Cash-generating farmland is hard to come by for one big reason: rock-bottom debt-to-asset ratio in the land sector has owners stuck like glue to their land assets. Cropland is abundant---400 million acres in the U.S.—but only a small portion of it is up for sale or rent. The dog-fight for that which does come available is as hairy a venture as is scrambling for the home-run ball smacked into crowded stands. Even seasoned farmers are frustrated when they make a good bid for land and lose.

You don't have to leave your New York City, Miami, or San Diego home to own and operate a chunk of Iowa farmland any more. The playing field has been leveled. The real estate land game is drawing non-farm players as well as Ag pros. These savvy individuals-turned-investors may have been tipped to land auctions or sales, serendipitously stumbled on the notion, or were among the few with inside knowledge of real estate investing at large. However they came to own profitable acreage they nevertheless trained their inner real estate investor to “see' beyond the East and West coast corridors of self-absorbed real estate mayhem.

Getting a piece of cash-generating American Farmland means:

In mid-2007 an acre of top-grade cropland in Illinois was selling at a cash-generating $5 to $10k per acre, in some cases.(1) Just 10 years earlier the per acre price in the state averaged $1,150. Land prices have since plateaued—one acre of arable land fetching anywhere between $2,500 and $7,000 depending on an assortment of factors steered by a breathing matrix of volatile conditions.(2)

While farmers were making bank, the housing bubble in nearby Suburbia was going bust. And even considering the matter-of-course plateau in farm price, the course has been paved.

The buzzwords, “self-sustaining' and “self-contained' might describe the best characteristics of the Farm Credit System, a government subsidized enterprise (GSE) that actually works, and really well. Established in 1916 it was the first GSE. Its purpose was simple-- to extend credit to buyers of land via a much more streamlined and fair lending system than that used in the home mortgage business. Subsequently the federal government established Fannie Mae and Freddie Mac as the mortgage GSEs and for better or worse they have since become household names.

In its own words the Farm Credit System is,

“…a federally chartered network of borrower-owned lending institutions comprised of cooperatives and related service organizations. Cooperatives are organizations that are owned and controlled by their members who use the cooperative's products, supplies or services.' (3)

To rehash the tale of Fannie and Freddie would be like beating a dead horse, but here are the characteristics of the Farm Credit System that make it impermeable to the residential mortgage hornet's nest:

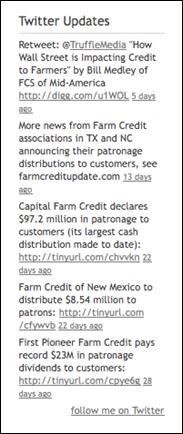

Twitter Sign of Life

You're not likely to find Fannie or Freddie Tweeting their recent news to followers. But the Farm Credit System is doing just that. Follow this Twitter update and you are rewarded with optimism and good news. How's that for a thriving real estate GSE?

New Energy Crops – Robust Appetite for Biofuel

New Energy Crops – Robust Appetite for Biofuel

Ethanol fuel demand smacked the Ag Industry in 2006, hard, so in 2007 farmers were tugging back fallow fields and row crops were scrapped for corn—the new energy crop. Corn, a staple food crop, was suddenly worth a lot more money as a biofuel and it was a no-brainer. Farmers have the know-how to get it from seed to harvest—no learning curve.

Prices for corn in the U.S. went sky-high and farmers were understandably elated. In February 2007 corn was worth $3.20+ per bushel (5) when in 2005 it had been at a decades low $2.00 per bushel. The demand has also led to runs in the market for rented and leased land options.

But corn-based ethanol production in this country is controversial, depending upon your perspective. Every major magazine that “sicks' journalists onto the scent of environmental culture has touted it as a scam, at the very least. (6)

Pro Corn Produced Ethanol:

Cons of Corn-Produced Ethanol:

Sure, land prices have been fueled partly by corn-based ethanol, but the news swirl over corn and ethanol is mixed depending on where you live and what you do for a living.

Ethanol production—largely corn produced right now -- is re-sectioning our oil lifeline to the Mideast. Short-term forecasts indicate that we will be buying 25% LESS oil from the war lords oil barons. (7)

Ethanol production—largely corn produced right now -- is re-sectioning our oil lifeline to the Mideast. Short-term forecasts indicate that we will be buying 25% LESS oil from the war lords oil barons. (7)

Wind Power—could it be the other energy “crop'…

Ag Secretary Vilsack—the Ethanol Man-- is also hip to wind power, the other energy “crop.'

Two recent federal grant programs benefit farmers' investment in small wind energy systems:

The upfront expense involved in building a small wind system is considerable, but this, like much of farming, is a long-term commitment. Return on the investment could take a few years or dozens of years depending upon, again, that breathing matrix of volatile industry factors. BUT with a wind system cranking out power, farmers can reap the rewards in slashed monthly energy bills.

Population density maps prove the highest number of people live along the East Coast between DC and Boston; in the industrial hotspots around the Great Lakes, and along the California coast, particularly LA and San Francisco. We are clustered, save for a few outliers, along the East and West Coasts. Not anecdotally our major news networks broadcast from New York, so it's not surprising that when you think of real estate you might be limiting your view of the acreage in your specific region—most of it residential  and commercial. What might happen if you started to expand your notion of available real estate to embrace LAND ownership where there's option for long-term value and even recurring income?

and commercial. What might happen if you started to expand your notion of available real estate to embrace LAND ownership where there's option for long-term value and even recurring income?

You don't need to necessarily leave your home in New York City, or Charlotte, or Seattle to own land in America's Heartland because…

You don't need to sell farmland to “see' the value. In fact the value is exactly what's keeping many farmers and other investors holding fast to the acreage they already own. And it's been luring in a small population, thus far, of non-farm buyers savvy to a good and alternative investment. You don't need to farm the land to reap the value.

Two common situations in which land lease agreements are established:

Land leasing can be a lucrative real estate option and in some areas the land grab is ultra competitive. But there are a lot of factors that decide the initial cost for land rental:

3 common types of farmland lease agreements:

The flexible cash lease has become a popular lease option particularly given industry volatility—weather, harvest, fertilizer and seed price, etc. In many areas rental land is put up for bid and depending upon the perceived value and the condition of the market, could net a competitive price.

What about the expected slide in commodities prices for 2009? Surely that little nosedive will drop land values? The overall Ag industry could be about 10% short in earnings compared to 2008. Truth be told, the loss will likely have scant effect on generally well performing land values. (USDA)

Will your inner real estate investor prick up his or her ears when you hear, “arable farmland for sale or auction'? Or will you remain one of the bi-coastal idiots that immediately disassociates – “farmland' doesn't pertain to you, right?

You may not have considered cropland ownership before now. And maybe you can imagine fewer objections, fewer obstacles to buying land.

Fact is farmland is a consistent performer in real estate investment – the golden egg.

No, not like a one-shot million-dollar lottery ticket.

Not a here-today-gone-tomorrow stock windfall.

With the right amount of tending, farmland can be a long-lasting recurring income that can broaden your horizons in so many ways.

Sources

1 NY Times, Ethanol Is Feeding Hot Market for Farmland

2 Farm Business Management

3, 4 Farm Credit Services

5 NY Times, The Price of Corn

6 Rolling Stone, The Ethanol Scam

7 Energy Business Daily, In Defense of Ethanol

8 Farm Industry News

9 USDA Rural Development