If you're interested in the current state of the US mortgage market, you need look no further. We've gathered together some of the most telling mortgage statistics to give you a general overview of the American housing market.

The financial crisis of 2007 and 2008 sent the American housing market into a tailspin. New construction all but ground to a halt, and the market for existing homes was at its lowest point in recent history. As hundreds of thousands of families watched the equity in their homes slip away, the demand for new mortgages dropped sharply. It's been a long slow struggle back, but the US economy is finally making a welcome recovery. New constructions are on the rise, the real estate market has rebounded strongly in the 15 years since the crisis. Proof of the recovery, if proof were needed, can be found in the annual mortgage statistics that are collated by both the government and other independent research firms.

COVID-19 & The American Mortgage Market

The COVID-19 crisis of 2020 had a much more muted impact on real estate prices than the popping of the prior housing bubble as politicians and central bankers acted much faster and much more aggressively to counteract the economic slowdown. As a matter of fact, Fannie Mae predicted 2020 would be a record year for residential mortgage originations across the United States. They projected $4.1 trillion in total loan volume with around $2.7 trillion of that being refinance volume. In the years after the COVID-19 crisis the easy money policies which papered over the market uncertainty led to a real estate boom. The Federal Reserve then raised interest rates quickly in 2022 and 2023, which has led to transaction volume slowdown while price appreciation slowed markedly.

The US mortgage market continues to feel the effects of the sub-prime mortgage crisis, but the numbers are on the rise. According to the Federal Reserve, outstanding mortgage debt for single family residences declined significantly from 2011 to 2012, but has been growing in fits and starts since 2013. Interestingly, outstanding mortgages for multifamily residences held steady, and even managed grow, despite the economic crisis. By contrast, commercial mortgages have remained relatively steady, even showing some consistent growth over the same four year period.

Nearly a decade after the 2008-2009 financial crisis the Federal Reserve started raising interest rates in earnest in 2017 & 2018. Increased rates caused the total residential mortgage production volume to fall nearly 7% between 2017 and 2018. The MBA estimated $1.64 trillion in production in 2018, while production stood at $1.76 trillion in 2017.

In October 3, 2017 Federal Reserve Chairman Jerome Powell stated rates were "a long way" from neutral. The stock market fell hard for the duration of the year, with the bottom happening on Christmas eve. In early 2019 the Federal Reserve changed their stated approach, announcing they did not expect to raise rates in 2019 & were going to end the wind down of their balance sheet this year. Rates which rose throughout most of 2018 fell hard in early 2019, reinvigorating what was a stagnant refinance market.

The COVID-19 crisis created a boom in home purchase loans and in mortgage refinances. Interest rates fell, causing refinance volume to jump to around $2.7 trillion while the total transaction volume for 2020 amounted to $4.1 trillion. Social unrest, lock downs, high urban living costs, and working from home from tight quarters made many city dwellers buy second larger homes in the suburbs or more remote areas. 2021 was another record year, with $4.43 trillion in mortgage originations.

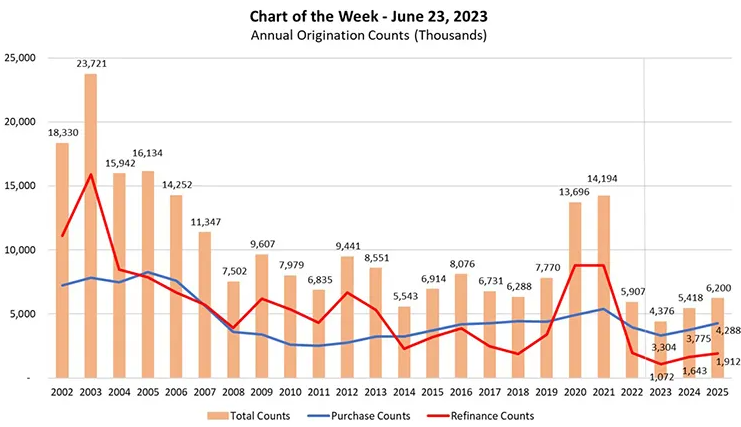

Typical Annual Mortgage Loan Origination Volume in the United States

Typically there is around $1.5 to $2.3 trillion of mortgage originations in the United States annually. When interest rates fall sharply the production volume increases as refinance becomes a larger share of the overall market. This graph from the MBA shows how refinance became the vast majority of the market after the dot-com crash, in the wake of the Great Recession, & after the COVID-19 crisis. Data shown for 2024 and 2025 are estimates. 2023 contains estimates for the back half of the year.

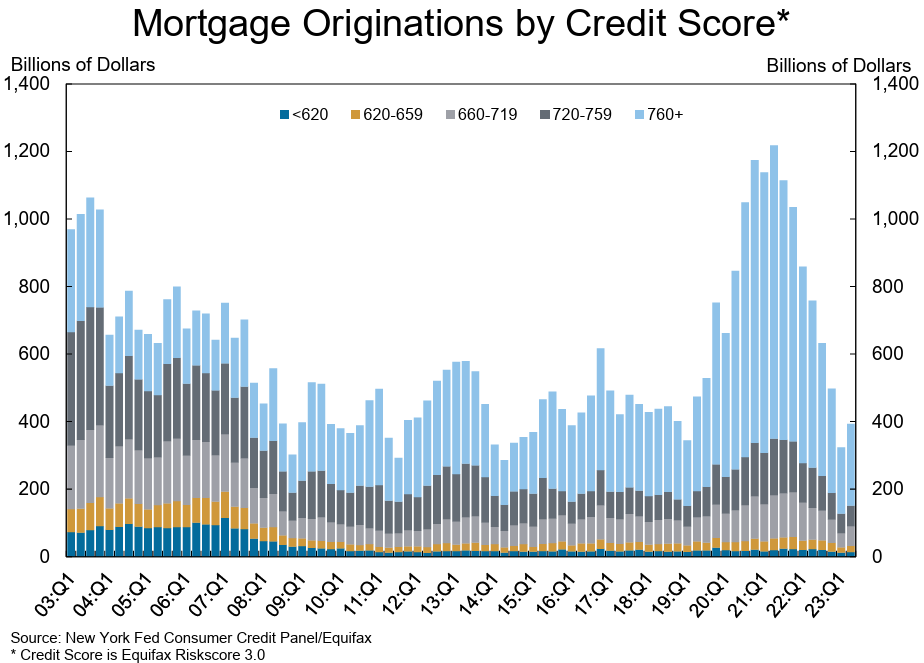

The aftermath of rate hikes from persistently high inflation in 2022 and 2023 caused home purchases, refinance, and home-equity lending to fall by 2/3, with purchases and refinances falling from over 14 million to under 5 million in 2 years. In the first quarter of 2023 there were 1.25 million mortgage originations - down 19% QoQ, 56% YoY, and 70% from the peak in Q1 2021.

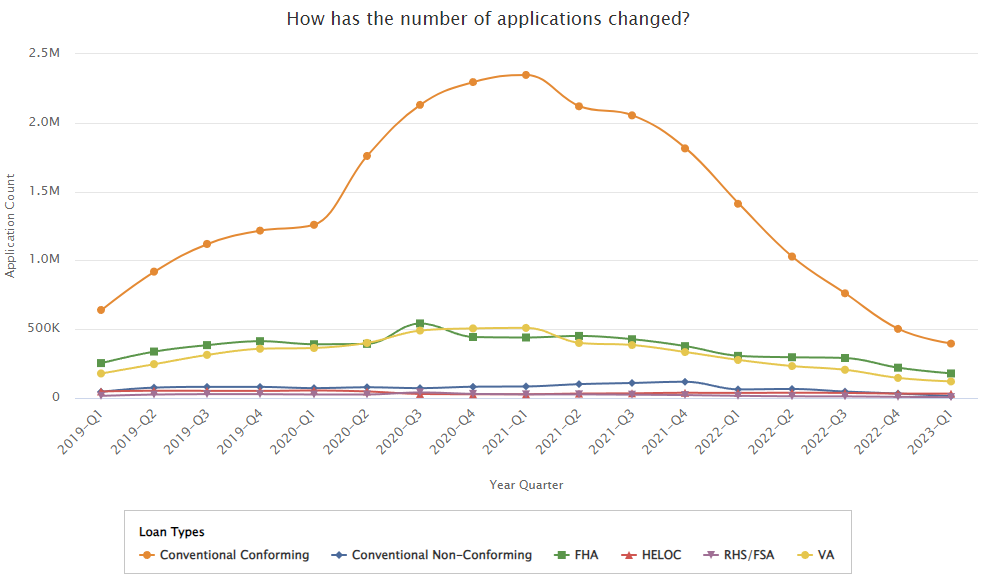

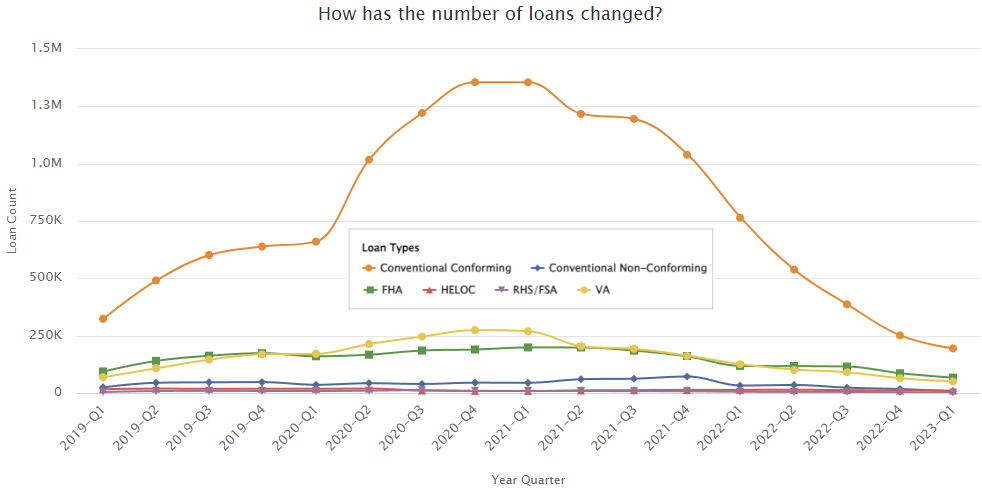

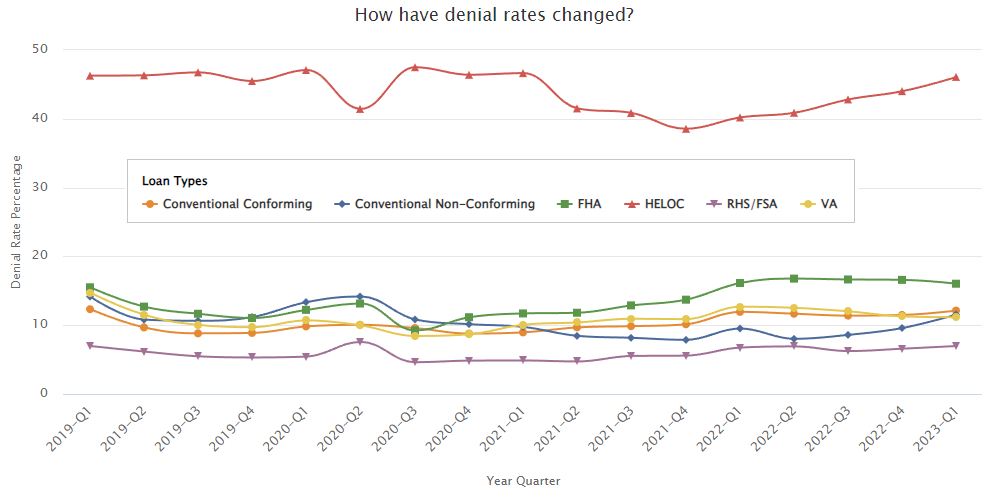

The following graphs show how mortgage applications and approvals changed over the past half decade. It is easy to see how the Federal Reserve ZIRP and QE policies drove a big spike in mortgage refinances. In the second graph you can see that the spike was mostly in conforming conventional loans, which makes sense since most refinances are into conventional loans since they do not require PMI if the LTV is 80% or below.

The following GIFs of the United States break down annual demand for mortgage refinances versus mortgage purchases. You can see how refinances respond much more quickly to changes in interest rates as they do not require moving.

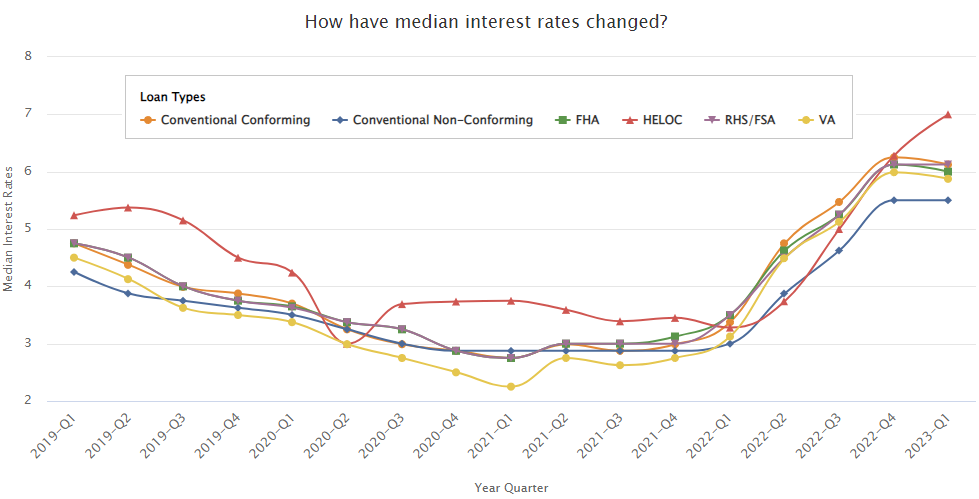

The following graph of median interest rates by quarter does a good job explaining the above trends.

Each year the Mortgage Bankers Association estimates the total production volume of 1 to 4 family unit residiential mortgages across the United States. Here is their annual mortgage origination volume estimate data from 1990 through 2026, with amounts listed in billions of Dollars.

| Year | Total | Purchase | Refinance | Refi Share |

|---|---|---|---|---|

| 1990 | 458 | 389 | 70 | 15.3% |

| 1991 | 562 | 385 | 177 | 31.5% |

| 1992 | 894 | 472 | 421 | 47.1% |

| 1993 | 1,020 | 486 | 535 | 52.5% |

| 1994 | 769 | 557 | 211 | 27.4% |

| 1995 | 639 | 494 | 145 | 22.7% |

| 1996 | 785 | 559 | 225 | 28.7% |

| 1997 | 834 | 590 | 243 | 29.1% |

| 1998 | 1,656 | 795 | 862 | 52.1% |

| 1999 | 1,379 | 878 | 500 | 36.3% |

| 2000 | 1,139 | 905 | 234 | 20.5% |

| 2001 | 2,243 | 960 | 1,283 | 57.2% |

| 2002 | 2,854 | 1,097 | 1,757 | 61.6% |

| 2003 | 3,812 | 1,280 | 2,532 | 66.4% |

| 2004 | 2,773 | 1,309 | 1,463 | 52.8% |

| 2005 | 3,027 | 1,512 | 1,514 | 50.0% |

| 2006 | 2,726 | 1,399 | 1,326 | 48.6% |

| 2007 | 2,306 | 1,140 | 1,166 | 50.6% |

| 2008 | 1,509 | 731 | 777 | 51.5% |

| 2009 | 1,995 | 664 | 1,331 | 66.7% |

| 2010 | 1,698 | 530 | 1,168 | 68.8% |

| 2011 | 1,436 | 505 | 931 | 64.8% |

| 2012 | 2,044 | 588 | 1,456 | 71.2% |

| 2013 | 1,845 | 734 | 1,111 | 60.2% |

| 2014 | 1,261 | 759 | 502 | 39.8% |

| 2015 | 1,679 | 903 | 776 | 46.2% |

| 2016 | 2,051 | 1,052 | 999 | 48.7% |

| 2017 | 1,760 | 1,143 | 616 | 35.0% |

| 2018 | 1,677 | 1,209 | 467 | 27.8% |

| 2019 | 2,253 | 1,225 | 1,028 | 45.6% |

| 2020 | 4,108 | 1,482 | 2,625 | 64% |

| 2021 | 4,436 | 1,863 | 2,574 | 58% |

| 2022 | 2,305 | 1,619 | 686 | 30% |

| 2023 | 1,639 | 1,325 | 314 | 19% |

| 2024 | 1,949 | 1,471 | 478 | 25% |

| 2025 | 2,254 | 1,639 | 616 | 27% |

| 2026 | 2,382 | 1,747 | 635 | 27% |

Data from years 2023 through 2026 contain estimates, made using information available on October 15, 2023.

The MBA estimates $13.61 trillion in mortgage debt oustanding on 1-to-4 family homes at the end of 2022. They anticipate the following mortgage debt outstanding in future years:

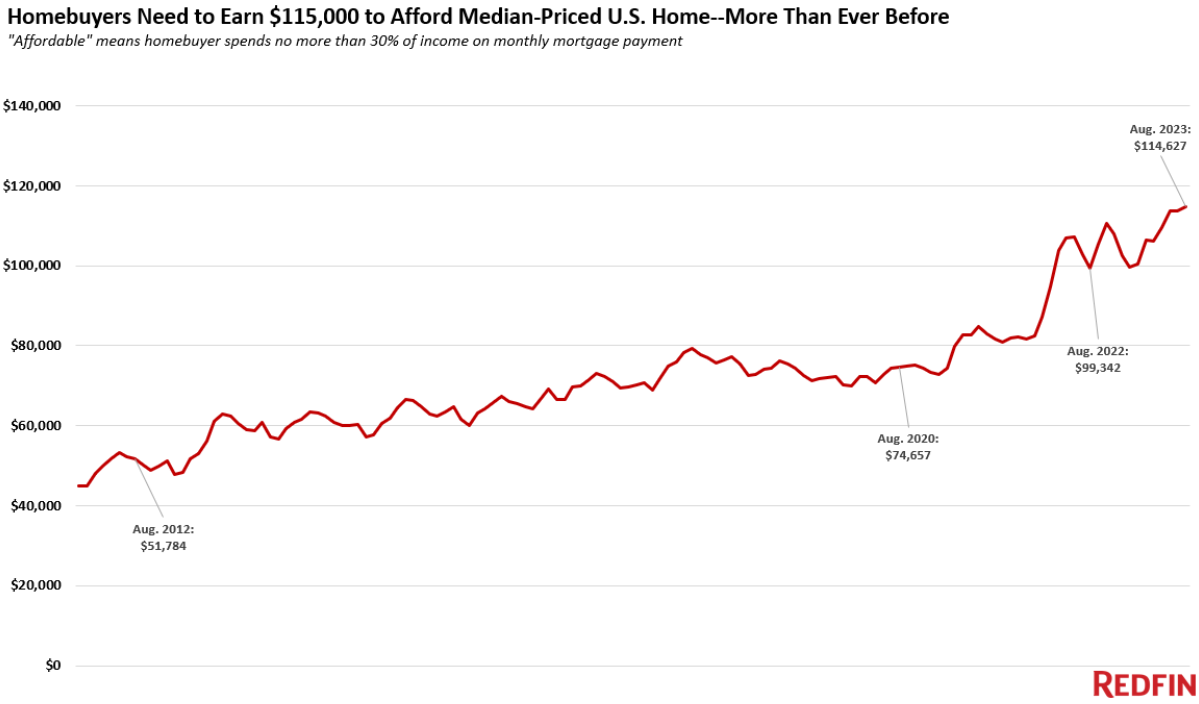

Each real estate market is local, however on a nationwide basis homes are not particularly affordable. In the wake of the COVID-19 lockdowns the Federal Reserve engaged in ZIRP and QE. This in turn drove a large wave of mortgage activity which stimulated the economy. Home prices increased to reflect the lower interest rates. As inflation took hold and became more persistent than expected the Federal Reserve had to sharply increase the Fed Funds rate in 2022 and 2023.

