically cancel PMI under certain conditions. With a ratio below 78%, for example, mortgage lenders are legally bound to cancel the call for Private Mortgage Insurance. If payments are in arrears, however, lenders are not compelled to act until deficiencies are corrected.

In another unique scenario, lenders are required to terminate PMI insurance once a borrower reaches the midpoint on payback – even if the 78% loan-to-value ratio remains unmet. This rarity occurs when loans are structured with higher payback proportions during the second half of the amortization schedule, as in the case of some balloon mortgages or those containing interest-only repayment periods.

Years to build 22% equity (& remove PMI payments) for a 30 year conforming loan, based on down payment amount & loan interest rate.

| Downpayment | 0% | 5% | 10% | 15% |

|---|---|---|---|---|

| APR | Years of PMI payments | |||

| 3% | 8.5 | 7.5 | 6 | 4 |

| 4% | 9.5 | 8.5 | 6.5 | 4.5 |

| 5% | 10.5 | 9.5 | 7.5 | 5 |

| 6% | 11.5 | 10.5 | 8.5 | 5.5 |

| 7% | 12.5 | 11.5 | 9 | 6.5 |

| 8% | 13.5 | 12 | 10 | 7 |

| 9% | 14.5 | 13.5 | 11 | 8 |

| 10% | 15.5 | 14.5 | 12 | 9 |

Years to build 22% equity (& remove PMI payments) for a 15 year conforming loan, based on down payment amount & loan interest rate.

| Downpayment | 0% | 5% | 10% | 15% |

|---|---|---|---|---|

| APR | Years of PMI payments | |||

| 3% | 3.5 | 3 | 2.5 | 1 |

| 4% | 4 | 3.5 | 2.5 | 1.5 |

| 5% | 4 | 3.5 | 2.5 | 1.5 |

| 6% | 4 | 4 | 3 | 2 |

| 7% | 4.5 | 4 | 3.5 | 2 |

| 8% | 5 | 4.5 | 3.5 | 2.5 |

| 9% | 5 | 4.5 | 3.5 | 2.5 |

| 10% | 5 | 5 | 3.5 | 2.5 |

If the value of your home increases significantly during the loan, you may be able to get PMI removed quicker than shown in the above charts if the bank recognizes the increased value of your home. To do so, you will have to contact your lender when your LTV is below 80% to request the removal of PMI.

Some lenders may state their loans do not require PMI or that they pay for the cost of PMI. However the point of PMI is to insure the lender in case of default. Thus if the lender is not charging you directly for PMI then the cost is typically rolled directly into the loan through charging a higher rate of interest.

Mortgage seekers are subject to lender requirements, so PMI is a reality for those with less than 20% down. To eliminate the mandate from their primary mortgages, creative borrowers sometimes take-on additional financing to cover their down payments. By borrowing enough to raise their initial stake above the 20-percent threshold, buyers meet lender requisites and avoid the add-on cost of Private Mortgage Insurance.

This “piggyback” approach using a second mortgage leaves buyers on the hook for two payments, so affordability should be carefully considered before taking this step.

Though it does not apply to all loans, mortgage insurance is commonly used to protect lenders and balance their risk. With 20% down, most buyers side-step the requirement, so substantial down payments are the best way to eliminate the expense. Multiple mortgages can also be used to cover the down payment and purchase price, bridging the gap between available funds and PMI down payment thresholds. For those required to add the coverage, consistent repayment and an 80% loan-to-value ratio are requisites for ultimately cancelling Private Mortgage Insurance.

The above article discusses mortgage insurance for conventional home loans. There are 3 popular government-sponsored home loan programs also worthy of consideration.

