Explore conventional mortgages, FHA loans, USDA loans, and VA loans to find out which option is right for you.

Check your options with a trusted lender.

Answer a few questions below and connect with a lender who can help you save today!

Life after college is usually hard, and you are likely to wonder what to do next. You are a young person harboring big dreams and living a life full of uncertainties. You just got a job, but you feel unsatisfied knowing you don't own a house. You desperately need to get on the property ladder to have the independence you want. What can you do to acquire a place to call home?

Like most young people who just started their career journey, your savings are scrawny and can hardly cover your bills. Will you ever own a house? What do you do now? Thankfully there are strong mortgage and savings markets in Canada, which should eventually let you achieve your goal of getting on the ladder.

Before we look at how mortgaging in Canada works, let us look at the definition of the term mortgage. A mortgage is a loan taken by individuals and businesses to make property purchases without paying the entire value up front. Simply put, it is a home or property loan, and it comes with different features to serve varying needs of clients. For this reason, it's important to understand the features that compliment your needs before you settle for a mortgage. This way, you are bound to make sound decisions.

Now let's take a look at mortgaging in Canada. Mortgages in Canada are either open or closed. The difference between the two is the flexibility of making extra payments. Read on to know which mortgage option suits you.

Open mortgages in Canada have high-interest rates compared to closed mortgages with a similar term length. You will be required to make extra payments on top of the usual amount when it comes to open mortgages. However, an open mortgage is more flexible than the closed mortgage. Do you want flexibility and don't mind making extra payments? If yes, then open mortgages are suitable for you. Moreover, most Canadian lending institutions offering open mortgages are highly accommodating, and they allow their clients to take various actions during the term without facing a penalty as follows:

Open mortgaging is recommended for clients who hope to move in the near future and those that plan to pay off their mortgages within the shortest time possible and have no problem with paying extra cash to top up payments from time to time. They can also be ideal if you expect mortgage rates to cheapen quickly in the next few years, as you'll have to freedom to any other product you want.

Closed mortgages in Canada have low interest rates compared to the open ones. They usually have limits on the amount of the extra cash that clients may be willing to commit towards their loan each year on top of their regular payments without any penalties. The threshold amount is clearly stated in their mortgage contract as a prepayment privilege. Unlike open mortgages, closed mortgages in Canada carry a penalty in case the client breaches contract or decides to change lenders. A prepayment penalty is charged if the client makes an advance that exceeds what the lender allows, and if they opt to violate the mortgage contract. These mortgages are ideal for the Canadians who plan to hold on to their current homes for the whole of their loan's term - as they keep costs down.

Which one serves your needs? Is it the open mortgage or the closed one? Well, it all comes down to preference.

The mortgage market in Canada provides clients with varying time lengths in which their contract will last. In the agreement is everything outlined inclusive of the interest rate. The terms may be as short as only a few months or as long as five years or more.

With every end term, clients are expected to make a mortgage renewal. However, if a client is capable of paying off the loan by the end of the prescribed term, they don't need to renew it.

Some clients may also opt to renegotiate their loan agreement or pay off their mortgage before their term ends. Although this is possible, it comes at a cost. The client will be required to pay an extra amount as a prepayment penalty. The amount you are expected to pay is highly dependent on the type of mortgage you are subscribed to and the terms and conditions of your agreement.

While making a choice on the length of their term, clients are advised to consider if they are planning on moving or they want to maintain the same payment they are making for a considerably longer period of time.

Long-term mortgage means clients can draw their budget as they will face the certainty of their housing costs for a longer time period. Nonetheless, it hinders their ability to effect changes to their mortgage contract for a number of years without the payment of the prepayment penalty.

With this option, clients are only eligible to pay a higher prepayment penalty for the first five years, and after that, the amount reduces gradually. In Canada, clients will only be charged three months' interest on the outstanding mortgage balance if they wish to make changes to their mortgage contract after five years.