At the end of Q2 in 2023 Redfin estimated buying a median-priced home would require an annual income of around $115,000 after factoring in all costs of ownership - an amount that has jumped 50% since the COVID-19 crisis. The median U.S. household income in 2022 was only $75,000 according to the U.S. Census Bureau.

Redfin also compiled median home price and required income statics for 100 large metro areas across the country.

| U.S. metro area | Required annual income | YoY change | Monthly mortgage payment | Median home-sale price |

|---|---|---|---|---|

| Akron, OH | $59,702 | 18.4% | $1,493 | $218,900 |

| Albany, NY | $87,276 | 26.0% | $2,182 | $320,000 |

| Allentown, PA | $88,639 | 23.2% | $2,216 | $325,000 |

| Anaheim, CA | $300,010 | 28.6% | $7,500 | $1,100,000 |

| Atlanta, GA | $107,731 | 19.4% | $2,693 | $395,000 |

| Austin, TX | $126,208 | 7.7% | $3,155 | $462,748 |

| Bakersfield, CA | $100,258 | 22.2% | $2,506 | $367,600 |

| Baltimore, MD | $103,640 | 21.1% | $2,591 | $380,000 |

| Baton Rouge, LA | $71,184 | 21.5% | $1,780 | $261,000 |

| Birmingham, AL | $76,912 | 16.3% | $1,923 | $282,000 |

| Boise City, ID | $126,869 | 9.1% | $3,172 | $465,170 |

| Boston, MA | $194,188 | 22.7% | $4,855 | $712,000 |

| Bridgeport, CT | $182,734 | 32.1% | $4,568 | $670,000 |

| Buffalo, NY | $70,093 | 25.1% | $1,752 | $257,000 |

| Camden, NJ | $91,367 | 27.8% | $2,284 | $335,000 |

| Cape Coral, FL | $108,249 | 16.9% | $2,706 | $396,900 |

| Charleston, SC | $112,231 | 17.9% | $2,806 | $411,500 |

| Charlotte, NC | $108,822 | 16.0% | $2,721 | $399,000 |

| Chicago, IL | $91,367 | 25.7% | $2,284 | $335,000 |

| Cincinnati, OH | $77,730 | 27.5% | $1,943 | $285,000 |

| Cleveland, OH | $61,536 | 22.1% | $1,538 | $225,625 |

| Columbus, OH | $90,276 | 23.8% | $2,257 | $331,000 |

| Dallas, TX | $115,913 | 15.0% | $2,898 | $425,000 |

| Dayton, OH | $60,002 | 31.2% | $1,500 | $220,000 |

| Denver, CO | $158,187 | 17.3% | $3,955 | $579,999 |

| Des Moines, IA | $79,094 | 25.0% | $1,977 | $290,000 |

| Detroit, MI | $51,793 | 19.4% | $1,295 | $189,900 |

| El Paso, TX | $69,548 | 23.6% | $1,739 | $255,000 |

| Elgin, IL | $92,730 | 27.6% | $2,318 | $340,000 |

| Fort Lauderdale, FL | $114,549 | 22.2% | $2,864 | $420,000 |

| Fort Worth, TX | $98,185 | 13.2% | $2,455 | $360,000 |

| Frederick, MD | $145,407 | 18.1% | $3,635 | $533,140 |

| Fresno, CA | $114,275 | 23.4% | $2,857 | $418,995 |

| Gary, IN | $72,125 | 18.3% | $1,803 | $264,450 |

| Grand Rapids, MI | $88,639 | 24.0% | $2,216 | $325,000 |

| Greensboro, NC | $76,503 | 23.1% | $1,913 | $280,500 |

| Greenville, SC | $87,821 | 18.9% | $2,196 | $322,000 |

| Hartford, CT | $94,640 | 30.2% | $2,366 | $347,000 |

| Honolulu, HI | $188,188 | 15.9% | $4,705 | $690,000 |

| Houston, TX | $92,185 | 15.6% | $2,305 | $338,000 |

| Indianapolis, IN | $81,794 | 23.7% | $2,045 | $299,900 |

| Jacksonville, FL | $99,549 | 15.2% | $2,489 | $365,000 |

| Kansas City, MO | $89,185 | 23.1% | $2,230 | $327,000 |

| Knoxville, TN | $102,276 | 28.1% | $2,557 | $375,000 |

| Lake County, IL | $95,458 | 28.9% | $2,386 | $350,000 |

| Lakeland, FL | $88,639 | 13.4% | $2,216 | $325,000 |

| Las Vegas, NV | $113,186 | 14.9% | $2,830 | $415,000 |

| Little Rock, AR | $62,729 | 13.9% | $1,568 | $230,000 |

| Los Angeles, CA | $237,281 | 19.8% | $5,932 | $870,000 |

| Louisville, KY | $73,612 | 20.8% | $1,840 | $269,900 |

| McAllen, TX | $68,184 | 29.8% | $1,705 | $249,999 |

| Memphis, TN | $79,094 | 16.3% | $1,977 | $290,000 |

| Miami, FL | $143,187 | 33.4% | $3,580 | $525,000 |

| Milwaukee, WI | $87,548 | 28.8% | $2,189 | $321,000 |

| Minneapolis, MN | $103,640 | 19.5% | $2,591 | $380,000 |

| Montgomery County, PA | $130,886 | 28.3% | $3,272 | $479,900 |

| Nashville, TN | $124,095 | 19.0% | $3,102 | $455,000 |

| Nassau County, NY | $177,279 | 20.0% | $4,432 | $650,000 |

| New Brunswick, NJ | $141,823 | 26.9% | $3,546 | $520,000 |

| New Haven, CT | $91,367 | 21.8% | $2,284 | $335,000 |

| New Orleans, LA | $75,003 | 15.1% | $1,875 | $275,000 |

| New York, NY | $197,734 | 20.5% | $4,943 | $725,000 |

| Newark, NJ | $159,551 | 33.4% | $3,989 | $585,000 |

| North Port, FL | $123,888 | 17.4% | $3,097 | $454,240 |

| Oakland, CA | $249,554 | 17.0% | $6,239 | $915,000 |

| Oklahoma City, OK | $71,457 | 19.1% | $1,786 | $262,000 |

| Omaha, NE | $83,185 | 25.8% | $2,080 | $305,000 |

| Orlando, FL | $108,597 | 18.5% | $2,715 | $398,175 |

| Oxnard, CA | $233,190 | 23.6% | $5,830 | $855,000 |

| Philadelphia, PA | $75,003 | 16.3% | $1,875 | $275,000 |

| Phoenix, AZ | $121,368 | 13.6% | $3,034 | $445,000 |

| Pittsburgh, PA | $64,639 | 22.5% | $1,616 | $237,000 |

| Portland, OR | $149,023 | 15.6% | $3,726 | $546,400 |

| Providence, RI | $125,459 | 28.9% | $3,136 | $460,000 |

| Raleigh, NC | $120,004 | 17.4% | $3,000 | $440,000 |

| Richmond, VA | $102,276 | 24.6% | $2,557 | $375,000 |

| Riverside, CA | $151,369 | 17.6% | $3,784 | $555,000 |

| Rochester, NY | $65,866 | 30.7% | $1,647 | $241,500 |

| Sacramento, CA | $156,824 | 17.8% | $3,921 | $575,000 |

| Salt Lake City, UT | $139,096 | 13.0% | $3,477 | $510,000 |

| San Antonio, TX | $87,273 | 14.5% | $2,182 | $319,990 |

| San Diego, CA | $241,372 | 28.7% | $6,034 | $885,000 |

| San Francisco, CA | $404,332 | 23.2% | $10,108 | $1,482,500 |

| San Jose, CA | $402,287 | 24.8% | $10,057 | $1,475,000 |

| Seattle, WA | $214,904 | 18.3% | $5,373 | $787,956 |

| St. Louis, MO | $70,912 | 21.0% | $1,773 | $260,000 |

| Stockton, CA | $144,550 | 15.2% | $3,614 | $530,000 |

| Tacoma, WA | $149,855 | 17.7% | $3,746 | $549,450 |

| Tampa, FL | $103,613 | 17.3% | $2,590 | $379,900 |

| Tucson, AZ | $99,549 | 21.3% | $2,489 | $365,000 |

| Tulsa, OK | $69,548 | 23.6% | $1,739 | $255,000 |

| Virginia Beach, VA | $93,003 | 25.9% | $2,325 | $341,000 |

| Warren, MI | $82,571 | 21.4% | $2,064 | $302,749 |

| Washington, DC | $150,005 | 23.0% | $3,750 | $550,000 |

| West Palm Beach, FL | $125,459 | 24.4% | $3,136 | $460,000 |

| Wilmington, DE | $90,412 | 21.5% | $2,260 | $331,500 |

| Worcester, MA | $118,640 | 23.4% | $2,966 | $435,000 |

It's Getting A Bit Frothy

The recent run up in mortgage rates has made buying much more expensive. According to CBRE analysis the average new monthly mortgage payment in 2023 is 52% higher than the average appartment rent. In the second quarter of 2006 that ratio peaked at 33%, which led to the housing crash Great Recession.

For these numbers to come in better alignment some combination of the following 3 are required:

The Mortgage Bankers Association records quarterly data on how much independent mortgage companies and hom-loan subsidiaries of chartered banks make on loans. Due to heavy buying of mortgage-backed securities by the Federal Reserve and record loan volumes from falling interest rates loan originators made 203 basis points of the loan principal in the third quarter of 2020. Given an average loan size of $282,660 that equated to a profit of $5,535 per loan. This performance was significantly above the same quarter in the year prior, when lenders earned 73.8 basis points, or $1,924 of net income on each loan. The strong performance was due in part to the large share of refinance loans after the Federal Reserve implemented ZIRP, did QE, and bought MBS paper.

Many nonbank mortgage lenders publicly listed their stock during the refinance boom to take advantage of valuations based on the temporary elevated profitability levels.

Don't Fight The Federal Reserve!

All of the above companies quickly fell as the Federal Reserve raised the Fed Funds Rate and mortgage volumes cratered as mortgage rates took off. Other nonbank lenders like AmeriHome and Caliber Home Loans also considered listing, but pulled IPOs which would have likely turned out similar to the Better SPAC.

After the Federal Reserve hiked rates rapidly in 2022 and 2023 the mortgage market rapidly deteriorated, with the refinance share falling from 64% in 2020 down to 19% in 2023. Independent mortgage banks had an average profit of $2,339 per loan in 2021 and lost an average of $301 per originated loan in 2022.

The MBA sells a detailed production statistics report with stats going back to 2008. Since 2008 most quarters have seen a net production income of between 25 and 75 basis points.

In Q3 2020 mortgage lenders had a per-loan expense of $7,452. This is up from $7,217 in the same quarter of 2019. Costs rose in the third quarter of 2020 over a cost of $6,566 in the second quarter of 2020 due to increased spending on hiring personnel to service unusually high demand caused by record low mortgage rates.

On December 1, 2020 the FHFA allowed the GSEs Fannie Mae and Freddie Mac to pass on a 50 basis point adverse market conditions fee for most mortgage refinances with a balance above $125,000. This fee was implemented to help protect the GSEs from an estimated $6 billion in COVID-19 related losses.

The cost to originate each loan had ballooned to $10,624 in 2022.

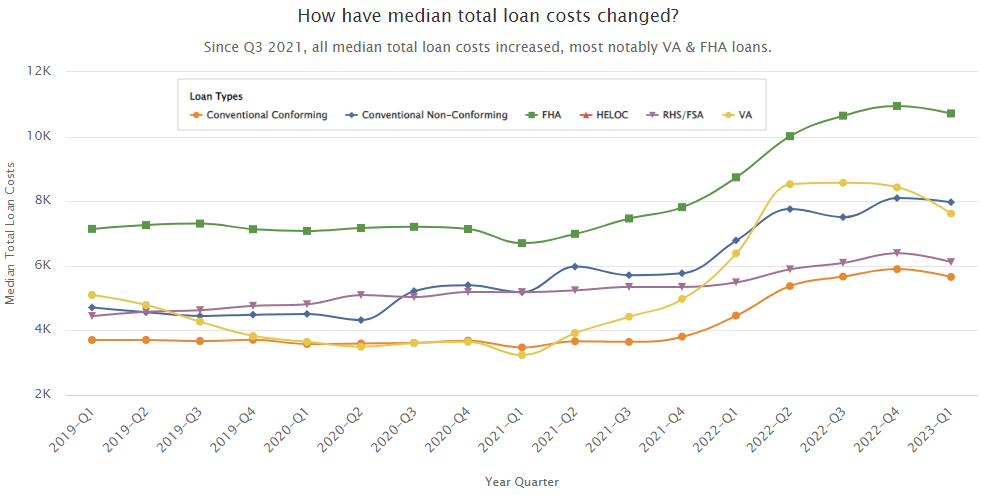

The following graph shows how the median loan origination costs have changed quarterly by loan type.

Almost nobody knows where mortgage rates will go in the future as the economy is inherently unpredictible. Black swans like the COVID-19 crisis are not easy to predict, though even more normal market conditions can be hard to predict. Many predictions are nothing more than a linear projection of the recent past onto the future.

The Federal Reserve raised rates 4 times in 2018 at their meetings in March, June, September and December. On October 3, 2018 Federal Reserve Chairman Jerome Powell stated the central bank was "a long way" from neutral, hinting many more rate hikes would be coming.

With that trend and guidance in place, many mortgage industry veterans predicted mortgage rate would rise in 2019. Rates actually fell as the Federal Reserve delivered no more rate hikes and instead began loosening monetary policy.

| Organization | Analyst | Rate prediction |

|---|---|---|

| Freddie Mac | Actual PMMS 30-Year Rates | 3.94% |

| Mortgage Banker's Association | Mike Fratantoni | 5.1% |

| Fannie Mae | Doug Duncan | 4.8% |

| Freddie Mac | Sam Khater | 5.1% |

| Realtor.com | Danielle Hale | 5.3% |

| Moody's Analytics | Mark Zandi | 5.0% |

| Wells Fargo | Sam Bullard | 4.9% |

| Carrington Mortgage | Rick Sharga | 5.25% |

| CoreLogic | Frank Nothaft | 5.25% |

| National Association of Home Builders | 4.81% | |

| Zillow | 5.8% |

Table sources: MBA, Fannie Mae, Freddie Mac, NAR, NAHB, CoreLogic

The NAHB saw 30-year fixed rates rising to 5.08% in 2020, when they anticipated ARMs to jump from 2019 estimates of 4.46% to 4.63%.

Despite being old data, the above predictions remain published on this page to show how significantly off major industry associations and leading experts at companies worth billions of dollars can be even in relatively benign environments. The average rate predicted for 2019 was 5.13% while the actual average rate throughout the year was 3.94%.

Industry experts can be that far off in relatively benign conditions. A true crisis can make accurate predictions nearly impossible.

As the COVID-19 healthcare crisis swept the globe governments pushed lockdowns which contracted many economies at record rates. In the second quarter of 2020 the United States economy contracted at a record annualized rate of 31.4%.

As the global economy crashed the Federal Reserve's FOMC cut interest rates twice, announced they would conduct unlimited quantitative easing, and gave forward guidance suggesting they were unlikely to lift rates through 2023.

As the Federal Reserve bought Treasury bonds and mortgage-backed securities while the economy cooled mortgage rates fell to new record lows. On the week of November 5th, the average 30-year fixed-rate fell to 2.78%. 2020 was a record year for mortgage originations with Fannie Mae predicting $4.1 trillion in originations and refinance loans contributing $2.7 to the total.

What Impact Did COVID-19 Have On US Home Prices?

In January 2020 the Case Shiller U.S National Home Price Index stood a 212.41. In July of 2023 it reached 310.16. The rate of change over 3.5 years amounts to 9.958% appreciation per year. From 1963 to 2019 the median house (of constant size) increased at a rate of 4.32% annually.

In the 2 years following the pandemic owner occupied housing added $9 trillion in wealth. Nearly half the price increase in 2020 was due to the stay-at-home demand phenomenon. Roughly 1/3 of the increase was due to lower interest rates, and most of the remainder was due to government stimulus.

