The following table shows current 30-year mortgage refinance rates. You can use the menus to select other loan durations, alter the loan amount. or change your location.

Washington D.C. is commonly referred to as “Washington,” “the District,” or “D.C.,” is formally known as the District of Columbia. It is the capital of the United States, and in 1790 it was formed as the capital district due to the signing of the Residence Act. Washington D.C. is unique in the fact that it doesn't have cities, and it instead divided up into neighborhoods. During the workweek, D.C.'s population doubles to over one million people thanks to commuters from Virginia and Maryland's suburbs. It is home to a thriving economy and a very diverse population.

Local living depends on where you settle in Washington D.C. Close to the capital buildings, and the downtown district is extremely fast-paced and can also bring higher stress levels. If you're looking for what living in a larger city is like, Washington D.C. may be the place for you. You'll get anonymity here, and this can be a draw for many people. Many people choose to live in the neighboring state suburbs and commute to work. The suburbs will give you a very diverse population as well. However, you'll also get the lower stress levels and a slightly slower pace of life, particularly if you can rely on public transportation rather than fighting the capital area traffic congestion daily.

People move to the District for a variety of important reasons. There are dozens of cultural points of interest, museums, festivals, and things to do 24 hours a day, 7 days a week. A partial list of attraction includes The White House, Lincoln Memorial, Washington Monument, Thomas Jefferson Memorial, Vietnam Veterans Memorial, Smithsonian Institution, The Pentagon, United States Botanic Garden, Arlington National Cemetery, National Postal Museum, National Museum of African American History and Culture, National Portrait Gallery, National Archives Building, National Museum of the American Indian, Ford's Theatre, Newsum, International Spy Museum, Franklin Delano Roosevelt Memorial, Martin Luther King, Jr. Memorial, United States Holocaust Memorial Museum, National Museum of American History, National Gallery of Art, National Air and Space Museum, National Museum of Natural History, and the National Zoological Park. These attractions make D.C. one of the most popular tourist destinations in the world.

You'll also have more mild weather here with four seasons, and the District features a central location. This makes it very easy to drive a few hours away for a vacation or a weekend away. You also get a variety of living conditions that range from traditional suburbs, more rural areas, townhomes, single-family homes, and tight-knit neighborhoods to choose from.

However, people also move out of the District for several important reasons. The traffic congestion is some of the worse in the nation, and the public transportation is very limited. The cost of living and housing prices also drive people away as the District has some of the highest living costs in the nation. It can also be very difficult to meet new people as most people in this are career-focused, and they work extremely long hours. The high-stress environment may also be a turnoff for many people, and the job market is extremely competitive and fast moving, so you have to be quick and assertive to succeed here.

Highly education professionals that have a high drive to succeed do very well here. Additionally, anyone with political aspirations might find Washington D.C. an attractive area to settle and work. Younger people who are eager to work in a variety of fields also find D.C. attractive as they most likely won't be competing with older workers much because they're willing to work for less. Anyone who wants to live in a cultural and ethnic melting pot will also enjoy it here, as there is a huge variety of cultures, traditions, and ethnic backgrounds found in the District.

The fourth quarter of 2005 was the first time the District's real estate market showed signs of trouble. It abruptly switched from a steep climb to a more sedate pace. This pace continued until the housing market hit its first and only peak during the third quarter of 2007. Once the housing market hit this peak, it went into a very gradual fall. There was a slight peak during the first quarter of 2009, but this quickly fell away, and the housing market continued on its downward track. This fall continued until the housing market hit its lowest point during the third quarter of 2009.

This low point in the market rose to a peak by the fourth quarter of 2009, and this peak gradually fell away as well. The market rose into one more gradual peak by the third quarter of 2010, and this dropped by the first quarter of 2011. This period brought the start of a gradual climb for the housing market, and this climb switched from a gradual pace to a more rapid one during the second quarter of 2012. This steep climb continued until the third quarter of 2013 when it hit a slight plateau that lasted until the end of the fourth quarter of 2013. This plateau ended, and the housing market resumed its climb with a slight peak during the first quarter of 2014 and the fourth quarter of 2014. The start of 2015 brought a slight drop, but the market recovered quickly and continued to climb with slight peaks during the first quarter of 2016 and the third quarter of 2016. The market has continued to climb to this day, and it has been higher than it was before the housing market crash since the third quarter of 2013.

Due to dozens of museums, attractions, famous buildings and beautiful sights many are inspired to invest in Washington DC real estate. From modern mansions to historic brownstones to brand new condominiums only steps from the cities hottest destinations attracts residents. The local economy's heavy reliance on government & lobbying makes the local real estate market strong even through economic downturns. Prices are unlikely to fall significantly unless there is both a recession and a restructure of the national government which distributes more power at the state rather than federal level.

Many of the most expensive real estate markets across the nation are around the nation's capital. As of the end of 2017 local prices were about 40% above the prior peak. High local property prices have kept DC homeownership rates well below the national average. Over the past 33 years ownership has ranged between 34.6% in 1986 and a high of 47.2% reached in 2007. As of 2016 ownership across the District of Columbia stood at 40.8% compared to a national average of 63.4%.

The start of the 1990s showed Washington D.C.'s real estate market on a plateau with no significant peaks or drops. There was a very slight drop during the third quarter of 1991, and this leveled out into another plateau. This plateau continued until the first quarter of 1994 when it dropped off slightly. The market continued to drop until the third quarter of 1994, and this is the point it started to turn around. The market rose until the first quarter of 1996, and this brought a slight peak. This peak leveled off, and the market hit another plateau that lasted until the first quarter of 1998. At this time, the market started to move in an upward trend. This trend continued until the fourth quarter of 2000.

Once the fourth quarter of 2000 started, the housing market started on a more steep track. This track continued until the third quarter of 2002 when the market slowed down and went into a more gradual rise. This gradual rise continued until the third quarter of 2003, and once this time came that housing market went on a steeper climb. This climb continued until the housing market started to show signs of trouble during the fourth quarter of 2005.

As Washington D.C. isn't a typical state, it doesn't have cities or towns. The area is divided into neighborhoods, and these are ranked as you would traditionally rank cities. Additionally, Washington D.C. is home to several popular suburbs that come from neighboring states.

