Here is a table listing current FHA home loan rates available in Columbus. You can use the menus to select other loan durations, alter the loan amount, or change your location.

After the global COVID-19 health and economic crisis mortgage rates reached all time record lows in October 2020.

Historically when the economy is hot the share of conventional loans increases, and when the economy goes into a recession the government-backed programs gain marketshare.

For example, if we go back to the prior economic crisis, nearly four out of 10 buyers who purchased a home in November of 2009 did so with the help of a mortgage loan insured by the Federal Housing Administration, or FHA.

According to the Mortgage Bankers Association, on November 6th, 2020 the 30-year fixed rate mortgage had an average price of 2.98%. The average FHA 203(b) loan was a tenth of a percent higher, at 3.28%.

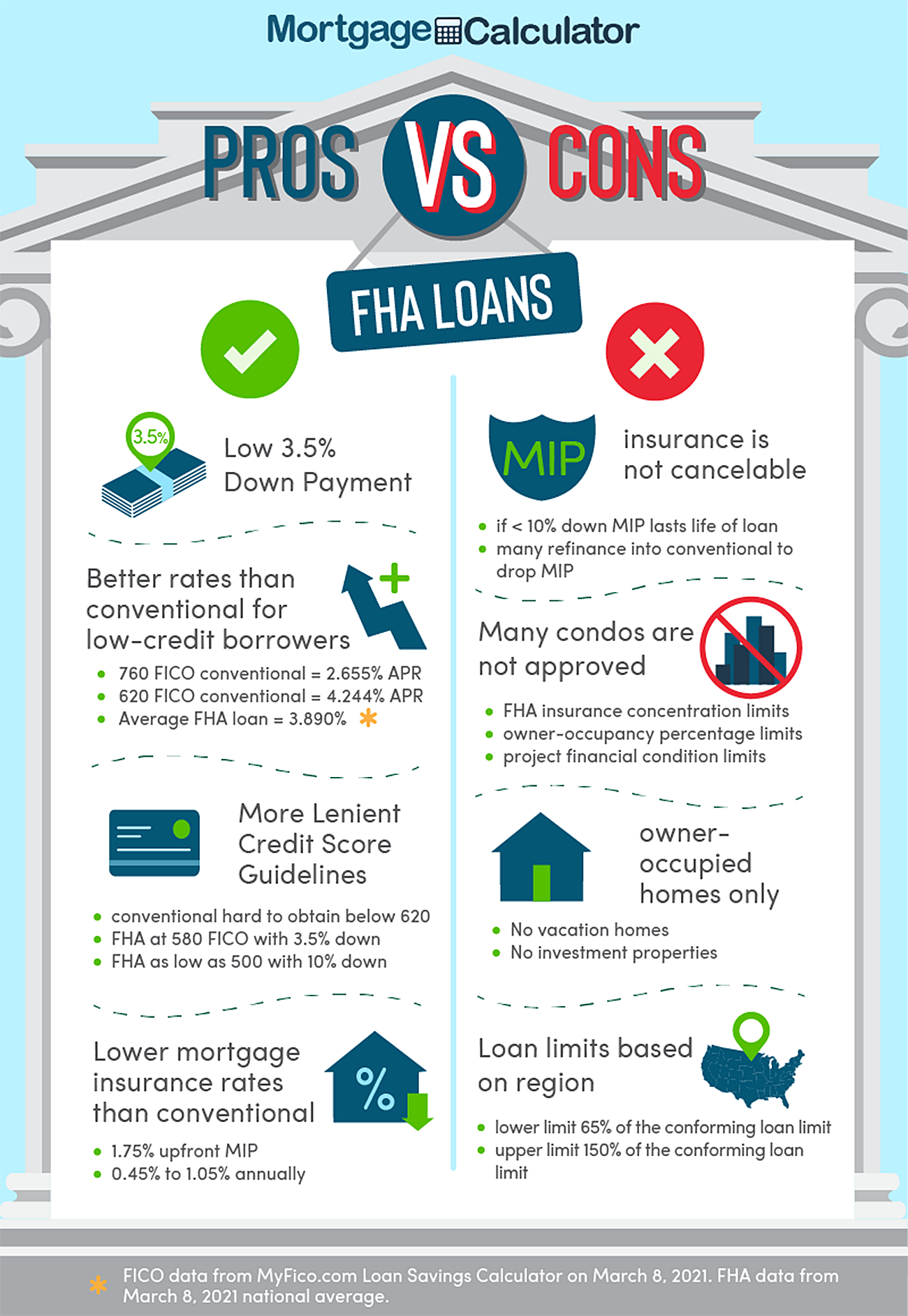

Need a mortgage with less stringent credit requirements and affordable down payments? FHA loans can work for you. The Federal Housing Administration (FHA) sponsors residential mortgages specifically for low to moderate-income consumers. It’s also a viable option for many first-time homebuyers.