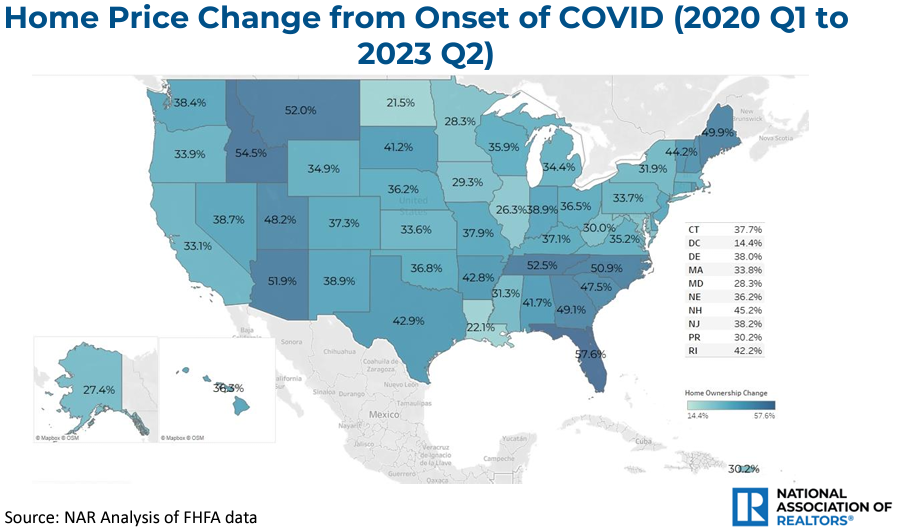

Some areas appreciated faster than other areas. The following chart from the NAR analyzes FHFA data, showing that in most states the prices of homes increased 30% to 50% in the 3 years following the onset of the COVID-19 emergency policies.

Home price appreciation not only impacts the value of the homes & the equity homeowners have in them, but it also impacts other costs of ownership including property taxes and homeowners insurance. Homeowners have record home equity, but many are stuck in place as most mortgages in the United States are not assumable, and it is hard to sell a property with a 3% or 4% fixed mortgage rate and then go out and buy a similar home elsewhere while paying a 7% or 8% mortgage rate.

On a quarterly basis, here is a prediction of mortgage rates for 2024.

| Source | Q1 2024 | Q2 2024 | Q3 2024 | Q4 2024 |

|---|---|---|---|---|

| Mortgage Bankers Association | 6.8% | 6.6% | 6.3% | 6.1% |

| Fannie Mae | 7.1% | 7.0% | 6.9% | 6.7% |

| National Association of Realtors | 6.1% | 6.0% | 6.0% | 6.0% |

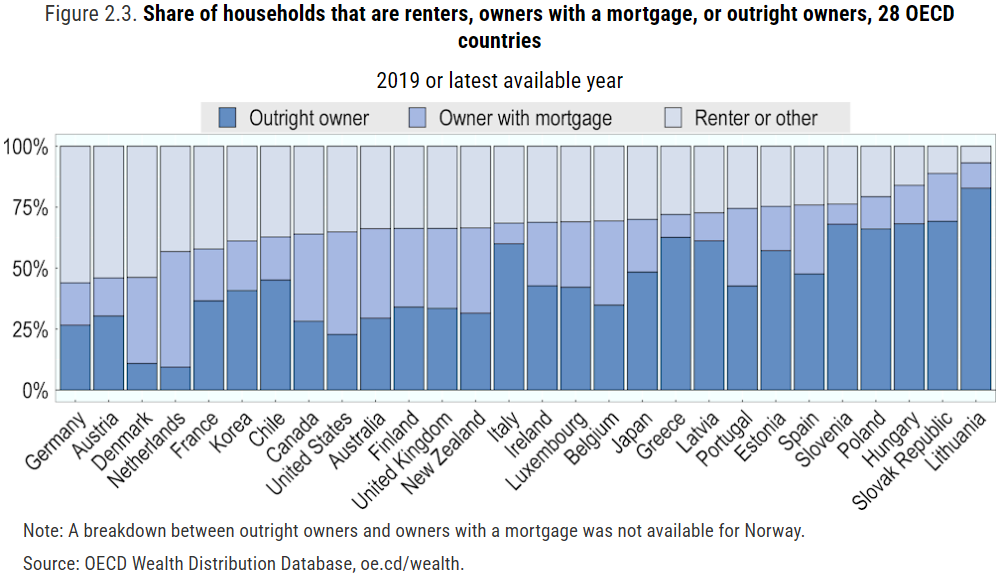

The OECD compared homeownership rates across 28 different countries in 2019. Among the 28 countries the United States ranked 26th in outright ownership and 20th in overall ownership including debt. In 2019 22.78% of United States households owned their home free-and-clear, while another 42.07% of the populous owned their home while holding mortgage debt against the properties, for a blended overall homeownership rate of 64.85%. Lithuania scored best in both categories, with 82.77% of homeowners owning free-and-clear and an additional 10.38% owing mortgage debt on their homes, for an overall homeownership rate of 93.15%.

| Country | Year | Outright Owner | Own Rank | Owner w Mortgage | Own + Mort | Own + Mort Rank | Renter / Other |

|---|---|---|---|---|---|---|---|

| Australia | 2018 | 29.47% | 23 | 36.72% | 66.19% | 19 | 33.81% |

| Austria | 2017 | 30.35% | 22 | 15.59% | 45.94% | 27 | 54.06% |

| Belgium | 2017 | 34.83% | 18 | 34.51% | 69.34% | 12 | 30.66% |

| Canada | 2019 | 28.20% | 24 | 35.75% | 63.95% | 21 | 36.05% |

| Chile | 2017 | 45.10% | 12 | 17.67% | 62.77% | 22 | 37.23% |

| Denmark | 2019 | 10.91% | 27 | 35.29% | 46.20% | 26 | 53.80% |

| Estonia | 2017 | 57.17% | 9 | 18.13% | 75.30% | 7 | 24.70% |

| Finland | 2016 | 34.02% | 19 | 32.25% | 66.27% | 18 | 33.73% |

| France | 2017 | 36.57% | 17 | 21.28% | 57.85% | 24 | 42.15% |

| Germany | 2017 | 26.61% | 25 | 17.34% | 43.95% | 28 | 56.05% |

| Greece | 2018 | 62.63% | 6 | 9.37% | 72.00% | 10 | 28.00% |

| Hungary | 2017 | 68.18% | 3 | 15.79% | 83.97% | 3 | 16.03% |

| Ireland | 2018 | 42.72% | 13 | 26.06% | 68.78% | 14 | 31.22% |

| Italy | 2016 | 60.01% | 8 | 8.45% | 68.46% | 15 | 31.55% |

| Japan | 2019 | 48.37% | 10 | 21.60% | 69.97% | 11 | 30.03% |

| Korea | 2019 | 40.77% | 16 | 20.40% | 61.17% | 23 | 38.83% |

| Latvia | 2017 | 61.18% | 7 | 11.49% | 72.67% | 9 | 27.32% |

| Lithuania | 2016 | 82.77% | 1 | 10.38% | 93.15% | 1 | 6.84% |

| Luxembourg | 2018 | 42.17% | 15 | 26.83% | 69.00% | 13 | 31.00% |

| Netherlands | 2019 | 9.41% | 28 | 47.38% | 56.79% | 25 | 43.21% |

| New Zealand | 2018 | 31.53% | 21 | 34.96% | 66.49% | 16 | 33.51% |

| Poland | 2016 | 66.05% | 5 | 13.26% | 79.31% | 4 | 20.70% |

| Portugal | 2017 | 42.66% | 14 | 31.83% | 74.49% | 8 | 25.51% |

| Slovak Republic | 2017 | 69.20% | 2 | 19.62% | 88.82% | 2 | 11.18% |

| Slovenia | 2017 | 68.03% | 4 | 8.23% | 76.26% | 5 | 23.74% |

| Spain | 2018 | 47.59% | 11 | 28.30% | 75.89% | 6 | 24.12% |

| United Kingdom | 2017 | 33.48% | 20 | 32.80% | 66.28% | 17 | 33.72% |

| United States | 2019 | 22.78% | 26 | 42.07% | 64.85% | 20 | 35.15% |

Source: OECD (2022), Housing Taxation in OECD Countries, OECD Tax Policy Studies, No. 29, OECD Publishing, Paris.