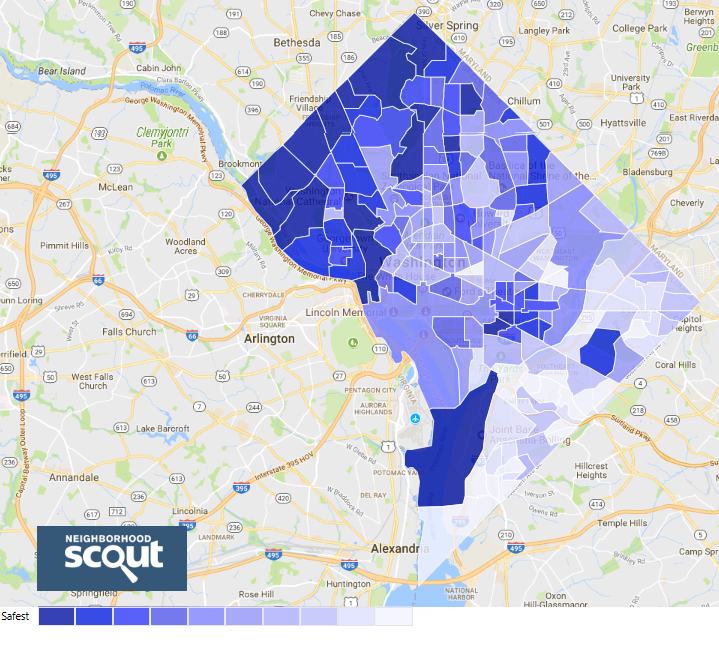

The southeastern part of Washington D.C. has lower living costs but higher rates of crime, whereas the central and northwestern parts of the district have higher living costs and lower crime rates. Areas north of downtown are rapidly gentrifying.

| Census | Pop. | Change | % △ |

|---|---|---|---|

| 1800 | 8,144 | ||

| 1810 | 15,471 | 7,327 | 90.00% |

| 1820 | 23,336 | 7,865 | 50.80% |

| 1830 | 30,261 | 6,925 | 29.70% |

| 1840 | 33,745 | 3,484 | 11.50% |

| 1850 | 51,687 | 17,942 | 53.20% |

| 1860 | 75,080 | 23,393 | 45.30% |

| 1870 | 131,700 | 56,620 | 75.40% |

| 1880 | 177,624 | 45,924 | 34.90% |

| 1890 | 230,392 | 52,768 | 29.70% |

| 1900 | 278,718 | 48,326 | 21.00% |

| 1910 | 331,069 | 52,351 | 18.80% |

| 1920 | 437,571 | 106,502 | 32.20% |

| 1930 | 486,869 | 49,298 | 11.30% |

| 1940 | 663,091 | 176,222 | 36.20% |

| 1950 | 802,178 | 139,087 | 21.00% |

| 1960 | 763,956 | -38,222 | −4.8% |

| 1970 | 756,510 | -7,446 | −1.0% |

| 1980 | 638,333 | -118,177 | −15.6% |

| 1990 | 606,900 | -31,433 | −4.9% |

| 2000 | 572,059 | -34,841 | −5.7% |

| 2010 | 601,723 | 29,664 | 5.20% |

| 2016 | 681,170 | 79,447 | 13.20% |

The Adams Morgan neighborhood is located in the Northwest portion of Washington D.C, and it has a population of 28,338 people with a ward population of 74,462 people. This neighborhood consists of primarily nineteenth and early twentieth-century apartment buildings and row style houses. This neighborhood's name comes from two elementary schools that were once segregated but combined due to the Boiling vs. Sharpe Supreme Court ruling.

Education and the service industry are the two main economic supports for this neighborhood. In particular, the nightlife is a thriving industry in this city with dozens of clubs, restaurants, and entertainment venues dotted along Adams Morgan. The government also plays a strong role in supporting the local economy, and thousands of workers come to this neighborhood during the work week.

The Adams Morgan neighborhood has a humid subtropical climate that comes with four distinct seasons and generally mild temperatures year round. The winter months are usually mild with moderate snowfall and temperatures in the thirties. The summer months are hot and humid with temperatures in the high seventies. The temperatures are also prone to large daily fluctuations year-round.

This neighborhood is considered to be a gateway community for immigrants, and this lends to the neighborhood's diversity and cultural points of interest. Over ninety establishments have a liquor license, and there is a large five block radius downtown that has a variety of shops, boutiques, and cafes. You can visit the Phillips Collection, which is a museum dedicated to modern art. You can also visit Madams Organ for music, beer, and a thriving nightlife or the Songbyrd Music House & Record Cafe.

The Adams Morgan neighborhood is served by the District of Columbia Public Schools. Students can also attend the Oyster Adams Bilingual School, which is split into two campuses by grade level. Residents of this neighborhood are zoned to a specific school district depending on their location in the Adams Morgan area.

The local economy for Adams Morgan is very diverse and strong. It has an unemployment rate that falls below the national average. The Northwest quadrant of Washington D.C. where Adams Morgan is located is the largest of the four quadrants. It contains the richer demographic of Washington, D.C.

The Adams Morgan neighborhood has a local median home price of $563,800, and this works out to a $609 price per square foot. These prices have risen by 1.1% in the past year, and they're projected to go up by another 0.9% in the coming year. The Washington Metro has a local median home price of $534,996.

Adams Morgan has a local crime rate that is over 29% higher than the national average, and this means that roughly every one in twenty-eight people will become a victim of a crime. However, Adams Morgan is still ranked as being a safer neighborhood than almost half of the Washington D.C. neighborhoods. It has a livability score of sixty-three out of one hundred, and this score makes it the eighteenth most livable neighborhood in the District.

The commute time from the Adams Morgan neighborhood to DC Proper is typically around ten minutes. However, when you consider you only have to travel around 1.5 miles, this puts it in perspective how bad traffic can be in this area.

The neighborhood of Anacostia is considered to be one of the historic neighborhoods in Washington D.C., and it is located in the Southeast quadrant of the city. It has a population of 51,256 people along with a ward population of 73,662 people. Around 1668 to 1670, the area known as Anacostia was settled, and it has since grown into a very diverse, historic district.

Anacostia has seen very large growth over the past few years in the employment and resident sectors due to a huge revitalization project. Tourism, healthcare, government, retail, and education make up the largest sectors of the local economy. Anicostia's waterfront was recently the city's fastest-growing area of employment, entertainment and residential growth. This is due to a $10 billion restoration and revitalization plan that is underway, creating 6,500 units of new housing and three million square feet of new parkland.

St. Elizabeth's Hospital has been serving the neighborhood for more than 100 years, and the Joint Base Anacostia-Bolling military facility is here as well.

This neighborhood has a humid subtropical climate with four seasons, and each season has a short transitional period. The summer months are hot with high humidity and temperatures in the low eighties. The winter months are more mild with moderate snowfall amounts and temperatures in the thirties. However, the temperatures can fluctuate greatly day by day.

Tourists come to visit the World's Largest Chair, which is widely considered to be Anacostia's landmark, and it is located at the corner of Martin Luther King Jr. Avenue and V Street. The Anacostia River Waterfront is another area of interest and it has been undergoing huge renovations to include parks, trails, a nursery, and much more. People also come to visit the Anacostia Community Museum and the Anacostia Arts Center.