Our guide will explain a brief history of the FHA mortgage program, how it works, and the qualifications to secure an FHA loan. We’ll discuss its main advantages, and several drawbacks to consider before taking this option. We’ll also compare FHA rates versus conventional loan rates, and explain why FHA mortgages may sometimes have lower or higher rates. Finally, we’ll provide a rundown of different FHA mortgage programs and how they can address specific housing needs.

Estimate Your FHA Loan Closing Costs & Monthly Payments in Advance

Use our FHA loan qualifier or quickly estimate your FHA loan closing costs.

The Federal Housing Administration (FHA) was first established under the National Housing Act in June 27, 1934. It was primarily created to facilitate and improve home financing in the wake of the Great Depression. The FHA sought to raise housing standards and boost liquidity in the housing market.

Prior to the Great Depression, mortgages were structured with adjustable rates and 11 to 12-year fully amortizing terms. Homebuyers could only receive financing for 50% to 60% of the home’s value, which meant they had to seek multiple mortgages to finance their home. Commercial banks and life insurance companies also offered 5-year balloon mortgages, which came with an expensive lump sum payment by the end of the term.

When homeowners could not afford to pay the large balloon payment, they kept on refinancing their mortgage to extend the term. Eventually, many borrowers could not afford the costly balloon payments, which resulted in massive foreclosures. By 1933, between 40% to 50% of all home loans in the U.S. were in default. The mortgage system was on the verge of total collapse.

However, with the FHA in place, rules were implemented to improve lending practices. The FHA increased the required loan-to-value ratio, which eliminated the need to obtain multiple mortgages. Homebuyers were guaranteed 80% financing in exchange for a 20% down payment. The FHA also recommended extended fixed-rate terms, which eventually gave rise to the 30-year fixed-rate mortgage. This allowed more Americans to afford homes and pay for them within a longer, more manageable period. The FHA’s efforts helped stabilize the housing market, which lifted the U.S. economy from depression.

By 1965, the FHA became an agency under the U.S. Department of Housing and Urban Development (HUD). Since 1934, the FHA has sponsored over 40 million home loans and counting. Today, the department continues to help make homebuying accessible to more Americans. FHA programs are known for low down payment options and relaxed credit qualifications.

As the economy continued to grow, many mortgage lenders became brash and overly confident about extending credit. Around the early 2000s, these lenders began offering conventional mortgages to high-risk borrowers with weak credit backgrounds. Some conventional loan programs even offered zero down payment options (100% financing), and mortgages with extended 40 and 50-year payment terms.

During this time, FHA mortgages still provided affordable down payment options, as low as 3% of the home’s purchase price. They also imposed mandatory credit requirements. But because many conventional lenders offered subprime mortgages, more borrowers chose them over FHA loans. FHA loans required mortgage insurance premium (MIP) and origination fees which made interest rates higher for borrowers. Rates were especially higher for those with past credit issues. For these reasons, more consumers obtained subprime mortgages from conventional lenders.

By the late 2000s, a massive decline in home prices prompted the housing crisis. This happened after the collapse of the housing bubble in 2006 and 2007, which was caused by the subprime credit problem. Since lenders extended mortgages to borrowers with shaky credit and large debts, they had greater risk of defaulting on loans.

When the housing bubble collapsed, it led to widespread delinquencies, foreclosures, and devaluation of housing-related securities. U.S. Homeowners were left with upside down mortgages. Because their mortgage balance was greater than their home’s value, even if they sold it, they couldn’t pay back their loan. According to online foreclosure company RealtyTrac.com, by 2009, a total of 2.8 million U.S. households received foreclosure filings.

After the subprime mortgage crisis, mortgage lenders became stricter with credit qualifications. Zero down payment conventional loans ceased to exist in the housing market. With higher lending standards, homebuyers with limited income and low credit found it harder to secure conventional loans. As a recourse, many borrowers turned to FHA mortgages once more. By November 2009, nearly 4 out of 10 homebuyers purchased homes with FHA loans. Today, besides low down payments offered by the FHA, only government-backed mortgages such as VA loans and USDA loans provide 100% financing options.