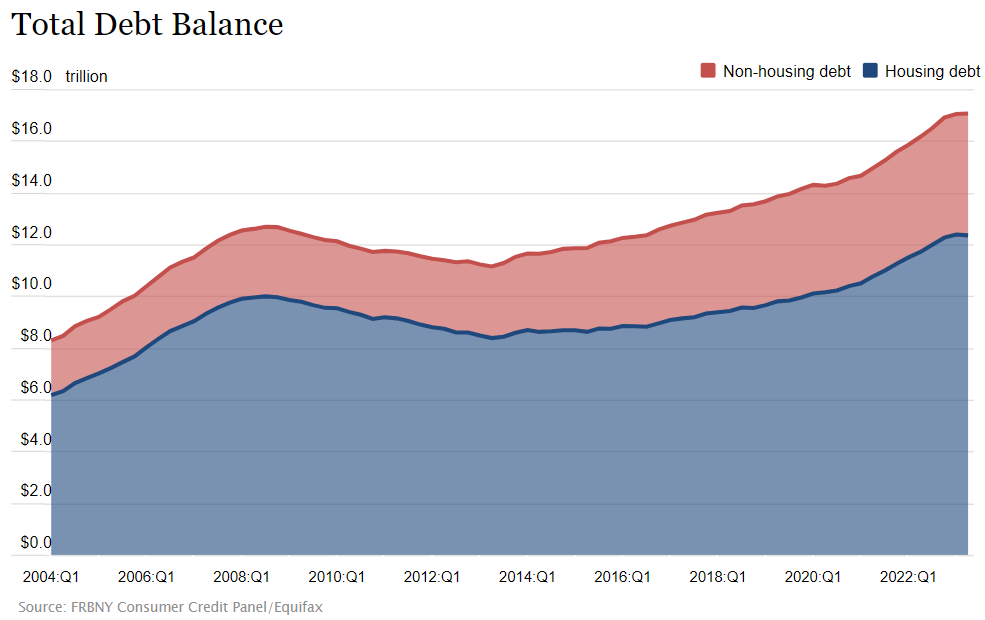

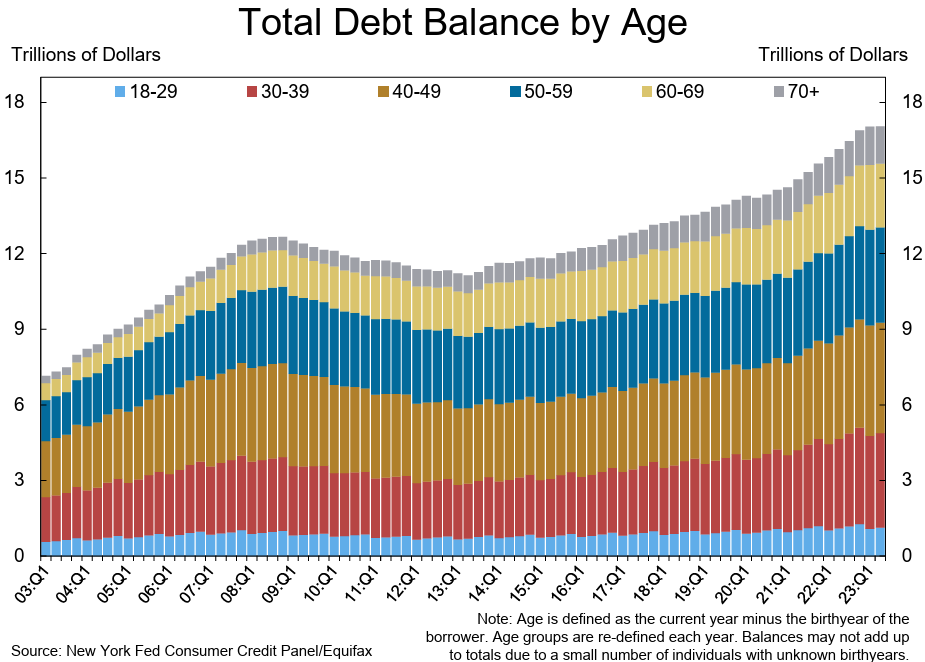

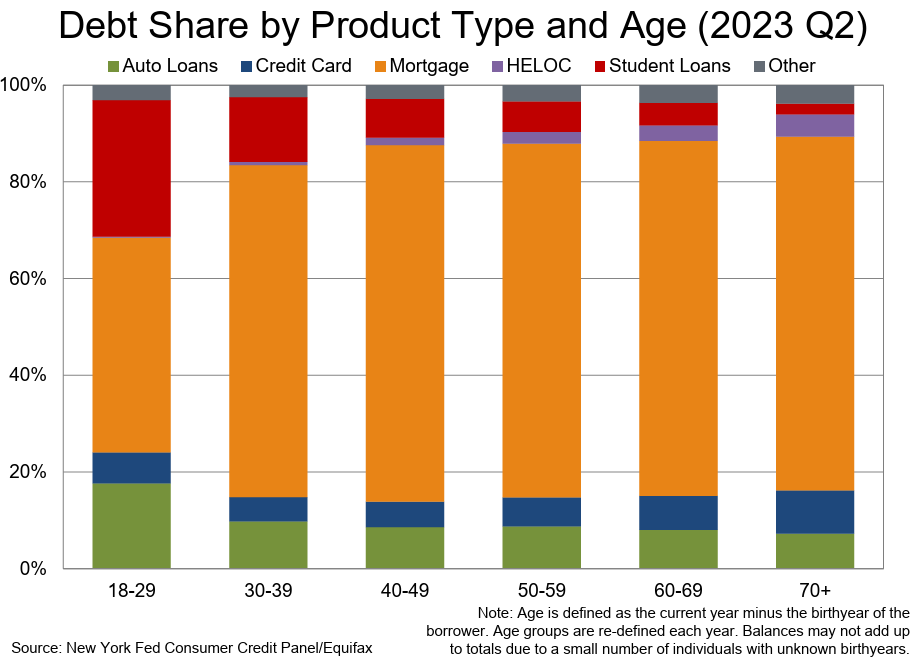

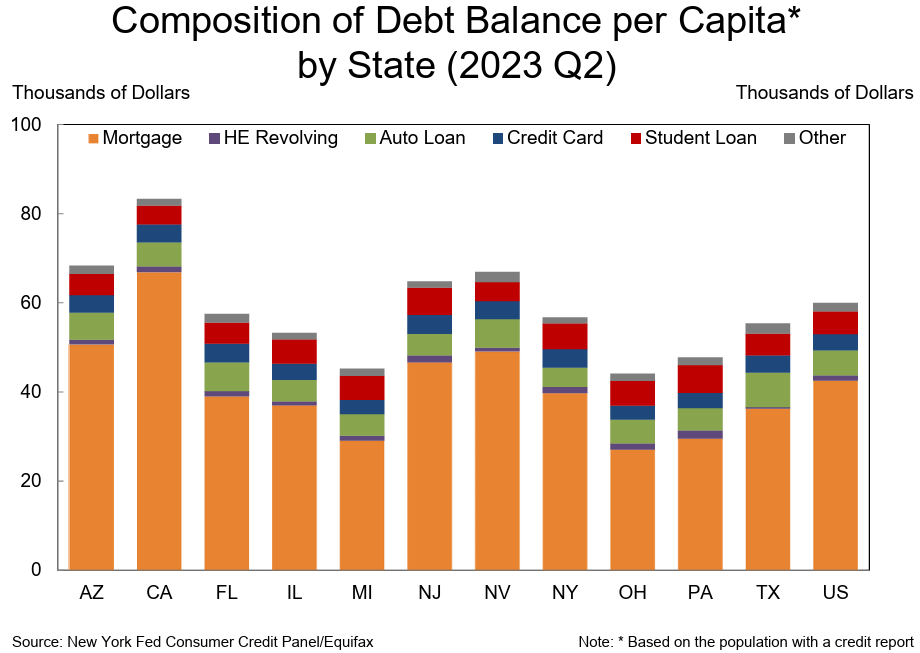

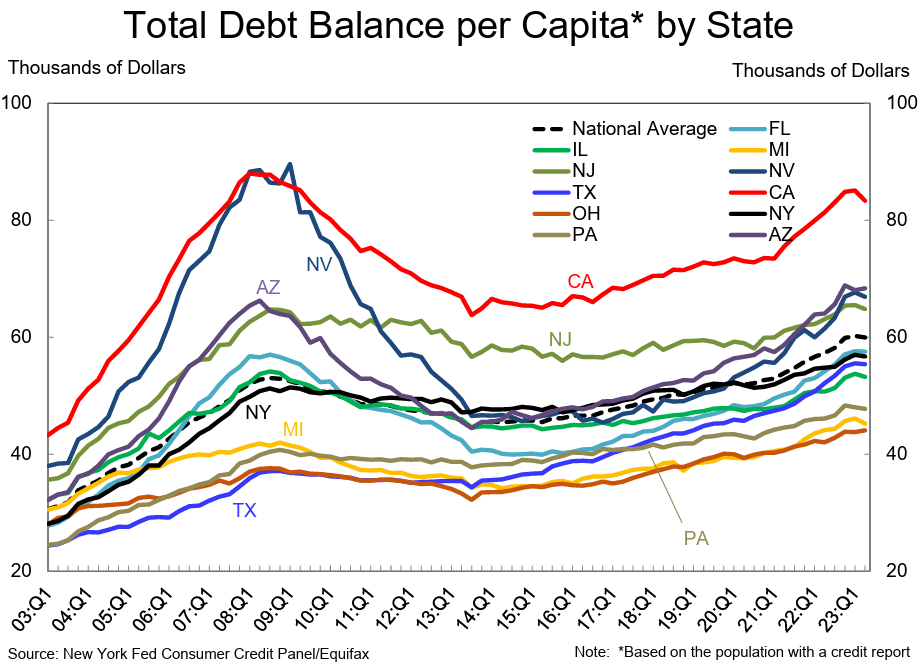

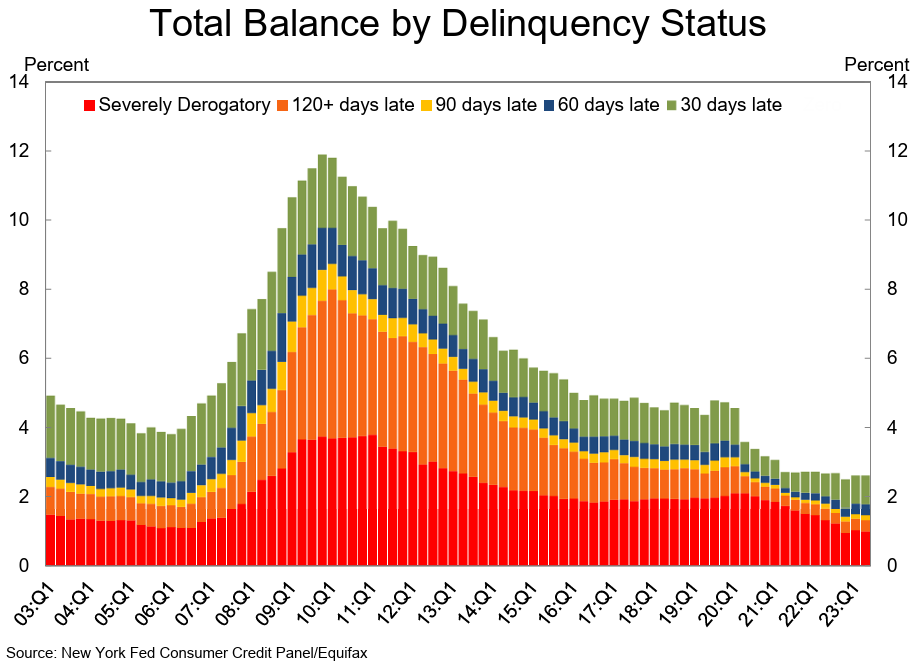

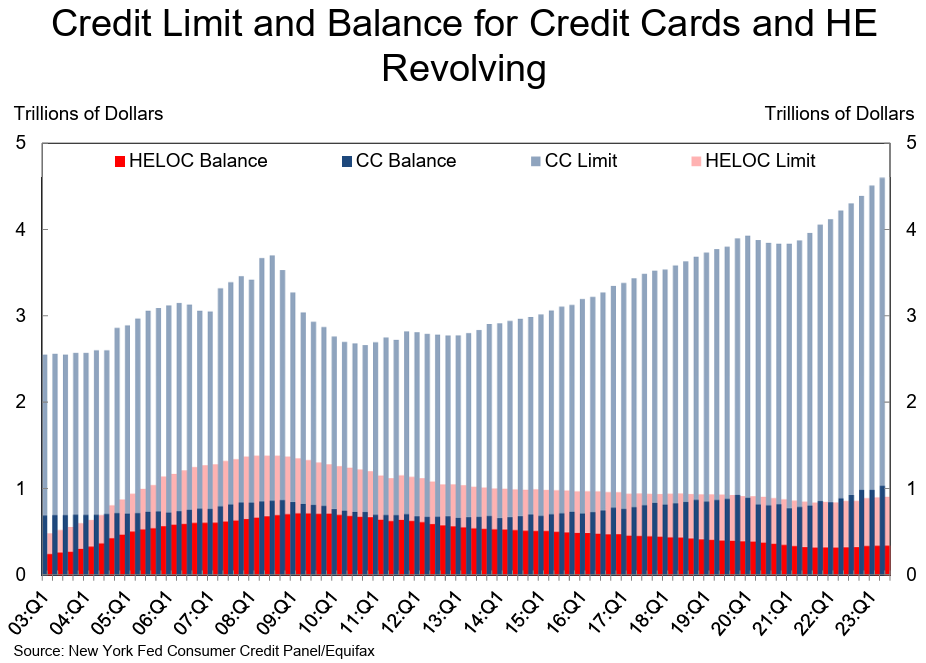

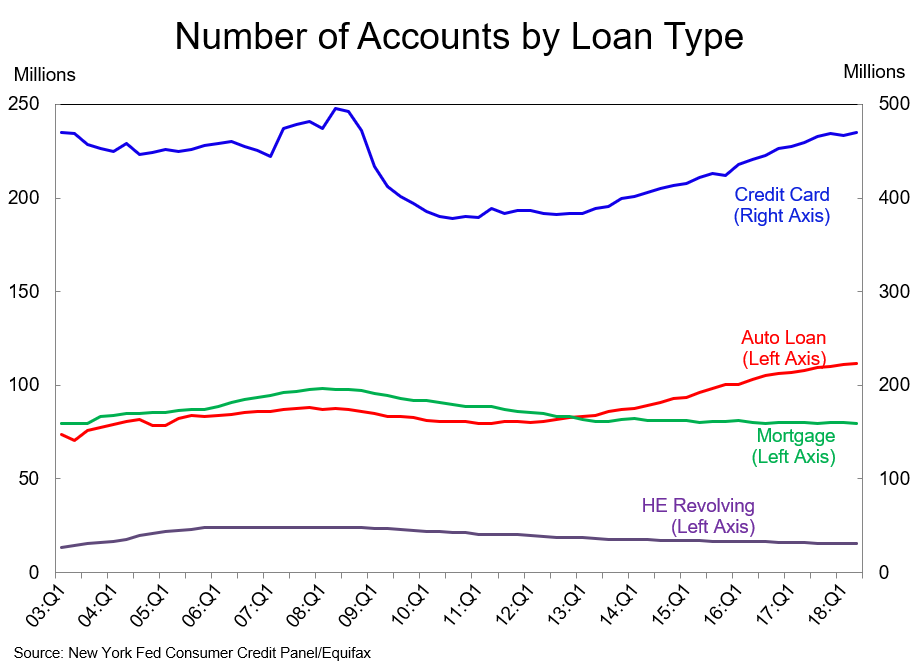

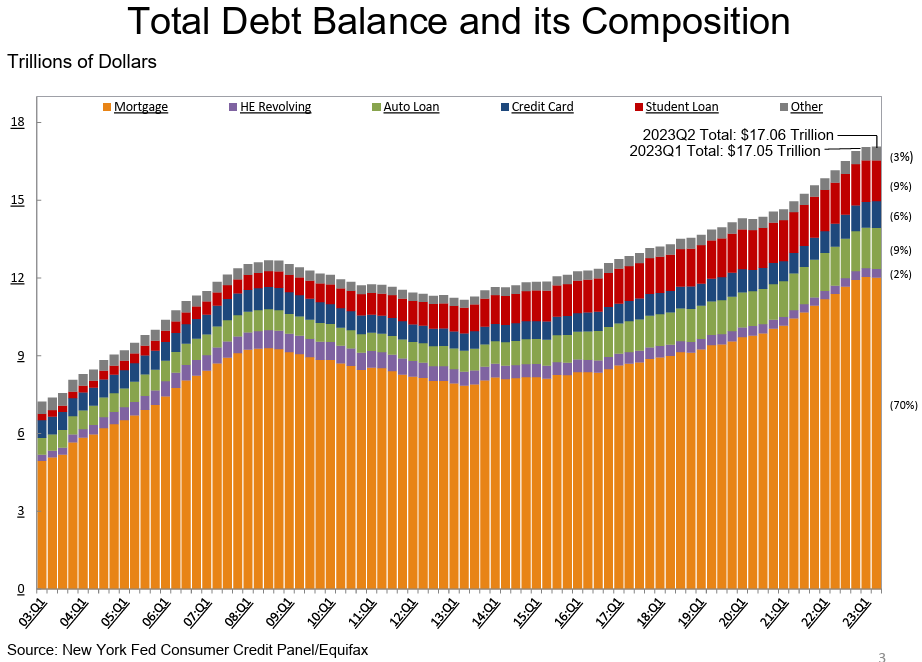

At the end of the second quarter of 2019 there were $13.86 trillion Dollars in outstanding household debt across the United States. Housing debt totaled $9.81 trillion, or 70.78% of the total. By the end of the second quarter of 2023 household debt reached $17.06 trillion. Housing debt totaled $12.35 trillion, or 72.39% of the total.

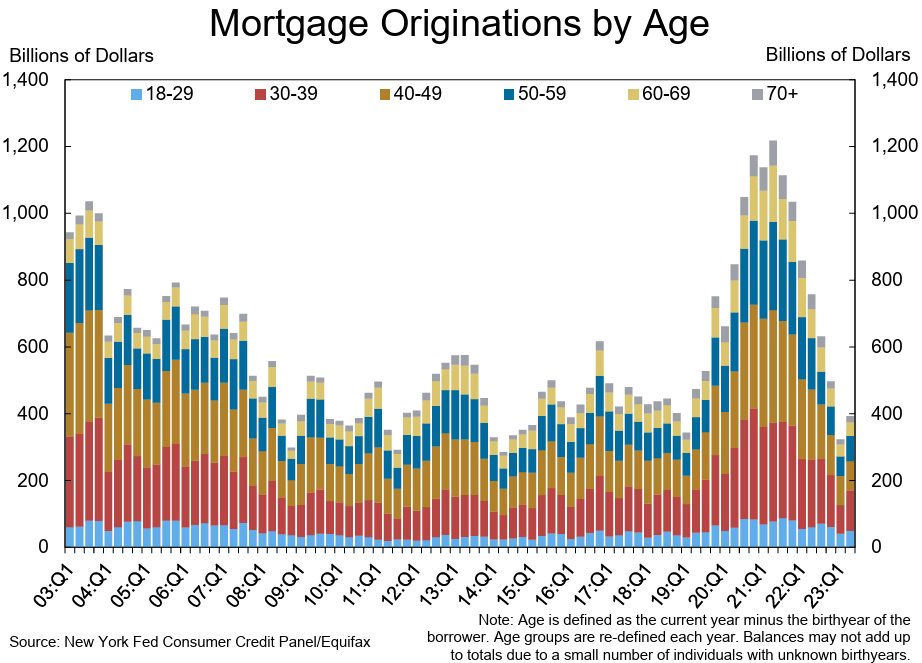

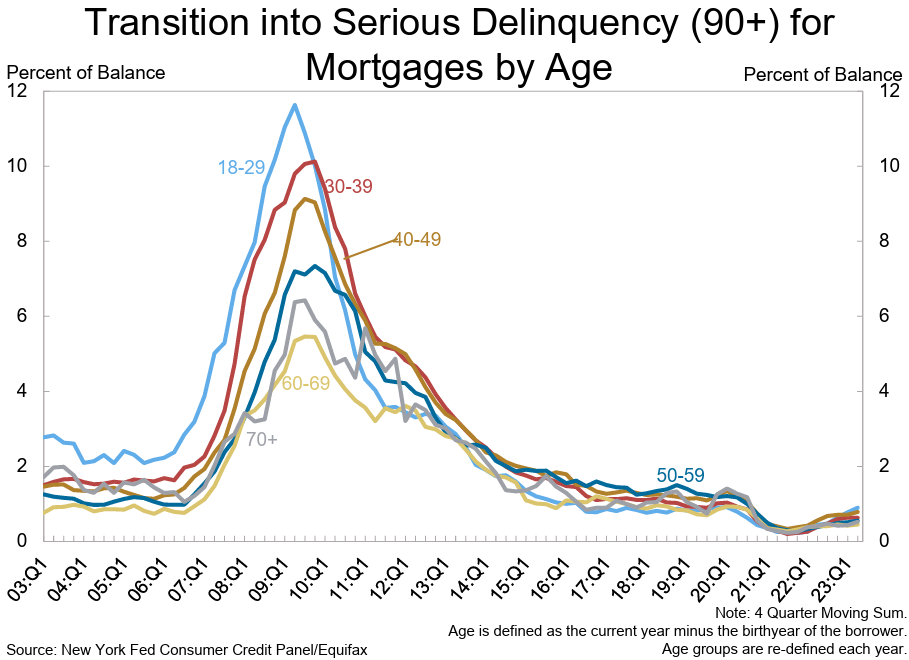

Most mortgage debt is originated by people in the 30 to 49 year old age group.

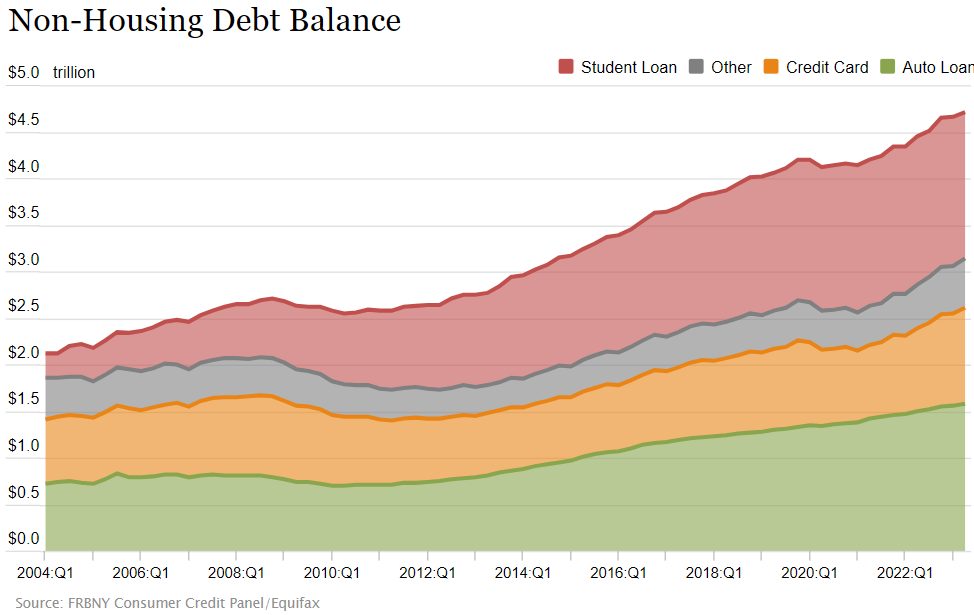

The following graph further breaks down the non-household debt composition.

The next graph highlights debt balance composition by age cohort.

According to HMDA, first mortgages represented 85.44% of originated home loans & 95.05% of all new mortgage debt originated in 2018. Secondary mortgages represented 14.56% of new loans & 4.95% of new mortgage debt.

| Loan Type | Lien Type | # of Records | % of loans | $ Amount | $ % |

|---|---|---|---|---|---|

| Conventional | First | 4,963,197 | 75.26% of first | 1,524,366,245,000 | 80.5% of first |

| FHA | First | 970,901 | 14.72% of first | 206,447,255,000 | 10.9% of first |

| USDA | First | 103,808 | 1.57% of first | 15,177,360,000 | 0.8% of first |

| VA | First | 556,414 | 8.44% of first | 147,733,570,000 | 7.8% of first |

| Total | First | 6,594,320 | 85.44% of total | 1,893,724,430,000 | 95.05% of total |

| Conventional | Second | 1,119,755 | 99.67% of second | 98,428,855,000 | 4.95% of second |

| FHA | Second | 3,468 | 0.31% of second | 165,760,000 | 0.17% of second |

| USDA | Second | 42 | 0% of second | 2,520,000 | 0% of second |

| VA | Second | 200 | 0.02% of second | 15,350,000 | 0.02% of second |

| Total | Second | 1,123,465 | 14.56% of total | 98,612,485,000 | 4.95% of total |

| Total | First & Second | 7,717,785 | 1,992,336,915,000 |

In 2022 conventional mortgages still dominated the market in terms of volume and dollar amount.

| Loan Type | # of Records | # % | $ Amount | $ % |

|---|---|---|---|---|

| Conventional | 6,917,131 | 82.40% | 2,393,440,925,000 | 84.29% |

| FHA | 861,740 | 10.27% | 237,654,580,000 | 8.37% |

| VA | 558,745 | 6.66% | 198,299,085,000 | 6.98% |

| USDA | 56,662 | 0.68% | 10,175,080,000 | 0.36% |

| Total | 8,394,278 | 2,839,569,670,000 |

The HMDA also breaks down the 2022 originated mortgages by purpose.

| Originated Loans | # of Loans | # % | $ Loan Amount | $ % |

|---|---|---|---|---|

| Home Purchase | 4,366,283 | 52.01% | 1,721,735,925,000 | 60.63% |

| Home Improvement | 782,649 | 9.32% | 98,385,435,000 | 3.46% |

| Refinancing | 1,082,136 | 12.89% | 407,474,440,000 | 14.35% |

| Cash Out Refinancing | 1,547,728 | 18.44% | 478,630,970,000 | 16.86% |

| Other Purpose | 613,131 | 7.30% | 111,360,395,000 | 3.92% |

| Not Applicable | 2,351 | 0.03% | 21,982,505,000 | 0.77% |

| Total | 8,394,278 | 2,839,569,670,000 |

The following data from the Federal Reserve shows how mortgage debt has grown over time.

Since 1945 through Q2 of 2033 mortgage debt has grown at an annual rate of 8.584% in nominal terms.

In recent years total mortgage debt has been growing at a rate of roughly 3.5% to 3.7% annually. The biggest pullback from the 2008 to 2009 global recession was in Q4 of 2010 with mortgage debt falling by 4.21%.