The District of Columbia Public Schools serves the Anacostia neighborhood, and students can also attend the charter school Thurgood Marshall Academy. The school district is split into several high and middle schools, and which school the students attend depends on their location in the neighborhood.

The diversity of the local economy makes for a very solid and strong foundation. Anacostia's unemployment rate is below the national average, and the revitalization project makes this neighborhood one of the fastest-growing in Washington D.C. with a variety of jobs available.

The local median home price for Anacostia is $323,500 with an average price per square foot of $490. These prices have increased by 8.7% in the past year, and they're estimated to increase by another 2.7% in the coming year. The Washington Metro has a local median home price of $534,996.

Anacostia has a crime rate that is over 214% higher than the national average, and this means that on average, everyone in twelve residents will become victims of violent crime. Anacostia is considered to be one of the unsafest neighborhoods in Washington D.C., and it has a livability score of forty-three out of one hundred. This score ranks Anacostia as the thirty-fourth safest place to live in the District.

On average, a person can expect to have almost a twenty-minute commute from the neighborhood of Anacostia to DC Proper. You'll travel just over five miles, and this commute can slow further if traffic is particularly bad.

Georgetown is another neighborhood that is located in the Northwest quadrant of Washington D.C. It has a population of 20,464 people with a ward population of 76,883 people. A port neighborhood, Georgetown features a very diverse economy. The neighborhood was established by a fur trader in 1632, and Georgetown was officially adopted as part of the District in 1871.

This is a vibrant community with upscale shops, bars, and restaurants along it's cobblestone streets. Many of the 200 year-old restored homes have beautiful gardens. This neighborhood is also the home of Georgetown University. You can get to this neighboorhood by the Georgetown Metro Connection which runs every ten minutes from 7a.m. to midnight from Rosslyn and Dupoint Circle metro stations. The local economy has influences from the education sector, government, retail, trade, tourism, and the service industry. It is home to a large main university campus, and there are also several foreign embassies based out of this neighborhood. The service industry and retail also help with several large shopping centers and dozens of smaller restaurants, hotels, and cafes.

Georgetown has a humid subtropical climate as well, and this means that you'll experience very hot and humid summer months, especially around July and August. The winter months are more mild, and January is typically the coldest month with temperatures ranges from the upper forties to freezing. As with most of Washington D.C., daily temperatures can fluctuate by as much as fifty degrees.

Tourists come to walk through the gorgeous gardens that are located in Dumbarton Oaks, and they also come for a walk along the Chesapeake and Ohio Canal. The House of Sweden is another architectural marvel people come to see, and it houses the Iceland and Sweden embassies. If you like blues and jazz music, take a stroll down Blues Alley or gallery hop around Book Hill for dozens of small art galleries and showings.

This particular neighborhood is home to many private and preparatory schools including the Georgetown Visitation Preparatory School. The District of Columbia Public Schools serves this neighborhood as well with several zoned schools throughout the neighborhood. For secondary education, students can take classes at the main campus of Georgetown University.

The local economy is very strong, and the several diverse sectors you can find in Georgetown enable this local economy to continue to grow at a rapid pace. Georgetown University provides thousands of jobs during the school year, and the busy tourist season works to strengthen the retail sector of the economy further.

Georgetown has a local median home price of $1,108,100 with an average price per square foot of $910. However, the real estate market is cold, and these prices have decreased over the past year by 2.2%. They're projected to continue to fall by another 0.1% in the coming year.

The neighborhood of Georgetown has a crime rate that is almost 20% lower than the national average, and this ranks it as safer than over 70% of the neighborhoods in Washington D.C. Every one in forty-four people will become the victim of a violent crime in Georgetown, and this makes Georgetown's livability a seventy-five out of one hundred. Out of all of the neighborhoods in the District, Georgetown comes in at number eleven.

People who live in Georgetown and commute to DC Proper should expect to have around a ten to fifteen-minute commute each day. However, people who commute only have to travel around two miles, and this is one of the shorter commutes residents will have.

The Burleith neighborhood is one of the more upscale neighborhoods in Washington D.C., and it has a population of 20,464 people. Additionally, the gated community of Hillandale is just west of the neighborhood, and it is considered to be part of Burleith. The ward population of this neighborhood is 76,883 people. Burleith's history can be traced back as far as 1886 when a family bought several large pieces of land and began to build on them.

The neighborhood of Burleith and the neighboring gated community of Hillandale come from a strong but varied economic background. The retail, government, and education sectors are the three main supports of the local economy. It has an unemployment rate that is below the national average, and it is showing potential for job growth over the next year.

Burleith is surrounded by green space, and it is a very vibrant community. There is a thriving arts scene, and it is also home to several college students and families. This neighborhood is a short walk from Georgetown, and this gives the people who live here a lot to do. You can visit parks, museums, walking trails, and dozens of smaller restaurants and shops.

This neighborhood is home to the Duke Ellington High School of the Arts, and the entire community is very art oriented. There is another elementary, middle, and high school to choose from as well. As Georgetown is just a short walk away, it is very easy for students to attend the neighboring Georgetown University.

Many people move to Burleith because it is so close to many larger employers, but the neighborhood has its own feel. The economy is very strong, and many people work in the education and government sectors. Hillandale has residents that commute to local neighborhoods for employment, and several of them are very well off.

This is one of the more upscale neighborhoods, and it has a local median home price of $1,061,200 with a price per square foot of $725. These prices have increased by 5.1% over the past year, and they're projected to go up another 1.4% in the coming year. The Hillandale local median home price is $1,145,980.

Burleith/Hillandale has a crime rate that is 10% below the national average. This means that every one in sixty people will become the victim of a violent crime, and this makes this neighborhood safer than 80% of the Washington D.C. neighborhoods. For a livability rating, Burleith/Hillandale scores an eighty out of one hundred.

The average commute time from Burleith/Hillandale to DC Proper is around thirteen minutes. However, most residents of Burleith/Hillandale only have to travel around two miles, so this commute depends heavily on how bad the traffic congestion is on that particular day or time.

Kalorama Heights is a neighborhood with a population of 18,338 people, and it is located in the Northwest quadrant of Washington D.C. The ward population of this area is 74,462 people. Kalorama Heights started off as a rural community in 1795, but it quickly expanded into a residential community. Today, Kalorama Heights is a busy neighborhood with a diverse population.

The economy in Kalorama is very strong, and it has an unemployment rate that falls below the national average. The service industry, government, education, and retail all play vital roles in the economy's health. There are several smaller cafes, shops, boutiques, and exhibits that draw tourists through Kalorama as well.

The Kalorama Heights neighborhood experiences a humid subtropical climate with very hot and humid summer months that have temperatures in the eighties. The winter months bring cooler weather and moderate snowfall with temperatures sitting between the low thirties and mid-forties. Daily temperatures can fluctuate in Kalorama Heights, especially in the winter months.