The 2020 COVID-19 Crisis & Record Low Rates

Due the COVID-19 crisis, mortgage rates dropped to unprecedented lows. Despite the recession, in August 2020, the U.S. Census Bureau reported that home sales increased by 43% compared to the previous year. By October 2020, the Washington Post reported that the average 30-year fixed-rate mortgage fell to 2.81% from 2.87%. At the time, the average rate was the lowest since Freddie Mac started conducting the survey in 1971. The 30-year fixed average rate fell below the 3.69% level compared to 2019.

Seeing COVID-19’s impact in 2020, the Federal Reserve intervened to keep benchmark index rates low. They did this in order to stimulate market activity and help the economy recover. True enough, many consumers started buying homes, with a great number of homeowners rushing to refinance their mortgage for lower rates. According to Fortune, home sales in 2020 were driven by demand for suburban property by millennial and first-time homebuyers. Their purchases came at a time when work-from-home policies became prevalent in many industries.

Throughout the decades, the FHA program has made mortgages accessible to many homebuyers. Today, qualified FHA borrowers are guaranteed 96.5% financing. This is possible if you have a credit score of at least 580 and above. Meanwhile, those with lower credit scores between 500 to 578 can also qualify for an FHA loan, as long as they provide a 10% down payment. The FHA program is meant to facilitate lending among lower and middle class consumers. To safeguard mortgage lenders, they provide federal insurance protections in case borrowers default on their loans.

Despite the 2020 recession, the U.S. homeownership rate increased from 65.1% in 2019, to 65.8% in 2020. An estimated 16% of homebuyers obtained FHA loans in 2020, according to a report by the National Association of Realtors (NAR). On the other hand, 64% were reported to take conventional mortgages. These remain the most widely purchased type of home loan in the U.S. Meanwhile, 14% of homebuyers chose to take VA mortgages. The report notes that 24% of first-time homebuyers chose FHA loans more than repeat homebuyers, who only chose FHA loans at 11%.

To understand how FHA loans work, let’s review its requirements in comparison with conventional mortgages. Generally speaking, mortgage eligibility for the FHA program is more relaxed compared to conventional loans.

Borrowers with low or poor credit scores may obtain FHA loans. If your credit score is at least 580, you are allowed to make a 3.5% down payment based on the home’s purchase price. If your credit score falls between 580 to 579, you are still eligible for an FHA loan. But to fulfill the requirement, you must provide a 10% down payment. This means you can secure 90% financing with an FHA loan.

Favorable Rates for Low Credit Borrowers

The FHA program offers one of the most lenient credit requirements in the housing market. If you have a low credit rating, you’re likely to receive a more favorable rate with an FHA loan than a conventional loan.

With conventional mortgages, lenders typically approve borrowers with a credit score of 680 and above. If your credit score falls at 620 and below, it’s harder to obtain a conventional loan. With conventional mortgages, the higher your credit score, the lower the rate you’ll receive. Meanwhile, if you have a low credit score, you’re bound to receive a much higher rate with a conventional loan. In other cases, a conventional lender might not approve your application at all.

As for down payment requirements, expect to make a higher down payment on a conventional loan than an FHA mortgage. Most conventional lenders prefer 20% down, though conventional lenders accept lower down payments. While it’s a large sum, it will help you bypass private mortgage insurance (PMI). On the other hand, many homebuyers offer less than 20% down, which requires them to pay PMI for a limited time. Once your loan-to-value ratio reaches 78%, PMI is automatically removed on a conventional mortgage.

Both FHA mortgages and conventional loans accept down payments offered as gifts. Your down payment can be gifted by your parents, sibling, or friends. Gift money may also come from a company or charitable organization. As a requirement, gift funds must include an official letter from the giver. It should state the amount of the gift money, and that they do not expect any payment in return. You must also submit supporting documents. A deposit slip and a copy of the giver’s latest account statement is needed as proof of the source of the funds.

Why are FHA rates usually higher than conventional loans? FHA mortgages especially offer low down payment options and relaxed credit standards for low to moderate-income borrowers. Thus, it requires lenders to secure unique certifications and participate in a lot of bureaucracy to provide this type of loan. For this reason, even with guaranteed federal protection, FHA mortgages are typically more costly for lenders.

Initially, the FHA set their own rate for mortgages up until the early 1980s. However, after the Housing and Urban-Rural Recovery Act of 1983, FHA mortgage rates began adapting a market-based setting. This meant that FHA loan rates would vary depending on the FHA-backed lender. Thus, it pays to shop around for different lenders while looking for an FHA mortgage to compare rates. On the other hand, because conventional lenders are usually more competitive, they typically provide lower rates than FHA loans.