All numbers are in millions of United States Dollars at the end of the associated time period.

| Date | Total | YoY △ | % △ | 1-4 Family | Multifamily | Commercial | Farm |

|---|---|---|---|---|---|---|---|

| 1945 Q4 | $35,853 | $18,706 | $4,922 | $7,465 | $4,760 | ||

| 1946 Q4 | $42,032 | $6,179 | 17.234% | $23,100 | $5,270 | $8,765 | $4,897 |

| 1947 Q4 | $49,198 | $7,166 | 17.049% | $28,267 | $5,787 | $10,080 | $5,064 |

| 1948 Q4 | $56,568 | $7,370 | 14.980% | $33,422 | $6,662 | $11,196 | $5,288 |

| 1949 Q4 | $62,679 | $6,111 | 10.803% | $37,406 | $7,829 | $11,865 | $5,579 |

| 1950 Q4 | $73,108 | $10,429 | 16.639% | $45,250 | $9,301 | $12,486 | $6,071 |

| 1951 Q4 | $82,573 | $9,465 | 12.947% | $51,792 | $10,642 | $13,488 | $6,651 |

| 1952 Q1 | $84,413 | $53,066 | $10,820 | $13,713 | $6,814 | ||

| 1952 Q2 | $86,783 | $54,798 | $11,037 | $13,927 | $7,021 | ||

| 1952 Q3 | $89,210 | $56,640 | $11,275 | $14,161 | $7,134 | ||

| 1952 Q4 | $91,530 | $8,957 | 10.847% | $58,416 | $11,481 | $14,397 | $7,236 |

| 1953 Q1 | $93,649 | $9,236 | 10.941% | $60,006 | $11,587 | $14,660 | $7,396 |

| 1953 Q2 | $96,517 | $9,734 | 11.216% | $62,225 | $11,766 | $14,939 | $7,587 |

| 1953 Q3 | $99,018 | $9,808 | 10.994% | $64,205 | $11,934 | $15,212 | $7,667 |

| 1953 Q4 | $101,360 | $9,830 | 10.740% | $65,938 | $12,121 | $15,564 | $7,737 |

| 1954 Q1 | $103,321 | $9,672 | 10.328% | $67,351 | $12,174 | $15,880 | $7,916 |

| 1954 Q2 | $106,366 | $9,849 | 10.204% | $69,614 | $12,312 | $16,324 | $8,116 |

| 1954 Q3 | $109,757 | $10,739 | 10.846% | $72,336 | $12,452 | $16,782 | $8,187 |

| 1954 Q4 | $113,580 | $12,220 | 12.056% | $75,356 | $12,665 | $17,313 | $8,246 |

| 1955 Q1 | $117,256 | $13,935 | 13.487% | $78,237 | $12,782 | $17,765 | $8,472 |

| 1955 Q2 | $121,656 | $15,290 | 14.375% | $81,697 | $12,989 | $18,263 | $8,707 |

| 1955 Q3 | $125,896 | $16,139 | 14.704% | $85,032 | $13,179 | $18,819 | $8,866 |

| 1955 Q4 | $129,823 | $16,243 | 14.301% | $87,936 | $13,490 | $19,375 | $9,022 |

| 1956 Q1 | $133,258 | $16,002 | 13.647% | $90,356 | $13,657 | $19,954 | $9,291 |

| 1956 Q2 | $137,325 | $15,669 | 12.880% | $93,327 | $13,827 | $20,582 | $9,589 |

| 1956 Q3 | $141,104 | $15,208 | 12.080% | $96,174 | $13,972 | $21,199 | $9,759 |

| 1956 Q4 | $144,447 | $14,624 | 11.265% | $98,745 | $14,064 | $21,803 | $9,835 |

| 1957 Q1 | $147,290 | $14,032 | 10.530% | $100,851 | $14,085 | $22,321 | $10,033 |

| 1957 Q2 | $150,246 | $12,921 | 9.409% | $103,039 | $14,182 | $22,794 | $10,231 |

| 1957 Q3 | $153,602 | $12,498 | 8.857% | $105,397 | $14,379 | $23,478 | $10,348 |

| 1957 Q4 | $156,641 | $12,194 | 8.442% | $107,374 | $14,611 | $24,259 | $10,397 |

| 1958 Q1 | $159,336 | $12,046 | 8.178% | $108,975 | $15,025 | $24,812 | $10,524 |

| 1958 Q2 | $162,909 | $12,663 | 8.428% | $111,142 | $15,517 | $25,496 | $10,754 |

| 1958 Q3 | $167,216 | $13,614 | 8.863% | $114,035 | $16,020 | $26,204 | $10,957 |

| 1958 Q4 | $172,073 | $15,432 | 9.852% | $117,177 | $16,565 | $27,222 | $11,109 |

| 1959 Q1 | $176,185 | $16,849 | 10.575% | $119,935 | $17,132 | $27,761 | $11,357 |

| 1959 Q2 | $181,322 | $18,413 | 11.303% | $123,346 | $17,679 | $28,553 | $11,744 |

| 1959 Q3 | $186,450 | $19,234 | 11.502% | $127,007 | $18,212 | $29,283 | $11,948 |

| 1959 Q4 | $191,128 | $19,055 | 11.074% | $130,099 | $18,700 | $30,228 | $12,101 |

| 1960 Q1 | $194,949 | $18,764 | 10.650% | $132,580 | $19,199 | $30,899 | $12,271 |

| 1960 Q2 | $199,295 | $17,973 | 9.912% | $135,366 | $19,702 | $31,668 | $12,559 |

| 1960 Q3 | $204,103 | $17,653 | 9.468% | $138,582 | $20,293 | $32,531 | $12,697 |

| 1960 Q4 | $208,409 | $17,281 | 9.042% | $141,378 | $20,786 | $33,407 | $12,838 |

| 1961 Q1 | $212,253 | $17,304 | 8.876% | $143,645 | $21,424 | $34,121 | $13,063 |

| 1961 Q2 | $217,156 | $17,861 | 8.962% | $146,603 | $21,943 | $35,173 | $13,437 |

| 1961 Q3 | $222,791 | $18,688 | 9.156% | $150,179 | $22,790 | $36,085 | $13,737 |

| 1961 Q4 | $228,969 | $20,560 | 9.865% | $154,027 | $23,622 | $37,403 | $13,917 |

| 1962 Q1 | $233,302 | $21,049 | 9.917% | $156,488 | $24,218 | $38,374 | $14,222 |

| 1962 Q2 | $239,432 | $22,276 | 10.258% | $160,237 | $24,937 | $39,584 | $14,674 |

| 1962 Q3 | $245,791 | $23,000 | 10.324% | $164,345 | $25,769 | $40,733 | $14,944 |

| 1962 Q4 | $252,438 | $23,469 | 10.250% | $168,307 | $26,732 | $42,206 | $15,193 |

| 1963 Q1 | $257,443 | $24,141 | 10.348% | $171,352 | $27,382 | $43,148 | $15,561 |

| 1963 Q2 | $264,646 | $25,214 | 10.531% | $175,801 | $28,202 | $44,492 | $16,151 |

| 1963 Q3 | $272,064 | $26,273 | 10.689% | $180,662 | $28,994 | $45,835 | $16,573 |

| 1963 Q4 | $279,256 | $26,818 | 10.624% | $185,106 | $30,024 | $47,304 | $16,822 |

| 1964 Q1 | $284,877 | $27,434 | 10.656% | $188,776 | $30,936 | $47,831 | $17,334 |

| 1964 Q2 | $292,203 | $27,557 | 10.413% | $193,368 | $32,095 | $48,672 | $18,068 |

| 1964 Q3 | $299,773 | $27,709 | 10.185% | $198,076 | $33,313 | $49,848 | $18,536 |

| 1964 Q4 | $307,034 | $27,778 | 9.947% | $202,335 | $34,578 | $51,179 | $18,942 |

| 1965 Q1 | $312,731 | $27,854 | 9.778% | $205,891 | $35,384 | $51,982 | $19,474 |

| 1965 Q2 | $320,010 | $27,807 | 9.516% | $210,329 | $36,300 | $53,197 | $20,184 |

| 1965 Q3 | $327,395 | $27,622 | 9.214% | $215,042 | $37,243 | $54,413 | $20,697 |

| 1965 Q4 | $334,510 | $27,476 | 8.949% | $219,449 | $38,213 | $55,661 | $21,187 |

| 1966 Q1 | $341,259 | $28,528 | 9.122% | $223,358 | $39,187 | $57,017 | $21,697 |

| 1966 Q2 | $348,424 | $28,414 | 8.879% | $227,232 | $40,075 | $58,796 | $22,321 |

| 1966 Q3 | $354,072 | $26,677 | 8.148% | $230,272 | $40,708 | $60,317 | $22,775 |

| 1966 Q4 | $358,537 | $24,027 | 7.183% | $232,742 | $41,275 | $61,468 | $23,052 |

| 1967 Q1 | $361,862 | $20,603 | 6.037% | $234,221 | $41,968 | $62,233 | $23,440 |

| 1967 Q2 | $367,447 | $19,023 | 5.460% | $237,076 | $42,801 | $63,577 | $23,993 |

| 1967 Q3 | $374,765 | $20,693 | 5.844% | $241,547 | $43,748 | $64,924 | $24,546 |

| 1967 Q4 | $382,055 | $23,518 | 6.559% | $245,974 | $44,815 | $66,249 | $25,017 |

| 1968 Q1 | $388,021 | $26,159 | 7.229% | $249,378 | $45,477 | $67,543 | $25,623 |

| 1968 Q2 | $395,418 | $27,971 | 7.612% | $253,675 | $46,242 | $69,114 | $26,387 |

| 1968 Q3 | $403,087 | $28,322 | 7.557% | $258,183 | $47,141 | $70,927 | $26,836 |

| 1968 Q4 | $411,381 | $29,326 | 7.676% | $262,934 | $48,251 | $73,019 | $27,177 |

| 1969 Q1 | $416,067 | $28,046 | 7.228% | $264,857 | $49,196 | $74,367 | $27,647 |

| 1969 Q2 | $424,224 | $28,806 | 7.285% | $269,738 | $50,352 | $75,792 | $28,342 |

| 1969 Q3 | $432,047 | $28,960 | 7.185% | $274,512 | $51,512 | $77,271 | $28,752 |

| 1969 Q4 | $439,911 | $28,530 | 6.935% | $278,689 | $53,176 | $79,051 | $28,995 |

| 1970 Q1 | $442,980 | $26,913 | 6.468% | $280,971 | $53,467 | $78,950 | $29,592 |

| 1970 Q2 | $450,595 | $26,371 | 6.216% | $284,366 | $55,054 | $81,253 | $29,922 |

| 1970 Q3 | $460,315 | $28,268 | 6.543% | $288,349 | $57,668 | $84,057 | $30,241 |

| 1970 Q4 | $469,364 | $29,453 | 6.695% | $292,240 | $60,129 | $86,503 | $30,492 |

| 1971 Q1 | $477,184 | $34,204 | 7.721% | $296,349 | $62,312 | $87,700 | $30,823 |

| 1971 Q2 | $490,134 | $39,539 | 8.775% | $303,206 | $65,052 | $90,090 | $31,786 |

| 1971 Q3 | $504,220 | $43,905 | 9.538% | $311,379 | $67,399 | $93,327 | $32,115 |

| 1971 Q4 | $517,869 | $48,505 | 10.334% | $318,411 | $70,094 | $96,983 | $32,381 |

| 1972 Q1 | $531,563 | $54,379 | 11.396% | $325,753 | $72,680 | $100,034 | $33,096 |

| 1972 Q2 | $550,187 | $60,053 | 12.252% | $335,726 | $76,046 | $104,306 | $34,109 |

| 1972 Q3 | $569,366 | $65,146 | 12.920% | $347,347 | $78,834 | $108,330 | $34,855 |

| 1972 Q4 | $589,786 | $71,917 | 13.887% | $357,381 | $82,876 | $114,168 | $35,361 |

| 1973 Q1 | $605,291 | $73,728 | 13.870% | $365,955 | $84,593 | $118,253 | $36,490 |

| 1973 Q2 | $627,950 | $77,763 | 14.134% | $378,024 | $87,957 | $124,008 | $37,961 |

| 1973 Q3 | $649,008 | $79,642 | 13.988% | $389,894 | $91,127 | $129,035 | $38,952 |

| 1973 Q4 | $666,543 | $76,757 | 13.014% | $399,840 | $93,191 | $133,706 | $39,806 |

| 1974 Q1 | $681,413 | $76,122 | 12.576% | $407,909 | $95,355 | $137,455 | $40,694 |

| 1974 Q2 | $700,754 | $72,804 | 11.594% | $418,838 | $97,221 | $142,377 | $42,318 |

| 1974 Q3 | $716,574 | $67,566 | 10.411% | $428,859 | $98,933 | $145,045 | $43,737 |

| 1974 Q4 | $728,426 | $61,883 | 9.284% | $435,176 | $100,049 | $148,279 | $44,922 |

| 1975 Q1 | $737,733 | $56,320 | 8.265% | $439,951 | $100,586 | $150,411 | $46,785 |

| 1975 Q2 | $753,522 | $52,768 | 7.530% | $450,826 | $100,735 | $153,431 | $48,530 |

| 1975 Q3 | $769,738 | $53,164 | 7.419% | $462,776 | $100,820 | $157,058 | $49,084 |

| 1975 Q4 | $785,568 | $57,142 | 7.845% | $474,003 | $100,693 | $161,019 | $49,853 |

| 1976 Q1 | $802,392 | $64,659 | 8.765% | $486,205 | $102,169 | $163,221 | $50,797 |

| 1976 Q2 | $823,307 | $69,785 | 9.261% | $501,045 | $103,607 | $166,345 | $52,310 |

| 1976 Q3 | $847,760 | $78,022 | 10.136% | $518,784 | $104,909 | $170,146 | $53,921 |

| 1976 Q4 | $870,518 | $84,950 | 10.814% | $535,022 | $105,895 | $174,189 | $55,412 |

| 1977 Q1 | $892,257 | $89,865 | 11.200% | $550,282 | $107,142 | $177,453 | $57,380 |

| 1977 Q2 | $926,270 | $102,963 | 12.506% | $575,838 | $109,746 | $180,348 | $60,338 |

| 1977 Q3 | $963,193 | $115,433 | 13.616% | $603,197 | $111,835 | $185,795 | $62,366 |

| 1977 Q4 | $999,213 | $128,695 | 14.784% | $627,724 | $114,279 | $193,261 | $63,949 |

| 1978 Q1 | $1,026,813 | $134,556 | 15.080% | $646,079 | $116,827 | $197,958 | $65,949 |

| 1978 Q2 | $1,066,897 | $140,627 | 15.182% | $674,540 | $120,272 | $203,343 | $68,742 |

| 1978 Q3 | $1,109,961 | $146,768 | 15.238% | $707,359 | $122,681 | $208,876 | $71,045 |

| 1978 Q4 | $1,150,674 | $151,461 | 15.158% | $738,254 | $125,152 | $214,511 | $72,757 |

| 1979 Q1 | $1,186,117 | $159,304 | 15.514% | $762,873 | $127,635 | $219,175 | $76,434 |

| 1979 Q2 | $1,231,418 | $164,521 | 15.421% | $794,869 | $129,903 | $225,711 | $80,935 |

| 1979 Q3 | $1,278,932 | $168,971 | 15.223% | $828,850 | $132,396 | $233,353 | $84,333 |

| 1979 Q4 | $1,317,030 | $166,356 | 14.457% | $855,779 | $135,048 | $239,448 | $86,755 |

| 1980 Q1 | $1,357,614 | $171,497 | 14.459% | $886,093 | $137,027 | $243,912 | $90,582 |

| 1980 Q2 | $1,383,696 | $152,278 | 12.366% | $902,289 | $138,408 | $248,864 | $94,135 |

| 1980 Q3 | $1,421,427 | $142,495 | 11.142% | $931,530 | $140,218 | $253,808 | $95,871 |

| 1980 Q4 | $1,457,828 | $140,798 | 10.691% | $957,912 | $142,526 | $259,903 | $97,487 |

| 1981 Q1 | $1,484,685 | $127,071 | 9.360% | $973,129 | $143,948 | $267,511 | $100,097 |

| 1981 Q2 | $1,523,566 | $139,870 | 10.108% | $996,937 | $144,952 | $278,496 | $103,181 |

| 1981 Q3 | $1,555,141 | $133,714 | 9.407% | $1,014,571 | $146,039 | $288,922 | $105,609 |

| 1981 Q4 | $1,579,504 | $121,676 | 8.346% | $1,030,213 | $142,377 | $299,685 | $107,229 |

| 1982 Q1 | $1,600,795 | $116,110 | 7.821% | $1,041,585 | $143,640 | $306,619 | $108,951 |

| 1982 Q2 | $1,625,667 | $102,101 | 6.701% | $1,055,044 | $144,694 | $315,647 | $110,282 |

| 1982 Q3 | $1,635,406 | $80,265 | 5.161% | $1,055,314 | $144,215 | $324,780 | $111,097 |

| 1982 Q4 | $1,661,290 | $81,786 | 5.178% | $1,070,187 | $146,112 | $333,680 | $111,311 |

| 1983 Q1 | $1,692,029 | $91,234 | 5.699% | $1,087,139 | $147,020 | $346,330 | $111,540 |

| 1983 Q2 | $1,739,644 | $113,977 | 7.011% | $1,116,296 | $150,761 | $360,215 | $112,372 |

| 1983 Q3 | $1,796,351 | $160,945 | 9.841% | $1,153,484 | $155,784 | $373,975 | $113,108 |

| 1983 Q4 | $1,850,645 | $189,355 | 11.398% | $1,186,271 | $161,229 | $389,424 | $113,721 |

| 1984 Q1 | $1,904,844 | $212,815 | 12.578% | $1,216,062 | $167,158 | $408,654 | $112,970 |

| 1984 Q2 | $1,972,432 | $232,788 | 13.381% | $1,254,448 | $174,957 | $429,688 | $113,339 |

| 1984 Q3 | $2,034,727 | $238,376 | 13.270% | $1,289,107 | $180,374 | $451,779 | $113,467 |

| 1984 Q4 | $2,091,991 | $241,346 | 13.041% | $1,321,526 | $186,145 | $471,898 | $112,422 |

| 1985 Q1 | $2,168,248 | $263,404 | 13.828% | $1,385,660 | $182,816 | $487,050 | $112,722 |

| 1985 Q2 | $2,234,883 | $262,451 | 13.306% | $1,428,061 | $189,290 | $505,953 | $111,579 |

| 1985 Q3 | $2,303,008 | $268,281 | 13.185% | $1,477,181 | $194,964 | $522,126 | $108,737 |

| 1985 Q4 | $2,368,542 | $276,551 | 13.220% | $1,526,876 | $205,915 | $541,661 | $94,090 |

| 1986 Q1 | $2,416,495 | $248,247 | 11.449% | $1,557,666 | $212,974 | $554,231 | $91,624 |

| 1986 Q2 | $2,492,143 | $257,260 | 11.511% | $1,616,328 | $220,862 | $565,823 | $89,130 |

| 1986 Q3 | $2,578,098 | $275,090 | 11.945% | $1,683,521 | $228,838 | $579,130 | $86,609 |

| 1986 Q4 | $2,655,581 | $287,039 | 12.119% | $1,730,129 | $239,394 | $601,970 | $84,088 |

| 1987 Q1 | $2,737,635 | $321,140 | 13.289% | $1,770,490 | $245,492 | $639,606 | $82,047 |

| 1987 Q2 | $2,829,845 | $337,702 | 13.551% | $1,843,953 | $250,241 | $655,668 | $79,983 |

| 1987 Q3 | $2,899,473 | $321,375 | 12.466% | $1,898,660 | $254,693 | $668,224 | $77,896 |

| 1987 Q4 | $2,954,269 | $298,688 | 11.248% | $1,928,457 | $258,355 | $691,647 | $75,810 |

| 1988 Q1 | $3,023,464 | $285,829 | 10.441% | $1,974,919 | $268,334 | $705,639 | $74,572 |

| 1988 Q2 | $3,111,962 | $282,117 | 9.969% | $2,044,958 | $265,969 | $727,702 | $73,333 |

| 1988 Q3 | $3,185,620 | $286,147 | 9.869% | $2,105,915 | $269,276 | $738,348 | $72,081 |

| 1988 Q4 | $3,271,905 | $317,636 | 10.752% | $2,162,789 | $274,544 | $763,743 | $70,829 |

| 1989 Q1 | $3,327,062 | $303,598 | 10.041% | $2,196,931 | $279,826 | $779,985 | $70,320 |