People come from nearby neighborhoods for the museums and cultural points of interest that are located in Kalorama Heights. The Korean Cultural Center is located here, and it has several displays and exhibits. Another event gallery that is worth the time to walk through is the IA&A at Hillyer. Finally, if you want to get outside into a green space, Mitchell Park has plenty of walking trails.

The public school district in this neighborhood are operated by the District of Columbia Public Schools. Additionally, students who live in this neighborhood are zoned to particular schools, and they attend elementary school in the Adams Morgan neighborhood. There are no colleges or universities located in this neighborhood.

The neighborhood of Kalorama Heights has a local median home price of $1,307,200 with a price per square foot of $675. These prices have increased over the past year by 0.3%, and they're projected to increase by another 0.8% in the coming year.

Kalorama Heights has a crime rate that falls 19% below the national average. On any given day, you have a one in forty-four chance of becoming a victim of a violent crime, and this makes Kalorama Heights safer than 71% of Washington D.C. neighborhoods. In addition to this, Kalorama Heights is the fourth most desirable neighborhood to live in throughout the District.

Residents can expect less than a ten-minute commute from Kalorama Heights to DC Proper, but they also only have to travel less than two miles to get there. Again, this demonstrates how bad the traffic can be around DC Proper, and residents should expect this total to fluctuate on any given day.

Aside from the United States capitol building and home of Congress it is one of the oldest residential communities in Washington and with roughly 35,000 people in just under two square miles, it is also one of the most densely populated. A large portion of the Capitol Hill neighborhood is now designated as the historic district. To the east of Capitol Hill lies the Anacostic River, to the north is the H Street corridor, to the south are the Southeast/Southwest Freeway and the Washington Navy Yard, and to the west are the National Mall and the city's central business district.

A vibrant community with some of Washington, DC's finest museums, historic homes and foreign embassies as well as a variety of ethnic restaurants, bookstores, and private art galleries. There are lots of high-rise apartment buildings and many rowhouses have been converted into apartments. The Circle itself is a gathering place with park benches, grass and a unique fountain in the center.

A very nice residential area with two of the biggest hotels in Washington(The Sheraton-Washington and the Omni Shoreham). It also has a huge collection of international restaurants.

This is a close-knit community-oriented neighborhood which has gone under revitalization such as a 92-unit condominium project. Also two new flanking buildings that are keeping with the architecture of the area's early 20th century apartment buildings and row houses. The neighborhood has many active neighborhood groups and associations including, but not limited to, the Bloomingdale Civic Association, the Bloomindale Garden Club, the Public Safety Initiative , the Big Bear Book Club, the Big Daddy Running Cub, and Crispus Attucks Development Corporation. New businesses have recently opened such as the Bloomingdale Inn(a bed and breakfast, Window's Market (a market and cafe with wifi access), Big Bear Cafe (a cafe and coffeehouse), the P Spot (a women's fitness studio featuring strip aerobics and polefit classes), Showtime Barbershop and Salon, and Timor Bodega(serving hard to find produce, wine, beers, and local/organic produce). Every summer the Bloomingdale Farmers' Market is open on Sundays from 10:A.M. to 2:P.M.. While only in the permit phase, the owners of the Veranda are looking to open an "American-style" pizzeria and tavern.

A 546,000 square feet shopping and entertainment complex is under contstruction in the heart of Columbia Heights. With major retailers like Target, Best Buy, Washington Sports Club, and Bed Bath and Beyond, DC USA will become the one-stop shopping destination for all of Washington, DC. An abandoned building will be converted to a 4-story 13,000 sq. ft. mixed -use developement. The first level and have a sit down restaurant and small eatery. The second through fourth levels will be residential condominiums.

The Washington DC Economic Partnership offers overview profiles of all 54 neighborhoods here.

The Urban Institute also offers neighborhood-by-neighborhood info here.

The DC Public Library offers a collection of neighborhood history resources.

DC.gov publishes an interactive map with all 39 neighborhood clusters.

Ever since the 2008 financial crisis happened the Washington D.C. metro area has become one of the fastest growing areas of the country, reversing population declines which began in the late 1950s and lasted into the 2000s due in part to rising crime rates & a high cost of living.

Between 2010 and 2016 the population of Washington D.C. increased by 13.2% while the broader metro area grew by 8.8%

| US Rank | Metropolitan Area | 2016 Pop | 2010 Pop | Change | % △ |

|---|---|---|---|---|---|

| 6 | Washington-Arlington-Alexandria, DC-VA-MD-WV Metro | 6,131,977 | 5,636,232 | 495,745 | 8.80% |

The national capital has 61.05 mi² of land area, giving it a population density of 11,157.58 people per mi².

Here is a map of the 8 wards which make up the nation's capital along with the 39 associated neighborhood clusters.

Source: NeighborhoodInfo DC [PDF]

All table columns are sortable. Click on the column headers to sort by that column. Click again to sort low to high.

| Neighborhood | Cluster | 2010 Cluster Pop | Ward | 2010 Ward Pop | Average Sale | Median Sale | Price / ft² |

|---|---|---|---|---|---|---|---|

| DISTRICT OF COLUMBIA AVERAGE | $625,000 | $544,500 | $539 | ||||

| DC METRO AREA | $458,000 | $428,700 | $218 | ||||

| Adams Morgan | 1 | 18,338 | 1 | 74,462 | $565,128 | $557,250 | $646 |

| American University Park | 11 | 12,216 | 3 | 78,887 | $1,065,464 | $1,092,500 | $609 |

| Barnaby Woods | 10 | 11,986 | 4 | 75,773 | $936,737 | $927,450 | $516 |

| Barry Farm | 37 | 8,071 | 8 | 73,662 | $294,975 | $295,000 | $280 |

| Bellevue | 39 | 30,959 | 8 | 73,662 | $299,351 | $319,000 | $295 |

| Benning | 32 | 13,008 | 7 | 71,748 | $242,833 | $287,500 | $213 |

| Benning Ridge | 32 | 13,008 | 7 | 71,748 | $293,425 | $291,500 | $304 |

| Bloomingdale | 21 | 19,481 | 5 | 74,308 | $682,654 | $705,000 | $550 |

| Brentwood | 22 | 8,459 | 5 | 74,308 | $359,100 | $342,000 | $365 |

| Brightwood | 17 | 19,455 | 4 | 75,773 | $566,114 | $580,000 | $444 |

| Brightwood Park | 18 | 39,924 | 4 | 75,773 | $652,571 | $699,900 | $474 |

| Brookland | 22 | 8,459 | 5 | 74,308 | $658,375 | $666,000 | $467 |

| Buena Vista | 37 | 8,071 | 8 | 73,662 | $118,000 | $90,000 | $214 |

| Burleith/Hillandale | 4 | 20,464 | 2 | 76,883 | $1,193,375 | $1,202,500 | $748 |