Over the years, FHA mortgage rates have generally been higher than conventional mortgage rates. Since the year 2000, FHA loan rates were usually 0.125% to 0.25% higher than conventional loans. But except for the years following the late 2000s financial crisis (2010 – 2015), for a couple of years, FHA loan rates were lower than conventional mortgages. At that time, loan level price adjustments and guarantee fees were offered with FHA loans, which made them lower than conventional mortgage. However, if the lender passed them on to the borrower, the rate becomes higher.

The following chart details average FHA loan rates beside average conventional loan rates from the year 2000 to 2020. It shows average rates every three years.

| Year | Loan Volume | Average FHA Loan Rate | Average Conventional Loan Rate |

|---|---|---|---|

| 2000 | 831,5472 | 8.38% | 8.26% |

| 2003 | 1,128,934 | 6.07% | 5.94% |

| 2006 | 399,905 | 6.53% | 6.50% |

| 2009 | 1,831,320 | 5.33% | 5.27% |

| 2012 | 1,184,498 | 3.65% | 3.85% |

| 2015 | 1,116,214 | 3.75% | 3.93% |

| 2018 | 1,014,609 | 4.78% | 4.54% |

| 2020 | 1,333,176 | 3.36% | 33.11% |

*Data from Freddie Mac, HUD, and Mortgage Bankers Association

As of March 5, 2021, the average interest rate for a 30-year fixed mortgage is 3.23%, with an average APR of 3.44%. Meanwhile, the average interest rate for a 30-year fixed FHA mortgage is 3.05%, with an average APR of 3.89%. This data was taken from Interest.com.

FHA mortgage rates can be higher or lower than conventional loan rates depending on the FHA-sponsored lender. It makes sense to check different lenders so you can choose the most favorable rate. Some lenders may include certain fees that make conventional loan rates more competitive. Your credit history and credit score will also impact the rate you will receive. If you’re comparing the same points and mortgage rates for an FHA loan and a conventional loan, the conventional loan may usually have a lower rate.

With the FHA loan program, you may still qualify for a mortgage even after a bankruptcy or foreclosure. Because it’s directly sponsored by the government, it gives lenders an added layer of protection in case you default on your loan. In contrast, it’s harder to secure a conventional loan with a foreclosure or bankruptcy record. You also have to wait longer. But with an FHA mortgage, you don’t have to wait as long to secure a loan again.

For instance, if you have a foreclosure record, you can apply for an FHA mortgage 3 years after the foreclosure has ended. And if the foreclosed home was insured by an FHA mortgage, you only have to wait for 1 year. But with a conventional mortgage, you’ll likely wait for 7 to 8 years before you can qualify again for a mortgage. Unless you can prove extenuating circumstances, you cannot shorten your waiting time to 3 years.

FHA Loans Do Not Charge Prepayment Penalties

Unlike many conventional mortgages, FHA loans do not come with prepayment penalties. This means you can sell your home early, refinance early, or make extra payments on your mortgage without worrying about extra costs. Prepayment penalty usually lasts for the first three years of a mortgage.

Meanwhile, many conventional mortgages come with a prepayment penalty rule. This is typically around 1% to 2% of your loan amount. While you can negotiate for a conventional loan without a prepayment penalty clause, it may be harder to get one depending on your lender.

Lenders assess your debt-to-income ratio (DTI), which helps lenders determine mortgage eligibility. Expressed in percentage, DTI ratio is a risk indicator that measures the amount of your debt payments in relation to your total monthly income. Having a high DTI ratio suggests you will likely have trouble meeting monthly payments. This indicates it’s not a good idea to take on further debt, unless you reduce your current balance or pay most of them off. On the other hand, a low DTI ratio means you’re a low-risk borrower with good financial standing. Even with sudden emergencies, you are more likely to keep making mortgage payments as agreed.

FHA loans charge a mandatory mortgage insurance premium (MIP), which is used by the FHA to fund the home loan program. It is required whether or not you make a 20% down payment on your property. Note that this type of mortgage insurance only protects the lender. It’s is an extra cost which does nothing for you in case you have trouble making loan payments. But as a trade-off, if you have low credit and limited funds, it helps you qualify for a mortgage to afford a home.

Unlike private mortgage insurance (PMI) for conventional loans, the MIP requirement is usually lower. MIP is paid both as an upfront fee and annual fee for FHA loans. Upfront MIP costs 1.75% of the loan, while the annual MIP ranges between 0.45% to 1.05% of your loan amount. For most FHA borrowers, they pay an average of 0.80% MIP over the life of the loan. Depending on your FHA loan, the annual MIP is typically required for the entire duration of the mortgage. This can make your loan more costly the longer you pay it down. Consider this drawback before taking an FHA mortgage.