| 1989 Q2 | $3,396,811 | $284,849 | 9.153% | $2,255,378 | $284,991 | $786,638 | $69,804 |

| 1989 Q3 | $3,472,866 | $287,246 | 9.017% | $2,321,631 | $285,815 | $796,137 | $69,283 |

| 1989 Q4 | $3,523,554 | $251,649 | 7.691% | $2,369,557 | $287,001 | $798,235 | $68,761 |

| 1990 Q1 | $3,617,613 | $290,551 | 8.733% | $2,450,148 | $290,563 | $808,419 | $68,483 |

| 1990 Q2 | $3,682,117 | $285,306 | 8.399% | $2,517,151 | $284,579 | $812,186 | $68,202 |

| 1990 Q3 | $3,737,912 | $265,046 | 7.632% | $2,567,225 | $286,904 | $815,867 | $67,917 |

| 1990 Q4 | $3,779,452 | $255,898 | 7.262% | $2,606,804 | $287,424 | $817,591 | $67,633 |

| 1991 Q1 | $3,823,204 | $205,591 | 5.683% | $2,641,560 | $288,957 | $825,099 | $67,588 |

| 1991 Q2 | $3,887,653 | $205,536 | 5.582% | $2,700,538 | $290,203 | $829,370 | $67,542 |

| 1991 Q3 | $3,890,397 | $152,485 | 4.079% | $2,722,798 | $282,656 | $817,447 | $67,496 |

| 1991 Q4 | $3,930,682 | $151,230 | 4.001% | $2,774,705 | $284,108 | $804,420 | $67,450 |

| 1992 Q1 | $3,961,054 | $137,850 | 3.606% | $2,814,343 | $283,928 | $795,227 | $67,557 |

| 1992 Q2 | $3,983,064 | $95,411 | 2.454% | $2,845,786 | $280,081 | $789,534 | $67,663 |

| 1992 Q3 | $4,021,258 | $130,861 | 3.364% | $2,899,090 | $276,591 | $777,806 | $67,771 |

| 1992 Q4 | $4,040,811 | $110,129 | 2.802% | $2,942,068 | $270,935 | $759,930 | $67,879 |

| 1993 Q1 | $4,041,824 | $80,770 | 2.039% | $2,952,182 | $268,838 | $752,788 | $68,016 |

| 1993 Q2 | $4,084,335 | $101,271 | 2.543% | $3,006,466 | $266,012 | $743,703 | $68,154 |

| 1993 Q3 | $4,129,839 | $108,581 | 2.700% | $3,058,883 | $264,738 | $737,926 | $68,293 |

| 1993 Q4 | $4,171,503 | $130,692 | 3.234% | $3,101,120 | $267,771 | $734,180 | $68,433 |

| 1994 Q1 | $4,194,789 | $152,965 | 3.785% | $3,132,652 | $267,659 | $725,680 | $68,797 |

| 1994 Q2 | $4,243,463 | $159,128 | 3.896% | $3,180,197 | $268,818 | $725,282 | $69,166 |

| 1994 Q3 | $4,294,496 | $164,657 | 3.987% | $3,230,936 | $268,710 | $725,311 | $69,539 |

| 1994 Q4 | $4,336,257 | $164,754 | 3.950% | $3,278,605 | $268,509 | $719,231 | $69,912 |

| 1995 Q1 | $4,369,098 | $174,309 | 4.155% | $3,306,735 | $267,474 | $724,531 | $70,358 |

| 1995 Q2 | $4,423,916 | $180,453 | 4.252% | $3,356,631 | $269,694 | $726,781 | $70,810 |

| 1995 Q3 | $4,484,773 | $190,277 | 4.431% | $3,413,402 | $270,827 | $729,279 | $71,266 |

| 1995 Q4 | $4,522,066 | $185,809 | 4.285% | $3,446,414 | $274,392 | $729,537 | $71,723 |

| 1996 Q1 | $4,593,483 | $224,385 | 5.136% | $3,508,980 | $275,280 | $736,829 | $72,394 |

| 1996 Q2 | $4,666,334 | $242,418 | 5.480% | $3,568,551 | $278,508 | $746,210 | $73,065 |

| 1996 Q3 | $4,734,740 | $249,967 | 5.574% | $3,633,468 | $280,946 | $746,582 | $73,744 |

| 1996 Q4 | $4,802,807 | $280,741 | 6.208% | $3,682,765 | $286,723 | $758,897 | $74,422 |

| 1997 Q1 | $4,857,205 | $263,722 | 5.741% | $3,728,459 | $287,035 | $766,280 | $75,431 |

| 1997 Q2 | $4,933,524 | $267,190 | 5.726% | $3,783,051 | $291,076 | $782,946 | $76,451 |

| 1997 Q3 | $5,045,994 | $311,254 | 6.574% | $3,875,717 | $293,294 | $799,501 | $77,482 |

| 1997 Q4 | $5,115,947 | $313,140 | 6.520% | $3,917,554 | $298,750 | $821,129 | $78,514 |

| 1998 Q1 | $5,205,292 | $348,087 | 7.166% | $3,986,110 | $305,369 | $834,168 | $79,645 |

| 1998 Q2 | $5,323,278 | $389,754 | 7.900% | $4,076,856 | $312,659 | $852,975 | $80,788 |

| 1998 Q3 | $5,446,265 | $400,271 | 7.932% | $4,168,504 | $321,177 | $874,640 | $81,944 |

| 1998 Q4 | $5,603,208 | $487,261 | 9.524% | $4,275,839 | $334,477 | $909,792 | $83,100 |

| 1999 Q1 | $5,728,717 | $523,425 | 10.056% | $4,365,807 | $344,256 | $934,541 | $84,113 |

| 1999 Q2 | $5,867,506 | $544,228 | 10.224% | $4,474,352 | $350,702 | $957,316 | $85,136 |

| 1999 Q3 | $6,068,601 | $622,336 | 11.427% | $4,606,366 | $361,316 | $1,014,748 | $86,171 |

| 1999 Q4 | $6,209,573 | $606,365 | 10.822% | $4,701,179 | $375,156 | $1,046,032 | $87,206 |

| 2000 Q1 | $6,313,670 | $584,953 | 10.211% | $4,772,403 | $381,966 | $1,072,712 | $86,589 |

| 2000 Q2 | $6,475,757 | $608,251 | 10.366% | $4,896,598 | $390,385 | $1,102,802 | $85,972 |

| 2000 Q3 | $6,626,320 | $557,719 | 9.190% | $5,020,704 | $395,707 | $1,124,561 | $85,348 |

| 2000 Q4 | $6,766,632 | $557,059 | 8.971% | $5,124,971 | $404,487 | $1,152,450 | $84,724 |

| 2001 Q1 | $6,850,414 | $536,744 | 8.501% | $5,221,818 | $409,263 | $1,133,668 | $85,665 |

| 2001 Q2 | $7,057,091 | $581,334 | 8.977% | $5,393,894 | $420,602 | $1,155,978 | $86,617 |

| 2001 Q3 | $7,264,412 | $638,092 | 9.630% | $5,553,552 | $429,993 | $1,193,288 | $87,579 |

| 2001 Q4 | $7,450,103 | $683,471 | 10.101% | $5,678,030 | $446,092 | $1,237,440 | $88,541 |

| 2002 Q1 | $7,619,582 | $769,168 | 11.228% | $5,825,479 | $452,285 | $1,251,580 | $90,238 |

| 2002 Q2 | $7,847,327 | $790,236 | 11.198% | $6,013,375 | $462,631 | $1,279,367 | $91,954 |

| 2002 Q3 | $8,092,918 | $828,506 | 11.405% | $6,222,401 | $469,748 | $1,307,081 | $93,688 |

| 2002 Q4 | $8,358,739 | $908,636 | 12.196% | $6,434,374 | $486,343 | $1,342,599 | $95,423 |

| 2003 Q1 | $8,560,075 | $940,493 | 12.343% | $6,605,236 | $496,998 | $1,365,435 | $92,406 |

| 2003 Q2 | $8,849,379 | $1,002,052 | 12.769% | $6,847,172 | $514,553 | $1,398,299 | $89,355 |

| 2003 Q3 | $9,130,381 | $1,037,463 | 12.819% | $7,076,622 | $533,298 | $1,434,190 | $86,271 |

| 2003 Q4 | $9,364,816 | $1,006,077 | 12.036% | $7,260,331 | $559,710 | $1,461,588 | $83,187 |

| 2004 Q1 | $9,630,211 | $1,070,136 | 12.501% | $7,466,141 | $570,917 | $1,506,867 | $86,286 |

| 2004 Q2 | $9,978,186 | $1,128,807 | 12.756% | $7,757,555 | $585,974 | $1,545,271 | $89,386 |

| 2004 Q3 | $10,311,404 | $1,181,023 | 12.935% | $8,024,521 | $601,402 | $1,592,962 | $92,519 |

| 2004 Q4 | $10,646,694 | $1,281,878 | 13.688% | $8,292,061 | $609,346 | $1,649,634 | $95,653 |

| 2005 Q1 | $10,940,720 | $1,310,509 | 13.608% | $8,537,015 | $619,197 | $1,686,607 | $97,901 |

| 2005 Q2 | $11,337,595 | $1,359,409 | 13.624% | $8,848,576 | $638,215 | $1,750,631 | $100,173 |

| 2005 Q3 | $11,732,853 | $1,421,449 | 13.785% | $9,166,673 | $654,907 | $1,808,802 | $102,471 |

| 2005 Q4 | $12,112,861 | $1,466,167 | 13.771% | $9,448,506 | $674,332 | $1,885,255 | $104,768 |

| 2006 Q1 | $12,513,782 | $1,573,062 | 14.378% | $9,772,780 | $683,309 | $1,952,116 | $105,577 |

| 2006 Q2 | $12,916,224 | $1,578,629 | 13.924% | $10,103,493 | $692,151 | $2,014,185 | $106,395 |

| 2006 Q3 | $13,259,400 | $1,526,547 | 13.011% | $10,363,701 | $702,145 | $2,086,333 | $107,221 |

| 2006 Q4 | $13,525,555 | $1,412,694 | 11.663% | $10,530,774 | $717,514 | $2,169,219 | $108,048 |

| 2007 Q1 | $13,807,652 | $1,293,870 | 10.340% | $10,748,884 | $736,476 | $2,213,101 | $109,191 |

| 2007 Q2 | $14,103,997 | $1,187,773 | 9.196% | $10,954,663 | $749,600 | $2,289,388 | $110,346 |

| 2007 Q3 | $14,405,544 | $1,146,144 | 8.644% | $11,143,957 | $774,825 | $2,375,248 | $111,514 |

| 2007 Q4 | $14,609,661 | $1,084,106 | 8.015% | $11,252,311 | $810,551 | $2,434,117 | $112,682 |

| 2008 Q1 | $14,742,876 | $935,224 | 6.773% | $11,322,911 | $824,063 | $2,477,754 | $118,148 |

| 2008 Q2 | $14,773,014 | $669,017 | 4.743% | $11,295,115 | $837,273 | $2,517,012 | $123,614 |

| 2008 Q3 | $14,757,243 | $351,699 | 2.441% | $11,251,838 | $847,510 | $2,528,754 | $129,141 |

| 2008 Q4 | $14,690,016 | $80,355 | 0.550% | $11,150,916 | $852,932 | $2,551,468 | $134,700 |

| 2009 Q1 | $14,679,117 | -$63,759 | -0.432% | $11,140,430 | $853,951 | $2,547,250 | $137,486 |

| 2009 Q2 | $14,633,039 | -$139,975 | -0.948% | $11,096,591 | $863,784 | $2,532,360 | $140,304 |

| 2009 Q3 | $14,536,977 | -$220,266 | -1.493% | $11,018,655 | $866,893 | $2,508,277 | $143,152 |

| 2009 Q4 | $14,445,082 | -$244,934 | -1.667% | $10,960,860 | $862,718 | $2,475,504 | $146,000 |

| 2010 Q1 | $14,291,797 | -$387,320 | -2.639% | $10,830,417 | $859,393 | $2,453,990 | $147,997 |

| 2010 Q2 | $14,174,786 | -$458,253 | -3.132% | $10,762,904 | $854,317 | $2,407,548 | $150,017 |

| 2010 Q3 | $14,070,412 | -$466,565 | -3.210% | $10,690,727 | $858,840 | $2,368,787 | $152,058 |

| 2010 Q4 | $13,892,841 | -$552,241 | -3.823% | $10,523,368 | $862,924 | $2,352,449 | $154,100 |

| 2011 Q1 | $13,802,969 | -$488,828 | -3.420% | $10,459,335 | $859,023 | $2,327,281 | $157,330 |

| 2011 Q2 | $13,703,125 | -$471,661 | -3.327% | $10,390,906 | $856,003 | $2,295,620 | $160,596 |

| 2011 Q3 | $13,621,319 | -$449,093 | -3.192% | $10,333,165 | $856,583 | $2,267,673 | $163,898 |

| 2011 Q4 | $13,567,772 | -$325,069 | -2.340% | $10,281,318 | $863,322 | $2,255,932 | $167,200 |

| 2012 Q1 | $13,487,190 | -$315,779 | -2.288% | $10,216,122 | $865,358 | $2,236,968 | $168,742 |

| 2012 Q2 | $13,410,892 | -$292,233 | -2.133% | $10,152,832 | $870,658 | $2,217,119 | $170,283 |

| 2012 Q3 | $13,364,420 | -$256,899 | -1.886% | $10,105,203 | $881,048 | $2,206,327 | $171,842 |

| 2012 Q4 | $13,331,268 | -$236,504 | -1.743% | $10,047,712 | $891,150 | $2,219,006 | $173,400 |

| 2013 Q1 | $13,292,099 | -$195,091 | -1.446% | $9,999,863 | $900,410 | $2,215,516 | $176,310 |

| 2013 Q2 | $13,292,023 | -$118,869 | -0.886% | $9,965,129 | $910,134 | $2,237,508 | $179,252 |

| 2013 Q3 | $13,335,599 | -$28,821 | -0.216% | $9,975,128 | $924,973 | $2,253,272 | $182,226 |

| 2013 Q4 | $13,344,539 | $13,271 | 0.100% | $9,959,628 | $940,948 | $2,258,763 | $185,200 |

| 2014 Q1 | $13,335,357 | $43,258 | 0.325% | $9,923,862 | $953,488 | $2,269,947 | $188,060 |

| 2014 Q2 | $13,362,678 | $70,655 | 0.532% | $9,914,037 | $966,929 | $2,290,760 | $190,952 |

| 2014 Q3 | $13,412,399 | $76,800 | 0.576% | $9,924,413 | $981,541 | $2,312,569 | $193,876 |

| 2014 Q4 | $13,486,816 | $142,277 | 1.066% | $9,936,605 | $1,009,083 | $2,344,328 | $196,800 |

| 2015 Q1 | $13,511,357 | $176,000 | 1.320% | $9,909,399 | $1,033,005 | $2,369,194 | $199,759 |

| 2015 Q2 | $13,623,872 | $261,194 | 1.955% | $9,954,437 | $1,059,393 | $2,407,291 | $202,751 |

| 2015 Q3 | $13,727,848 | $315,449 | 2.352% | $10,004,098 | $1,078,236 | $2,439,739 | $205,775 |

| 2015 Q4 | $13,883,332 | $396,516 | 2.940% | $10,076,373 | $1,118,826 | $2,479,333 | $208,800 |

| 2016 Q1 | $13,931,273 | $419,916 | 3.108% | $10,076,117 | $1,144,936 | $2,497,143 | $213,077 |

| 2016 Q2 | $14,047,243 | $423,371 | 3.108% | $10,137,065 | $1,170,496 | $2,522,328 | $217,353 |

| 2016 Q3 | $14,211,202 | $483,354 | 3.521% | $10,220,804 | $1,203,059 | $2,565,662 | $221,677 |

| 2016 Q4 | $14,331,866 | $448,534 | 3.231% | $10,277,103 | $1,236,309 | $2,592,454 | $226,000 |

| 2017 Q1 | $14,431,193 | $499,920 | 3.588% | $10,334,768 | $1,262,264 | $2,605,646 | $228,515 |

| 2017 Q2 | $14,575,689 | $528,446 | 3.762% | $10,411,764 | $1,287,971 | $2,644,896 | $231,058 |

| 2017 Q3 | $14,710,944 | $499,742 | 3.517% | $10,500,589 | $1,312,423 | $2,664,303 | $233,629 |

| 2017 Q4 | $14,892,013 | $560,147 | 3.908% | $10,581,506 | $1,358,641 | $2,715,666 | $236,200 |

| 2018 Q1 | $14,980,281 | $549,088 | 3.805% | $10,621,062 | $1,380,837 | $2,739,840 | $238,542 |

| 2018 Q2 | $15,144,799 | $569,110 | 3.905% | $10,705,639 | $1,408,572 | $2,789,677 | $240,911 |

| 2018 Q3 | $15,292,261 | $581,317 | 3.952% | $10,806,843 | $1,445,653 | $2,796,460 | $243,305 |

| 2018 Q4 | $15,429,103 | $537,090 | 3.607% | $10,871,784 | $1,480,576 | $2,831,043 | $245,700 |

| 2019 Q1 | $15,519,767 | $539,486 | 3.601% | $10,901,399 | $1,505,454 | $2,862,011 | $250,903 |

| 2019 Q2 | $15,654,403 | $509,604 | 3.365% | $10,984,063 | $1,529,811 | $2,884,366 | $256,163 |

| 2019 Q3 | $15,856,088 | $563,827 | 3.687% | $11,085,523 | $1,577,586 | $2,931,497 | $261,482 |

| 2019 Q4 | $16,008,389 | $579,286 | 3.755% | $11,157,551 | $1,617,673 | $2,966,365 | $266,800 |

| 2020 Q1 | $16,138,986 | $619,219 | 3.990% | $11,219,387 | $1,637,375 | $3,011,744 | $270,480 |

| 2020 Q2 | $16,284,118 | $629,715 | 4.023% | $11,303,843 | $1,671,826 | $3,034,289 | $274,160 |

| 2020 Q3 | $16,553,100 | $697,012 | 4.396% | $11,508,300 | $1,709,100 | $3,060,000 | $275,700 |

| 2020 Q4 | $16,788,200 | $779,811 | 4.871% | $11,650,910 | $1,755,300 | $3,093,400 | $288,600 |

| 2021 Q1 | $16,958,200 | $819,214 | 5.076% | $11,784,500 | $1,784,900 | $3,108,000 | $280,800 |

| 2021 Q2 | $17,275,200 | $991,082 | 6.086% | $12,022,200 | $1,807,800 | $3,150,100 | $295,100 |

| 2021 Q3 | $17,611,400 | $1,058,300 | 6.393% | $12,274,300 | $1,835,100 | $3,203,700 | $298,400 |

| 2021 Q4 | $18,317,700 | $1,529,500 | 9.111% | $12,786,300 | $1,912,300 | $3,294,800 | $324,300 |

| 2022 Q1 | $18,584,800 | $1,626,600 | 9.592% | $12,941,400 | $1,954,000 | $3,359,000 | $330,400 |

| 2022 Q2 | $19,006,800 | $1,731,600 | 10.024% | $13,219,600 | $1,997,700 | $3,452,800 | $336,600 |

| 2022 Q3 | $19,330,200 | $1,718,800 | 9.760% | $13,445,700 | $2,036,100 | $3,505,600 | $342,800 |

| 2022 Q4 | $19,599,400 | $1,281,700 | 6.997% | $13,610,400 | $2,078,000 | $3,561,900 | $349,100 |

| 2023 Q1 | $19,742,300 | $1,157,500 | 6.228% | $13,671,400 | $2,110,400 | $3,604,700 | $355,700 |

| 2023 Q2 | $19,900,300 | $893,500 | 4.701% | $13,766,800 | $2,139,300 | $3,631,800 | $362,400 |

As the Federal Reserve lifted interest rates to offset stimulus economic policies by the Trump administration (including the 2017 TCJA) many home owners shifted away from cash out refinancing toward using home equity lines of credit. The COVID-19 crisis caused interest rates to crater with mortgage rates reaching fresh all-time lows. This in turn caused 2020 to be a record year for home loan origination volume, with roughly $2.7 trillion of $4.1 trillion in mortgage volume being refinance loans. 2021 then went on to beat 2020.