In Canada the shortest term mortgages available are fixed for six months. You'll pay the price for a short-term loan in the form of a higher interest rate, as it's normal for lenders to charge a 1% interest premium compared to a longer mortgage. You should only take one out if you're worried about committing to a longer loan, for example if your income is irregular, or if you expect lending conditions to improve down the line.

The Canadian mortgage market also offers loans with convertible terms. To put it simply, this means that some short-term mortgages could be extended to a longer term than previously prescribed. With the conversion or extension, the contract's interest rate is bound to change to a new rate offered by the lender.

These mortgages have constant interest rates, so they're ideal if you want certainty over your level of payments for a few years. They're an especially good option if you anticipate that the market interest rates will shoot up over the term of the mortgage.

A variable interest rate mortgage can increase and decrease during the mortgage term. Choosing this option usually means you are looking for a lower interest rate than offered by a fixed rate. New clients seeking to get a house through this option should keep in mind that both the rise and fall of interest rates are hard to predict. In Canada, for instance, the interest rates on mortgages varied from 0.5% to 4.75% within a span of 10 years, between 2005 and 2015. Hence, you need to be aware of how much increase in mortgage payments you would afford if the rates skyrocket.

Fortunately, some lenders in Canada offer an interest rate cap, which prescribes the maximum interest rate you can be charged on a mortgage. Therefore, you will never have to pay more in interest even if the interest rates rise. Also, they may present you with a convertibility feature that enables you to convert or even change your mortgage to attract a fixed interest rate.

The Canadian housing market has had a frenetic few years of ups and downs, especially in Toronto and Vancouver.

Since the start of the pandemic house prices increased by 34% in Canada (source), as pent-up demand spiked following a lull caused by successive lockdowns.

After cities started returning to normal following the pandemic, house prices and transactions surged thanks to pent up demand and favourably low interest rates, keeping the cost of mortgages at a cheap level.