How long is MIP paid? While rules have changed over time, MIP is required for the entire life of a 30-year FHA loan. Meanwhile, borrowers with 15-year FHA loans or less pay their MIP for 11 years. If you pay 10% down, you’ll only have to pay MIP for 11 years. On the other hand, if you put less than 10% down, MIP is required for the entire duration of the mortgage.

On the other hand, PMI for conventional loans costs between 0.25% to 2% of your mortgage. This is only required if you offer less than 20% down payment. It is also automatically canceled once you’ve gained sufficient equity on your home. This is nowhere as long as MIP payments for FHA loans. PMI is removed once your loan-to-value ratio (LTV) reaches 78%.

MIP for FHA loans is determined based on the borrowers loan-to-value ratio (LTV). Making a small down payment increases loan-to-value ratio, which imposes more risk on lenders. Thus, a higher loan-to-value ratio leads to a higher annual MIP rate. For a list of annual FHA MIP rates in 2021, refer to the following tables.

MIP Rates for FHA Loans Over 15 Years

These are for borrowers with 30-year FHA loans or loans longer than 15 years.

| Base Loan Amount | LTV | Annual MIP |

|---|---|---|

| ≤ $625,500 | ≤ 95% | 80 bps (0.80%) |

| ≤ $625,500 | > 95% | 85 bps (0.85%) |

| >$625,500 | ≤ 95% | 100 bps (1.00%) |

| > $625,500 | > 95% | 105 bps (1.05%) |

MIP Rates for FHA Loans Up to 15 Years

Borrowers who make a higher down payment and take a 15-year term or less receive lower MIP rates.

| Base Loan Amount | LTV | Annual MIP |

|---|---|---|

| ≤ $625,500 | ≤ 90% | 45 bps (0.45%) |

| ≤ $625,500 | > 90% | 70 bps (0.70%) |

| > $625,500 | ≤ 78% | 45 bps (0.45%) |

| > $625,500 | 78.01% to 90% | 70 bps (0.70%) |

| > $625,500 | > 90% | 95 bps (0.95%) |

How Long Borrowers Pay for FHA MIP

Borrowers with FHA mortgages which originated after June 3, 2013 pay MIP for the following number of years:

| Term | LTV | Before June 3, 2013 | After June 3, 3013 |

|---|---|---|---|

| ≤ 15 years | ≤ 78% | no yearly MIP | 11 years |

| ≤ 15 years | 78.01% to 90% | removed at 78% LTV | 11years |

| ≤ 15 years | > 90% | loan term | loan term |

| > 15 years | ≤ 78% | 5 years | 11 years |

| > 15 years | 78.01% to 90% | removed at 78% LTV & 5 years | 11 years |

| > 15 years | > 90% | removed at 78% LTV & 5 years | loan term |

Refinancing to Eliminate MIP

Because MIP is paid for majority of the mortgage term, it makes your monthly payments more costly over time. To remove this extra cost, many FHA borrowers eventually refinance into a conventional mortgage. Refinancing is basically taking a new loan to pay off your existing mortgage. It’s a strategy that allows you to reduce your current mortgage rate, shorten your term, or both. First-time homebuyers use FHA loans as a means to secure an affordable mortgage. Afterwards, they refinance into a conventional loan to obtain more favorable terms which boost their interest savings.

When you choose an FHA loan, take note of the required loan limits. If you need a specifically large amount, depending on your area, an FHA loan might not be an available option. If this is the case, you might have to look for a conventional lender who is willing to finance a larger loan amount.

FHA mortgage limits vary per county and is grouped into different tier levels. The ‘floor’ limit, which is designated for low-cost areas, is 65% of the national conforming limit. Meanwhile, the ‘ceiling,’ which is the designated loan limit for high-cost areas, is 150% of the national conforming loan limit. Furthermore, the ceiling also lists down limits for special exception areas with more expensive construction costs. Special exception areas include Alaska, Hawaii, Guam, and the U.S. Virgin Islands.

While there are loan limits to FHA mortgages, throughout the years, the FHA has increased the ceiling. Thus, it is possible to obtain a large enough loan if you plan to purchase a house in a high-cost area. If you’re thinking about relocating to a new area, it’s worth checking FHA mortgage lending caps in different counties. The HUD website provides a special feature that shows current FHA loan limits for counties throughout the country.