Median incomes have not kept pace with home price increases, which has slowed the pace of home purchases.

Through the first 9 months of 2018 home builders were one of the weakest performing categories across the domestic stock market, which has offset a massive 76% total return they achieved in 2017. Home builders rebounded strongly in 2019 & were one of the strongest categories after the COVID-19 crisis. While the mortgage market has been weak in the face of higher interest rates this provides an advantage to new home builders, which can use mortgage rate buydown offers to maintain the sale prices on their homes while giving home buyers lower interest rates either for an introductory period or for the duration of the loan.

| Borrower details | 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Asian | 4.8% | 5.0% | 4.5% | 4.5% | 4.9% | 5.3% | 5.5% | 5.2% | 5.3% | 5.7% | 5.4% | 5.3% | 5.5% | 5.8% |

| African American | 7.1% | 7.7% | 8.7% | 7.6% | 6.3% | 5.7% | 6.0% | 5.5% | 5.1% | 4.8% | 5.2% | 5.5% | 6.0% | 6.4% |

| Hispanic white | 7.6% | 10.5% | 11.7% | 9.0% | 7.9% | 8.0% | 8.1% | 8.3% | 7.7% | 7.3% | 7.9% | 8.3% | 8.8% | 8.8% |

| Non-Hispanic white | 57.1% | 61.7% | 61.2% | 65.4% | 67.5% | 67.9% | 67.6% | 68.7% | 70.0% | 70.2% | 69.1% | 68.1% | 66.4% | 64.9% |

| Other minority | 1.4% | 1.3% | 1.1% | 1.0% | 0.9% | 0.9% | 0.9% | 0.8% | 0.8% | 0.7% | 0.8% | 0.8% | 0.8% | 0.9% |

| Joint | 2.3% | 2.3% | 2.3% | 2.5% | 2.8% | 2.8% | 2.7% | 2.8% | 2.9% | 3.1% | 3.4% | 3.5% | 3.6% | 3.7% |

| Missing | 19.8% | 11.5% | 10.5% | 10.1% | 9.6% | 9.3% | 9.1% | 8.6% | 8.2% | 8.2% | 8.3% | 8.5% | 8.9% | 9.6% |

| Low or moderate income | 27.7% | 24.6% | 23.6% | 24.6% | 28.0% | 36.6% | 35.4% | 34.4% | 33.3% | 28.5% | 27.0% | 27.9% | 26.2% | 26.3% |

| Middle income | 26.9% | 25.7% | 24.7% | 25.1% | 27.0% | 26.6% | 25.6% | 25.2% | 25.1% | 25.2% | 25.6% | 26.1% | 26.4% | 26.7% |

| High income | 41.4% | 45.5% | 46.7% | 46.9% | 42.9% | 34.6% | 37.3% | 38.8% | 40.0% | 44.7% | 46.1% | 44.9% | 46.4% | 46.0% |

| Income not used or N/A | 4.0% | 4.2% | 5.0% | 3.4% | 2.1% | 2.2% | 1.7% | 1.6% | 1.5% | 1.6% | 1.3% | 1.1% | 1.0% | 1.0% |

| Low or moderate income neighborhood | 14.5% | 15.1% | 15.7% | 14.4% | 13.2% | 12.6% | 12.1% | 11.0% | 12.8% | 12.7% | 13.3% | 13.5% | 14.1% | 16.1% |

| Middle income neighborhood | 48.7% | 49.2% | 49.5% | 49.6% | 49.8% | 50.2% | 49.5% | 49.4% | 43.6% | 43.7% | 44.6% | 45.2% | 45.8% | 44.2% |

| High income neighborhood | 35.8% | 34.7% | 33.7% | 35.1% | 35.9% | 35.8% | 37.7% | 39.1% | 43.2% | 43.2% | 41.8% | 41.0% | 40.0% | 39.6% |

| Home Purchase loans (thousands) | 3,331 | 2,533 | 2,391 | 2,157 | 2,018 | 2,284 | 2,638 | 2,747 | 3,134 | 3,463 | 3,594 |

Most mortgage applications are approved. Only second mortgages have a denial rate above 20%.

The following table shows current mortgage rates in your local market.

Here are historical average annual interest rates for popular home loan products.

| Year | 30-YR FRM Rate | 30-YR Points | 15-YR FRM Rate | 15-YR Points | 1-YR ARM Rate | 1-YR Points | 1-YR Margin | 5/1-YR ARM Rate | 5/1-YR Points | 5/1-YR Margin |

|---|---|---|---|---|---|---|---|---|---|---|

| 2022 | 5.34 | 0.81 | 4.58 | 0.84 | 4.09 | 0.29 | 2.75 | |||

| 2021 | 2.96 | 0.68 | 2.27 | 0.64 | 2.61 | 0.29 | 2.75 | |||

| 2020 | 3.10 | 0.73 | 2.59 | 0.69 | 3.07 | 0.30 | 2.75 | |||

| 2019 | 3.94 | 0.5 | 3.39 | 0.5 | 3.57 | 0.4 | 2.75 | |||

| 2018 | 4.54 | 0.5 | 4.00 | 0.5 | 3.82 | 0.3 | 2.76 | |||

| 2017 | 3.99 | 0.5 | 3.27 | 0.5 | 3.20 | 0.4 | 2.74 | |||

| 2016 | 3.65 | 0.5 | 2.93 | 0.5 | 2.87 | 0.5 | 2.74 | |||

| 2015 | 3.85 | 0.6 | 3.09 | 0.6 | 2.53 | 0.3 | 2.74 | 2.94 | 0.5 | 2.74 |

| 2014 | 4.17 | 0.6 | 3.29 | 0.6 | 2.44 | 0.4 | 2.73 | 3.02 | 0.5 | 2.74 |

| 2013 | 3.98 | 0.7 | 3.11 | 0.7 | 2.62 | 0.4 | 2.76 | 2.88 | 0.5 | 2.75 |

| 2012 | 3.66 | 0.7 | 2.93 | 0.7 | 2.69 | 0.5 | 2.76 | 2.78 | 0.6 | 2.74 |

| 2011 | 4.45 | 0.7 | 3.68 | 0.7 | 3.03 | 0.6 | 2.76 | 3.31 | 0.6 | 2.74 |

| 2010 | 4.69 | 0.7 | 4.1 | 0.7 | 3.78 | 0.6 | 2.76 | 3.82 | 0.6 | 2.74 |

| 2009 | 5.04 | 0.7 | 4.57 | 0.7 | 4.7 | 0.6 | 2.75 | 4.75 | 0.6 | 2.74 |

| 2008 | 6.03 | 0.6 | 5.62 | 0.6 | 5.17 | 0.6 | 2.74 | 5.74 | 0.6 | 2.75 |

| 2007 | 6.34 | 0.4 | 6.03 | 0.4 | 5.56 | 0.6 | 2.75 | 6.07 | 0.5 | 2.76 |

| 2006 | 6.41 | 0.5 | 6.07 | 0.5 | 5.54 | 0.7 | 2.76 | 6.08 | 0.6 | 2.77 |

| 2005 | 5.87 | 0.6 | 5.42 | 0.6 | 4.49 | 0.7 | 2.77 | 5.32 | 0.6 | 2.78 |

| 2004 | 5.84 | 0.7 | 5.21 | 0.6 | 3.9 | 0.7 | 2.77 | |||

| 2003 | 5.83 | 0.6 | 5.17 | 0.6 | 3.76 | 0.6 | 2.76 | |||

| 2002 | 6.54 | 0.6 | 5.98 | 0.6 | 4.62 | 0.7 | 2.77 | |||

| 2001 | 6.97 | 0.9 | 6.5 | 0.9 | 5.82 | 0.9 | 2.77 | |||

| 2000 | 8.05 | 1 | 7.72 | 1 | 7.04 | 1 | 2.78 | |||

| 1999 | 7.44 | 1 | 7.06 | 1 | 5.99 | 1.1 | 2.79 | |||

| 1998 | 6.94 | 1.1 | 6.59 | 1.1 | 5.58 | 1.1 | 2.79 | |||

| 1997 | 7.6 | 1.7 | 7.13 | 1.7 | 5.61 | 1.4 | 2.79 | |||

| 1996 | 7.81 | 1.7 | 7.32 | 1.7 | 5.67 | 1.4 | 2.79 | |||

| 1995 | 7.93 | 1.8 | 7.48 | 1.8 | 6.06 | 1.5 | 2.8 | |||

| 1994 | 8.38 | 1.8 | 7.86 | 1.8 | 5.36 | 1.5 | 2.79 | |||

| 1993 | 7.31 | 1.6 | 6.83 | 1.6 | 4.58 | 1.5 | 2.77 | |||

| 1992 | 8.39 | 1.7 | 7.96 | 1.7 | 5.62 | 1.7 | 2.76 | |||

| 1991 | 9.25 | 2 | 7.09 | 1.9 | 2.77 | |||||

| 1990 | 10.13 | 2.1 | 8.36 | 2.1 | 2.77 | |||||

| 1989 | 10.32 | 2.1 | 8.8 | 2.3 | 2.77 | |||||

| 1988 | 10.34 | 2.1 | 7.9 | 2.3 | 2.75 | |||||

| 1987 | 10.21 | 2.2 | 7.83 | 2.2 | ||||||

| 1986 | 10.19 | 2.2 | 8.43 | 2.3 | ||||||

| 1985 | 12.43 | 2.5 | 10.05 | 2.5 | ||||||

| 1984 | 13.88 | 2.5 | 11.51 | 2.5 | ||||||

| 1983 | 13.24 | 2.1 | ||||||||

| 1982 | 16.04 | 2.2 | ||||||||

| 1981 | 16.63 | 2.1 | ||||||||

| 1980 | 13.74 | 1.8 | ||||||||

| 1979 | 11.2 | 1.6 | ||||||||

| 1978 | 9.64 | 1.3 | ||||||||

| 1977 | 8.85 | 1.1 | ||||||||

| 1976 | 8.87 | 1.1 | ||||||||

| 1975 | 9.05 | 1.1 | ||||||||

| 1974 | 9.19 | 1.2 | ||||||||

| 1973 | 8.04 | 1 | ||||||||

| 1972 | 7.38 | 0.9 |

Source: Freddie Mac PMMS

The following table lists purchase loans by type from the Home Mortgage Disclosure Act (HMDA). Conventional mortgages consist of the majority of the purchase market, with both FHA & VA loans being popular choices.

| Year | Conventional | Conventional % | FHA | FHA % | VA | VA % | FSA/RHS | Rural / Farm % | Total |

|---|---|---|---|---|---|---|---|---|---|

| 2015 | 1,950,245 | 60.95% | 809,236 | 25.29% | 324,769 | 10.15% | 115,395 | 3.61% | 3,199,645 |

| 2016 | 2,182,458 | 61.57% | 883,469 | 24.92% | 364,471 | 10.28% | 114,196 | 3.22% | 3,544,594 |

| 2017 | 2,357,454 | 63.95% | 830,638 | 22.53% | 379,554 | 10.30% | 118,870 | 3.22% | 3,686,516 |

The next table is similar to the above, but includes both refinance first liens and purchase first liens. Notice how the share of conventional loans overall is higher than in the above table, because most mortgage refinances are into conventional loans.

| Year | Conventional | Conventional % | FHA | FHA % | VA | VA % | FSA/RHS | Rural / Farm % | Total |

|---|---|---|---|---|---|---|---|---|---|

| 2018 | 4,972,421 | 75.26% | 973,571 | 14.37% | 557,309 | 8.43% | 103,909 | 1.57% | 6,607,210 |

| 2019 | 6,150,850 | 74.46% | 1,175,133 | 14.23% | 833,049 | 10.08% | 101,499 | 1.23% | 8,260,531 |

| 2020 | 10,859,412 | 78.85% | 1,372,649 | 9.97% | 1,403,700 | 10.19% | 136,447 | 0.99% | 13,772,208 |

| 2021 | 11,388,263 | 80.63% | 1,383,052 | 9.79% | 1,236,719 | 8.76% | 116,321 | 0.82% | 14,124,355 |

| 2022 | 5,476,970 | 78.78% | 860,860 | 12.38% | 558,718 | 8.04% | 55,533 | 0.80% | 6,952,081 |

The popularity of various loan options changes over time depending on broader credit conditions & the fees associated with various programs. The following 2 tables show the breakdown of nonconventional share based upon ethnicity & neighborhood information. The first table is for home purchases & the second table is for refinancing.

Home Purchases

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Asian | 2.9% | 1.8% | 2.1% | 2.6% | 13.4% | 26.1% | 26.6% | 25.8% | 21.9% | 16.1% | 14.7% | 16.6% | 15.6% | 13.4% |

| African American | 21.7% | 14.3% | 13.6% | 21.7% | 64.1% | 82.0% | 82.9% | 80.3% | 77.2% | 70.8% | 68.0% | 70.2% | 68.5% | 64.9% |

| Hispanic white | 13.7% | 7.5% | 7.0% | 12.4% | 51.4% | 75.4% | 77.0% | 74.1% | 70.7% | 63.1% | 59.6% | 62.7% | 59.8% | 55.5% |

| Non-Hispanic white | 11.1% | 8.9% | 9.5% | 11.5% | 35.4% | 52.0% | 50.3% | 47.4% | 42.2% | 35.5% | 33.4% | 36.0% | 35.2% | 33.1% |

| Other minority | 14.0% | 9.3% | 9.4% | 14.8% | 48.4% | 67.6% | 68.8% | 65.9% | 62.2% | 55.5% | 54.0% | 55.3% | 54.2% | 52.1% |

| Joint | 16.9% | 12.8% | 14.4% | 17.2% | 46.4% | 59.4% | 56.3% | 53.6% | 48.9% | 42.1% | 41.3% | 43.8% | 43.1% | 40.8% |

| Missing race | 11.3% | 5.1% | 5.7% | 8.8% | 32.7% | 50.6% | 49.4% | 45.9% | 39.4% | 31.9% | 32.2% | 34.9% | 34.7% | 31.9% |

| Low or moderate income | 20.3% | 15.2% | 14.9% | 16.0% | 46.1% | 65.3% | 66.6% | 64.5% | 59.7% | 52.5% | 50.3% | 53.4% | 51.7% | 47.4% |

| Middle income | 14.3% | 11.0% | 12.6% | 16.7% | 46.1% | 60.4% | 59.3% | 57.0% | 51.5% | 45.6% | 44.8% | 47.7% | 47.6% | 45.0% |

| High income | 5.3% | 3.9% | 4.9% | 7.5% | 26.7% | 38.5% | 37.2% | 34.4% | 29.5% | 25.1% | 24.2% | 26.3% | 26.7% | 25.2% |

| Low or moderate income neighborhood | 15.8% | 9.7% | 9.6% | 13.8% | 45.4% | 64.3% | 65.0% | 61.2% | 57.9% | 49.9% | 48.1% | 50.4% | 48.8% | 46.2% |

| Middle income neighborhood | 14.1% | 10.2% | 10.8% | 14.2% | 42.7% | 59.8% | 59.4% | 56.9% | 52.1% | 44.7% | 43.1% | 45.6% | 44.6% | 41.7% |

| High income neighborhood | 7.1% | 5.4% | 6.1% | 7.6% | 27.4% | 43.4% | 42.0% | 39.5% | 34.6% | 28.2% | 26.1% | 29.0% | 28.4% | 26.2% |

| All borrowers | 11.9% | 8.5% | 9.0% | 11.8% | 37.6% | 54.4% | 53.4% | 50.5% | 45.2% | 38.2% | 36.6% | 39.4% | 38.7% | 36.3% |

Refinancing

| 2004 | 2005 | 2006 | 2007 | 2008 | 2009 | 2010 | 2011 | 2012 | 2013 | 2014 | 2015 | 2016 | 2017 | |