| Burrville | 31 | 14,500 | 7 | 71,748 | $270,000 | $270,000 | $283 |

| Capitol Hill | 26 | 20,909 | 6 | 76,000 | $710,526 | $730,000 | $618 |

| Capitol View | 33 | 14,888 | 7 | 71,748 | $325,095 | $350,653 | $256 |

| Cardozo / Shaw | 3 | 12,174 | 1 | 74,462 | $765,145 | $695,000 | $678 |

| Carver / Langston | 23 | 14,510 | 5 | 74,308 | $467,125 | $515,000 | $476 |

| Cathedral Heights | 14 | 11,713 | 3 | 78,887 | $416,415 | $364,500 | $383 |

| Chevy Chase | 10 | 11,986 | 3 | 78,887 | $944,554 | $995,000 | $522 |

| Cleveland Park | 15 | 12,829 | 3 | 78,887 | $754,462 | $476,250 | $571 |

| Colonial Village | 16 | 3,957 | 4 | 75,773 | $1,149,666 | $1,050,000 | $422 |

| Columbia Heights | 2 | 47,378 | 1 | 74,462 | $582,566 | $566,000 | $569 |

| Congress Heights | 39 | 30,959 | 8 | 73,662 | $322,618 | $343,000 | $270 |

| Connecticut Ave / K Street | 6 | 17,318 | 2 | 76,883 | $485,000 | $370,000 | $580 |

| Crestwood | 18 | 39,924 | 4 | 75,773 | $1,160,464 | $1,157,325 | $531 |

| Deanwood | 31 | 14,500 | 7 | 71,748 | $286,519 | $290,000 | $253 |

| Douglass | 38 | 9,710 | 8 | 73,662 | $303,000 | $319,000 | $285 |

| Downtown | 8 | 13,560 | 2 | 76,883 | $550,166 | $527,500 | $615 |

| Dupont Circle | 6 | 17,318 | 2 | 76,883 | $633,376 | $499,500 | $681 |

| Dupont Park | 34 | 14,963 | 7 | 71,748 | $413,500 | $413,500 | $347 |

| Eastland Gardens | 29 | 2,445 | 7 | 71,748 | $317,500 | $317,500 | $317 |

| Eckington | 21 | 19,481 | 5 | 74,308 | $522,423 | $525,000 | $499 |

| Edgewood | 21 | 19,481 | 5 | 74,308 | $517,397 | $550,000 | $485 |

| Embassy Row | 15 | 12,829 | 3 | 78,887 | $1,275,000 | $1,275,000 | $667 |

| Fairfax Village | 35 | 7,688 | 7 | 71,748 | $94,716 | $85,000 | $138 |

| Fairlawn | 34 | 14,963 | 7 | 71,748 | $318,500 | $310,000 | $258 |

| Foggy Bottom | 5 | 16,160 | 2 | 76,883 | $668,042 | $551,000 | $666 |

| Forest Hills | 12 | 15,500 | 3 | 78,887 | $583,895 | $399,990 | $464 |

| Fort Davis Park | 34 | 14,963 | 7 | 71,748 | $318,125 | $321,250 | $277 |

| Fort Dupont | 32 | 13,008 | 7 | 71,748 | $52,447 | $52,447 | $51 |

| Fort Lincoln | 24 | 11,723 | 5 | 74,308 | $470,563 | $540,000 | $281 |

| Fort Stanton | 36 | 7,572 | 8 | 73,662 | $265,000 | $265,000 | $198 |

| Fort Totten | 19 | 13,206 | 4 | 75,773 | $686,666 | $675,000 | $478 |

| Foxhall Crescent | 13 | 18,558 | 3 | 78,887 | $1,298,500 | $1,297,500 | $589 |

| Foxhall Village | 13 | 18,558 | 3 | 78,887 | $958,000 | $910,000 | $630 |

| Friendship Heights | 31 | 14,500 | 3 | 78,887 | $893,818 | $875,000 | $665 |

| George Washington University | 5 | 16,160 | 2 | 76,883 | $208,750 | $208,750 | $569 |

| Georgetown | 4 | 20,464 | 2 | 76,883 | $1,469,866 | $1,260,000 | $873 |

| Grant Park | 31 | 14,500 | 7 | 71,748 | $281,500 | $300,000 | $319 |

| Greenway | 32 | 13,008 | 7 | 71,748 | $239,500 | $239,500 | $224 |

| Hawthorne | 10 | 11,986 | 4 | 75,773 | $907,500 | $907,500 | $567 |

| Hill East | 25 & 26 | 6 | 76,000 | $817,546 | $830,000 | $620 | |

| Hillcrest | 35 | 7,688 | 7 | 71,748 | $465,000 | $465,000 | $287 |

| Historic Anacostia | 28 | 4,876 | 8 | 73,662 | $282,874 | $296,000 | $224 |

| Ivy City | 23 | 14,510 | 5 | 74,308 | $270,000 | $270,000 | $288 |

| Kalorama Heights | 1 | 18,338 | 1 | 74,462 | $3,081,333 | $2,875,000 | $747 |

| Kenilworth | 29 | 2,445 | 7 | 71,748 | $319,450 | $319,450 | $288 |

| Kingman Park | 25 | 29,295 | 6 | 76,000 | $611,500 | $625,000 | $525 |

| Lamond Riggs | 19 | 13,206 | 4 | 75,773 | $551,579 | $539,000 | $452 |

| Langdon | 22 | 8,459 | 5 | 74,308 | $590,625 | $556,250 | $320 |

| Lanier Heights | 1 | 18,338 | 1 | 74,462 | $746,780 | $710,000 | $632 |

| LeDroit Park | 3 | 12,174 | 1 | 74,462 | $570,400 | $472,000 | $508 |

| Lincoln Heights | 31 | 14,500 | 7 | 71,748 | $325,750 | $325,750 | $297 |

| Logan Circle / Shaw | 7 | 23,895 | 2 | 76,883 | $681,986 | $675,000 | $687 |

| Lower Central NE | 30 | 6,573 | 7 | 71,748 | $318,058 | $250,000 | $302 |

| Lower Fairfax Village | 35 | 7,688 | 7 | 71,748 | $594,000 | $594,000 | $470 |

| Manor Park | 17 | 19,455 | 4 | 75,773 | $556,246 | $588,000 | $433 |

| Marshall Heights | 33 | 14,888 | 7 | 71,748 | $306,136 | $325,000 | $282 |

| Massachusetts Avenue Heights | 15 | 12,829 | 3 | 78,887 | $634,159 | $392,000 | $525 |