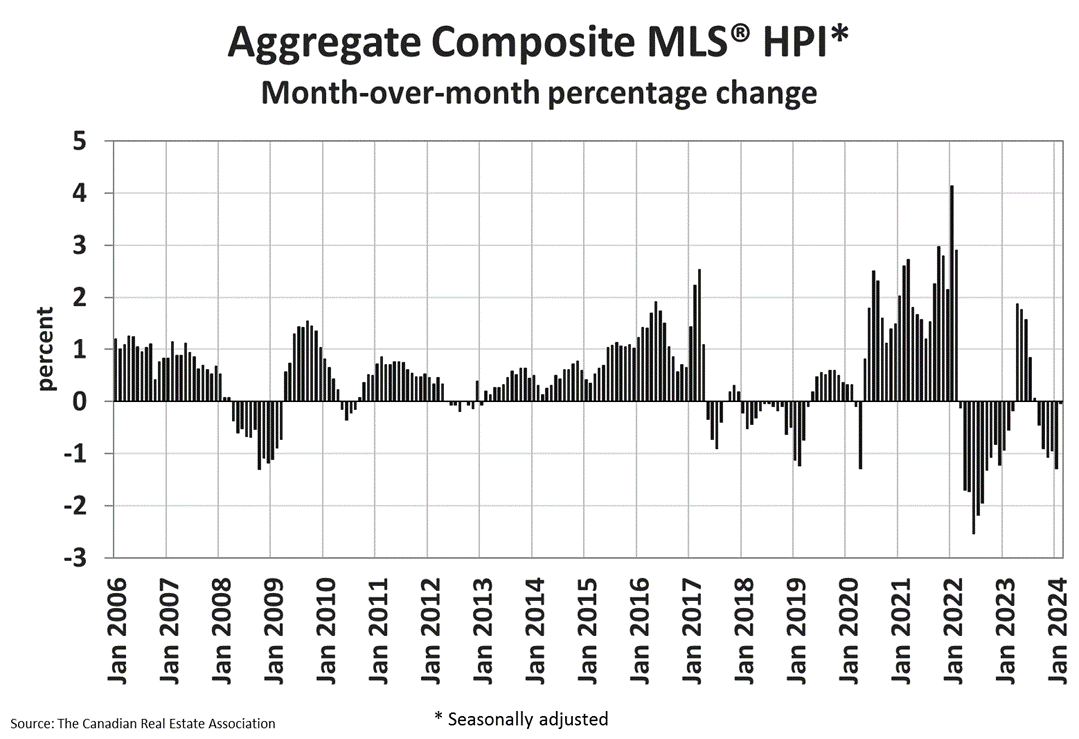

However conditions have since become more difficult for home buyers, which has served to cool down the property markets. This trend can be observed from the spring of 2022.

Between March 2022 to July 2023 Canada's policy interest rate rose from 0.25% to 5.0%, making mortgages far more costly. Indeed, typical three year fixed rate mortgages in Canada rose from an average of 3.49% in early 2022 to 6.29% one year later - nearly double (source).

This occurred as a domino effect after the Russian invasion of Ukraine caused global inflation to take hold. Raising the national interest rate is a good way of curbing inflation, which is why you can observe the same trends in the US and UK. This is not a Canada-only phenomenon.

Costlier mortgages have made it more difficult for aspiring buyers both to afford and qualify for finance, as you have to be able to prove you can pay your mortgage even if mortgage rates go up further - even though that's unlikely to happen to any great degree.

To a lesser extent, the Canadian federal government has slowed down the property markets with a political move, as it banned foreign property buyers from the start of 2023. This was designed to put the brakes on the ‘buy-to-leave' phenomenon, where investors buy property and fail to utilise stock.

This likely hasn't made a huge difference, but it's at least served to make sure investment into Canadian housing comes from those who want to live and work there. Temporary residents and permanent residents can still buy in Canada, so it's just the absentee landlords that are being targeted.

The housing market is now entering a period of stability, helped by the Bank of Canada holding the policy interest rate at 5.0% for the best part of a year.

This means aspiring buyers are beginning to adapt to this environment, where mortgages are more expensive - and so are returning to the market.

This renewed confidence is reflected in figures from the Canadian Real Estate Association, which found that in February 2024 home sales jumped by nearly 20% from the year before (source). This upward trajectory is compared to a very weak February in 2023 however, so the market is in a steady place rather than there being a mad rush of buyers.

There's some optimism that the cost of loans will cheapen down the line, as the inflation rate fell to 2.8% in Canada. Raising Canada's policy interest rate was designed to curb inflation, so once that comes down it's likely the Bank of Canada will opt for a rate cut in 2024, malking mortgages cheaper again.

While the conditions have made it harder for new buyers to afford monthly payments, one positive is this higher interest rate environment has served to cool down the market, putting a break on rapid house price growth.

If you're not on the ladder you may feel gutted you didn't benefit from this growth, but even so, if you can afford to buy your chosen home, you probably should.

It may be tempting as a new buyer to sit and wait until financial conditions improve, but if you do so it would be a double edged sword. Yes, mortgage rates could become cheaper in future, but in that situation you'd face more competition from other buyers, which in the long term serves to push house prices up.

There's been rising concerns about Toronto and Vancouver, and whether there's a housing bubble of high prices in both cities. However history tells us that Canadian house prices tend to be robust, as they fell far less than in the US following the 2008 Global Financial Crisis (source).

Therefore, despite the risks, it's generally better to get on the ladder if you can. That way you can start paying down your loan, and you may be able to benefit from cheaper mortgage rates once you refinance.

If you're not able to qualify for a mortgage yet, which is understandable given the high house prices in Toronto and Vancouver, you're best off saving for a bigger downpayment.

One method of doing that is with the First Home Savings Account (FHSA), an account in Canada which allows you to pay up to $8,000 per year into the account until you have $40,000, which is money you can offset against your income tax bill every year.

What's important is setting a clear goal and being disciplined with your cash - for many people getting on the housing ladder is a marathon rather than a sprint.