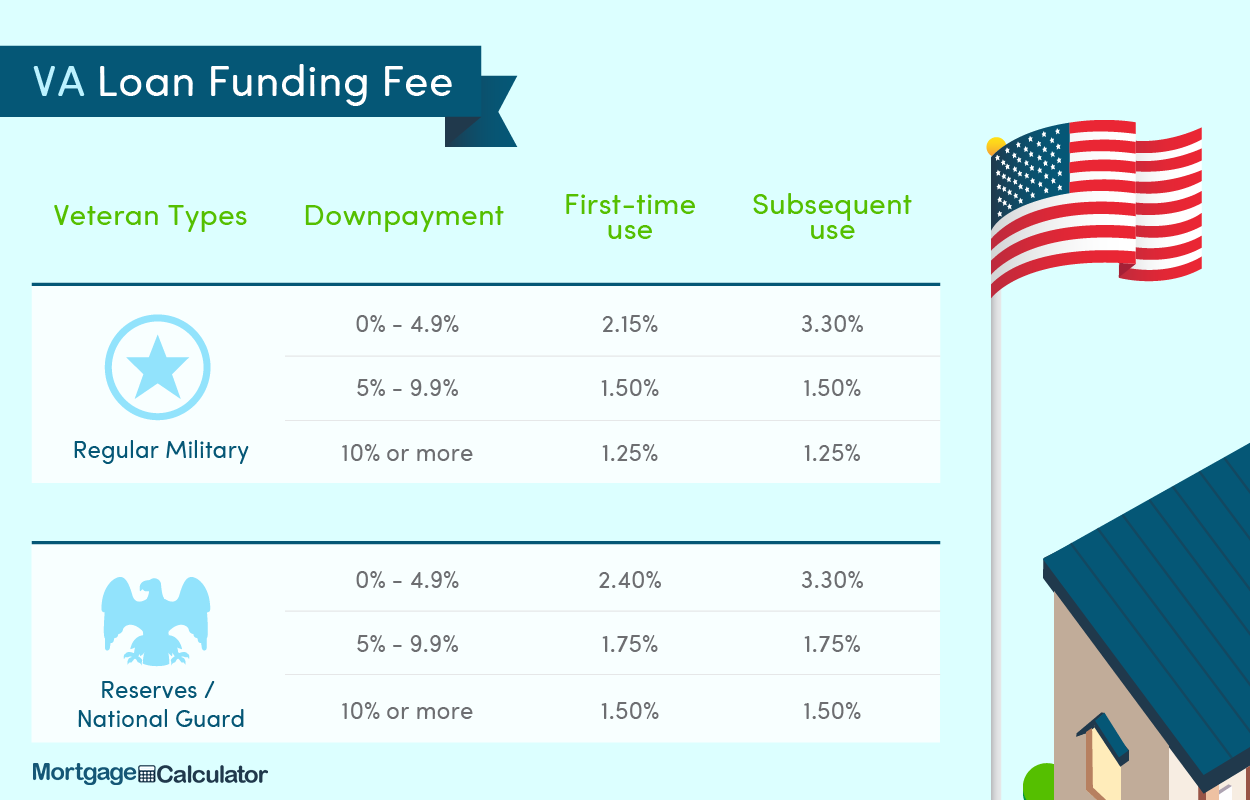

VA loans are offered to active duty military members, national guard members and military veterans. They do not require mortgage insurance as they are insured by the United States Department of Veterans Affairs. While these loans do not have an ongoing insurance requirement there is an upfront funding fee.

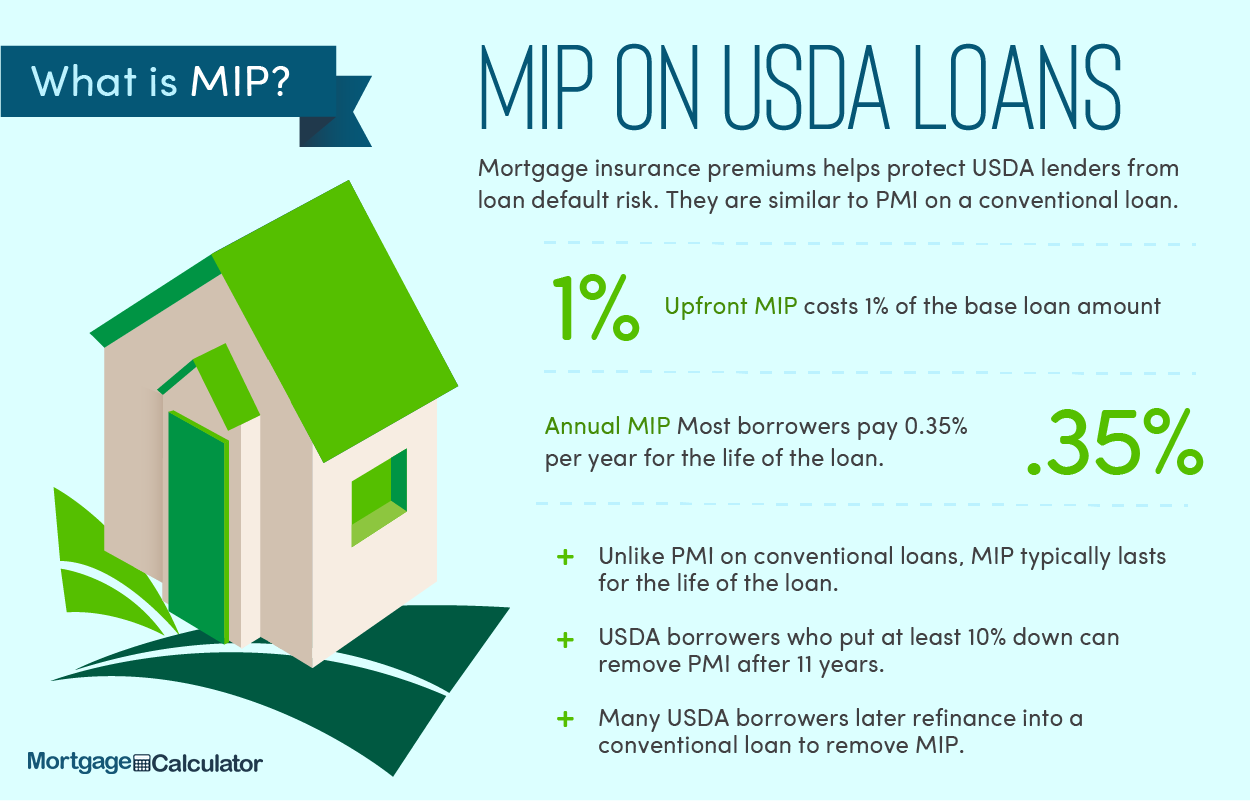

FHA loans & USDA loans both require insurance coverage, though for these loan types it is called mortgage insurance premiums (MIP) instead of PMI. The following graphics highlight how mortgage insurance work for these loan types.

Since it is hard to remove MIP from FHA loans many homeowners who have built up equity in homes purchased with FHA loans later refinance into a conventional loan to remove the insurance requirement.

The Federal Reserve has hinted they are likely to taper their bond buying program later this year. Lock in today's low rates and save on your loan.

Are you paying too much for your mortgage?

Check your refinance options with a trusted El Monte lender.

Answer a few questions below and connect with a lender who can help you refinance and save today!