| Mayfair | 30 | 6,573 | 7 | 71,748 | $279,266 | $275,300 | $286 |

| McLean Gardens | 14 | 11,713 | 3 | 78,887 | $586,158 | $410,000 | $539 |

| Michigan Park | 20 | 8,875 | 5 | 74,308 | $562,306 | $577,500 | $421 |

| Mount Pleasant | 2 | 47,378 | 1 | 74,462 | $887,525 | $893,750 | $584 |

| Mount Vernon Square | 8 | 13,560 | 2 | 76,883 | $629,562 | $677,450 | $666 |

| Near Northeast | 25 | 29,295 | 6 | 76,000 | $796,665 | $770,000 | $570 |

| Near Southeast | 27 | 5,705 | 6 | 76,000 | $649,985 | $629,900 | $622 |

| North Capitol Street | 8 | 13,560 | 2 | 76,883 | $184,000 | $184,000 | $413 |

| North Cleveland Park | 12 | 15,500 | 3 | 78,887 | $1,275,886 | $1,300,000 | $618 |

| North Michigan Park | 20 | 8,875 | 5 | 74,308 | $592,722 | $609,000 | $503 |

| North Portal Estates | 16 | 3,957 | 4 | 75,773 | $1,009,500 | $1,009,500 | $506 |

| Northeast Boundary | 31 | 14,500 | 7 | 71,748 | $219,125 | $220,750 | $202 |

| Park View | 2 | 47,378 | 1 | 74,462 | $721,225 | $734,950 | $532 |

| Penn Branch | 34 | 14,963 | 7 | 71,748 | $417,833 | $385,000 | $358 |

| Petworth | 18 | 39,924 | 4 | 75,773 | $683,964 | $700,000 | $475 |

| Pleasant Plains | 2 | 47,378 | 1 | 74,462 | $580,542 | $579,500 | $570 |

| Queens Chapel | 19 | 13,206 | 4 | 75,773 | $494,544 | $470,000 | $392 |

| Randle Highlands | 34 | 14,963 | 7 | 71,748 | $200,000 | $200,000 | $271 |

| Shepherd Park | 16 | 3,957 | 4 | 75,773 | $784,476 | $807,500 | $435 |

| Shipley | 38 | 9,710 | 8 | 73,662 | $303,500 | $303,500 | $273 |

| Southwest / Waterfront | 9 | 11,588 | 6 | 76,000 | $435,966 | $391,250 | $474 |

| Southwest Employment Area | 9 | 11,588 | 6 | 76,000 | $510,000 | $510,000 | $379 |

| Spring Valley | 13 | 18,558 | 3 | 78,887 | $1,736,250 | $1,525,000 | $617 |

| Stanton Park | 25 | 29,295 | 6 | 76,000 | $721,433 | $712,500 | $599 |

| Stronghold Metropolis View | 22 | 8,459 | 5 | 74,308 | $380,000 | $380,000 | $345 |

| Takoma | 17 | 19,455 | 4 | 75,773 | $488,211 | $450,000 | $386 |

| Tenleytown | 11 | 12,216 | 3 | 78,887 | $804,500 | $949,000 | $707 |

| The Palisades | 13 | 18,558 | 3 | 78,887 | $1,648,579 | $1,325,000 | $652 |

| Trinidad | 23 | 14,510 | 5 | 74,308 | $564,900 | $600,950 | $457 |

| Truxton Circle | 21 | 19,481 | 5 | 74,308 | $894,833 | $722,500 | $631 |

| University Heights | 20 | 8,875 | 5 | 74,308 | $551,600 | $535,450 | $508 |

| Upper Central NE | 30 | 6,573 | 7 | 71,748 | $178,500 | $306,000 | $215 |

| Washington Highlands | 39 | 30,959 | 8 | 73,662 | $290,962 | $311,925 | $258 |

| Wesley Heights | 13 | 18,558 | 3 | 78,887 | $2,840,000 | $2,950,000 | $695 |

| West End | 5 | 16,160 | 2 | 76,883 | $673,954 | $605,000 | $700 |

| Woodley Park | 15 | 12,829 | 3 | 78,887 | $1,088,086 | $751,000 | $626 |

| Woodridge / South Central | 24 | 11,723 | 5 | 74,308 | $600,918 | $597,500 | $404 |

In addition to its numerous neighborhoods, Washington D.C.'s residents like to live in a few suburbs and commute to work during the work week. This can be a less expensive option, and you get to get away from where you work on the weekends.

As a suburb of Washington D.C. Metro, Alexandria has a population of 155,810 people. This suburb is broken up into a more historic sector and a newer sector, and it was founded in 1749. However, it wasn't incorporated as a city until 1852, and as an independent city until 1870. It is part of the larger Washington-Arlington-Alexandria Metro, and this Metro has a population of 6,131,977 people.

The local economy has large influences from the government and military sectors. The education sector also plays a vital role in supporting the local economy, as does health, finance, and transportation. All of these varied and diverse sectors translate over into a strong economy with a large variety of jobs both in the city and in neighboring Washington D.C.

Alexandria has a humid subtropical climate zone that brings long, humid, and hot summer months with July temperatures in the low nineties. The winter months are more mild with moderate snowfall amounts and temperatures in the mid-thirties. The spring brings rain and cooler temperatures, and the fall is crisp.

Tourists come to Alexandria in the winter months to see the annual Scottish Christmas Walk, which has been ongoing since 1969 and features a variety of music, food, and booths. The George Washington Masonic National Memorial is another tourist draw, along with the First Night Alexandria. For sports, the Alexandria Aces call this city home.

There are several private schools in Alexandria, and the city is served by the Alexandria City Public Schools. There are also several secondary education institutions located in and around this city including the Northern Virginia Community College – Alexandria Campus. Students can also attend Virginia Theological Seminary, or the Virginia Commonwealth University.

The local economy has a mix of large public and private employers, and the biggest employer is the United States Department of Commerce with over 1,400 employees. The second biggest employer is the United States Department of Defense with 1,200 staff. Finally, the third biggest employer is Alexandria City Public Schools with over 1,000 staff.

Alexandria has a strong economy, and this is evident by its low unemployment rate that is well below the national average. In addition to this, it has also seen job growth over the past year to strengthen the economy further. Alexandria is projecting that it'll add 38% more jobs in the next decade.

This city's crime rate gives a livability score of thirty-five out of one hundred, and you have a one in one hundred and forty-four chance of becoming a victim of a violent crime. Alexandria is marked as being safer than 35% of cities in the United States.

The local median home price for Alexandria is around $582,000 with a price per square foot of $341. These prices have increased over the last year by 4.2%, and they're projected to increase over the next year by another 1.2%. The Washington Metro has a local median home price of $534,996.

Residents who live in Alexandria and commute to DC Proper for work should expect a commute time of around twenty minutes. Although Alexandria is only seven in a half miles from the District, traffic slows down the average commute time.

