Former chairman of The Fed (Federal Reserve) from 1987 to the end of 2006, he was previously referred to as “The Maestro”. So, people used to think he was awesome, but these days he’s even being singled out as one of those chiefly responsible for the economic crisis, yet he himself protests that he is blameless. Nevertheless, it was Greenspan that was an important figure in terms of how the economy went (or was supposed to go) and he was in charge when things looked like they might turn out the way they did. Some call him a liar and Greenspan himself has commented that there were flaws in his market ideology. But the problems with crises such as these is that no one person can shoulder all of the blame for such goings wrong and Greenspan – for better or for worse – has been fingered as one of the culprits behind the problems, as he was in a position of authority and didn’t do enough to prevent it.

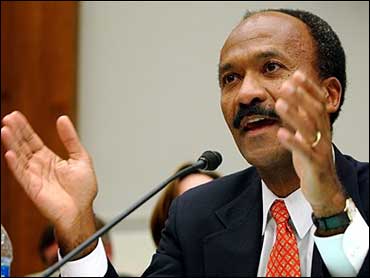

There are some economists that lay claim that this man (who was responsible for spearheading the 1999 Gramm-Leach-Bliley Act which was signed by Bill Clinton), is responsible for having “deregulated” the financial services industry, leading to the subprime mortgage crisis, which isn’t something to be proud of. Gramm has also been labeled as being “the single most important reason” for the financial crisis by a former lawyer for the SEC.

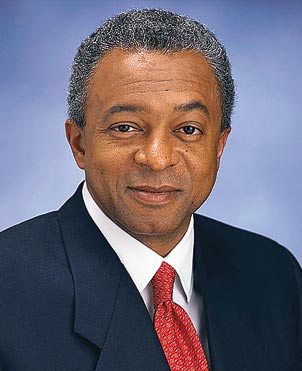

Previously the boss of the Federal National Mortgage Association (Fannie Mae), was another of those responsible for diving into the subprime mortgage market, although not until 2004, but the damage was still there to be done to the economy. In the end, it worked out well for him, as he left with a reported $240 million in benefits. However, Raines was then subsequently asked to return some of it, possibly because he couldn’t carry it all.

The CEO of Northern Rock from 2001 until the end of 2007. It was he who commandeered the bank when it was to become the fifth largest provider of mortgages in Britain; he then drew significant attention when he subsequently asked for a loan from the Bank of England, which resulted in many, many worried savers queuing up at the bank to withdraw their money, as they feared for its safety. This was the first time this had ever happened in the UK. For his “troubles”, Applegarth left the bank, but not before receiving a payoff that equates to roughly $1.15 million dollars (£760,000).

Former CEO of Citigroup, Charles “Chuck” Prince was responsible for managing the bank’s foray into subprime mortgages. However, towards the end of 2007, when he saw that the good times were coming to an end, Chuck took the hefty burden of resigning all by himself. Of course, for the effort this took him, he walked away with a $38 million payoff in bonuses, shares and the like. Man runs bank into ground. Man leaves bank whilst simultaneously rewarding himself millions. No wonder he was "still dancing" even after the music ended.

Former boss of bosses at Merrill Lynch, technically ruined the business to the tune of losses of $8 billion. Even a founder’s son laid the blame squarely on old Stan’s shoulders. Stan then announces his retirement, with a compensation package worth $161.5. It must be nice to run a bank into a wall for fun, all the time playing golf, knowing that you’d leave with financial security.

Naturally, the general public through which all this disappearing money circulates, is to share some of the blame. Average people, borrowing far beyond their means, some as much as 10 times their salaries are to blame for contributing to the overwhelming tide of debt that’s sweeping over every which way. Mortgages brokers even assigned an acronym to these people that they relentlessly lent money to; people with “no income, no job, no assets” were called “ninjas”. The reason the majority of us in the US and the UK are feeling more of the brunt of financial trauma rather than, say, France, Spain or the most of mainland Europe, is because the European Central bank runs a much tighter policy when it comes to monetary matters. Far tighter than The Fed or the Bank of England, at least. There’s also a difference in cultural dispositions when it comes to buying or renting houses. The people contributing to the financial crisis are those with a disposition to buy (resulting in mortgages and debt far beyond their ability to pay off), whereas those in other countries are more disposed towards renting, thereby keeping financials more readily under control.

Disclaimer: The above article is based on our opinions and shouldn’t be misconstrued as being anything else.