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Asian | 1.2% | 0.7% | 0.6% | 1.0% | 4.6% | 5.7% | 4.7% | 4.3% | 5.9% | 6.7% | 6.8% | 9.8% | 8.3% | 10.3% |

| African American | 11.1% | 5.8% | 4.4% | 10.2% | 39.2% | 53.8% | 42.0% | 37.8% | 38.6% | 37.1% | 39.1% | 49.4% | 53.0% | 47.4% |

| Hispanic white | 5.6% | 2.6% | 1.9% | 3.9% | 20.5% | 36.2% | 28.2% | 22.9% | 26.9% | 25.8% | 21.2% | 32.1% | 30.5% | 26.4% |

| Non-Hispanic white | 4.0% | 2.4% | 2.6% | 4.9% | 15.9% | 16.8% | 13.6% | 12.2% | 14.2% | 14.8% | 16.3% | 21.0% | 21.7% | 22.4% |

| Other minority | 5.5% | 3.4% | 2.4% | 4.9% | 20.0% | 28.3% | 23.3% | 21.9% | 25.5% | 24.9% | 25.0% | 32.6% | 36.7% | 34.0% |

| Joint | 7.5% | 3.7% | 3.4% | 6.2% | 19.5% | 21.1% | 16.6% | 16.3% | 20.1% | 20.5% | 25.5% | 28.0% | 29.3% | 29.5% |

| Missing race | 4.2% | 1.9% | 1.7% | 4.1% | 18.7% | 19.0% | 12.5% | 13.6% | 16.5% | 16.7% | 21.5% | 25.5% | 27.7% | 27.7% |

| Low or moderate income | 2.3% | 1.6% | 2.9% | 5.7% | 18.3% | 16.6% | 14.1% | 11.5% | 9.3% | 9.3% | 13.0% | 16.5% | 18.4% | 23.5% |

| Middle income | 1.7% | 1.3% | 2.7% | 6.2% | 19.6% | 13.2% | 12.3% | 10.9% | 8.9% | 9.5% | 13.2% | 14.8% | 15.3% | 21.3% |

| High income | 0.8% | 0.6% | 1.1% | 2.7% | 10.6% | 7.2% | 6.8% | 6.3% | 5.5% | 6.1% | 8.8% | 9.2% | 9.2% | 14.2% |

| Low or moderate income neighborhood | 5.9% | 3.2% | 2.9% | 6.3% | 24.6% | 31.2% | 23.1% | 19.7% | 22.2% | 22.1% | 22.4% | 29.5% | 30.4% | 30.4% |

| Middle income neighborhood | 5.2% | 3.0% | 2.9% | 5.8% | 20.2% | 22.3% | 17.5% | 16.1% | 18.4% | 19.0% | 20.9% | 26.8% | 28.2% | 27.8% |

| High income neighborhood | 2.9% | 1.7% | 1.6% | 3.0% | 11.3% | 12.1% | 10.0% | 9.3% | 11.7% | 12.4% | 14.5% | 18.5% | 19.0% | 19.4% |

| All borrowers | 4.6% | 2.6% | 2.5% | 5.0% | 17.6% | 18.7% | 14.4% | 13.3% | 15.6% | 16.4% | 18.4% | 23.5% | 24.3% | 24.9% |

The next table shows what percent of dollar value of the nonconventional market various government-backed loan programs have represented since 2004.

| Loan Type | FHA Purchase | VA Purchase | FSA/RHS Purchase | FHA Refi | VA Refi | FSA/RHS Refi |

|---|---|---|---|---|---|---|

| Jan 2004 | 74.4% | 23.0% | 2.5% | 69.5% | 30.2% | 0.2% |

| Feb 2004 | 73.9% | 23.6% | 2.5% | 64.1% | 35.7% | 0.2% |

| Mar 2004 | 74.3% | 23.2% | 2.5% | 65.6% | 34.2% | 0.2% |

| Apr 2004 | 73.8% | 23.2% | 2.9% | 62.2% | 37.5% | 0.3% |

| May 2004 | 72.6% | 24.5% | 2.9% | 63.0% | 36.8% | 0.2% |

| June 2004 | 71.8% | 25.3% | 2.9% | 65.5% | 34.1% | 0.4% |

| July 2004 | 70.9% | 26.2% | 2.9% | 68.6% | 31.0% | 0.4% |

| Aug 2004 | 71.0% | 26.0% | 3.1% | 74.4% | 25.3% | 0.4% |

| Sept 2004 | 71.0% | 26.0% | 3.0% | 76.6% | 23.1% | 0.3% |

| Oct 2004 | 70.7% | 26.5% | 2.9% | 76.8% | 22.8% | 0.4% |

| Nov 2004 | 70.7% | 26.5% | 2.8% | 73.4% | 26.4% | 0.2% |

| Dec 2004 | 69.1% | 27.8% | 3.1% | 73.5% | 26.2% | 0.3% |

| Jan 2005 | 67.6% | 29.1% | 3.3% | 71.7% | 28.0% | 0.3% |

| Feb 2005 | 66.7% | 30.3% | 3.0% | 75.3% | 24.4% | 0.3% |

| Mar 2005 | 66.4% | 30.3% | 3.3% | 72.4% | 27.3% | 0.3% |

| Apr 2005 | 65.5% | 30.9% | 3.6% | 76.7% | 23.0% | 0.3% |

| May 2005 | 64.6% | 31.9% | 3.5% | 80.3% | 19.5% | 0.2% |

| June 2005 | 63.2% | 33.1% | 3.7% | 78.0% | 21.7% | 0.3% |

| July 2005 | 62.5% | 34.0% | 3.5% | 73.7% | 25.9% | 0.4% |

| Aug 2005 | 62.0% | 34.5% | 3.5% | 72.8% | 26.8% | 0.4% |

| Sept 2005 | 61.5% | 34.6% | 3.9% | 74.0% | 25.5% | 0.4% |

| Oct 2005 | 62.0% | 34.7% | 3.4% | 75.7% | 23.8% | 0.5% |

| Nov 2005 | 61.2% | 34.9% | 3.9% | 76.8% | 22.6% | 0.6% |

| Dec 2005 | 61.0% | 35.5% | 3.5% | 79.4% | 20.2% | 0.3% |

| Jan 2006 | 60.9% | 35.5% | 3.6% | 84.9% | 14.9% | 0.3% |

| Feb 2006 | 62.4% | 34.5% | 3.1% | 84.9% | 14.7% | 0.5% |

| Mar 2006 | 62.6% | 34.2% | 3.2% | 85.9% | 13.6% | 0.4% |

| Apr 2006 | 62.1% | 34.6% | 3.3% | 86.8% | 13.0% | 0.2% |

| May 2006 | 61.5% | 35.0% | 3.5% | 88.5% | 11.1% | 0.4% |

| June 2006 | 59.3% | 37.3% | 3.4% | 90.2% | 9.7% | 0.2% |

| July 2006 | 59.0% | 37.6% | 3.4% | 90.7% | 9.1% | 0.2% |

| Aug 2006 | 59.3% | 37.1% | 3.6% | 90.4% | 9.2% | 0.4% |

| Sept 2006 | 58.7% | 37.6% | 3.7% | 88.7% | 11.1% | 0.2% |

| Oct 2006 | 58.2% | 37.9% | 3.9% | 87.3% | 12.5% | 0.2% |

| Nov 2006 | 58.3% | 38.1% | 3.6% | 84.4% | 15.3% | 0.3% |

| Dec 2006 | 56.6% | 39.7% | 3.7% | 84.4% | 15.1% | 0.5% |

| Jan 2007 | 55.2% | 40.1% | 4.6% | 83.4% | 16.1% | 0.4% |

| Feb 2007 | 56.8% | 38.7% | 4.5% | 85.1% | 14.3% | 0.5% |

| Mar 2007 | 58.3% | 36.9% | 4.8% | 86.3% | 13.1% | 0.5% |

| Apr 2007 | 58.4% | 36.3% | 5.3% | 86.4% | 13.3% | 0.3% |

| May 2007 | 58.7% | 36.1% | 5.1% | 88.7% | 11.1% | 0.2% |

| June 2007 | 58.4% | 36.6% | 5.0% | 90.5% | 9.3% | 0.3% |

| July 2007 | 59.7% | 35.0% | 5.2% | 93.5% | 6.4% | 0.1% |

| Aug 2007 | 61.0% | 34.0% | 5.0% | 93.8% | 6.0% | 0.2% |

| Sept 2007 | 63.4% | 31.5% | 5.0% | 93.7% | 6.3% | 0.1% |

| Oct 2007 | 64.7% | 30.0% | 5.3% | 92.9% | 6.9% | 0.1% |

| Nov 2007 | 64.8% | 30.3% | 4.9% | 91.7% | 8.2% | 0.1% |

| Dec 2007 | 65.4% | 30.0% | 4.5% | 90.2% | 9.7% | 0.1% |

| Jan 2008 | 66.9% | 28.3% | 4.8% | 88.9% | 11.0% | 0.1% |

| Feb 2008 | 69.9% | 25.6% | 4.6% | 84.8% | 15.0% | 0.2% |

| Mar 2008 | 72.8% | 23.1% | 4.1% | 87.2% | 12.5% | 0.3% |

| Apr 2008 | 76.6% | 19.6% | 3.9% | 89.7% | 10.1% | 0.2% |

| May 2008 | 78.2% | 18.2% | 3.6% | 91.7% | 8.2% | 0.1% |

| June 2008 | 78.2% | 18.2% | 3.5% | 93.4% | 6.5% | 0.1% |

| July 2008 | 78.9% | 17.6% | 3.5% | 94.5% | 5.4% | 0.1% |

| Aug 2008 | 80.0% | 16.4% | 3.6% | 95.4% | 4.6% | 0.1% |

| Sept 2008 | 83.2% | 13.7% | 3.2% | 95.1% | 4.8% | 0.1% |

| Oct 2008 | 78.9% | 16.8% | 4.3% | 93.2% | 6.7% | 0.1% |

| Nov 2008 | 78.2% | 17.2% | 4.6% | 94.0% | 5.9% | 0.1% |

| Dec 2008 | 78.3% | 17.3% | 4.4% | 89.9% | 9.9% | 0.2% |

| Jan 2009 | 76.7% | 18.4% | 4.8% | 82.0% | 17.7% | 0.3% |

| Feb 2009 | 75.7% | 19.4% | 4.9% | 80.1% | 19.5% | 0.4% |

| Mar 2009 | 76.9% | 18.3% | 4.8% | 81.7% | 18.0% | 0.3% |

| Apr 2009 | 77.0% | 17.6% | 5.5% | 81.9% | 17.8% | 0.3% |

| May 2009 | 76.3% | 17.8% | 5.9% | 80.2% | 19.5% | 0.3% |

| June 2009 | 76.2% | 17.8% | 6.0% | 77.8% | 21.8% | 0.4% |

| July 2009 | 76.4% | 17.1% | 6.5% | 82.5% | 17.3% | 0.3% |

| Aug 2009 | 76.7% | 16.5% | 6.8% | 84.7% | 15.1% | 0.2% |

| Sept 2009 | 76.9% | 15.9% | 7.3% | 86.5% | 13.3% | 0.2% |

| Oct 2009 | 77.8% | 15.0% | 7.2% | 87.1% | 12.6% | 0.2% |

| Nov 2009 | 77.4% | 15.1% | 7.5% | 85.7% | 14.1% | 0.2% |

| Dec 2009 | 75.8% | 16.0% | 8.1% | 84.6% | 15.2% | 0.2% |

| Jan 2010 | 75.6% | 16.4% | 8.0% | 81.2% | 18.4% | 0.5% |

| Feb 2010 | 76.3% | 16.4% | 7.3% | 81.6% | 18.0% | 0.4% |

| Mar 2010 | 76.8% | 15.7% | 7.5% | 80.9% | 18.7% | 0.4% |

| Apr 2010 | 76.5% | 15.5% | 8.1% | 81.2% | 18.4% | 0.4% |

| May 2010 | 79.0% | 16.5% | 4.5% | 80.5% | 19.2% | 0.4% |

| June 2010 | 79.5% | 17.7% | 2.8% | 78.9% | 20.8% | 0.3% |

| July 2010 | 75.8% | 21.2% | 3.0% | 77.9% | 21.9% | 0.2% |

| Aug 2010 | 75.9% | 20.8% | 3.3% | 78.8% | 21.0% | 0.3% |

| Sept 2010 | 76.1% | 20.0% | 3.9% | 79.0% | 20.7% | 0.2% |

| Oct 2010 | 75.1% | 20.0% | 4.9% | 78.3% | 21.5% | 0.2% |

| Nov 2010 | 73.6% | 20.5% | 5.8% | 75.9% | 23.6% | 0.5% |

| Dec 2010 | 72.5% | 21.3% | 6.2% | 70.9% | 28.5% | 0.6% |

| Jan 2011 | 71.7% | 20.9% | 7.3% | 69.4% | 30.1% | 0.5% |

| Feb 2011 | 72.2% | 20.9% | 6.8% | 72.0% | 27.4% | 0.5% |

| Mar 2011 | 72.3% | 20.4% | 7.3% | 74.9% | 24.6% | 0.4% |

| Apr 2011 | 72.0% | 20.4% | 7.6% | 75.0% | 24.6% | 0.4% |

| May 2011 | 70.9% | 21.8% | 7.3% | 70.6% | 28.9% | 0.5% |

| June 2011 | 68.6% | 23.5% | 7.9% | 63.2% | 36.2% | 0.6% |

| July 2011 | 67.6% | 23.9% | 8.6% | 57.2% | 42.1% | 0.7% |

| Aug 2011 | 67.1% | 23.8% | 9.1% | 57.3% | 42.0% | 0.7% |

| Sept 2011 | 66.8% | 22.8% | 10.4% | 51.3% | 47.1% | 1.6% |

| Oct 2011 | 67.7% | 24.0% | 8.3% | 50.1% | 48.7% | 1.2% |

| Nov 2011 | 67.7% | 24.1% | 8.3% | 49.8% | 49.6% | 0.6% |

| Dec 2011 | 67.0% | 24.9% | 8.1% | 51.0% | 48.5% | 0.6% |

| Jan 2012 | 68.3% | 23.0% | 8.7% | 53.6% | 46.0% | 0.5% |

| Feb 2012 | 68.1% | 23.5% | 8.4% | 56.4% | 43.1% | 0.5% |

| Mar 2012 | 68.9% | 22.8% | 8.2% | 58.6% | 40.8% | 0.6% |

| Apr 2012 | 68.7% | 23.0% | 8.4% | 59.3% | 40.0% | 0.6% |

| May 2012 | 66.9% | 24.4% | 8.7% | 53.3% | 45.8% | 0.9% |

| June 2012 | 64.9% | 26.3% | 8.8% | 55.0% | 44.1% | 0.9% |

| July 2012 | 64.2% | 26.8% | 9.0% | 60.4% | 38.8% | 0.8% |

| Aug 2012 | 64.1% | 26.3% | 9.6% | 58.6% | 40.5% | 0.9% |

| Sept 2012 | 63.5% | 26.0% | 10.5% | 57.9% | 41.8% | 0.2% |

| Oct 2012 | 64.8% | 26.2% | 9.0% | 59.7% | 39.8% | 0.6% |

| Nov 2012 | 64.5% | 26.6% | 8.9% | 57.6% | 41.5% | 1.0% |

| Dec 2012 | 64.0% | 26.8% | 9.2% | 57.5% | 41.5% | 1.1% |

| Jan 2013 | 63.5% | 25.8% | 10.7% | 58.0% | 41.0% | 1.0% |

| Feb 2013 | 63.2% | 26.9% | 9.9% | 57.9% | 41.1% | 1.0% |

| Mar 2013 | 63.1% | 27.1% | 9.8% | 57.8% | 41.2% | 1.0% |

| Apr 2013 | 63.2% | 27.2% | 9.6% | 60.6% | 38.4% | 1.0% |

| May 2013 | 61.4% | 29.5% | 9.1% | 54.2% | 44.7% | 1.1% |

| June 2013 | 59.5% | 31.6% | 8.9% | 49.8% | 49.1% | 1.1% |

| July 2013 | 58.1% | 32.2% | 9.7% | 50.2% | 48.9% | 1.0% |

| Aug 2013 | 56.9% | 32.7% | 10.4% | 54.8% | 44.3% | 0.9% |

| Sept 2013 | 57.1% | 32.0% | 11.0% | 58.7% | 40.6% | 0.7% |

| Oct 2013 | 60.9% | 33.6% | 5.6% | 55.8% | 43.8% | 0.4% |

| Nov 2013 | 57.3% | 32.0% | 10.7% | 51.1% | 48.1% | 0.7% |

| Dec 2013 | 56.9% | 33.0% | 10.2% | 49.3% | 49.9% | 0.8% |

| Jan 2014 | 56.2% | 32.1% | 11.7% | 51.1% | 48.3% | 0.6% |

| Feb 2014 | 56.1% | 34.3% | 9.7% | 49.0% | 50.3% | 0.6% |

| Mar 2014 | 56.0% | 34.3% | 9.8% | 46.2% | 53.2% | 0.6% |

| Apr 2014 | 56.7% | 33.6% | 9.7% | 47.7% | 51.7% | 0.6% |

| May 2014 | 55.6% | 35.0% | 9.3% | 45.6% | 54.1% | 0.3% |

| June 2014 | 54.4% | 36.7% | 8.9% | 40.1% | 59.5% | 0.4% |

| July 2014 | 54.5% | 36.5% | 9.0% | 39.0% | 60.6% | 0.4% |

| Aug 2014 | 53.9% | 36.6% | 9.5% | 38.0% | 61.7% | 0.3% |

| Sept 2014 | 53.6% | 36.2% | 10.2% | 37.2% | 62.4% | 0.4% |

| Oct 2014 | 54.3% | 35.8% | 9.9% | 35.3% | 64.3% | 0.4% |

| Nov 2014 | 53.5% | 35.6% | 10.9% | 28.2% | 71.5% | 0.3% |

| Dec 2014 | 54.1% | 37.8% | 8.1% | 29.4% | 70.3% | 0.3% |

| Jan 2015 | 52.3% | 37.6% | 10.1% | 24.1% | 75.6% | 0.3% |

| Feb 2015 | 57.6% | 34.4% | 8.0% | 53.8% | 46.0% | 0.2% |

| Mar 2015 | 60.7% | 32.4% | 6.9% | 62.3% | 37.5% | 0.2% |

| Apr 2015 | 62.6% | 31.0% | 6.3% | 61.1% | 38.6% | 0.3% |

| May 2015 | 62.2% | 31.8% | 6.0% | 57.7% | 42.1% | 0.2% |

| June 2015 | 61.9% | 32.1% | 6.1% | 58.8% | 41.0% | 0.2% |

| July 2015 | 62.1% | 32.0% | 5.9% | 57.5% | 42.3% | 0.2% |

| Aug 2015 | 62.2% | 31.3% | 6.5% | 57.5% | 42.3% | 0.2% |

| Sept 2015 | 62.4% | 30.8% | 6.8% | 55.4% | 44.4% | 0.2% |

| Oct 2015 | 62.2% | 31.6% | 6.1% | 52.3% | 47.5% | 0.2% |

| Nov 2015 | 61.9% | 31.7% | 6.4% | 50.7% | 49.1% | 0.2% |

| Dec 2015 | 61.7% | 32.5% | 5.8% | 49.8% | 50.0% | 0.2% |

| Jan 2016 | 62.0% | 31.8% | 6.2% | 49.9% | 49.9% | 0.1% |

| Feb 2016 | 62.3% | 32.1% | 5.5% | 47.5% | 52.3% | 0.2% |