Another popular suburb of Washington D.C. is Arlington County in Virginia. Arlington has a population of 223,945 people, and this makes it the second-largest principle city in the District. It is part of the larger Washington-Arlington-Alexandria Metro, and the Metro has a combined population of 6,131,977 people. Arlington has the highest median income in the nation, and it also has one of the highest ratios of single people.

Arlington has a very strong and stable economy, and it has the lowest unemployment rate of anywhere else in Virginia. Both the state and Federal governments play a large part in supporting Arlington's economy, and there are also several bigger companies who have their headquarters here as well. Insurance, education, hospitality, military, and healthcare also play vital roles in the local economy.

A humid subtropical climate dominates Arlington, and this brings four seasons and fluctuating temperatures year-round. The winters here are generally more mild when you compare them to the rest of the nation, and the city sees moderate amounts of snowfall. The summers are usually very hot and humid with rain coming in the early spring and lasting through August.

Millions of tourist come to Arlington each year to visit Arlington National Cemetery and the Tomb of the Unknown Soldier. You can also take several tours throughout the day and evening including the Double Decker Bus Tour. This city has a very rich historical background, and it shows by the dozens of tours, museums, exhibits, and monuments here like the Arlington House.

Arlington Public Schools serves this city with twenty-two elementary schools, five middle schools, and four high schools, and it has almost 26,000 enrolled students. There are also several private and religious schools throughout Arlington. For secondary education, students can attend Marymount University or the Virginia Tech Research Center – Arlington.

The city's economy is dominated by the government sector, and the United States Department of Defense currently employs over 24,000 people. The second biggest employer is Arlington County, and the County has over 7,750 staff. Finally, the employer that rounds out the top three biggest employers is the United States Department of Homeland Security with 7,300 staff.

Arlington's economy is over 1.5% below the national average, and it has also seen recent job growth over the past year by 0.45%. This is largely due to the heavy government influences that stabilize the local economy. Over the next ten years, Arlington is estimating that it'll add 38% more jobs to the local economy.

Arlington's crime rate ranks it at a forty-two out of one hundred, and this means that you have a one in seven hundred twenty-eight chance of being the victim of a violent crime. The livability score ranks Arlington as a safer place to live than over 40% of the nation's cities and suburbs.

The local median home price for Arlington is $647,400 with an average price per square foot of $454. These prices have gone up over the past year by 2.8%, and they're on track to increase by another 1.3% in the coming year. The Washington Metro has a local median home price of $534,996.

People who live in Arlington and commute to DC Proper for work should expect to have around a fifteen minute commute time. They're going to be traveling just over four miles, but the traffic can make this commute time fluctuate greatly.

Bethesda is another Washington D.C. suburb that a lot of the workers live in and commute from during the work week. Bethesda has a population of 62,102 people. This town has been ranked as one of the best educated in the nation, along with one of the top-earning. It took its name from the Hebrew word that means “House of Mercy.” As Bethesda is an unincorporated part of Montgomery County, it has no official boundaries.

The government, finance, education, healthcare, and the hospitality industry all make up big roles in supporting the local economy. Education and medical research also play supporting roles, and there is a large and thriving business district in downtown Bethesda. This diverse economy is constantly evolving and changing to keep up with the larger surrounding cities.

Bethesda has a humid subtropic climate zone, and this means residents can experience temperatures up in the eighties during the summer months with cooler temperatures from November through March. The summer months also bring very high humidity and light rainfall starting in early spring.

This city is home to several cultural points of interest, museums, festivals, and art exhibits. You can visit the Strathmore Theatre and take in a variety of live performances. The Ratner Museum also features a wide variety of regional and local art exhibits, or you can spend the day at the KID Museum with your family.

There are ten public elementary schools, three public middle schools, and three public high schools in Bethesda. In addition to this, students can attend one of nineteen private schools located throughout the suburb. For secondary education, students can attend the Uniformed Services University of the Health Sciences, which is a Federally funded health science university.

The local economy is dominated by the government and the technology industry. The biggest employer is Lockheed Martin with over 2,500 employees. The second biggest employer is IBM, and it currently has over 1,800 staff. The third biggest employer found in Bethesda is Development Alternatives Inc. with 1,500 staff members.

The economy is doing very well, and it has an unemployment rate that falls well below the national average. There has also been 1.3% job growth over the past year to strengthen the economy further. Over the next ten years, Bethesda is projecting that it'll add 39% more jobs to the local economy.

Bethesda has a crime index ranking of sixty-one out of one hundred, and this ranking means that you have a one in nine hundred and four chance of becoming the victim of a violent crime. Additionally, Bethesda ranks a safer than 60% of the communities in Maryland.

The local median home price for Bethesda is $825,200, and this averages out to a price per square foot of $450. These prices have increased over the past year by 1.2%, and they're slated to increase another 0.5% in the coming year.

For people who live in Bethesda and commute to DC Proper, they should expect to have at least a twenty-five-minute commute. You'll only travel around seven miles, but you're going through some of the heavier traffic areas of Washington D.C.

As of 2024 the conforming loan limit across the United States for single-famly homes was set to $766,550, with a ceiling of 150% that amount in areas where median home values are higher. As the District of Columbia is a high cost area, the conventional mortgage limits are as follows:

| Property Type | Amount |

|---|---|

| Single Unit | $1,149,825 |

| Double Unit | $1,472,250 |

| Triple Unit | $1,779,525 |

| Quadruple Unit | $2,211,600 |

The median home value in Washington D.C. is $641,455 yielding a price per square foot of $539. The median monthly rent is $2,600 in Washington D.C., while rent in the broader metro area runs $2,150 per month. Home buyers who are borrowing more than the above limits will likely need to obtain a jumbo mortgage. Jumbo loans typically have a slightly higher rate of interest than conforming mortgages, which varies based on credit market conditions.

Several different types of home loans are available in the nation's capital. Fixed-rate loans are very common, and the terms include thirty, twenty, fifteen, and ten years. The longer the life of the mortgage, the lower the monthly payment will be, which is why the 30-year loan is the most popular. The downside of this, however, is that the APR is higher compared to shorter-term loans. The difference can be as large as a full percentage point. 30-year loans are the most popular choice across the nation & high local property values make them the most popular choice in the capital as well.

In addition to conventional 30-year and 15-year fixed-rate mortgages, lenders offer a wide variety of adjustable rate mortgages (ARM’s). While these instruments have lost some of their attractiveness during the recession, there are still circumstances where they offer the only way for a borrower to qualify. Properly structured (that is, with strict limits on how much the rate can fluctuate), such loans are still a legitimate way for borrowers to purchase a home and start building equity while establishing their credit so as to qualify for conventional loans upon the ARM’s expiration. These loans provide interest rates that fluctuate, as the name implies. The APR is usually fixed for an initial term, such as three, five, seven or ten years. Then the rate adjusts depending on the performance of a referenced index rate, usually once per year; but it can change more frequently. The loan agreement may state in detail how frequently the APR can change, and it may also include a rate cap to prevent large changes.