The national conforming loan limit is set to $766,550 in 2024. The minimum FHA loan limit is set to 65% this amount, while the cap is set at 150%. For the year 2024, FHA floor limits for single-unit housing is $498,257, and the ceiling is $1,149,825. For special exception areas, single-unit housing come with a loan limit of $1,724,725. For a full list of 2024 FHA loan limits, see the chart below.

| Home Type | Floor | Ceiling | Special Exception Areas |

|---|---|---|---|

| 1-unit | $498,257 | $1,149,825 | $1,724,725 |

| 2-unit | $637,950 | $1,472,250 | $2,208,375 |

| 3-unit | $771,125 | $1,779,525 | $2,669,275 |

| 4-unit | $958,350 | $2,211,600 | $3,317,400 |

To know the updated FHA mortgage limit in your area, visit the HUD FHA loan limits page.

As for conventional mortgages, you can technically borrow any amount from a lender as long as you qualify for it. Of course, this requires a strong credit history, high credit score, and a stable source of income. But if you need to borrow a specifically expensive mortgage, you must look for a conventional lender that provides jumbo loans. To further explain, there are two types of conventional mortgages: conforming conventional loans and non-conforming conventional mortgages, also called jumbo loans.

Conforming Conventional Loans: These mortgages obey the conforming loan limits established by the Federal Housing Finance Agency (FHFA). Conforming limits are updated annually to accurately reflect changes in housing market prices. If your loan amount is within this limit, your mortgage is secured by Fannie Mae or Freddie Mac. There are conforming loan limits for low-cost areas, high-cost areas, and special exception areas. Conforming limits for high-cost areas is 50% higher than the baseline limit.

Non-conforming Conventional Loans: Also called jumbo mortgages, non-conforming loans basically exceed the assigned conforming loan limits. If your loan amount goes beyond the limit, it cannot be secured by Fannie Mae or Freddie Mac. Thus, you must find a jumbo loan lender, such as a large bank, that can finance the expensive loan amount. Jumbo loans are used by high-income borrowers to buy luxury homes or expensive property in affluent neighborhoods. Since it entails borrowing a large amount, jumbo loans require more stringent qualifying standards than conforming conventional mortgages.

To see an updated list of conforming limits, visit our conforming loan limits page.

For a summary of the differences between FHA mortgages and conventional loans, refer to the table below.

| Requirements | FHA Mortgages | Conventional Mortgages |

|---|---|---|

| Credit Score | 580 is the ideal credit score 500 is the minimum credit score | 700 & up is preferred 680 is usually approved 620 & below is harder to approve |

| Down Payment | 3.5% if your credit score is 580 10% if your credit score is 500-579 | 20% bypasses PMI 10% is the average down payment 3% is the minimum for 97-3 loans |

| Loan Limit | Requires specific loan limits based on the type of property and location | Conforming mortgages follow loan limits assigned by the FHFA Loans that exceed the conforming limit are secured as non-conforming loans or jumbo mortgages |

| Rates | Rates are low even if you have a poor credit score Making a down payment of 10% helps reduce your MIP rate | The higher your credit score, the lower your rate The lower your credit score, the higher your rate Offering a higher down payment reduces your rate |

| Front-end DTI | Should not exceed 31% | Should not exceed 28% |

| Back-end DTI | Soft limit – 43% Hard limit – 57% w/ compensating factors | Soft limit – 36%, can be up to 43% Hard limit – 50% w/ compensating factors |

| Mortgage insurance | Upfront MIP – 1.75% of the loan Annual MIP – 0.45%-1.05% MIP is required for the entire 30-year FHA mortgage | PMI is 0.25% – 2% of the loan PMI is removed once LTV ratio reaches 78% |

| Prepayment Penalty | None | May come with a prepayment penalty clause depending on the lender |

Though FHA mortgages provide plenty of benefits to homebuyers, it still comes with several disadvantages. There are trade-offs to taking a loan with affordable down payment options and forgiving credit standards. Take note of the following drawbacks when you choose FHA loans:

More FHA Borrowers Tend to Default on Mortgages

In recent years, FHA mortgages had higher default rates than conventional loans, according to analytics company CoreLogic. Higher occurrence of mortgage defaults may be caused by several reasons. It likely has a lot to do with the type of borrowers the program services. FHA loans accept borrowers with lower credit ratings than conventional mortgage lenders. This means that people with weak credit histories and small incomes could qualify for FHA loans. These borrowers already had greater risk of default than people taking conventional mortgages.

Because of the affordable down payment and lenient credit standards, more low waged workers may take FHA loans. They have greater risk of employment disruption, especially in today’s economy where many companies outsource work in other countries. Moreover, major economic down turns (such as the COVID-19 crisis) could easily cause job loss and reduced incomes for these people.