Balloon mortgages are another route for aspiring homeowners. Balloon mortgages are when a large portion of the borrowed principle is repaid in a single payment at the end of the loan period. Balloon loans are not common for most residential buyers, but are more common for commercial loans and people with significant financial assets.

A few lenders in the state offer interest-only loans, but usually only for periods of three years. These are mortgages where payments are applied only to interest for a period of time. The loan's principal isn't paid down, so the monthly payments are very low. The low monthly payments only lasts a few years, however. Typically, it's about three years. After this period, monthly payments spike because the loan's principal hasn't been reduced & the remainder of the loan must be paid off in a compressed period of time. For example, on a 3 year IO 30-year loan, the first 3 years are interest only payments, then the loan principal must be paid in full in the subsequent 27 years.

When qualifying for a loan, a credit score of 720 or better can help secure a favorable loan. Some mortgage lenders have approved borrowers with credit scores around 640. The best rates and deals will be obtained with a score above 740. There is a lot of competition among lenders, and this environment can create nice perks for borrowers. For example, some banks will offer special deals on closing costs for borrowers who qualify. The cost might be added to the mortgage or the bank will pay the closing costs but add a few basis points to the APR.

A debt-to-income ratio of 40% and a down payment of 20% are what most banks want to see on a home loan application. They will accept worse numbers, but fees and APR's could go up as a result. Also, a down payment of less than 20% typically results in required mortgage insurance. This down payment requirement does not apply for Federal assistance programs such as FHA, in which applicants can have a lower credit score and income but still receive financing.

The piggyback loan is another type of mortgage which is simply two mortgages in one. The piggyback loan can eliminate the need for private mortgage insurance by covering 80% of the home's value with the first loan, while the second loan helps to pay for part of the down payment.

Prospective home buyers who don't find what they're looking for at one of the state's private banks may want to take a look at some of the mortgage options the federal government offers. One of them is the loan program at the Veterans Administration, which provides mortgages with zero down. On top of that great deal, VA loans do not require private mortgage insurance. The agency does, however, charge a funding fee, and this varies from 1.2% to 3.3%. Making a voluntary down payment will reduce this charge. And in case you're wondering, yes you do have to be a qualified veteran to get one of these unbeatable deals.

If you're not a vet, you may want to consider the Federal Housing Administration's home loan services. The FHA offers loans to people who have a credit score of at least 580 and who can put at least 3.5% down. The government agency also offers mortgages for lower credit scores, but it requires more money down with these loans.

Home Purchase Assistance Program

The goal of the Home Purchase Assistance Program is to help people who qualify purchase a home with an interest-free mortgage loan. Any applicant for this program has several eligibility requirements they have to meet to be considered eligible. Applicants have to be at or below the 80% area income limit, meet the purchase price requirements, and show documentation of their income.

Funding for this program comes in an interest-free loan that provides a minimum of $80,000 in gap financing assistance. It may also contain up to $4,000 in closing cost funding assistance. Additionally, the loan is deferred until the property owner refinances or sells the property. For people who are at or below 110% of the area's median income limit, payments are deferred for five years, and the funding is a 40-year principal only repayment system.

DC Open Doors Down Payment Assistance Program

The DC Open Doors Down Payment Assistance Program aims to provide down payment assistance to eligible home buyers in the Washington D.C. area. Applicants do have to follow either the FHA or Frannie May/Freddie Mac mortgage guidelines. The funding comes in the form of a five-year forgivable loan that is non-amortizing.

Applicants for this program will have to meet income limits, but they're higher. The household income limit for this program is set at a maximum amount of $132,360. Additionally, the assistance is repayable if the applicant sells, refinances, or moves out of the property within five years of receiving the funding.

The nation's capital is considered to have a moderate risk of hail & tornadoes. A basic homeowners policy should cover financial damages from tornadoes & hail damages to roofs.

The capital region is considered to have a very low risk of: flooding, hurricane storm surges, earthquakes & wildfire.

Most natural disasters are typically covered by homeowner's insurance polices with the exception of flooding and earthquakes.

The local property tax rate stood at 0.64% in 2016, which is far below the national average rate of 1.24%. Local home prices are well above the national average, which drives up the local assessment.

Washington D.C. has one of the higher property tax expenses in the nation, and it ranks as the twentieth highest state. On average, a property owner whose home has an assessed market value of $443,700 can expect to pay around $2,057 in property taxes every year. This amount works out to approximately 2.09% of the property owner's yearly income. Unlike other states that have a fluctuating property tax rate from county to county, Washington D.C.'s property tax rate is one flat rate no matter where you live.

Single-family homeowners in the nation's capital paid $4,915 on a median $772,008 home in 2016, placing the average DC single-family home assessment above states like California & Illinois while being slightly below the rates charged throughout much of New England & other states in the northeast. The average single-family homeowner across the nation paid $3,313 on a $279,715 home.

Washington D.C. has a different system for their homestead exemption. The homestead exemption was designed to help struggling homeowners keep their property in the event of a bankruptcy. While this is true for Washington D.C. residents, there is a slight twist on this law.

If the person purchased their home within 1,215 days of filing for bankruptcy, the homestead exemption caps at a maximum exemption of $155,675. However, if the person purchased the property prior to 1,215 days before they filed for bankruptcy, the homestead exemption is unlimited. The exemption applies to real property, and this includes your home or condo as well as any interest the homeowner or the homeowner's dependents have in a co-op property where they reside. It can also be used to protect a burial plot.

The type of mortgages used in Washington are called THE DEED OF TRUST. This differs from a mortgage in that, in many states, it can be foreclosed by a non-judicial or judical proceedings. Foreclosures in Washington D.C. are handled both through the judicial and the nonjudicial process. Most mortgage lenders choose to utilize the nonjudicial foreclosure process. The nonjudicial foreclosure doesn't involve the court system, and the mortgage lender has to follow a detailed set of guidelines to complete the foreclosure process. This is typically a faster process than a judicial foreclosure, and this is one reason why many mortgage lenders choose to use it.

Washington D.C. is a recourse state, and the mortgage lender is allowed to sue a defaulted borrower for a deficiency in both the judicial and nonjudicial foreclosure. However, if the mortgage lender plans to use the defaulted borrower in a judicial foreclosure, this must be part of the original foreclosure lawsuit. Additionally, the mortgage lender is allowed to sue the borrower for the full deficiency amount.

Foreclosure Process

Check out the following resources to learn more about the Washington D.C. real estate market.

The Federal Reserve has started to taper their bond buying program. Lock in today's low rates and save on your loan.

Are you paying too much for your mortgage?

Check your refinance options with a trusted lender.

Answer a few questions below and connect with a lender who can help you refinance and save today!