Next, while FHA borrowers could qualify with a small down payment, they are also more likely to have trouble affording consistent monthly payments. Furthermore, homebuyers who tend to get FHA loans use it as a means to obtain homeownership. After they secure the mortgage, they refinance to a conventional loan once they have better credit scores.

1

First-time homebuyers: FHA loans are a popular among first-time homebuyers because of the affordable down payment. The relaxed credit standards also make it easier to obtain financing compared to conventional loans. Borrowers with small incomes and limited funds can take advantage of this option. Ideally, your credit score should be at least 580 to make a 3.5% down.

2

Low credit score borrowers: Even if you have a poor credit score, you can still qualify for an FHA loan. Borrowers with credit scores between 500 to 579 can take this option as long as they provide a 10% down payment. You are likely to secure a lower rate with an FHA loan than a conventional mortgage if you have a low credit score.

3

Homebuyers with past credit issues: Borrowers with foreclosure or bankruptcy records typically have a hard time obtaining conventional mortgages. They also tend to wait longer to qualify again for a mortgage. A chapter 7 bankruptcy record, for instance, usually takes 4 to 5 years before you can secure a conventional mortgage. But with the FHA program, you can take a mortgage after just 2 years of being discharged.

3

Senior homeowners who need a reverse mortgage: The FHA sponsors Home Equity Conversion Mortgages (HECM). These are reverse mortgages specially offered to older homeowners aged 62 years old and above. HECM provides homeowners with regular payouts or a line of credit that supplements their retirement expenses. The amount is determined by how much equity they have on their home and their estimated life expectancy.

Since FHA loan rates are market-based, be sure to shop around and request quotes from different lenders. FHA rates vary per lender, and each lender can include their own fees into the loan. While origination fees are usually around 1%, some lenders may require a higher rate. Try to negotiate origination fees to reduce your mortgage costs.

Before applying for a loan, make it a point to check your credit report. Borrowers are entitled to a free copy of their credit report every 12 months. You can request your copy at AnnualCreditReport.com. Review your credit report for any corrections, such as a wrong address, name, or incorrectly recorded payments. Disputing credit errors on your credit report can help raise your credit score.

Though the FHA program has more forgiving credit standards, it pays to improve your credit score before applying for a mortgage. Make sure to get your finances in order at least six months before applying for the loan. Paying bills on time and reducing your outstanding debts will help improve your credit rating. Lenders also take note of the following factors on your credit history:

Next, you must prepare the necessary documents. You should send proof of employment and your wages. If you are self-employed, you must show proof of your income for the last two years. It also helps to show other sources of income, such as overtime salary, investments, money from alimony, etc. You must also show detailed financial information such as bank statements, retirement benefits, and pay stubs. If you’re a veteran, you must show documentation relating to your discharge of DD Form 214. The lender will provide you with the appropriate application form.

Get ready with the following documents for your FHA application:

The 203(b) loan is the primary mortgage program provided by the FHA. This is the loan that comes with 3.5% down payment if a borrower has a credit score of 580. Meanwhile, borrowers with credit scores between 500 and 579 can take this mortgage option with a 10% down payment. The FHA basic mortgage program is eligible for single family housing to multifamily housing.

Moreover, section 251 allows borrowers to take FHA loans as adjustable-rate mortgages (ARM). Just note that when ARM rates increase, you must be ready for higher monthly payments. ARMs are usually taken by borrowers who will not be staying long-term in a home.

FHA refinancing allows a cash-out option that lets borrowers tap their home equity. To be eligible, you must have at least 20% equity on your home based on the latest appraisal. The minimum credit score required is 580, but most FHA-sponsored lenders prefer a credit score of 600 to 620 for cash-out refinancing. As of August 1, 2019, the LTV limit for FHA cash-out refi is 80%, which was previously 85%.

The FHA streamline refinance program also allows you to refinance your existing FHA loan. To qualify, your mortgage must be current, meaning you should have made the last 6 months of payments on your loan. Your FHA mortgage should also be at least 210 days active before you refinance. An FHA streamline refinance is a type of rate and term refinance option. This only allows you to obtain a lower rate, change your term, or both. It does not offer cash-out, so your new loan cannot exceed your initial loan amount. But you may receive a cash excess of $500 as long as it’s not taken from the refinanced mortgage.

As a main requirement, the streamline refinance must have a net tangible benefit to the borrower. This depends on your loan and the new rate or term you’re refinancing into. With this condition in mind, if the refinance lets you make easier monthly payment, lenders will not be reimbursed by the FHA if you default on your loan. While these are the main requirements, depending on your lender, they may ask for additional requirements to qualify for an FHA streamline refinance.

If you need a mortgage to finance the purchase and repair of a home, you can take advantage of the FHA 203(k) rehab mortgage insurance. To secure this loan, the repair or renovation cost must be at least $5,000, including complete reconstruction and structural alterations. You must also submit detailed information about what kind of construction work must be done together with cost estimates. The mortgage rehab loan can also be used to finance home improvements on current property.

The graduated payment program is ideal for borrowers expecting a gradual and steady increase in income. Perhaps you’re anticipating a raise the longer you work for a company. This mortgage option allows you to arrange how your payments will increase over the years. This makes planning monthly payments easier and more manageable. It also features a growing equity mortgage that plans recurring increases on your monthly principal payments. The graduated payment program also lets you make extra principal payments to help pay off your mortgage faster.

The FHA began the Energy Efficient Mortgage (EEM) program in 1992 to help families save money on utility bills. The program does this by financing energy efficient improvements on existing FHA-backed homes. The FHA recognizes how old homes tend to incur higher electricity and water bills. Expensive utilities can also be a hindrance to making timely mortgage payments. But if homes are more energy efficient, lower utility costs can help families save more.

Under the EEM program, a borrower chooses to make energy efficiency updates based on recommendations from a qualified home energy assessor. You can improve your property’s infrastructure, upgrade your insulation, or even install solar panels. You may also gain tax benefits from certain energy efficient improvements.

If you’re 62 years old and above, you may qualify for a Home Equity Conversion Mortgage (HECM). This is a type of reverse mortgage that provides monthly payouts or a revolving credit line for seniors. With a reverse mortgage, you can use your home equity to supplement your retirement funds. You don’t have to pay the loan unless you sell the house, or when you pass away and your heir pays the loan using proceeds from the home’s sale.

The HECM loan amount is based on three primary factors: the amount of home equity on the home, the homeowner’s age, and the interest rate. If you’ve built more equity on your home, expect to receive a higher reverse mortgage loan amount. This is also true if the property has significantly appreciated in value.

Next, older borrowers generally receive larger HECM payouts. Because the loan calculates your life expectancy, a shorter loan generates higher payouts. But if you are younger, you’ll likely receive smaller payouts on your HECM. Lastly, a higher interest rate means you’ll receive a lower monthly stream of income from your reverse mortgage.

The HECM mortgage limit for 2024 is set to $1,149,825 nationwide, which is 150% of the $766,550 loan limit.

FHA mortgages are a good option especially for first-time homebuyers and borrowers with limited income. The basic FHA program offers a low 3.5% down payment as long as you have a credit score of 580. Borrowers with lower credit scores between 500 to 579 can also secure an FHA loan, provided they pay at least 10% down. FHA mortgages are known for affordable down payments and relaxed credit standards. It’s a viable alternative to conventional loans which impose stricter credit standards.

Remember that FHA loan rates are also market-based. This means that depending on your lender, FHA rates may be higher or lower than prevailing conventional loan rates. Thus, it’s best to shop around for different lenders to compare and choose the most favorable rate. On the other hand, conventional lenders usually offer more competitive rates. However, as a compromise, you must comply with higher credit qualifications. Moreover, FHA mortgages are more forgiving with past credit issues. If you have a foreclosure or bankruptcy record, you don’t have to wait as long to obtain a mortgage compared to conventional loans. In this regard, it’s easier to secure FHA loans.

But before you take this option, be mindful of its disadvantages. FHA mortgages come with upfront and annual mortgage insurance premium (MIP). This is an extra charge that makes your mortgage more costly the longer your pay your loan. Because the FHA program is funded by mortgage premiums, they tend to require long-term annual MIP charges. For 30-year fixed FHA loans, MIP is usually required for the entire loan. To avoid MIP costs, many FHA borrowers eventually refinance into a conventional loan.

In conclusion, the FHA program provides low to moderate-income borrowers with the opportunity to gain homeownership. They offer a wide array of loan programs which can address specific housing and financing needs.

US 10-year Treasury rates have recently fallen to all-time record lows due to the spread of coronavirus driving a risk off sentiment, with other financial rates falling in tandem. Homeowners who buy or refinance at today's low rates may benefit from recent rate volatility.

Don't pay too much for your mortgage. Leverage our lender network to get a FHA loan at today's historically low mortgage rates.

Check your mortgage options with a trusted Columbus lender.

Answer a few questions below and connect with a lender who can help you lock-in a low rate FHA loan and save today!